Get the free Loan-closing costs sheet.doc

Show details

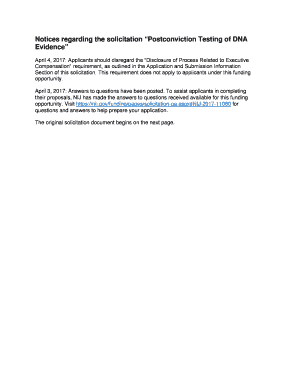

SOUTHERN REALTY E N T E R P R I S E S, I N C 2648 State Road 434 West, Longwood, FL 32779 Office 4078690033, Fax 4078695668, Toll free 18007710031, http://FloridaHouses.com Each office independently

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan-closing costs sheetdoc

Edit your loan-closing costs sheetdoc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan-closing costs sheetdoc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan-closing costs sheetdoc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit loan-closing costs sheetdoc. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan-closing costs sheetdoc

How to fill out a loan-closing costs sheetdoc:

01

Start by gathering all the necessary information and documents related to your loan. This may include your loan agreement, closing disclosure, and any receipts or invoices for expenses incurred during the mortgage process.

02

Begin filling out the loan-closing costs sheetdoc by entering the basic details, such as the borrower's name, address, loan amount, and loan number. These details are typically provided on the loan agreement or closing disclosure.

03

Next, list the various categories of closing costs. Common categories may include appraisal fees, attorney fees, title insurance, loan origination fees, and prepaid expenses such as property taxes or homeowner's insurance.

04

For each cost category, enter the description of the expense, the amount incurred, and the date it was paid. It is important to be accurate and thorough in documenting all the costs associated with the loan closing. This will help ensure transparency and clarity for both the borrower and the lender.

05

Additionally, you may need to enter any credits or reductions in closing costs. This can include seller concessions or any other negotiated agreements that reduce the overall cost burden on the borrower.

06

Review the completed loan-closing costs sheetdoc for accuracy and completeness. Double-check all the entered information to make sure it matches the actual expenses incurred during the loan closing process.

07

Finally, obtain any necessary signatures from the relevant parties involved, such as the borrower and the lender. This will serve as acknowledgment and agreement to the documented closing costs.

Who needs a loan-closing costs sheetdoc:

01

Borrowers: The loan-closing costs sheetdoc is primarily needed by borrowers who are financing a mortgage. It provides a detailed breakdown of the various costs associated with closing the loan and helps the borrower understand the financial obligations they are undertaking.

02

Lenders: Lenders also require a loan-closing costs sheetdoc to ensure accurate documentation of all expenses incurred during the loan closing. This helps them assess the financial stability of the borrower and ensures compliance with legal and regulatory requirements.

03

Real Estate Professionals: Real estate agents, brokers, and other professionals involved in the mortgage process may also need access to the loan-closing costs sheetdoc. It helps them provide accurate information to clients and ensures transparency in the transaction.

In summary, the loan-closing costs sheetdoc serves as a vital tool for both borrowers and lenders to document and understand the various costs associated with closing a loan. It helps ensure accuracy, transparency, and compliance throughout the mortgage process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loan-closing costs sheetdoc?

loan-closing costs sheetdoc is a document that provides a breakdown of the costs associated with closing a loan.

Who is required to file loan-closing costs sheetdoc?

The lender or loan officer is typically responsible for providing and filing the loan-closing costs sheetdoc.

How to fill out loan-closing costs sheetdoc?

Fill out the loan-closing costs sheetdoc by carefully documenting all costs associated with closing the loan, such as appraisal fees, origination fees, and closing agent fees.

What is the purpose of loan-closing costs sheetdoc?

The purpose of the loan-closing costs sheetdoc is to provide transparency to the borrower regarding all the costs associated with closing the loan.

What information must be reported on loan-closing costs sheetdoc?

The loan-closing costs sheetdoc must report all fees and expenses related to closing the loan, including lender fees, third-party fees, and escrow costs.

Can I sign the loan-closing costs sheetdoc electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your loan-closing costs sheetdoc in seconds.

How do I fill out loan-closing costs sheetdoc using my mobile device?

Use the pdfFiller mobile app to fill out and sign loan-closing costs sheetdoc on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete loan-closing costs sheetdoc on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your loan-closing costs sheetdoc. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your loan-closing costs sheetdoc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan-Closing Costs Sheetdoc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.