Get the free Tax Highlights - KPMG agentic corporate services

Get, Create, Make and Sign tax highlights - kpmg

Editing tax highlights - kpmg online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax highlights - kpmg

How to fill out tax highlights - kpmg

Who needs tax highlights - kpmg?

Tax highlights - KPMG form: A comprehensive guide for 2023

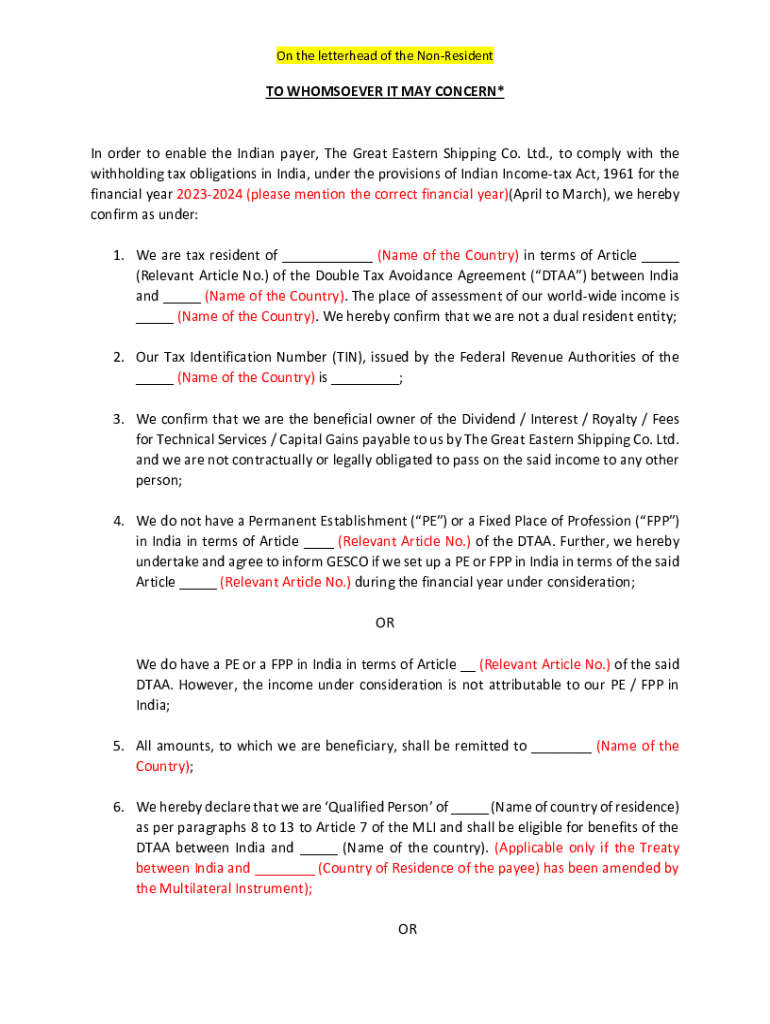

Understanding the KPMG Tax Form

The KPMG Tax Form serves as a crucial tool for individuals and businesses alike to ensure compliance with tax regulations while maximizing potential benefits. Its importance lies in its ability to consolidate various tax-related information in a standardized format, facilitating easier processing and review by tax authorities.

Key features of the KPMG Tax Form include a comprehensive layout that captures essential financial data, a user-friendly design for better navigation, and clearly defined sections for income, deductions, and credits. This form not only streamlines the filing process but also helps users to accurately report their financial activities.

Individuals earning income and businesses reporting profits should consider using the KPMG Tax Form. It caters to a wide range of users, from freelancers to established corporations, ensuring that everyone can benefit from its structured format.

Key tax highlights for 2023

2023 is ushering in significant changes in tax regulations that taxpayers need to be aware of to optimize their tax filings. Recent legislative updates may affect tax brackets, deductions, and credits, thereby altering the tax liabilities for both individuals and businesses.

For instance, adjustments to income tax brackets may lead to changes in your overall tax responsibility. Additionally, new regulations regarding business expenses and allowable deductions can create opportunities for enhanced tax benefits. Taxpayers should keep abreast of these updates to ensure compliance and optimize their financial outcomes.

Notable deductible expenses for this year include qualified medical expenses, certain educational costs, and contributions to retirement accounts. It’s also critical to track important deadlines for filing taxes, typically falling on or around April 15th, to avoid any penalties.

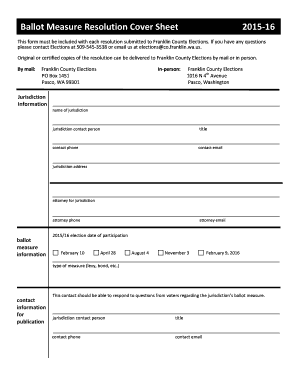

Step-by-step guide to completing the KPMG tax form

Completing the KPMG Tax Form begins with preparation. Gather all necessary documents and information, such as W-2s, 1099s, and records of deductible expenses. It is advisable to keep your financial data organized, which can significantly reduce filing time and prevent errors.

When filling out the form, start with the personal information section. Ensure that all details match official documents to avoid discrepancies. Next, the income reporting section should accurately reflect all earnings. Take time in the deductions and credits section; miscalculations here can lead to missed savings. Lastly, don’t forget to verify your entries and provide a signature to finalize the submission.

Common mistakes often occur in the income reporting and deductions sections. It’s critical to ensure that every earned dollar is reported and that deductions are legitimate to avoid an audit.

Tools to enhance your tax filing experience

To further simplify the tax filing process, leveraging technological tools can be extremely beneficial. Interactive tax calculators and tools can provide immediate feedback on your tax situation, allowing for better financial planning.

Using pdfFiller to fill and edit your KPMG Tax Form can streamline your experience significantly. Accessing and using pdfFiller is straightforward; simply upload the form, fill in the required fields, and save your progress at any time. The cloud-based platform allows for seamless document management, meaning you can access your tax forms from anywhere.

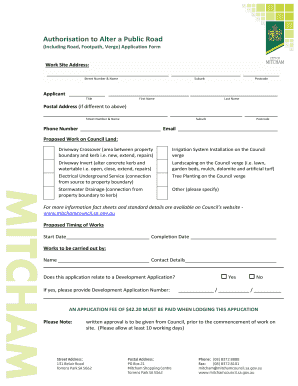

Managing your tax documents effectively

Effective management of your tax documents is crucial for both current filings and future seasons. Start by adopting best practices for document organization. One effective strategy is to categorize documents by type (e.g., income, deductions) and store them in easily accessible folders, either digitally or on paper.

Choosing between digital and paper filing involves weighing convenience against security. Digital files can be organized quickly, backed up, and accessed from anywhere, whereas paper files might require more physical space but can feel more intuitive for some users. Also, securing your KPMG Tax Form and related documents is vital; consider password protecting sensitive digital files and using locked cabinets for paper versions.

Frequently asked questions about the KPMG tax form

When dealing with tax submissions, it's common for questions to arise, especially regarding errors. If you find you’ve made an error on your form after submission, promptly file an amendment. This process is essential to correct any inaccuracies and to ensure compliance.

Understanding your rights and responsibilities as a tax filer is also vital. Every filer must ensure accurate reporting, remain informed about applicable deductions, and follow the proper timelines for submission and reviews.

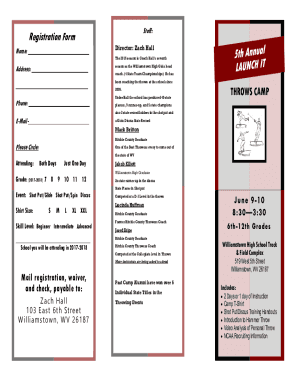

Real-life examples & case studies

Examining real-life examples of individuals and teams utilizing the KPMG Tax Form via pdfFiller showcases its practical benefits. Users have reported streamlined processes, reduced errors, and maximized deductions through better organization and form completion.

For example, a freelance graphic designer utilized the KPMG Tax Form to report multiple income streams and deductions resulting from supplies and workspace costs. By using pdfFiller to manage their documents, they efficiently compiled all necessary information, resulting in a refund significantly larger than anticipated.

Troubleshooting and support

While utilizing pdfFiller for managing your KPMG Tax Form, technical issues may occasionally arise. Fortunately, the platform provides comprehensive support options, including troubleshooting guides and customer support services to assist you promptly.

Familiarity with the tool can reduce technical issues, but should problems occur, resources are available to guide users through common fixes. It’s always advisable to consult customer support for any issues requiring expert assistance, ensuring that your tax filing process remains smooth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tax highlights - kpmg?

Can I create an electronic signature for the tax highlights - kpmg in Chrome?

Can I edit tax highlights - kpmg on an iOS device?

What is tax highlights - kpmg?

Who is required to file tax highlights - kpmg?

How to fill out tax highlights - kpmg?

What is the purpose of tax highlights - kpmg?

What information must be reported on tax highlights - kpmg?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.