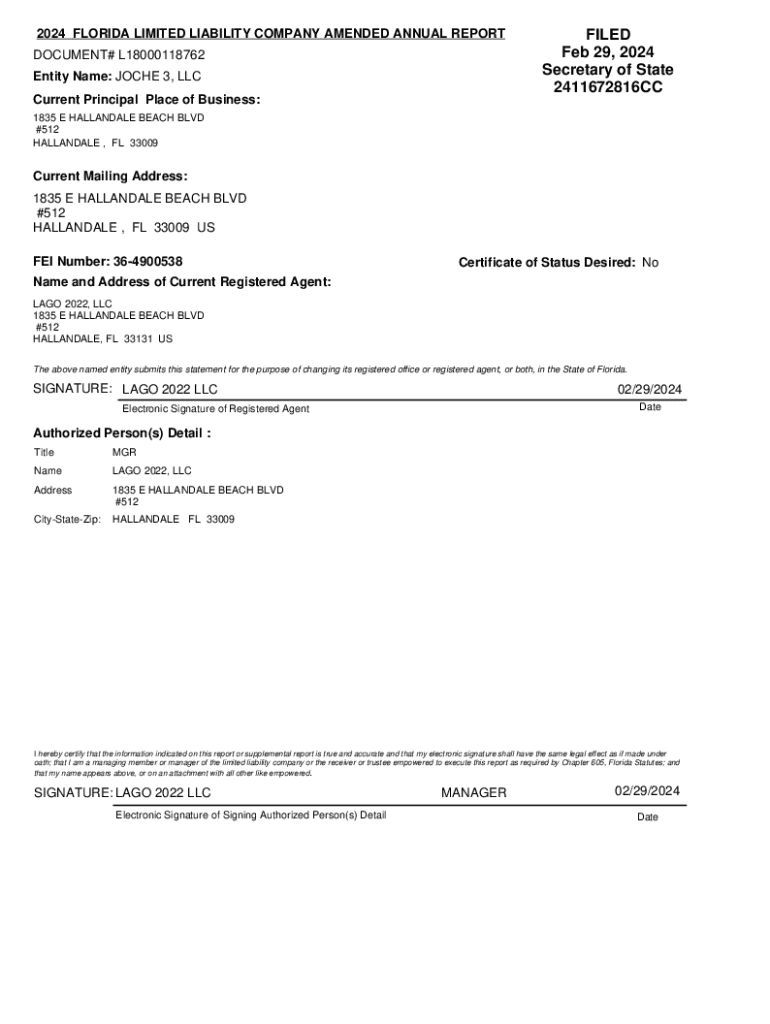

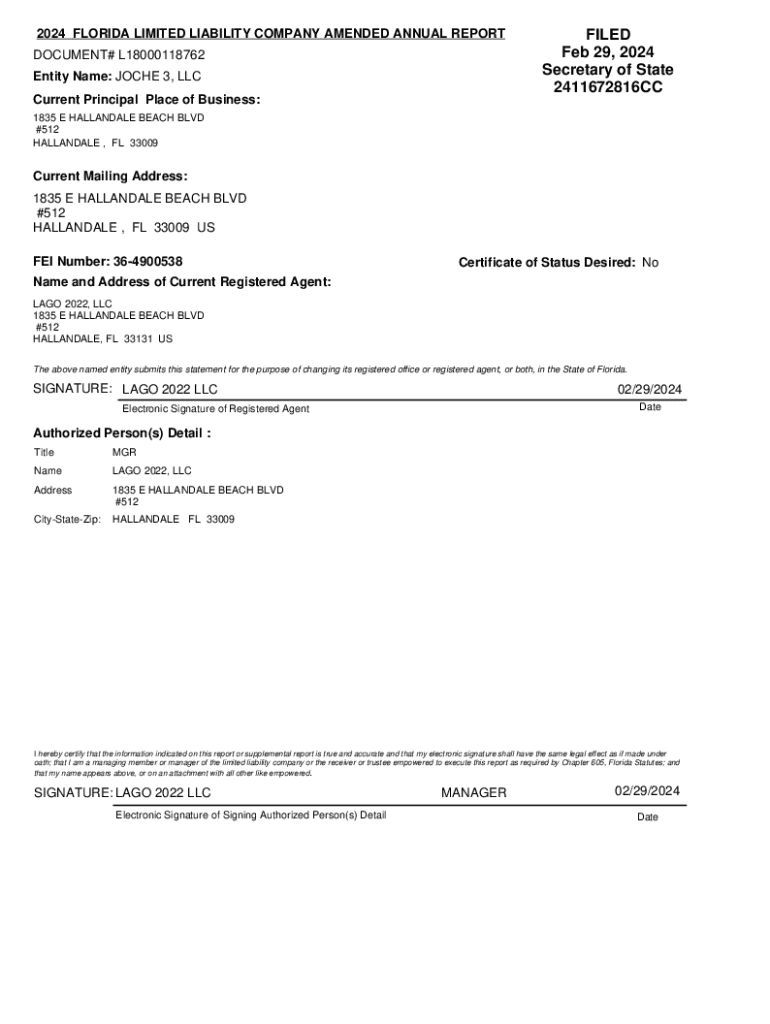

Get the free 2024 Florida Limited Liability Company Amended Annual Report

Get, Create, Make and Sign 2024 florida limited liability

Editing 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

Your Guide to the 2024 Florida Limited Liability Form

Understanding limited liability companies (LLCs) in Florida

A Limited Liability Company (LLC) is a hybrid business structure that combines elements of both corporations and partnerships, providing entrepreneurs with flexibility and protection. In Florida, LLCs are increasingly popular due to the advantageous legal and financial framework they offer. Importantly, they protect the owners' personal assets from business liabilities, which is crucial for anyone venturing into entrepreneurship.

The benefits of forming an LLC in Florida are compelling. First and foremost, LLCs provide limited liability protection, ensuring that owners are not personally responsible for debts incurred by the business. Additionally, LLCs enjoy pass-through taxation, meaning that profits and losses are reported on the owners' personal tax returns, thereby avoiding double taxation. Finally, establishing an LLC enhances your business's credibility, making it easier to attract customers, investors, and partners.

As we move into 2024, the landscape for LLCs in Florida continues to evolve, offering new opportunities and challenges for entrepreneurs looking to establish their businesses.

Key requirements for the 2024 Florida limited liability form

Before diving into the filing process, it is essential to understand the eligibility criteria for establishing an LLC in Florida. Generally, any individual or entity can form an LLC, provided they comply with the state’s requirements. Notably, one must designate a registered agent with a physical address in Florida, ensuring legal notices can be served effectively.

The core document required for establishing an LLC is the Articles of Organization. This essential document includes specific information such as the LLC's name, address, purpose, duration, and the registered agent's details. Understanding the nuances of this form and common pitfalls can help ensure smooth processing.

Step-by-step guide to completing the 2024 Florida limited liability form

Completing the 2024 Florida Limited Liability Form requires careful attention to detail. Here’s a step-by-step guide to help you navigate the process successfully.

Step 1: Choose a unique name for your LLC. The name must not only be distinct but also indicate the LLC designation, such as ‘LLC’ or ‘Limited Liability Company.’ It’s advisable to check the Florida Division of Corporations database to ensure your chosen name isn’t already in use.

Step 2: Determine your LLC's management structure. You can opt for a member-managed LLC, where all members participate in operations, or a manager-managed LLC, where appointed managers handle day-to-day tasks.

Step 3: Appoint a registered agent. This individual or company is responsible for receiving legal notices on behalf of the LLC. Ensure that they have a physical address in Florida.

Step 4: Complete the Articles of Organization. Fill in essential sections like LLC name, address, registered agent details, and management structure succinctly to avoid confusion.

Step 5: File your LLC formation documents with the Florida Division of Corporations. You can file online for quicker processing or send in your documents via mail. Access the e-filing system for detailed instructions.

Payment and fees associated with filing

Filing fees for the 2024 Florida LLC are typically around $125. It is crucial to confirm the current fee via the Florida Division of Corporations’ website. Accepted payment methods include credit cards for online filing or checks for mail submissions.

Post-formation, additional costs may arise, such as licenses and permits required for specific business activities. These vary significantly by business type and local regulations, so thorough research is necessary.

After filing: what to expect

Once you’ve submitted your Articles of Organization, you’ll receive a confirmation from the Florida Division of Corporations. Tracking your filing status online is possible. The processing time typically ranges from a few days to several weeks, depending on the current workload.

You can request a copy of your approved LLC documents through the division’s website. This document serves as proof of your business's existence and is necessary for opening bank accounts or securing loans.

Common issues and solutions

Filing rejections can be disheartening but knowing common reasons can help prepare you. Common mistakes include selecting a name that’s too similar to an existing LLC or skipping essential information on the Articles of Organization.

If your filing is rejected, reviewing the specific reasons in the rejection notice is crucial. Amendments can be made by correcting the errors and resubmitting your form with the required information.

Additional considerations for Florida LLCs

Beyond the initial filing, it’s essential to be aware of Florida’s beneficial ownership reporting requirements, which necessitate disclosing individuals who have significant control of the LLC. Maintaining compliance is critical to avoid penalties.

Florida LLCs must file annual reports to maintain good standing and avoid administratively dissolving. This report, due each year by May 1, incurs a fee and updates any changes in the LLC's details, like member changes or address updates.

Conclusion

The 2024 Florida Limited Liability Form plays a vital role in establishing your LLC, setting the stage for a successful business venture. By understanding the requirements and following the necessary steps, you can navigate the formation process smoothly.

Utilizing document management tools like those offered by pdfFiller can help streamline the entire process, ensuring you stay organized and compliant with your business documentation. With the right approach and resources, your LLC can flourish.

Interactive tools and resources for formation

pdfFiller offers an array of features designed to facilitate document management, including editing PDFs, e-signing, and collaboration tools. Users can access step-by-step interactive guides, helping them fill out forms accurately and efficiently.

Additionally, pdfFiller provides links to relevant forms and downloadable templates, ensuring that users have all the resources they need at their fingertips for successful LLC formation.

Frequently asked questions

The processing time for LLC formation documents typically ranges from a few days to a few weeks. It’s advisable to check your application status online for real-time updates.

If you need to change your LLC name after filing, you can do so by submitting an amendment to the Division of Corporations, following the appropriate procedures.

Maintaining good standing for your LLC in Florida requires timely filing of annual reports and adhering to state compliance obligations. Regularly monitor your LLC’s status to ensure it remains compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2024 florida limited liability to be eSigned by others?

How do I complete 2024 florida limited liability online?

Can I edit 2024 florida limited liability on an Android device?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.