Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out application for residence homestead

Who needs application for residence homestead?

A comprehensive guide to the application for residence homestead form

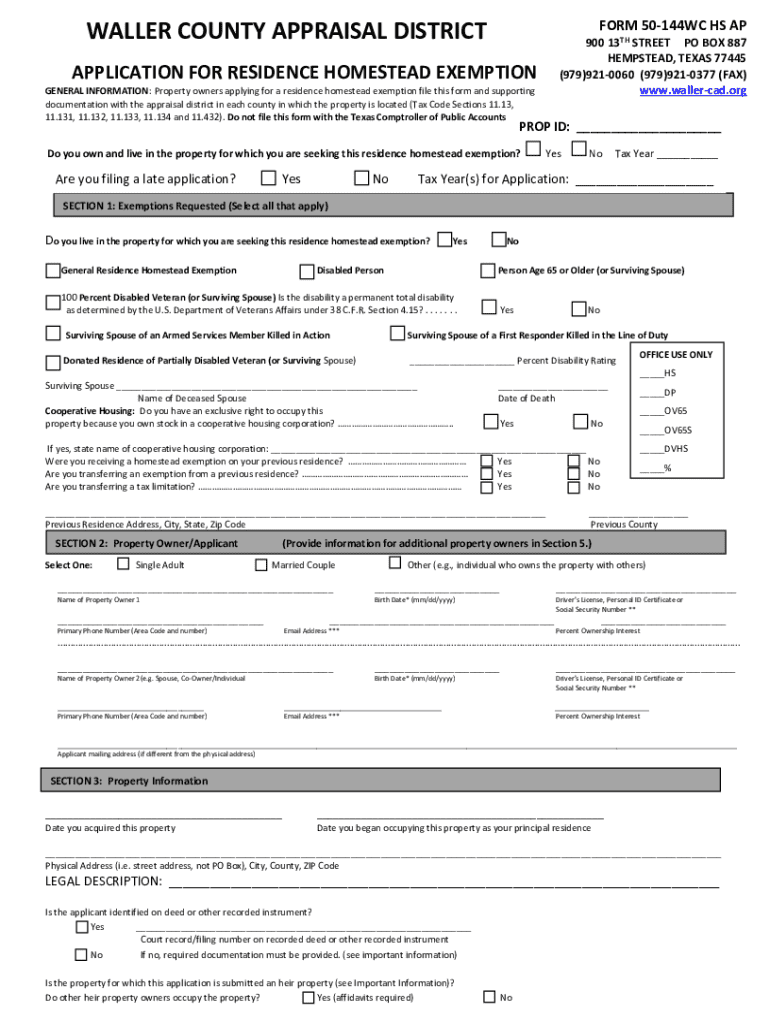

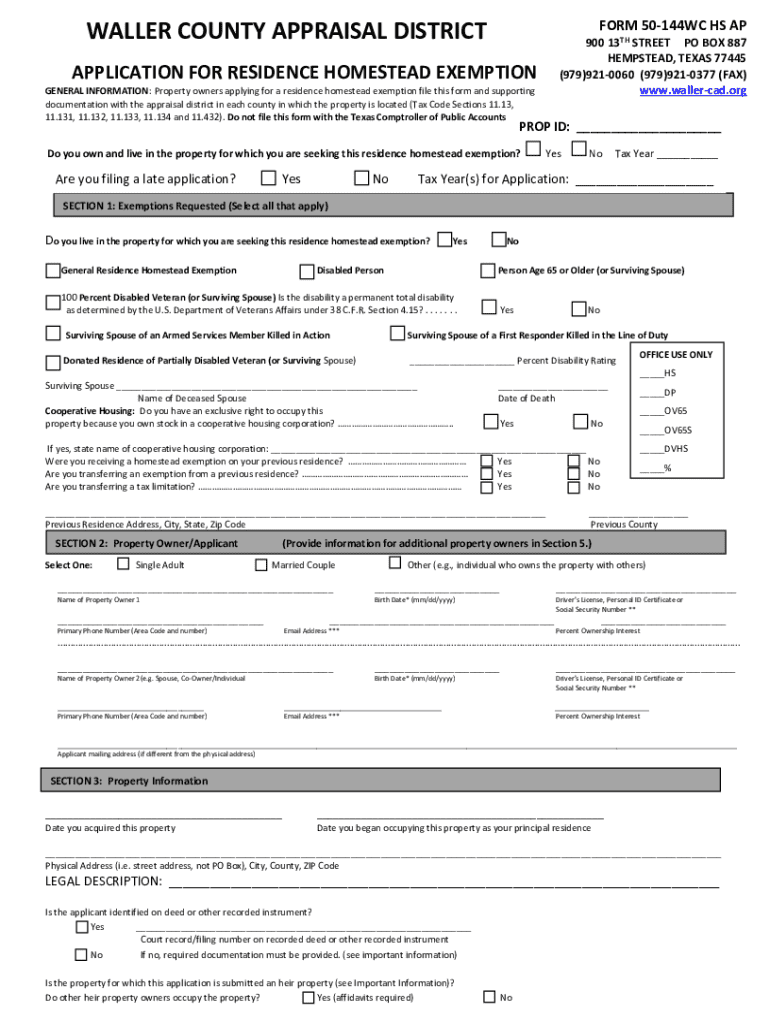

Overview of residence homestead form

The residence homestead form is a crucial document that enables homeowners to claim a homestead exemption. A residence homestead refers to a primary residence that individuals occupy and use as their home. This exemption can lead to significant property tax savings, as it often reduces the assessed value of the property for tax purposes. Understanding how to properly complete the application is essential for homeowners looking to benefit from these savings.

To qualify for a homestead exemption, applicants typically must meet specific eligibility criteria including age, income level, and ownership status. Many states require that the property be the owner’s principal residence, and failing to adhere to these standards may result in disqualification.

Preparing to complete the residence homestead form

Before starting the application for residence homestead form, it's essential to gather all required documentation. This preparation not only facilitates a smoother application process but also ensures that you present the necessary evidence to support your eligibility.

It's vital to understand that requirements and processes may differ across states and counties. Local tax offices may have different policies regarding forms and processing, so it's essential to check specific deadlines and regulations in your area.

Step-by-step guide to filling out the application

Filling out the application for residence homestead form can be straightforward if broken down into manageable steps. Here is a comprehensive approach to ensure you complete the application accurately.

Common mistakes and how to avoid them

Mistakes during the application process for the residence homestead form can lead to delays or even denial of the exemption. Being aware of common pitfalls can help you avoid them.

Submitting the application

Submitting the application for residence homestead form can be done in several ways, offering options that suit your preference and convenience. It's important to be aware of the different channels available for submission.

After submission, tracking your application status is vital. Being informed about processing times and having tips for follow-up can ease concerns while waiting for a decision.

Understanding potential outcomes

Understanding the potential outcomes after submitting your application for residence homestead form is crucial. Knowing how to navigate both approval and denial can significantly ease the process.

Local homestead exemption programs

There is considerable variation in homestead exemption programs across the country. Federal guidelines set a foundation, but local policies can offer additional benefits or differ significantly.

Interactive tools for effective document management

pdfFiller provides several interactive tools that simplify the management and completion of your residence homestead form, making the process more efficient and user-friendly.

Support and resources

As you navigate the application for residence homestead form, having access to support and resources becomes invaluable. Knowing where to find help enhances your ability to process your application smoothly.

Popular searches related to residence homestead

When researching the application for residence homestead form, users often display interest in related documents and resources that further simplify the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pdffiller form online?

Can I edit pdffiller form on an iOS device?

How do I edit pdffiller form on an Android device?

What is application for residence homestead?

Who is required to file application for residence homestead?

How to fill out application for residence homestead?

What is the purpose of application for residence homestead?

What information must be reported on application for residence homestead?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.