Get the free New Account Application and Update Form

Get, Create, Make and Sign new account application and

Editing new account application and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account application and

How to fill out new account application and

Who needs new account application and?

A Comprehensive Guide to New Account Application and Form

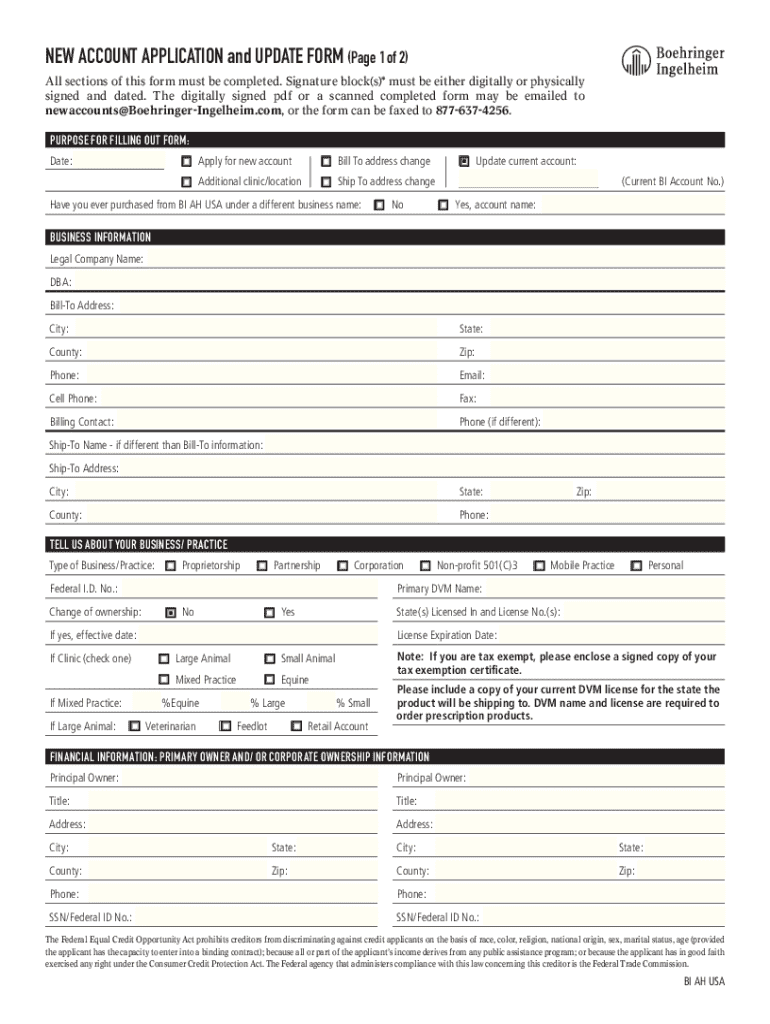

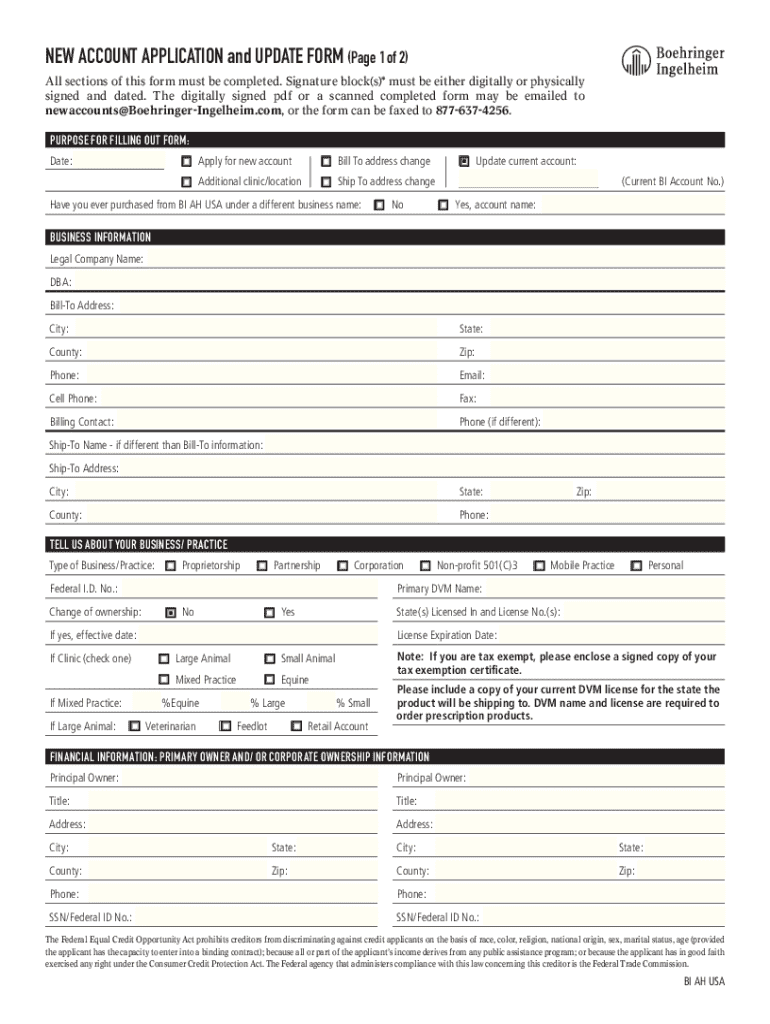

Understanding the new account application process

A new account application is essential when you're looking to open an account with any financial institution, be it a bank, credit union, or investment firm. This form acts as the formal request to establish your financial relationship and includes crucial details about your identity, financial status, and account type.

Providing accurate information is vital. Mistakes can lead to application delays, or worse, denial. Institutions require این اطلاعات to ensure they comply with regulatory standards and offer you appropriate products. Additionally, a well-completed application can present you as a reliable and credible customer.

Employing a digital form offers several key benefits, including convenience, ease of access, and often a quicker processing time. Websites like pdfFiller provide tailored templates that simplify the application process, making it straightforward for users to fill out and submit their forms.

Types of new account applications

Understanding the types of new account applications you can submit is crucial to choosing the right one for your needs. The most common types include individual, joint, retirement, and business accounts, each requiring different information and documentation.

Preparing to fill out the new account application

Before you begin filling out your application, gather essential documents. Being prepared not only speeds up the process but also minimizes the chances of errors or omissions.

Tips for gathering information include creating a checklist, ensuring documents are current, and having both digital and physical formats available. You should also decide whether to use online forms or paper forms, with online forms generally offering more convenience.

Step-by-step guide to completing the application form

When filling out the application, accuracy is paramount. Start by entering personal information accurately, including your full name, date of birth, and contact details. If you're completing a joint application, ensure that the second account holder’s information is included.

Utilizing interactive tools for form completion

Advancements in technology now allow interactive tools to assist you in completing your application efficiently. Online form fillers not only automate some of the mundane tasks but also enhance accuracy.

Common mistakes to avoid when submitting your application

Even small errors can lead to the rejection of your application. Understanding common pitfalls can help you navigate the process smoothly.

Submitting your new account application

The submission process can vary based on whether you're submitting a digital or physical form. Each method has its steps you will need to take.

Managing your new account once opened

Once your account is open, managing it effectively is crucial. Setting up online access is typically the first step, enabling you to monitor transactions and manage funds easily.

FAQs regarding new account applications

Having questions about the application process is common. Here are some frequently asked questions to alleviate concerns about your application.

Further assistance with new account applications

If you need help while navigating your account application, there are several resources available to assist you. Customer support can provide direct assistance with your questions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify new account application and without leaving Google Drive?

How can I edit new account application and on a smartphone?

How do I complete new account application and on an Android device?

What is a new account application?

Who is required to file a new account application?

How to fill out a new account application?

What is the purpose of a new account application?

What information must be reported on a new account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.