Get the free Business tax forms for US LLCs explained

Get, Create, Make and Sign business tax forms for

How to edit business tax forms for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax forms for

How to fill out business tax forms for

Who needs business tax forms for?

Business Tax Forms for Form

Understanding business tax forms

Business tax forms are essential documents that businesses must complete and submit to report their income, expenses, and taxes owed to the government. These forms ensure compliance with federal, state, and local tax laws and maintain transparency in financial activities. Understanding the nuances of these forms can save business owners time, money, and potential legal issues.

Different types of business tax forms exist, and they can broadly be categorized into federal and state tax forms. Federal tax forms are mandated by the Internal Revenue Service (IRS), while state forms vary based on location. Additionally, tax forms can be categorized into direct and indirect forms—direct forms relate to income taxes, while indirect forms may cover sales taxes and employment taxes.

There are many myths surrounding business tax forms. Some owners believe that if they are operating at a loss, they don't need to file at all, which can lead to significant penalties later. Educating yourself on these misconceptions is vital.

Key business tax forms every owner should know

Every entrepreneur should be acquainted with essential IRS tax forms relevant to their business type. For instance, Form 1040 Schedule C is crucial for sole proprietors reporting profit or loss from their business. Understanding when and how to utilize each form can streamline your tax filing experience and minimize errors.

Furthermore, corporations have different requirements, primarily reliant on Form 1120 for income tax returns, while partnerships must complete Form 1065. Employment tax forms like 941 and 940 are also essential for any business with employees.

Each business structure—be it a sole proprietorship, partnership, or corporation—has specific forms that streamline tax obligations, which is vital for compliance.

Navigating filing requirements

Understanding filing requirements is crucial for every business owner. Key dates and deadlines for filing can vary significantly; for instance, individual tax returns are typically due on April 15, while corporate tax returns follow a different timeline. Companies may have monthly, quarterly, and annual responsibilities, making it vital to plan ahead.

Determining who must file is another crucial aspect. Not all businesses, especially small or newly established ones, are required to file every form. However, ignorance of these requirements can lead to consequences, including late fees and interest penalties.

Being informed about the deadlines pertinent to your business type can prevent costly mistakes.

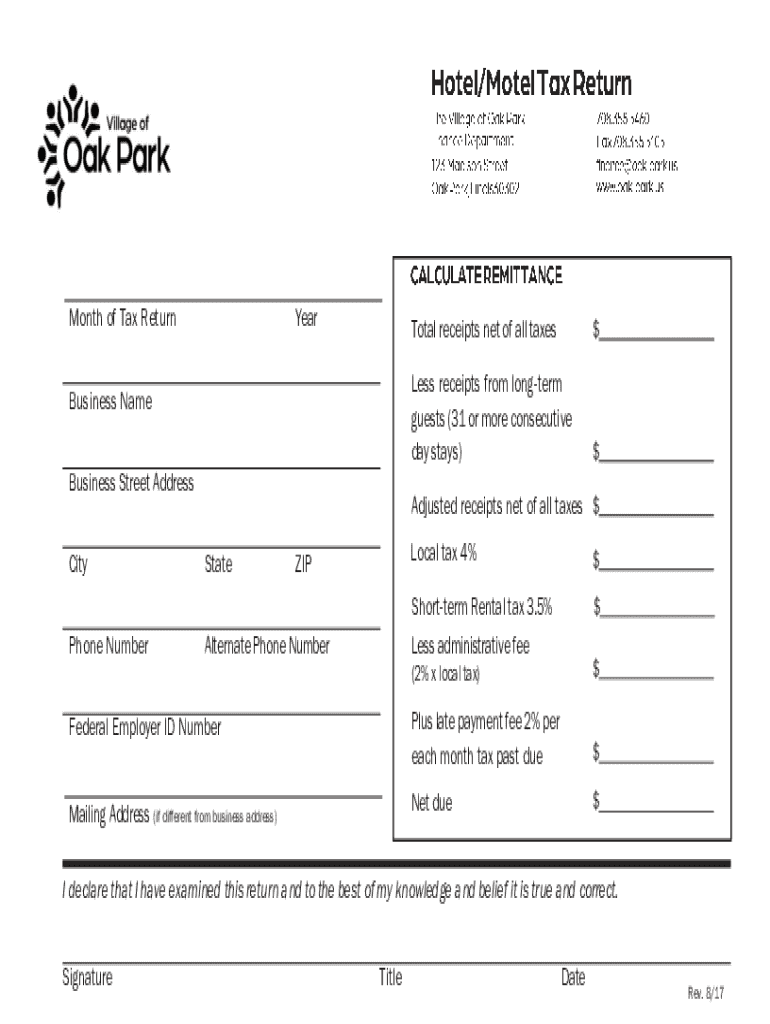

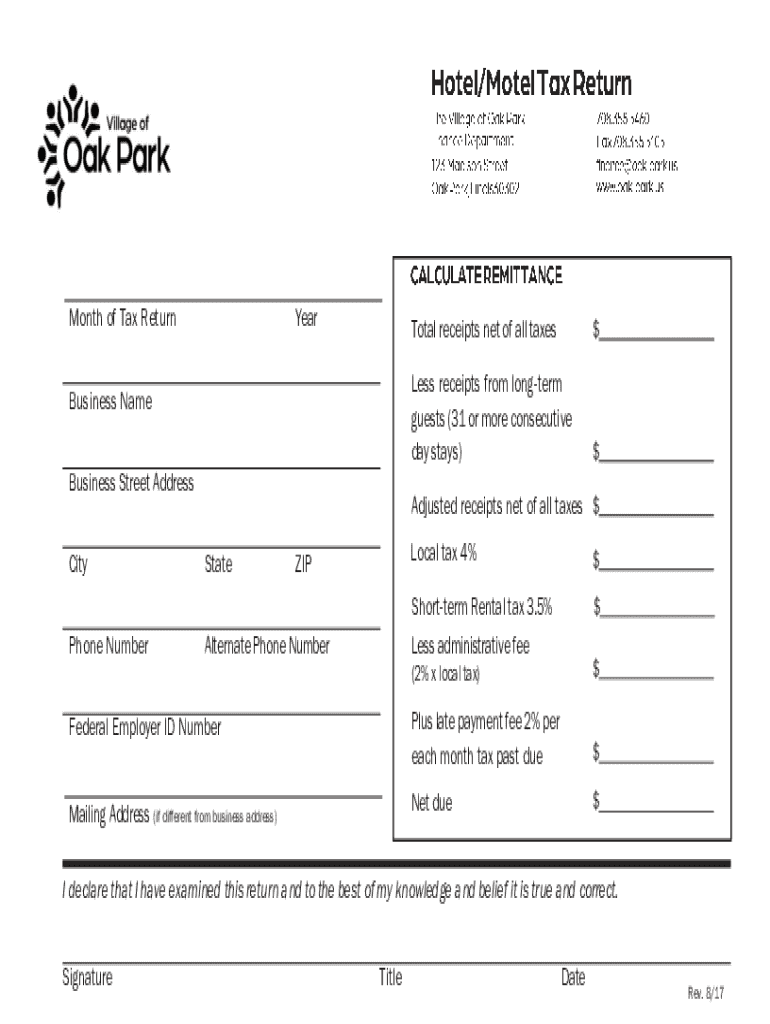

Filling out business tax forms

Completing business tax forms can seem daunting, but a step-by-step approach can demystify the process. Start by collecting all financial documents, such as income statements and receipts. For Form 1040 Schedule C, for instance, you must report total income and deduct qualifying business expenses. Understanding each line item will ease your worries.

When filling out Form 1065 for partnerships, attention to detail is critical, especially regarding income allocation to each partner. Accurate data entry is not just a best practice; it's fundamental to avoid audits and ensure compliance.

Utilizing tools that assist with error reduction and provide templates can greatly enhance compliance and accuracy in your submissions.

Editing and managing business tax forms with technology

Leveraging technology for editing and managing business tax forms can save significant time and eliminate common errors. pdfFiller offers seamless editing and customization features that empower users to adapt forms as necessary. This tool can simplify the tax filing process and ensure that documents are easily accessible.

Collaboration on tax forms is another advantage of using a cloud-based platform like pdfFiller. Team members can review and edit documents in real-time, ensuring input from all relevant parties is accounted for before submission. This capability improves the quality of the final document.

Harnessing the functionalities of pdfFiller not only streamlines the process but also enhances the overall efficiency of document management.

Additional tax form considerations

A variety of supplemental tax forms may be required based on your business activities. State-specific forms are paramount to ensure compliance with local laws. Additionally, excise tax forms exist for businesses engaged in specific activities, such as manufacturing or selling certain goods. Sales and use tax compliance forms are also necessary when selling commodities.

Determining which forms apply to your business type is critical. Conducting research or consulting with a tax professional can clarify your obligations and ensure comprehensive coverage.

Being proactive in understanding these requirements can prevent potential legal challenges.

Moving forward: preparing for tax season

Preparing for tax season well in advance is essential for any business owner. Organizing your financials and ensuring accurate documentation can streamline the filing process. Good preparation helps avoid last-minute stress and inaccuracies, supporting efficient compliance.

Maintaining solid record-keeping habits is vital. Keeping track of receipts, invoices, and bank statements will create a clear picture of the financial health of your business and is invaluable during tax season.

Creating a tax strategy by anticipating obligations can significantly benefit your business, both strategically and financially.

Frequently asked questions about business tax forms

Business tax forms can lead to several frequently asked questions, especially regarding submission methods and deadlines. Owners often inquire about whether to file online or by mail. Many find online submission faster and more efficient, although certain forms may require physical submission.

Keeping updated on tax laws is also essential. Business owners are encouraged to subscribe to IRS newsletters, attend local seminars, or consult tax professionals to stay abreast of any changes to forms or filing requirements.

Understanding common queries can ease the process and enhance compliance.

Looking for legacy forms or paper forms?

Accessing older business tax forms may not always be straightforward. The IRS provides an archive of many older forms, though not all may be readily available. Maintaining records of past forms is essential for businesses as they serve as benchmarks for future budgeting and planning.

Retaining previous years’ forms allows business owners to compare year-on-year performance and recognize trends or issues that may need addressing.

Having a robust understanding of legacy forms is just one part of managing a successful business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in business tax forms for?

Can I create an electronic signature for the business tax forms for in Chrome?

Can I edit business tax forms for on an Android device?

What is business tax forms for?

Who is required to file business tax forms for?

How to fill out business tax forms for?

What is the purpose of business tax forms for?

What information must be reported on business tax forms for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.