Get the free Nrd Form 3

Get, Create, Make and Sign nrd form 3

Editing nrd form 3 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nrd form 3

How to fill out nrd form 3

Who needs nrd form 3?

A Comprehensive Guide to NRD Form 3

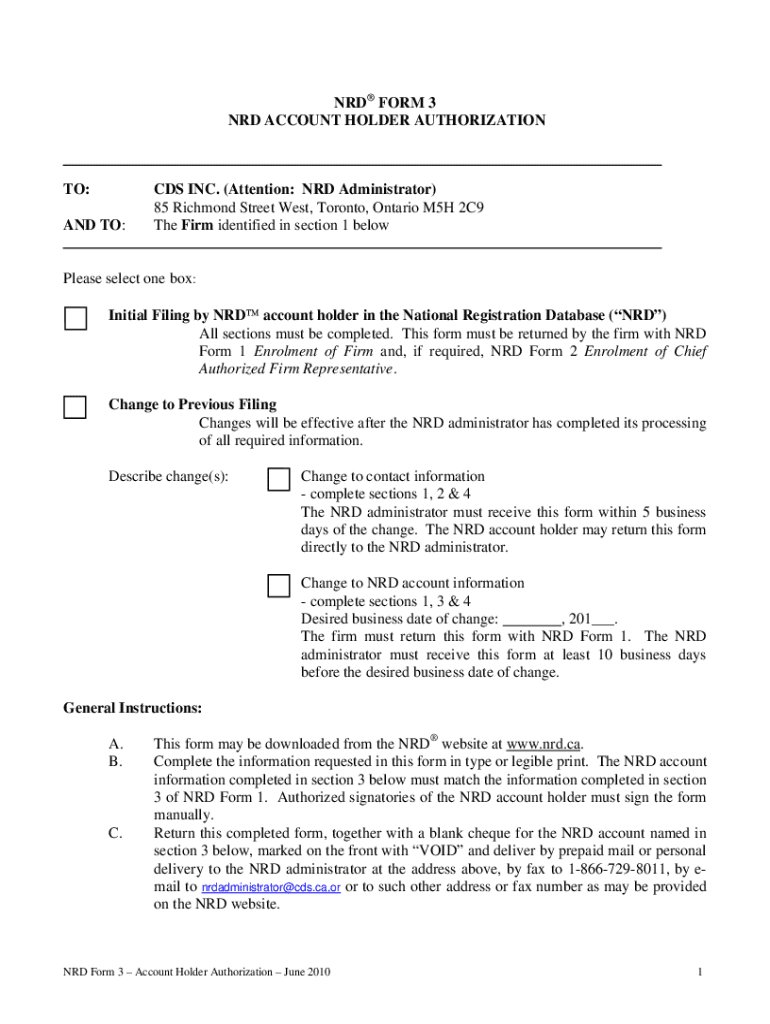

Overview of the NRD Form 3

NRD Form 3 is a critical document in the landscape of business registration, specifically designed for companies in certain jurisdictions. This form serves as an application to register a business entity with relevant regulatory authorities.

The importance of completing the NRD Form 3 accurately cannot be overstated. It not only legitimizes your business but also ensures compliance with local laws and regulations. Regulatory bodies such as the local chamber of commerce or state business registrar are typically involved in the processing and approval of this form.

Understanding the components of NRD Form 3

To fill out the NRD Form 3 correctly, familiarity with its various components is essential. The form is divided into several key sections that provide essential information about your business and its ownership.

Detailed instructions for filling out NRD Form 3

Filling out the NRD Form 3 can be broken down into an organized, step-by-step process. Following these instructions ensures completeness and reduces the chance of errors.

Editing and managing your NRD Form 3

Once the NRD Form 3 is filled out, managing it effectively is crucial. Utilizing tools like pdfFiller can streamline editing and collaboration.

Signing the NRD Form 3

Legal validity is crucial when signing your NRD Form 3, and utilizing an electronic signature (eSignature) is a practical solution.

Common challenges and solutions

Filling out the NRD Form 3 can present various challenges, especially for first-time users. Identifying frequent errors can significantly enhance the accuracy of submissions.

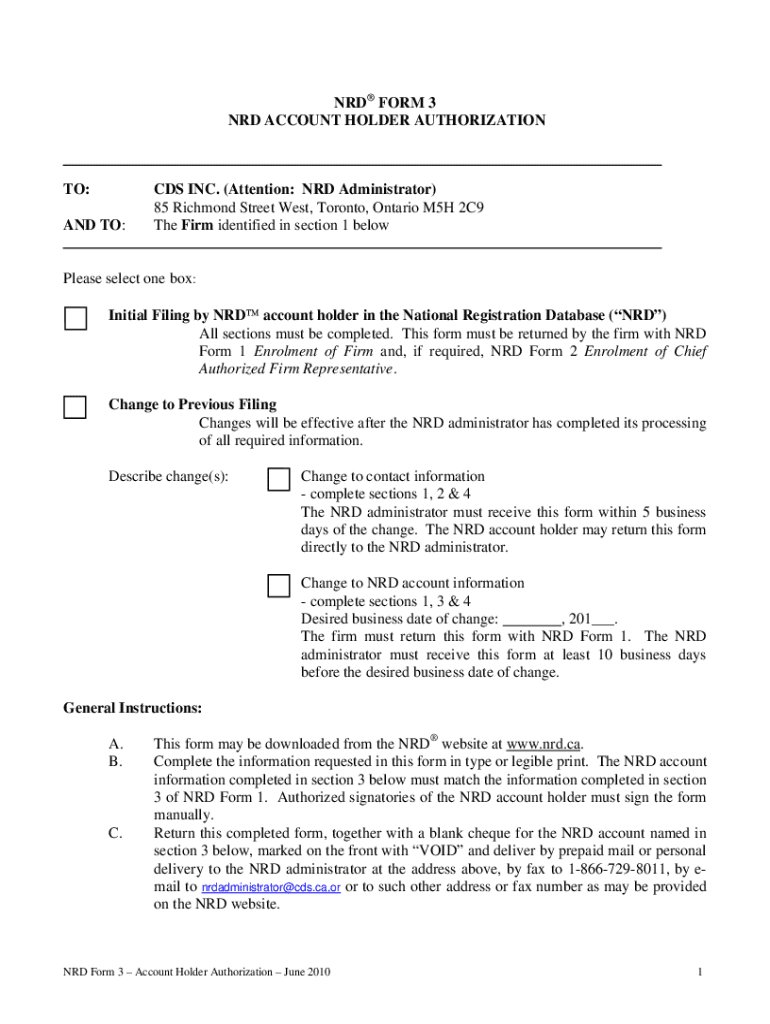

Submission process

After carefully completing the NRD Form 3, the next step involves submission. Understanding submission channels is vital for expedited processing.

Feedback and follow-up

User feedback is invaluable in refining the NRD Form 3 process and can guide improvements in future iterations of the form.

Important considerations

While navigating the NRD Form 3 process, several important considerations must be kept in mind, particularly compliance and data privacy.

Additional features of pdfFiller for NRD form management

Beyond just filling out the NRD Form 3, pdfFiller offers features that enhance the document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my nrd form 3 in Gmail?

How can I get nrd form 3?

How do I edit nrd form 3 on an Android device?

What is nrd form 3?

Who is required to file nrd form 3?

How to fill out nrd form 3?

What is the purpose of nrd form 3?

What information must be reported on nrd form 3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.