Get the free Beneficiary Designation Form

Get, Create, Make and Sign beneficiary designation form

How to edit beneficiary designation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation form

How to fill out beneficiary designation form

Who needs beneficiary designation form?

Guide to Understanding and Managing Your Beneficiary Designation Form

Understanding beneficiary designation

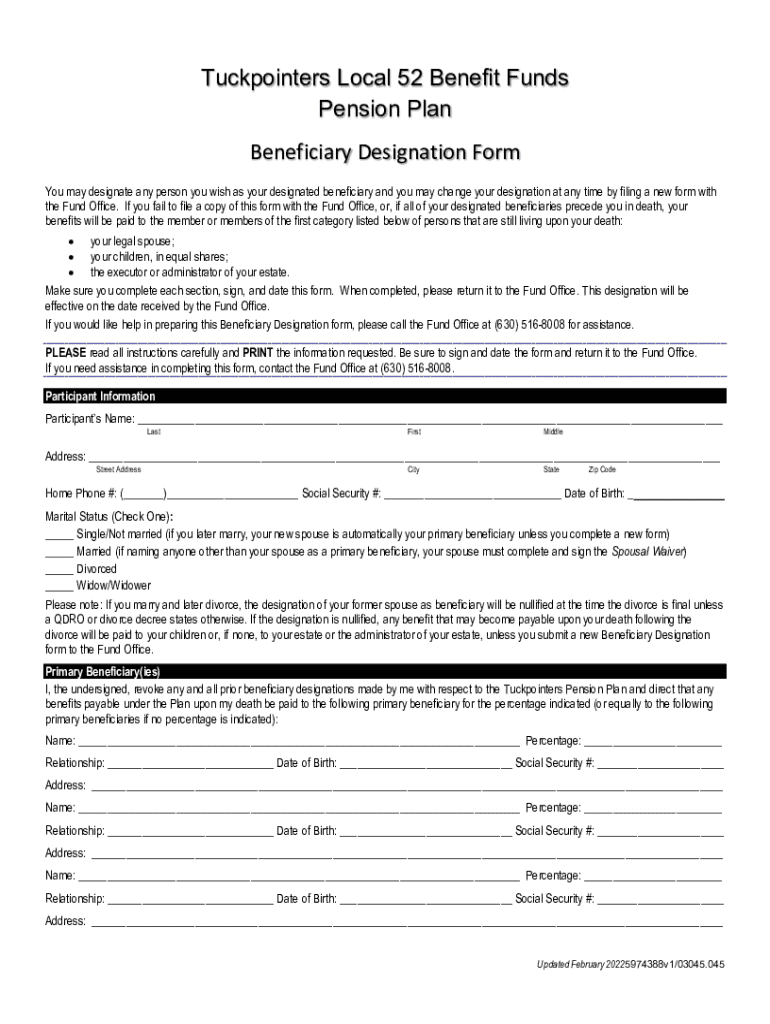

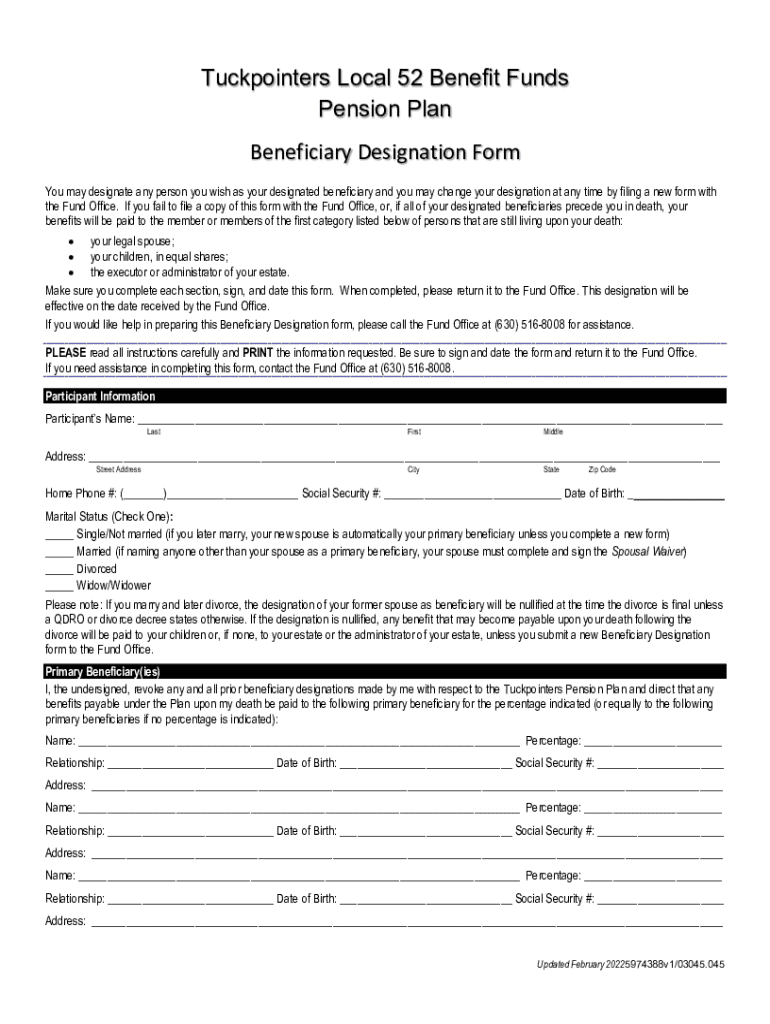

A beneficiary designation form is a crucial document that allows individuals to specify who will receive their assets upon death. This form plays an essential role in various financial accounts, including life insurance policies, retirement accounts, and bank accounts. By filling out this form accurately, account holders can ensure their assets are distributed according to their wishes, minimizing misunderstandings among surviving family members.

Key components of a beneficiary designation form

To ensure that your beneficiary designation form is comprehensive and effective, it’s critical to understand its key components. This form isn't just a simple checklist; it requires specific and detailed information to be legally valid and effective in carrying out your intents. Missing any essential elements can lead to complications in the future.

Steps to fill out a beneficiary designation form

Completing a beneficiary designation form may feel daunting, but following a systematic approach can simplify the process. Each step is integral to ensuring that your wishes are accurately documented and legally recognized. Start by gathering all necessary information to facilitate a smooth filling experience.

Signing and submitting the form

Once your beneficiary designation form is completed, the next step is to sign and submit it. Adhering to the signature requirements outlined in your financial institution's guidelines can prevent unnecessary delays and challenges in executing your intent.

Managing beneficiary designations over time

Beneficiary designations are not one-time tasks; they require periodic reviews and updates to remain relevant and effective. Life is dynamic, and changes in personal circumstances can significantly affect beneficiaries, making it essential to stay proactive.

Frequently asked questions (FAQs) about beneficiary designation forms

Despite the clarity a beneficiary designation form provides, many questions often arise from users. Addressing these common queries can help individuals navigate their decisions with greater confidence and understanding.

Related resources and tools

Access to useful resources can provide further clarity and assistance as you navigate the process of completing and managing your beneficiary designation form. Utilizing interactive tools and official guidelines ensures that you stay informed and protected.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send beneficiary designation form for eSignature?

Can I sign the beneficiary designation form electronically in Chrome?

Can I edit beneficiary designation form on an Android device?

What is beneficiary designation form?

Who is required to file beneficiary designation form?

How to fill out beneficiary designation form?

What is the purpose of beneficiary designation form?

What information must be reported on beneficiary designation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.