Get the free Withdrawal Form

Get, Create, Make and Sign withdrawal form

Editing withdrawal form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out withdrawal form

How to fill out withdrawal form

Who needs withdrawal form?

A Comprehensive Guide to Withdrawal Forms

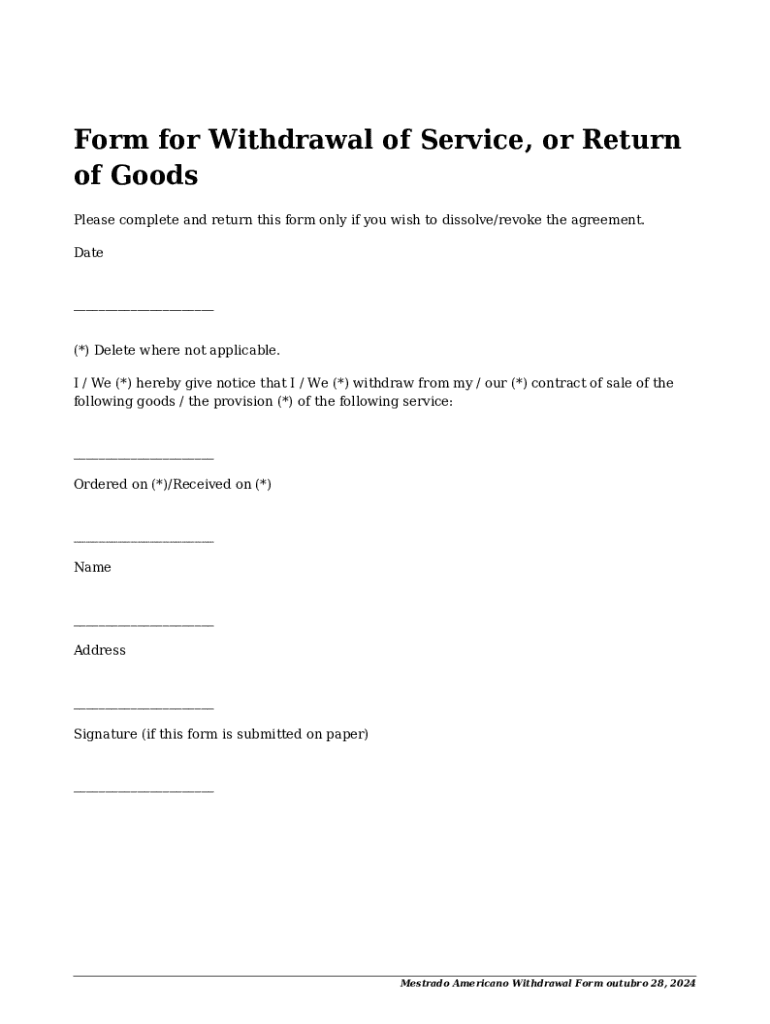

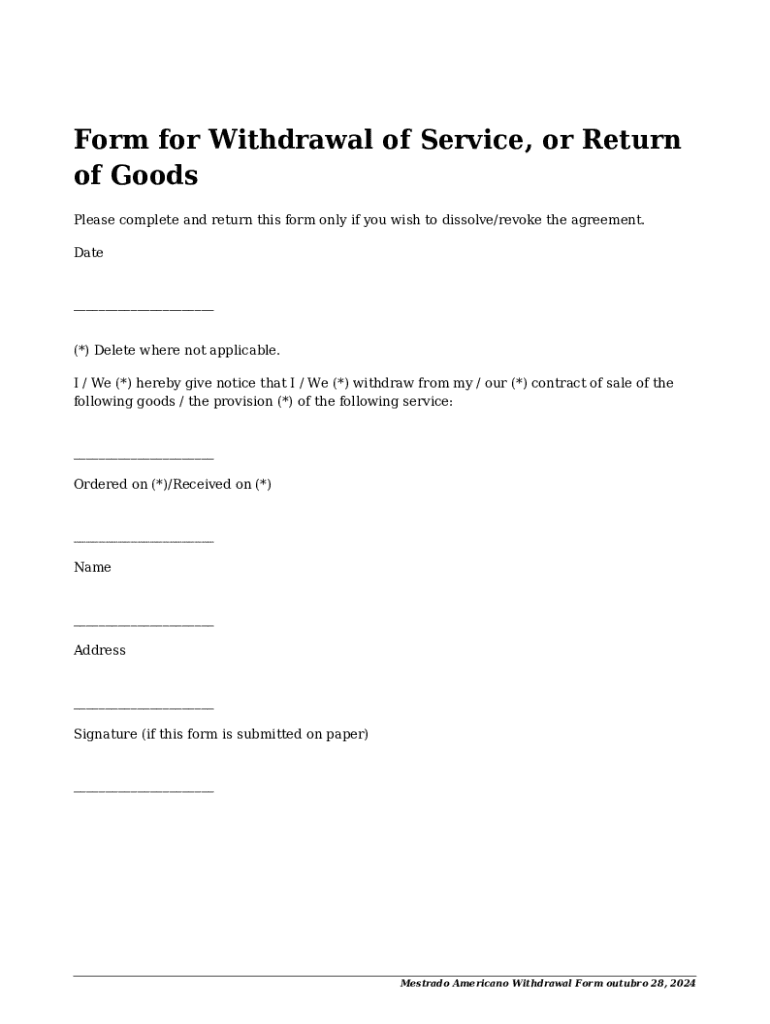

Understanding the withdrawal form

A withdrawal form is a crucial document used to formalize the request for the removal or withdrawal of a service, application, or funds from an institution or an entity. This document is essential in various contexts, including academia, financial institutions, and insurance providers. It serves as a record that notifies the relevant party of the user’s intent, ensuring transparency and compliance with procedural requirements.

Commonly, withdrawal forms are utilized in different scenarios. For instance, students may need academic withdrawal forms to retract enrollment in courses during a semester. Financial institutions often require withdrawal forms when clients wish to remove funds from accounts or investment portfolios. Similarly, insurance companies utilize withdrawal forms for policyholders to withdraw benefits or dividends.

Properly completing a withdrawal form is imperative to avoid delays or rejections. Inaccurate information or incomplete submissions can lead to a miscommunication of the intent, potentially causing complications in future transactions.

Types of withdrawal forms

Withdrawal forms can be categorized based on their specific uses. Understanding the distinctions among these forms is critical for ensuring proper use and compliance.

Each type of withdrawal form features its unique procedures and policies, essential information requirements, and rules for effective submission. Understanding these aspects is crucial to ensure timely processing and compliance with institutional or organizational regulations.

Preparing to fill out a withdrawal form

Before diving into the completion of a withdrawal form, it is prudent to gather all necessary documentation. Essential documents might include identification paperwork, bank statements, and any previous correspondence related to the withdrawal. This preparation helps in providing accurate data and addressing any specific requirements needed for successful submission.

While preparing to fill out the form, a few common mistakes should be avoided. Omitting important information, such as account details, withdrawal amounts, or reasons for withdrawal, can cause significant delays. Additionally, trying to submit the form at the last minute often leads to rushed mistakes that may result in a rejected application.

Step-by-step guide to completing your withdrawal form

Completing your withdrawal form becomes seamless when followed step-by-step. Here’s how you can efficiently navigate this essential process.

Following these steps diligently will facilitate a smoother withdrawal process, reducing the likelihood of errors and ensuring prompt responses.

Tracking your withdrawal request

Once your withdrawal form is submitted, it’s essential to understand what to expect next. Responses to withdrawal requests can vary in processing times depending on the institution or company involved.

Using tools available through pdfFiller, users can monitor the progress of their withdrawal requests. Maintaining communication with the relevant institution can help in clarifying any additional information needed, ensuring all requirements are fulfilled promptly.

FAQs about withdrawal forms

Many individuals have questions about withdrawal forms which can greatly affect their use and understanding. Here are some commonly asked questions.

Utilizing pdfFiller for your withdrawal needs

pdfFiller is a formidable ally when managing withdrawal forms and related documentation. The advantages of using pdfFiller for your withdrawal needs are numerous.

Beyond withdrawal forms, pdfFiller provides tools for editing, annotating PDFs, and organizing forms effectively, enhancing users’ document management capabilities.

Best practices for future withdrawals

Keeping meticulous records of past withdrawals is essential for preventing future issues. Retaining copies of submitted withdrawal forms, correspondence, and any relevant documents can serve as valuable references.

Furthermore, staying informed about the withdrawal policies of different institutions can save time and prevent confusion. Rules and regulations can change; thus, regularly checking for updates ensures that your withdrawals proceed smoothly.

Lastly, utilizing educational resources or forums related to withdrawal processes can keep you informed about best practices, enabling you to handle future withdrawals with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the withdrawal form in Chrome?

How do I fill out the withdrawal form form on my smartphone?

Can I edit withdrawal form on an iOS device?

What is withdrawal form?

Who is required to file withdrawal form?

How to fill out withdrawal form?

What is the purpose of withdrawal form?

What information must be reported on withdrawal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.