Get the free New Account Application

Get, Create, Make and Sign new account application

Editing new account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account application

How to fill out new account application

Who needs new account application?

Guide to Completing a New Account Application Form

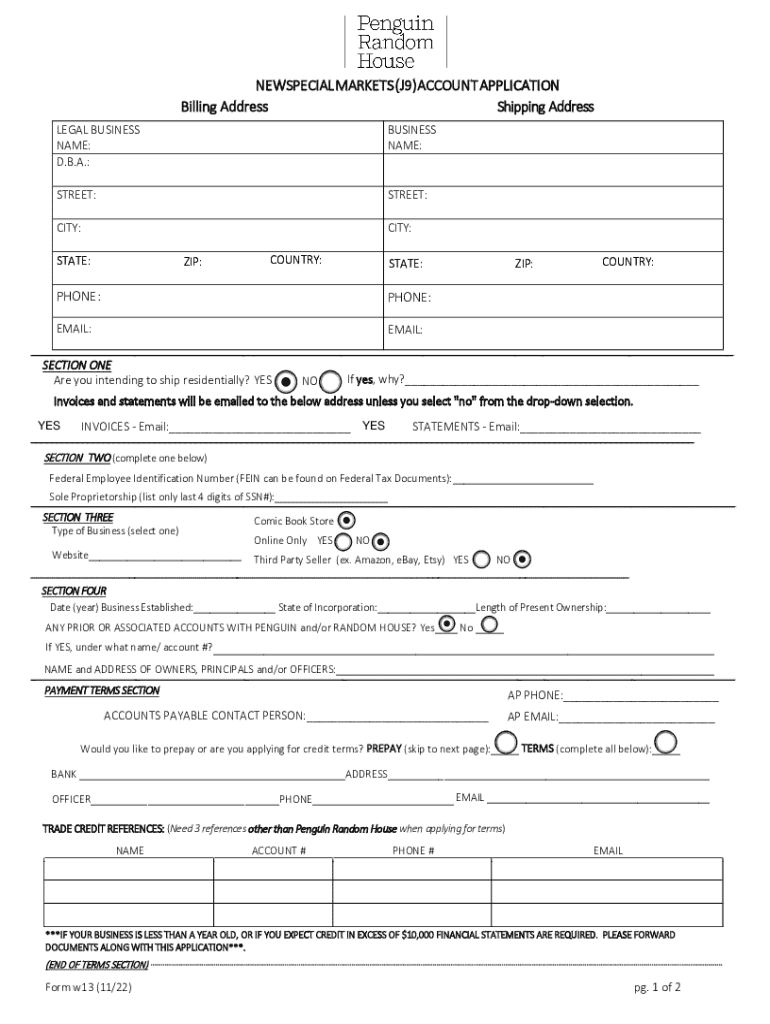

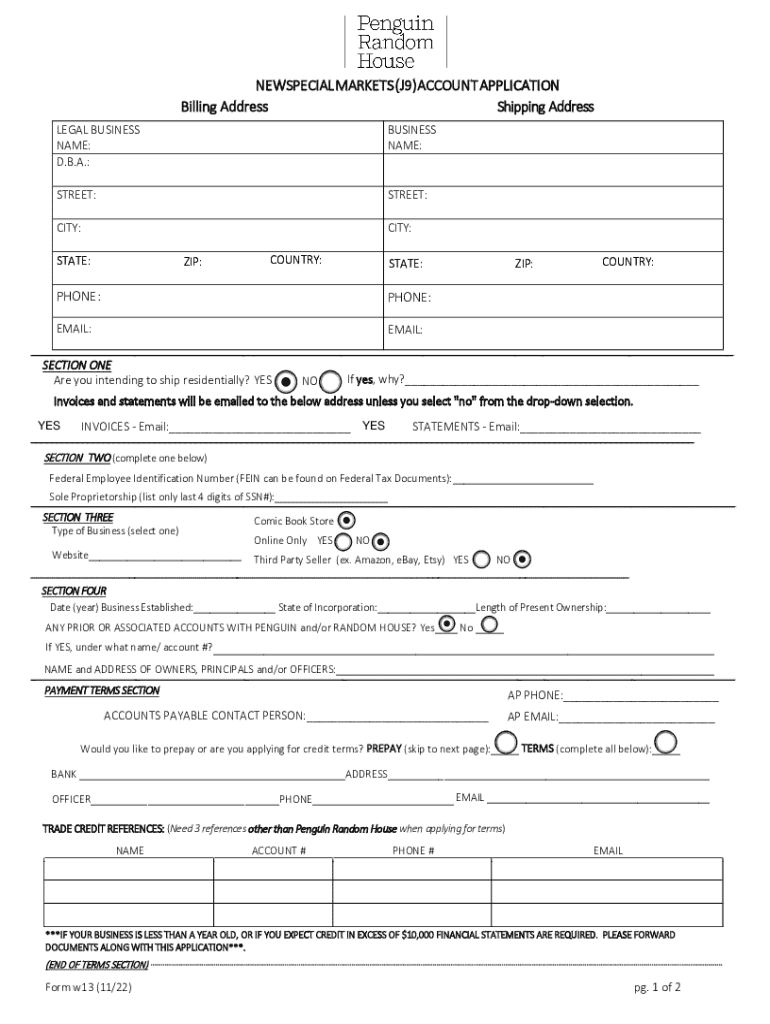

Overview of the new account application process

Completing a new account application form is a crucial step for individuals and businesses looking to access various financial products and services. An accurate and complete application not only expedites the approval process but also minimizes the risk of delays that can arise from missing or incorrect information. By ensuring that all details are filled out correctly, applicants can significantly enhance their chances of securing the desired account.

Utilizing a digital application process through pdfFiller offers numerous advantages. First, it provides users the flexibility to access their applications from anywhere, making it easier to manage documentation on the go. Second, time-saving features, such as auto-fill options and template usage, streamline the application process. Lastly, pdfFiller prioritizes enhanced security and compliance, ensuring that sensitive information remains protected throughout the application journey.

Understanding different types of accounts

Before diving into the application form, it’s essential to understand the types of accounts being offered, as each comes with its own features and requirements.

Non-retirement accounts

Non-retirement accounts are typically used for everyday banking transactions, savings, and investment activities. They may include checking accounts, savings accounts, and brokerage accounts. Eligibility criteria can vary based on the financial institution, but generally, any adult with a valid identification and a social security number can apply. Required documentation often includes proof of identity, proof of address, and potentially income verification.

Retirement accounts

Retirement accounts, such as IRAs (Individual Retirement Accounts) and 401(k) plans, are designed for long-term savings with tax benefits. When applying for these accounts, it's critical to understand eligibility based on age, income thresholds, and employment status. Important considerations include contribution limits, tax implications on withdrawals, and the importance of designating beneficiaries. Necessary forms often include the application form itself, as well as any supplementary documents confirming employment and income.

Existing accounts

Managing existing accounts can sometimes require updates due to changes in personal circumstances—such as a new address, or even a change in account ownership. Procedures for changing account details typically involve submitting a request form, which may include verifying your identity and providing supporting documents. It's essential to stay informed on how these processes function to ensure your accounts remain current and secure.

Step-by-step guide to completing the new account application form

Completing a new account application form can seem daunting at first, but breaking it down into manageable steps can ease the process significantly.

Gathering required information

Start by gathering all necessary information, which typically includes personal details like your full name, address, date of birth, and social security number. Financial institutions may also request employment details, such as your job title, employer’s name, and annual income—this information helps them to assess your eligibility and account features.

Filling out the application

When filling out the application, it’s crucial to understand each section. Below is a breakdown of standard sections commonly found in a new account application form:

Common mistakes to avoid

Applicants should be vigilant in avoiding common pitfalls such as overlooking required fields, providing outdated or incorrect information, and failing to sign or date the application. These mistakes can lead to delays in processing, or even rejection of the application.

Editing your new account application form

Once you've completed the form, you may wish to review and make changes. pdfFiller offers user-friendly editing tools that allow for easy adjustments to your application.

Utilizing pdfFiller's editing tools

To access your application in pdfFiller, simply log in to your account and locate the document in your dashboard. Follow these steps to edit text and fields:

Adding signatures

Signing your application is a crucial step for validation. Within pdfFiller, you can eSign directly on the platform, which is convenient and efficient. A valid signature often signifies agreement to the terms and conditions, which can be especially important for financial services.

Submitting your application

After completing and reviewing your new account application form, it’s time to submit it. Understanding your submission options will help ensure that your application reaches the institution quickly and correctly.

Understanding submission methods

You have two common options for submitting your application: direct online submission and mailing a printed copy. Each method has its pros and cons:

Tracking the application status

Using pdfFiller allows you to track your application status effortlessly. Simply log into your account to view updates. If there are any issues or delays, the platform often provides a point of contact for customer service, ensuring you can take prompt action.

Frequently asked questions (FAQs)

As with any new process, applicants often have questions. Here are some common inquiries regarding the new account application form:

Interactive tools and resources

To further assist in completing the new account application form, pdfFiller provides various interactive tools and resources that can simplify the process.

Templates and pre-filled forms

Accessing templates for various account types allows for a quicker start when filling out applications. Pre-filled forms can expedite the process by having common information already populated, saving you time and reducing errors.

Video tutorials

pdfFiller also offers a collection of video tutorials that guide users through the platform. These videos provide insightful tips on navigating the application forms and completing them correctly, enhancing your overall experience.

Additional considerations and best practices

Filing a new account application form doesn't stop at submission. To ensure a smooth experience, consider these essential practices:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the new account application in Chrome?

How can I edit new account application on a smartphone?

How can I fill out new account application on an iOS device?

What is new account application?

Who is required to file new account application?

How to fill out new account application?

What is the purpose of new account application?

What information must be reported on new account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.