Get the free 2024 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2024 florida limited liability

Editing 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

2024 Florida Limited Liability Form - How-to Guide

Understanding Florida Limited Liability Companies (LLCs)

Limited liability companies, or LLCs, are a popular choice for business owners in Florida due to their blend of flexibility, tax benefits, and liability protection.

An LLC is a distinct business structure that combines the characteristics of a corporation and a partnership or sole proprietorship. Essentially, it allows owners—referred to as members—to enjoy limited liability protection, meaning their personal assets are generally not at risk in the event of business debts or lawsuits.

Some of the notable benefits of choosing an LLC structure include the ease of management, tax flexibility where profits can be passed through to members without facing corporate taxes, and fewer formalities when compared to corporations.

When comparing LLCs with other business structures, such as sole proprietorships or corporations, LLCs often present less risk while allowing greater operational freedom.

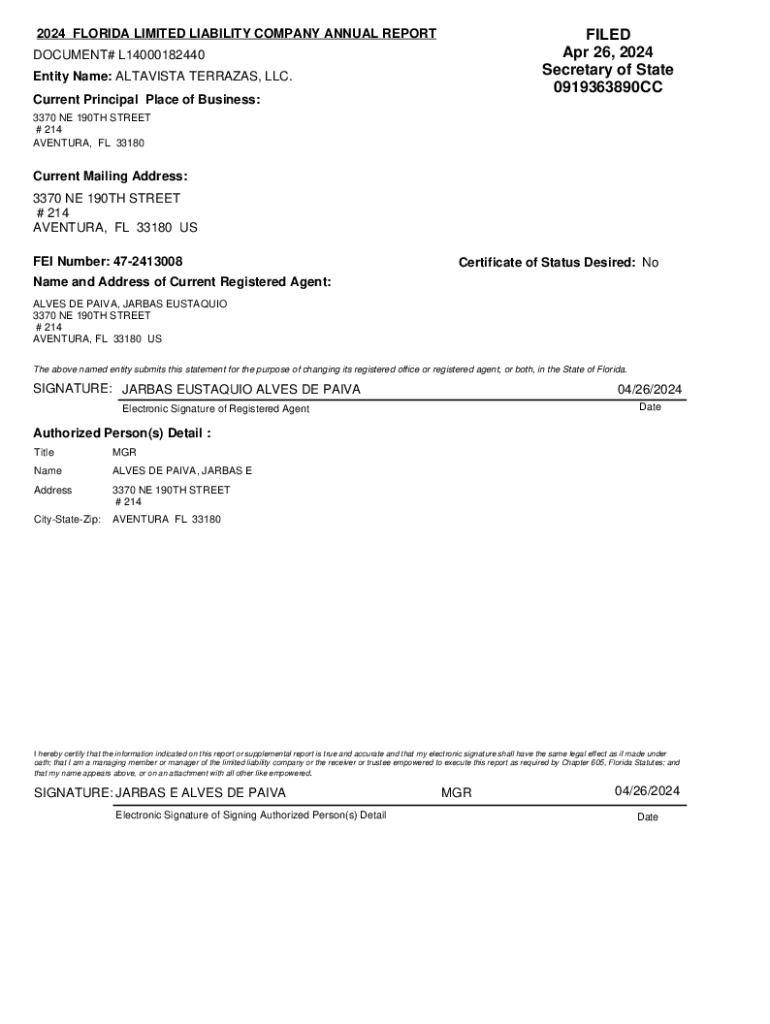

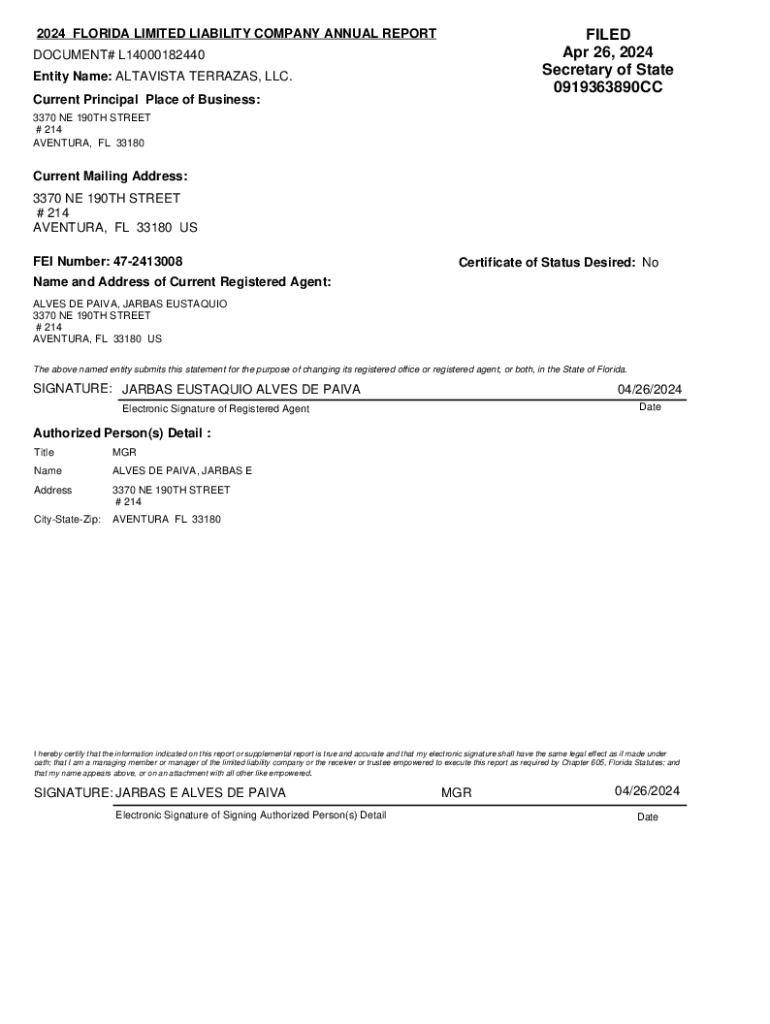

2024 Florida Limited Liability Form Overview

The 2024 Florida Limited Liability Form, known as the Articles of Organization, is a crucial document required for establishing your LLC within the state. This form contains essential information about the LLC, serving as the foundation for its legal existence.

Key components of the Florida Limited Liability Form include the LLC's name, principal office address, registered agent information, and management structure. Understanding each of these components is vital, as they contribute to legal compliance and organizational clarity.

Recent updates in 2024 highlight an emphasis on clarity in naming requirements and changes in the registration process to streamline submissions.

Step-by-step guide to filling out the Florida Limited Liability Form

Filling out the 2024 Florida Limited Liability Form doesn't have to be a daunting task. Here’s a breakdown of the steps involved.

Step 1: Choosing a name for your

Your LLC's name must be unique and not misleading. It should include the terms 'Limited Liability Company' or abbreviations like 'LLC' or 'L.L.C.'

To ensure name availability, check the Florida Department of State’s Division of Corporations database, and consider reserving your chosen name if you're not ready to file immediately.

Step 2: Designating your management structure

Decide whether your LLC will be member-managed or manager-managed. A member-managed LLC allows all owners to actively participate in daily operations, while a manager-managed LLC designates specific individuals to oversee operations.

Step 3: Selecting a registered agent

A registered agent is responsible for receiving legal documents on behalf of the LLC. In Florida, your registered agent must have a physical address in the state and can be an individual or a registered business entity.

Choose someone reliable to ensure that important notifications are received promptly.

Step 4: Completing the Articles of Organization

When filling out the Articles of Organization, provide accurate information in every section. Pay special attention to the required fields to avoid common mistakes such as misspelled names or incomplete addresses.

Step 5: File the form online with the State of Florida

To file online, access the Florida Division of Corporations' e-filing portal. Follow the prompts carefully, ensuring that all sections are complete before submitting.

You'll have several payment options for the filing fees, which vary depending on the services you require.

Alternatives to online filing

If you prefer to file the Florida Limited Liability Form offline, you can print the form and submit it via postal mail. Download the form from the state website, fill it out, and mail it to the appropriate address.

One potential challenge of offline filing is the slower processing times, which generally take longer than online submissions, leading to delays in your LLC’s official recognition.

Post-filing process and confirmation

After filing the Articles of Organization, you'll receive confirmation from the state regarding your submission. Usually, this confirmation arrives via email or postal mail, depending on your filing method.

Processing times can vary, but you can generally expect to receive your confirmation within 1 to 2 weeks for online submissions, and longer for mail submissions. Stay proactive by tracking your submission status through the same portal used for filing.

Common issues and troubleshooting

While the process is straightforward, issues may arise. If your filing is rejected, it often results from common errors such as incomplete sections, unclear forms, or problems with name availability.

To resolve these issues, you should identify the reason for rejection, correct the errors, and resubmit the form. Be sure to double-check all information before sending.

Important fees and costs associated with forming an

Setting up an LLC in Florida incurs certain costs, including filing fees, which can range from $125 to $150 depending on additional requests like expedited services.

It's also important to budget for other potential expenses, including business licenses, permits, and possible legal consultations to ensure compliance with local regulations.

Frequently asked questions about Florida LLCs

Some of the common queries surrounding Florida LLC formation include: What are the state requirements? For LLCs in Florida to be lawful, at least one member and a registered agent are required, and the LLC name must be distinguishable from existing entities.

As for tax implications, Florida LLCs benefit from flexible taxation options, permitting members to choose how they wish to be taxed. This might also include considerations for foreign entities looking to operate in Florida as LLCs — they must appropriately register with the state.

Leveraging pdfFiller for a smooth form experience

Using pdfFiller enhances the process of completing your 2024 Florida Limited Liability Form. This platform allows users to edit and collaborate on documents seamlessly, ensuring accuracy and timely submissions.

With pdfFiller, you can also access your forms from anywhere, making it easier to manage your business paperwork on the go. The interactive tools available assist in streamlining the form-filling process.

Key state resources for Florida formation

There are several official resources available for individuals looking to form an LLC in Florida, including the Florida Division of Corporations' website, which provides comprehensive guidelines.

Contact information for assistance is also readily available, ensuring that business owners can seek help with compliance and legal structure needs.

Additional support and services

Beyond form-filling, pdfFiller offers various document management solutions, such as compliance support and filing services to ensure that your business remains in good standing.

Engaging in ongoing educational tools and resources provided by pdfFiller will keep you informed about best practices for managing your LLC and staying updated on changes in regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2024 florida limited liability in Gmail?

How can I send 2024 florida limited liability to be eSigned by others?

How do I edit 2024 florida limited liability online?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.