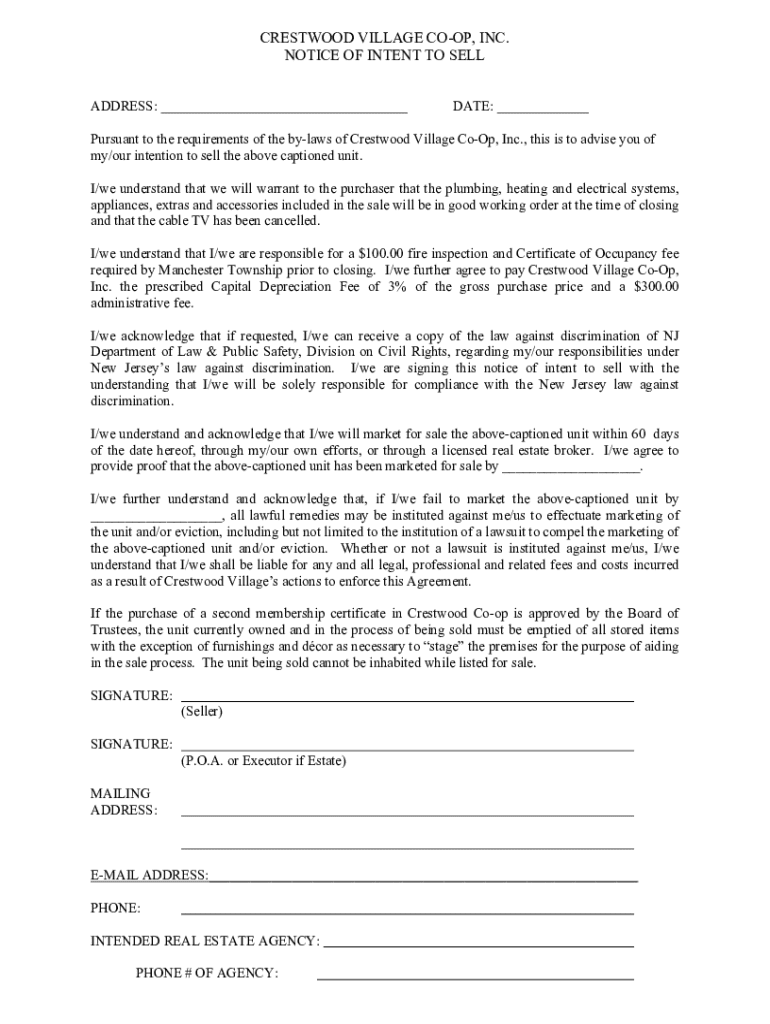

Get the free Notice of Intent to Sell

Get, Create, Make and Sign notice of intent to

Editing notice of intent to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of intent to

How to fill out notice of intent to

Who needs notice of intent to?

Comprehensive Guide to Notice of Intent to Form

Understanding the notice of intent to form

A Notice of Intent to Form is a formal declaration typically filed with a state government announcing the intention to create a business entity, such as a corporation or limited liability company (LLC). This document serves as the initial step in the formation process, laying the groundwork for more detailed filings and legal requirements. It is essential for legally establishing the presence of a business entity.

The importance of a Notice of Intent to Form in legal contexts cannot be understated. This notice not only signals the forthcoming establishment of a business but also serves to protect the chosen business name from being claimed by others. Furthermore, it acts as a public record that stakeholders can reference, promoting transparency in business operations.

Who needs to file a notice of intent to form?

Both individuals and organizations are required to file a Notice of Intent to Form under certain circumstances. For individuals, this typically applies to sole proprietors wishing to formalize their businesses, while organizations such as partnerships, corporations, or non-profits must file based on their structures. The need to file is most pronounced when there is a formal, legal intention to create a business that will operate independently.

Specific scenarios necessitating this filing include the formation of new businesses, non-profit entities, and in some instances, changes to an existing entity structure. The legal implications of not filing can be severe; without this notice, an entity's legal formation could be contested, leading to potential financial and operational issues down the line.

Detailed breakdown of the notice of intent to form

The Notice of Intent to Form consists of several critical components, each vital for successful filing. Required fields generally include the name of the entity, the type of business structure, the principal address, and the names of the initial members or directors. In some jurisdictions, additional data such as the business purpose or designated agent may also be required.

Optional sections may allow for extra details, though including too much information can complicate rather than clarify the filing. Formatting and submission standards vary by state. Therefore, it is essential to consult local regulations to ensure adherence to specific state requirements for layout and content.

Step-by-step instructions for completing the form

Filing a Notice of Intent to Form can seem daunting, but following a structured approach can simplify the process significantly. Begin with gathering the necessary information. Essential documents typically include identification of the members involved, any previous business licenses, and potentially a legal representative's details. Knowing these elements beforehand accelerates the process.

With all information compiled, move on to filling out the form accurately. Clarity is key; using straightforward language and providing precise descriptions can prevent confusion. Once the form is filled out, take the time to review for accuracy—common errors include typos in company names or incorrect addresses. When satisfied, you can submit the form through available methods, which often include online submissions, fax, or traditional mail. Be aware of any filing fees and crucial deadlines to avoid late submissions.

Frequently asked questions (faqs)

When it comes to the processing time after submission, this can vary widely depending on the jurisdiction. Generally, expect anywhere from a few days to several weeks for your application to be processed. Amending a submitted Notice of Intent is possible in most areas, but you’ll need to follow the specific procedures outlined by the state. If a mistake occurs on your form, act promptly to contact the relevant office to understand the correction process.

Late filing can lead to penalties or other negative consequences, including the potential invalidation of your business formation. Always check local guidelines for the exact implications to avoid these setbacks.

Best practices for filing a notice of intent to form

To ensure compliance with both federal and state laws, it is crucial to stay updated on the regulations governing business formations in your area. Each state has its own rules, and adhering to them not only facilitates a smoother application process but also helps prevent future legal issues. Keeping organized records and documentation related to your notice and any subsequent filings will serve you well in potential audits or legal inquiries.

After submission, it is wise to follow up with the relevant agency to confirm receipt and inquire about the status of your application. This proactive approach encourages transparency and communication, ensuring that all parties are informed and engaged throughout the formation process. Engaging stakeholders, whether they are members, investors, or mentors, can provide insights and additional support as you move forward with your business endeavors.

Common pitfalls to avoid when filing

When navigating the complexities of filing a Notice of Intent to Form, it’s important to stay vigilant against common mistakes that could derail your efforts. One prevalent issue is misinformation; relying on incorrect or outdated resources can lead to errors in your filing. Additionally, overlooking state-specific requirements can cause unnecessary delays. It's essential to take the time to verify all details before submission.

Lack of documentation is another common pitfall. Ensuring you have all required documents and information at hand before filling out the form is crucial. To help avoid these pitfalls, consider developing a checklist of necessary information and requirements, and use case studies or personal experiences to guide your approach. Learning from others’ mistakes can foster a smoother process.

Resources for assistance

If navigating the Notice of Intent to Form filing process feels overwhelming, reaching out to legal professionals can provide beneficial guidance. Many lawyers specialize in business law and can offer personalized advice tailored to your situation. Furthermore, consider utilizing recommended tools and software for document preparation that can streamline your filing process, such as pdfFiller, which simplifies document management and collaboration.

Additionally, many jurisdictions offer templates and sample forms for reference, which can help ensure your submissions are complete and correct. Community forums can also be a great resource, allowing you to tap into the experiences of peers who have gone through the process before.

Related forms and documents

In addition to the Notice of Intent to Form, there are several other related forms and documents that might need to be filed as part of the business formation process. These often include the Articles of Incorporation, which provide detailed information about the business structure and purpose, as well as Operating Agreements or Bylaws, which outline governance rules.

Understanding how these documents interrelate with the Notice of Intent is crucial. The Articles of Incorporation typically require information provided in the Notice of Intent, making it imperative to ensure that both documents are in alignment. Consult your state's business formation guidelines to navigate these requirements efficiently.

Perspectives from industry leaders

Insights from legal experts highlight best practices for filing notices. Successful case studies often illustrate how organized preparation and clear communication can lead to smoother filings. Additionally, testimonials from individuals who have successfully navigated the process underscore the importance of thorough understanding and planning during the formation phase. Engaging with industry professionals can often unveil additional perspectives and strategies that will aid in successful business establishment.

Industry leaders often recommend a collaborative approach in engaging stakeholders to strengthen the business foundation as it develops. By fostering an environment of transparency and inclusivity, businesses can benefit from diverse insights and expertise, enhancing their chances of long-term success.

Conclusion

Properly filing a Notice of Intent to Form is pivotal for anyone looking to establish a new business entity. This proactive step not only protects your business name but also is essential for laying out the formalities of your business structure. By leveraging resources such as pdfFiller, users can manage their document creation process efficiently. Whether you are a first-time entrepreneur or seasoned professional, understanding and navigating the filing process is crucial for a successful business start.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit notice of intent to from Google Drive?

Can I edit notice of intent to on an iOS device?

How can I fill out notice of intent to on an iOS device?

What is notice of intent to?

Who is required to file notice of intent to?

How to fill out notice of intent to?

What is the purpose of notice of intent to?

What information must be reported on notice of intent to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.