Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

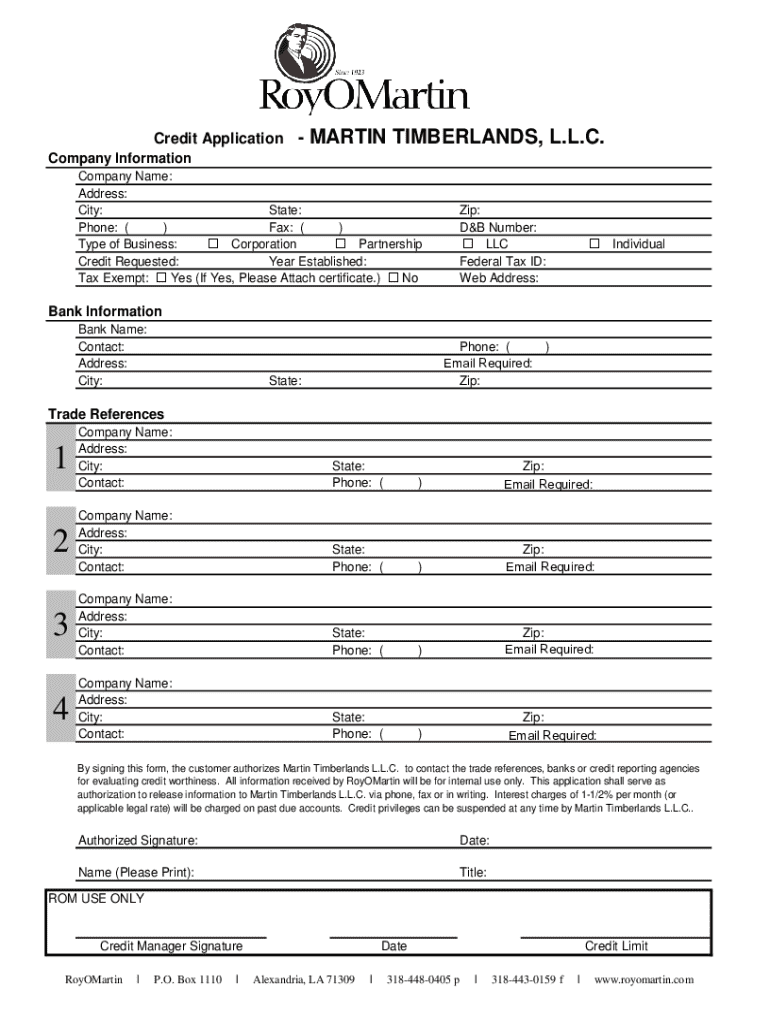

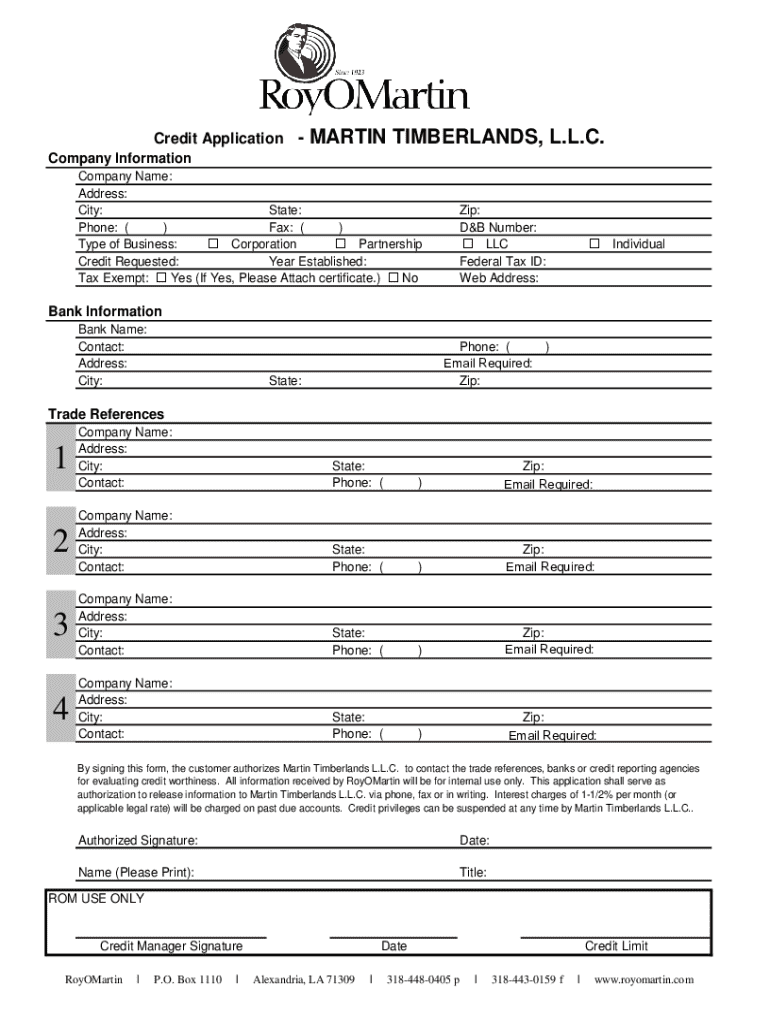

Comprehensive Guide to Credit Application Forms

Understanding credit application forms

A credit application form is a standardized document used by lenders to gather information about a potential borrower. This form helps lenders assess an applicant’s financial stability and creditworthiness, making it an essential part of the lending process.

Understanding the importance of credit application forms can significantly enhance your chances of securing a loan. They serve as a gateway for individuals and businesses alike to acquire financing for various needs, such as home purchases, business expansions, or personal loans.

Key components of a credit application form

A credit application form typically consists of several key components designed to capture pertinent information about the applicant. These components include personal information, employment history, financial details, and consent for credit checks.

Each section has both required and optional fields. Providing accurate information ensures a smoother approval process.

How to fill out a credit application form

Filling out a credit application form accurately can be daunting, but it is crucial for a positive outcome. A methodical approach can simplify the process and ensure all necessary components are addressed.

Begin with gathering all necessary documentation, as this will streamline the completion of your application.

Editing and signing your credit application form

Utilizing pdfFiller’s advanced editing tools enhances the experience of filling out a credit application form. With these tools, you can easily upload, modify, and electronically sign your documents.

The platform ensures your documents remain secure while allowing convenient edits, streamlining the entire submission process.

Common mistakes to avoid in credit applications

Avoiding common pitfalls in your credit application form can greatly enhance your chances of approval. Many applicants unknowingly make mistakes that can lead to delays or denials.

By being aware of these mistakes, you can minimize setbacks and improve your prospects.

After submitting your credit application form

Once you submit your credit application form, understanding what to expect can alleviate anxiety and prepare you for next steps. Lenders typically have a defined process for evaluating applications.

Expect a timeframe for review and be aware of your options if your application is approved or denied.

Appendices

To enhance your understanding of credit application forms, we provide helpful appendices with sample forms, FAQs, and downloadable resources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my credit application in Gmail?

How do I edit credit application straight from my smartphone?

Can I edit credit application on an Android device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.