Get the free 2024 Florida Profit Corporation Annual Report

Get, Create, Make and Sign 2024 florida profit corporation

Editing 2024 florida profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida profit corporation

How to fill out 2024 florida profit corporation

Who needs 2024 florida profit corporation?

Navigating the 2024 Florida Profit Corporation Form: A Comprehensive Guide

Understanding the Florida profit corporation

A profit corporation in Florida is a legal entity formed to generate profits for its shareholders. It operates under Florida state law and is characterized by limited liability for its owners, ensuring that personal assets are protected from business debts. Filing the Articles of Incorporation is crucial as it formally establishes your corporation and provides legal recognition. This step not only legitimizes your business structure but also grants access to various benefits such as tax advantages, the ability to raise capital, and the protection of personal assets.

Incorporating in Florida offers numerous benefits, including a favorable business climate, no state income tax, and a robust legal framework. Entrepreneurs can leverage these advantages to enhance their business’s credibility and prospects for growth, making the process of filing the 2024 Florida profit corporation form a strategic move.

Filing information for the 2024 Florida profit corporation

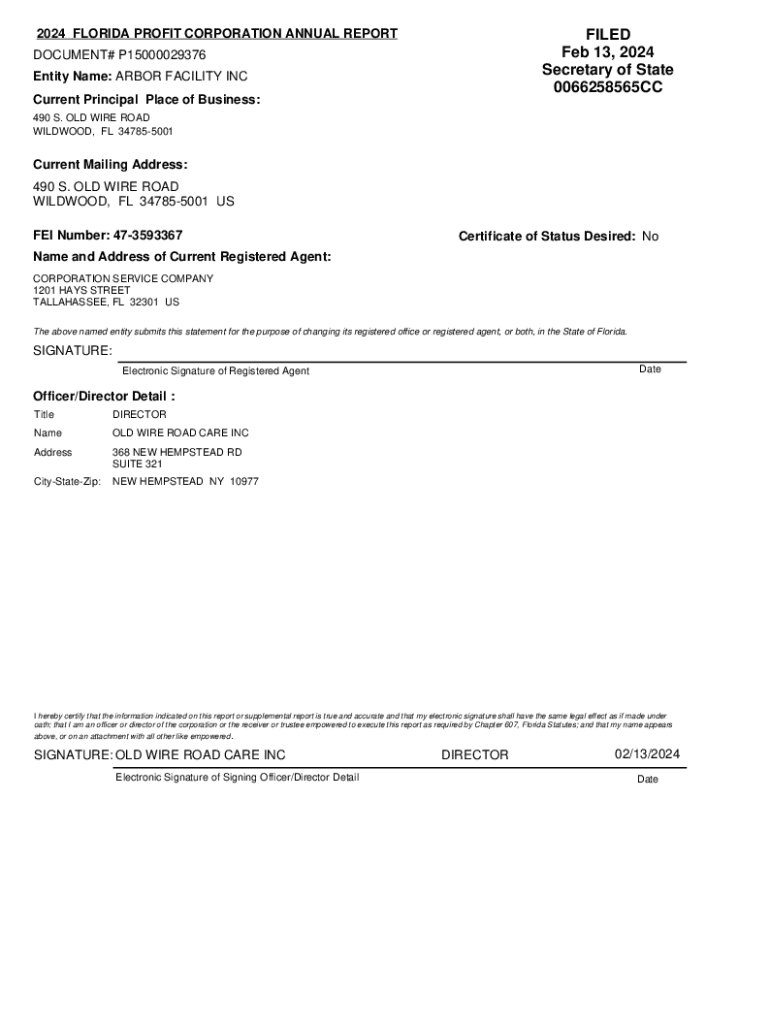

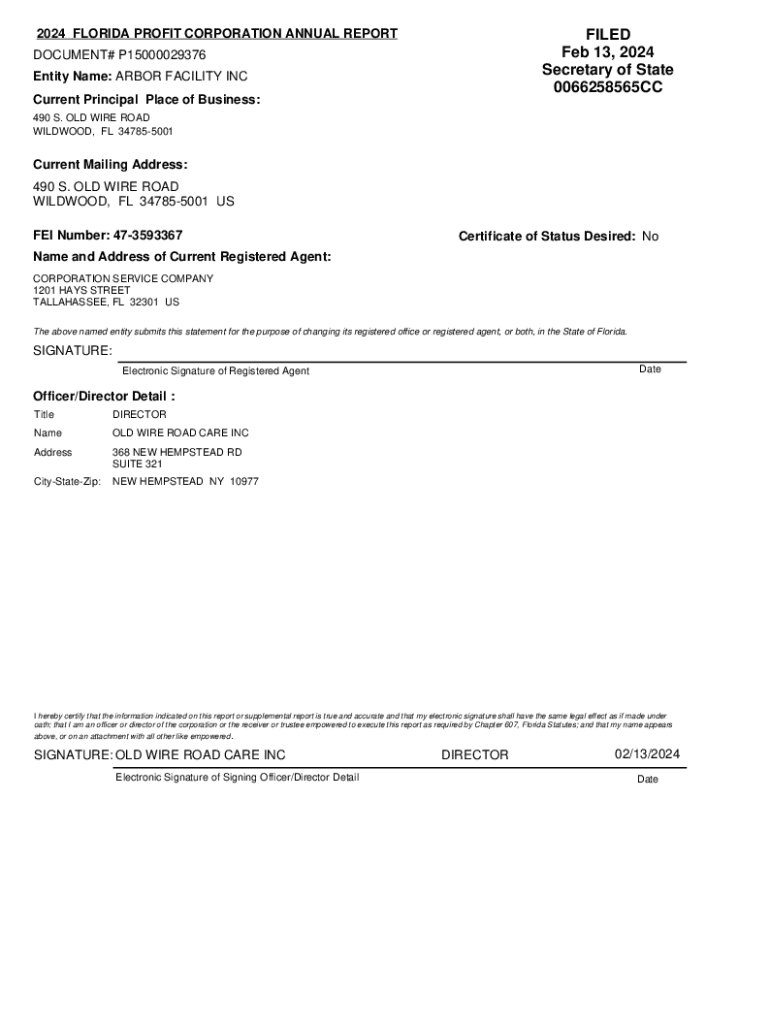

Before you file the 2024 Florida profit corporation form, there are several important topics to consider. Firstly, the corporate name requirements must be satisfied. The name should be unique and distinguishable from other registered entities in Florida. Additionally, include 'Corporation,' 'Incorporated,' or abbreviations like 'Inc.' to meet state requirements.

Next, you’ll need to gather the required documentation, including the Articles of Incorporation form and any identification for individuals involved in the corporation. Eligibility criteria dictate that at least one director and one officer must be designated. Furthermore, you must provide a registered agent with a physical address in Florida to receive legal documents.

Step-by-step guide to filing the 2024 Florida profit corporation form

Filing your Florida profit corporation form is a multi-step process that requires careful preparation. First, gather all necessary documents and information, including the corporate name, registered agent details, and the purpose of the business. Completing the Articles of Incorporation accurately is vital, so double-check for any errors that could delay your application.

Next, you'll move on to e-filing. Access the e-filing portal on Sunbiz, Florida's official business filing website. Here, you’ll follow a step-by-step process for electronic submission. Upload your documents, fill out all required fields meticulously, and ensure you check system compatibility with supported browsers such as Chrome and Firefox.

After your submission, check the payment options available for filing fees, which vary based on the type of corporation. Acceptable methods include credit card and electronic check payments, and you should be aware of the state’s refund policies and any potential fee waivers for specific circumstances.

Managing your corporation post-filing

Once your filing is accepted, confirmation of acceptance is crucial. You can verify the status of your filing through the Sunbiz portal, where you’ll receive updates and processing times for your Articles of Incorporation. Typically, the processing time can vary but expect it within a few days to a week under normal circumstances.

Retrieving your corporation's Articles of Incorporation involves requesting and obtaining copies through the Sunbiz portal. It's essential to store these documents securely, as they contain critical details like your corporation’s name, date of filing, and registered agent contact information, which are fundamental for any future business operations.

Troubleshooting filing issues

If you encounter filing issues, it's vital to identify common reasons for rejections. Typical errors in the Articles of Incorporation may include missing signatures, incorrect information relating to the registered agent, or failure to meet naming conventions. Should your form be rejected, ensure you correct these issues and resubmit the application promptly.

In instances where you’ve missed the filing deadline, addressing late filings is critical to maintaining your corporate status. Florida imposes penalties on late filings, and depending on the length of the delay, you may face increased fees or other implications. Act swiftly to rectify any outstanding matters to avoid complications.

Special considerations for foreign corporations

Foreign corporations looking to operate in Florida must be aware of specific regulations that apply to their incorporation process. These entities typically need to obtain a Certificate of Authority, which necessitates additional documentation to ensure compliance with local laws. Corporations must include proof of good standing in their home state and may need to provide specific forms tailored for foreign entities.

The filing procedures and timelines for foreign businesses can vary significantly, so it is advisable to plan ahead and consult state resources for the latest updates and requirements. Understanding these nuances can help streamline the incorporation experience and establish the business efficiently within Florida.

Fee schedules and additional costs

A comprehensive breakdown of related fees is essential for budgeting your incorporation process. For the 2024 Florida profit corporation form, the filing fee varies based on the type of corporation but generally starts around $70. Additional costs may include fees for name reservations, Certified Copies of your Articles of Incorporation, and various fees for amendments or reinstatements in the future.

It's also important to understand the ongoing costs associated with maintaining a corporation in Florida. This includes annual report fees, typically around $150, which are due each year. Incorporators should keep track of these expenses to ensure financial prudence and compliance with state regulations.

Reporting obligations for Florida profit corporations

Florida profit corporations have specific corporate income tax requirements that must be adhered to. All corporations earning income must file a Florida corporate income tax return (F-1120A) annually. The tax base is generally 5.5% of net income, and corporations should be prepared to estimate payments throughout the year leading up to the filing deadline.

Understanding due dates is vital for compliance. The tax return and payment are typically due on the 1st day of the 4th month following the end of the fiscal year. Regular updates to tax policy may change these obligations, necessitating review and action in advance of deadlines.

Compliance and ongoing management

Annual reporting is a fundamental responsibility for Florida corporations, requiring timely submission of informative reports to the state Department of State. This helps maintain good standing and ensures continuous compliance with state laws. Meticulous record-keeping practices are also essential, bolstering corporate governance and facilitating transparency in operations.

Key compliance dates include the annual report deadline, usually April 1st for most businesses. Failure to conform to these dates can lead to administrative dissolution of the corporation. Regular audits of your corporation's activities and compliance status can help mitigate risks and safeguard your business’s longevity.

Understanding beneficial ownership reporting

Florida has recently implemented beneficial ownership information requirements for corporations. This means that certain entities must report the individuals who have significant control or ownership stakes in the corporation. This aims to enhance transparency and combat financial crimes, ensuring that businesses are held accountable for their structure and decision-making processes.

The filing process involves submitting specific documentation that details beneficial owners, including full names, addresses, and the nature of ownership. Non-compliance with these requirements can lead to significant penalties, reinforcing the importance of staying updated on regulatory changes and ensuring accurate reporting to the state.

External resources for Florida profit corporations

To assist in navigating the incorporation process, numerous external resources are available. Quick links to important forms and applications are accessible through the Sunbiz website, which provides a user-friendly interface for both new and established businesses. This can significantly streamline your filing experience.

Direct access to state resources is vital for keeping abreast of any legislative changes impacting your corporation. Additionally, seeking recommendations for professional services can be beneficial for complex situations, ensuring compliance and proper guidance throughout the incorporation process.

Advanced tools for efficient document management

pdfFiller enhances the documentation process for Florida profit corporations, offering powerful tools to simplify form management. Users can easily edit PDFs, eSign documents, collaborate on corporate paperwork, and store all related files from a single, cloud-based platform. This streamlines workflows and reduces the risk of document mismanagement.

With features designed for business needs, like automatic reminders for filing deadlines and compliance requirements, pdfFiller empowers corporations to streamline their operations effectively. Utilizing a robust document management system allows business owners to focus on growth and expansion, rather than getting bogged down by paperwork.

Conclusion of filing process and next steps

Successfully completing the 2024 Florida profit corporation form is more than just a one-time task; it marks the beginning of your corporate journey. Key takeaways include understanding the importance of accurate filings, being aware of ongoing compliance requirements, and managing your documentation efficiently through tools like pdfFiller.

As you navigate the complexities of incorporation and corporate management, leverage technological solutions to streamline processes and support your business growth. Staying engaged with resources that enhance compliance can significantly improve your business trajectory and mitigate risks in today’s regulatory landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2024 florida profit corporation online?

Can I create an electronic signature for the 2024 florida profit corporation in Chrome?

Can I edit 2024 florida profit corporation on an iOS device?

What is 2024 florida profit corporation?

Who is required to file 2024 florida profit corporation?

How to fill out 2024 florida profit corporation?

What is the purpose of 2024 florida profit corporation?

What information must be reported on 2024 florida profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.