Get the free CHAPTER III - Trust Proceedings Before the Clerk of Court

Get, Create, Make and Sign chapter iii - trust

How to edit chapter iii - trust online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chapter iii - trust

How to fill out chapter iii - trust

Who needs chapter iii - trust?

Chapter - Trust Form: A Comprehensive Guide

Understanding trust forms

Trust forms are essential legal documents that enable individuals to outline the management and distribution of their assets upon death or incapacity. The primary importance of trust forms lies in their ability to provide clarity and structure to estate planning. They ensure that the grantor's wishes are fulfilled regarding the disposition of their assets, minimizing disputes and facilitating smoother transitions for beneficiaries.

Key components of trust forms include the identity of the grantor, the trustee, the beneficiaries, and a detailed inventory of the assets included in the trust. Additionally, terms governing the management and distribution of those assets, as well as any specific conditions or stipulations, should also be clearly included in the trust form.

Overview of trust laws and regulations

Trust laws can vary significantly across jurisdictions, necessitating a thorough understanding of local regulations. Key trust laws affecting trust forms include the Uniform Trust Code (UTC) in the United States, which provides a standardized framework for trust formation and management. Each state may have variations based on its statutes, so it’s crucial to be aware of local laws when completing trust forms.

The impact of trust law can influence how different jurisdictions handle issues such as tax implications, creditor protections, and fiduciary responsibilities. Compliance with regulations is critical; failure to do so can result in trust invalidation or legal challenges. Common legal terminology associated with trust formation includes "grantor," "trustee," "beneficiary," and "fiduciary duty," all of which play essential roles in trust management.

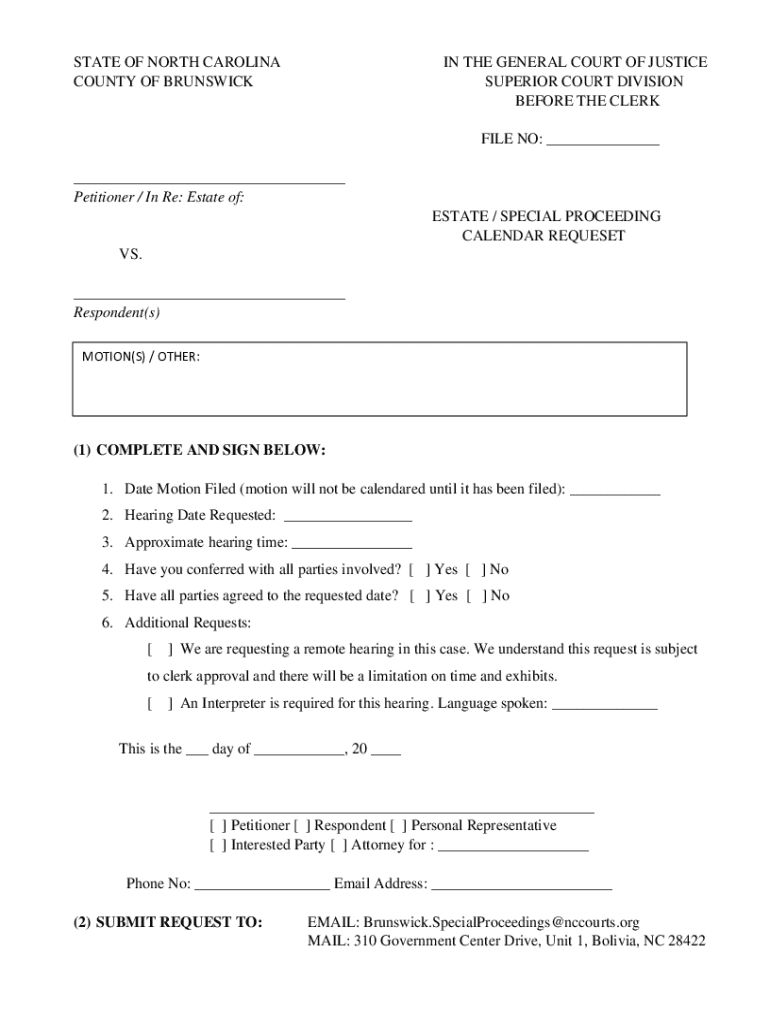

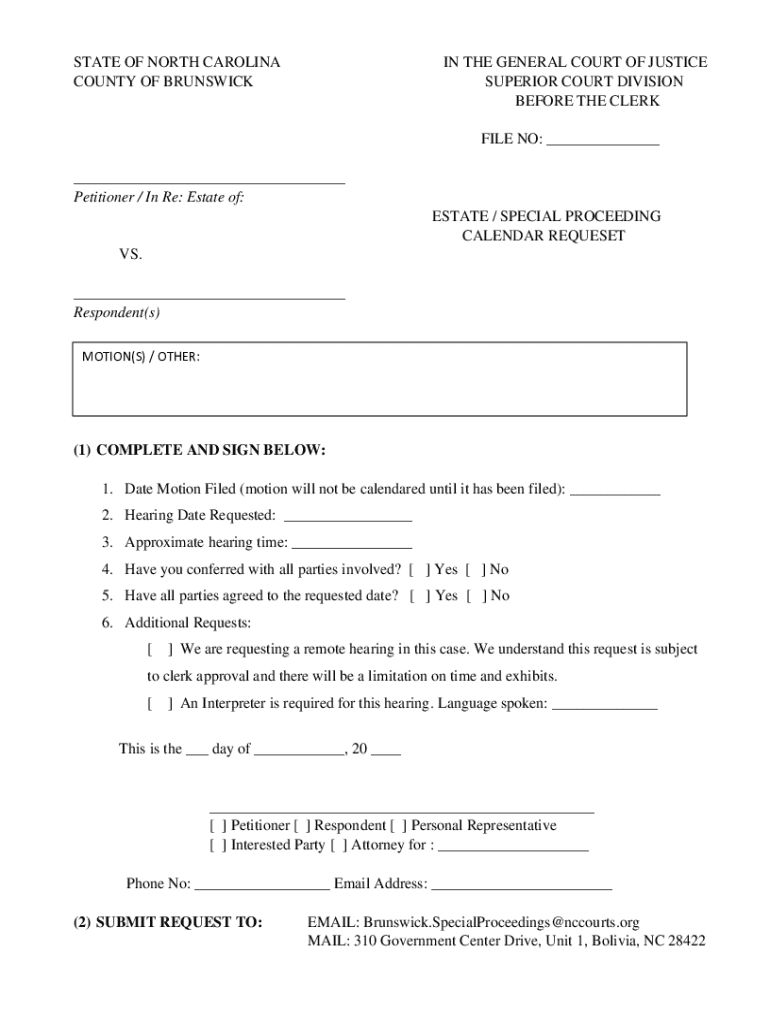

Step-by-step guide to completing a trust form

Completing a trust form can seem daunting, but with the right guidance, it can be a straightforward process. Start by gathering necessary information. This includes personal information such as your full name, address, and date of birth; an inventory of your assets, including real estate, bank accounts, and investments; and details about your chosen beneficiaries, including their names and relationships to you.

Next, you must choose the right type of trust tailored to your specific needs. Options include revocable and irrevocable trusts, which differ in flexibility and asset protection, and other types like special needs trusts or testamentary trusts. Understanding these distinctions is vital for ensuring your trust aligns with your financial and familial goals.

Editing and customizing your trust form

Utilizing pdfFiller, editing trust forms can be a seamless process. This tool allows users to modify existing documents by adding or removing clauses as needed. For instance, you may want to include specific ownership clauses or tailor terms to protect minors through guardianship provisions. Special terms ensure that beneficiaries receive their inheritance under arrangements consistent with your intentions.

Incorporating special provisions for specific assets is crucial. If you own unique properties, artworks, or specialized investments, reflecting these in the trust form can safeguard their intended use, such as designating a family member to manage a vacation home or ensuring that funds are allocated for a college education.

eSigning and sharing your trust form

The legality of electronic signatures (eSignatures) has become increasingly recognized, cementing their role in modern document management. Using pdfFiller, eSigning a trust form can be done effortlessly. The platform adheres to legal standards, providing a secure and streamlined way to obtain signatures from all necessary parties.

Sharing your completed trust form is just as important as its creation. pdfFiller allows you to securely send PDFs via email or share links, ensuring only authorized individuals have access to sensitive documents. Collaboration features enable multiple contributors to review and make adjustments, fostering a comprehensive approach to estate planning.

Managing trust forms over time

Trust forms are not static; regular reviews are essential to ensure they continue to reflect your wishes and circumstances. Life changes, such as marriage, divorce, or the birth of a child, necessitate amendments or revocations of existing trusts. Familiarizing yourself with the process of making these changes can save significant legal and logistical complexities in the future.

Archiving old trust forms is another critical aspect of trust management. Maintaining a clear record of past documents can help clarify your history and decision-making processes. Utilizing cloud-based storage solutions, such as those offered by pdfFiller, allows for secure access and retrieval of trust documentation, ensuring easy management and oversight.

Common challenges and solutions in completing trust forms

Navigating the complexities of trust forms can present challenges, particularly for those unfamiliar with legal language. Legal jargon can be intimidating and lead to misunderstandings regarding the implications of specific provisions. To overcome this, consider consulting with legal professionals who specialize in estate planning, ensuring your trust form is legally sound and reflects your wishes.

Additionally, disputes among beneficiaries can arise, particularly in families with blended dynamics or significant assets. Establishing clear communication and transparency throughout the trust creation process can mitigate potential conflicts. Addressing concerns upfront, possibly through mediation or discussions, can pave the way for smoother transitions.

Interactive tools for trust form creation

pdfFiller offers interactive templates that simplify the trust form creation process. These templates guide users through each section, ensuring compliance with legal requirements while minimizing risk. Comprehensive tools embedded within the platform allow users to manage their estate effectively, from asset management to trust fund distribution.

Frequently asked questions about trust forms can help demystify common uncertainties. Answers to questions regarding trust revocation, tax implications, and special provisions enable individuals to make informed decisions. By offering FAQs, pdfFiller aims to equip users with the knowledge necessary to navigate their estate planning journey confidently.

Best practices for trust form creation

When filling out a trust form, accuracy is paramount. Double-checking information can prevent costly legal issues in the future. Additionally, it’s essential to seek professional legal assistance, especially when dealing with unique or complex circumstances that may require tailored solutions. Keeping your trust form updated ensures it remains relevant and reflective of your current situation.

Moreover, involving key family members in discussions surrounding the trust can promote understanding and lessen potential conflicts. Engaging in conversations about intentions and projections lays a foundation for indispensable clarity and consensus among stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the chapter iii - trust in Gmail?

How can I edit chapter iii - trust on a smartphone?

How do I fill out chapter iii - trust on an Android device?

What is chapter iii - trust?

Who is required to file chapter iii - trust?

How to fill out chapter iii - trust?

What is the purpose of chapter iii - trust?

What information must be reported on chapter iii - trust?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.