Get the free ira contribution form

Get, Create, Make and Sign ira contribution form

Editing ira contribution form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ira contribution form

How to fill out form 5498

Who needs form 5498?

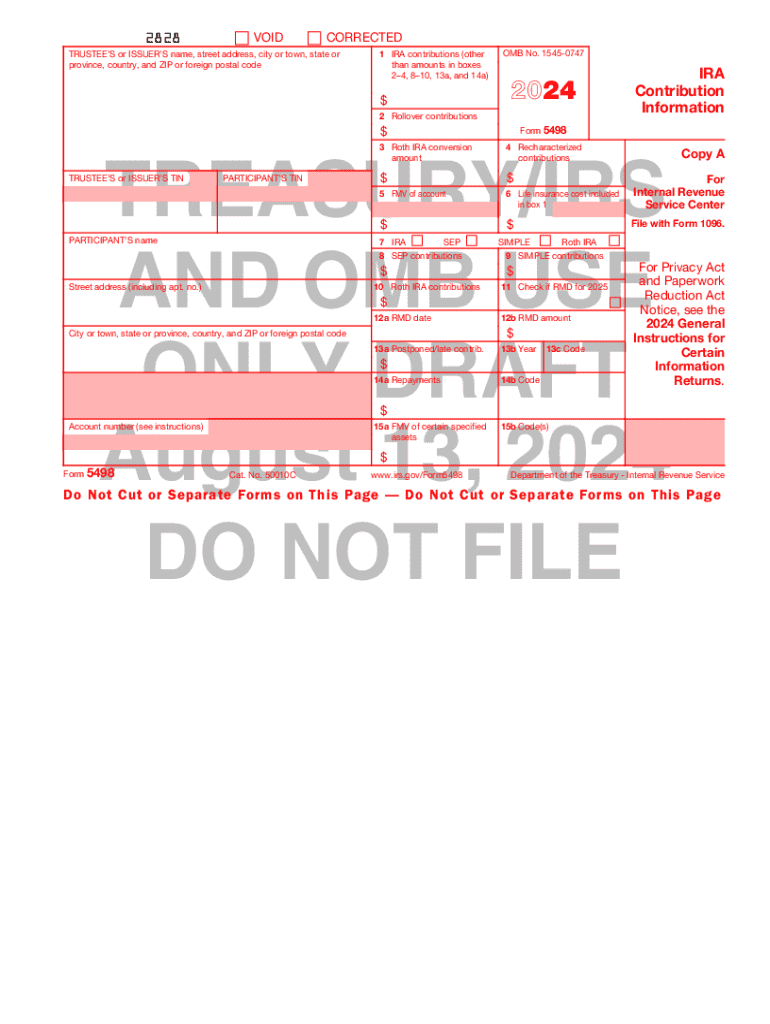

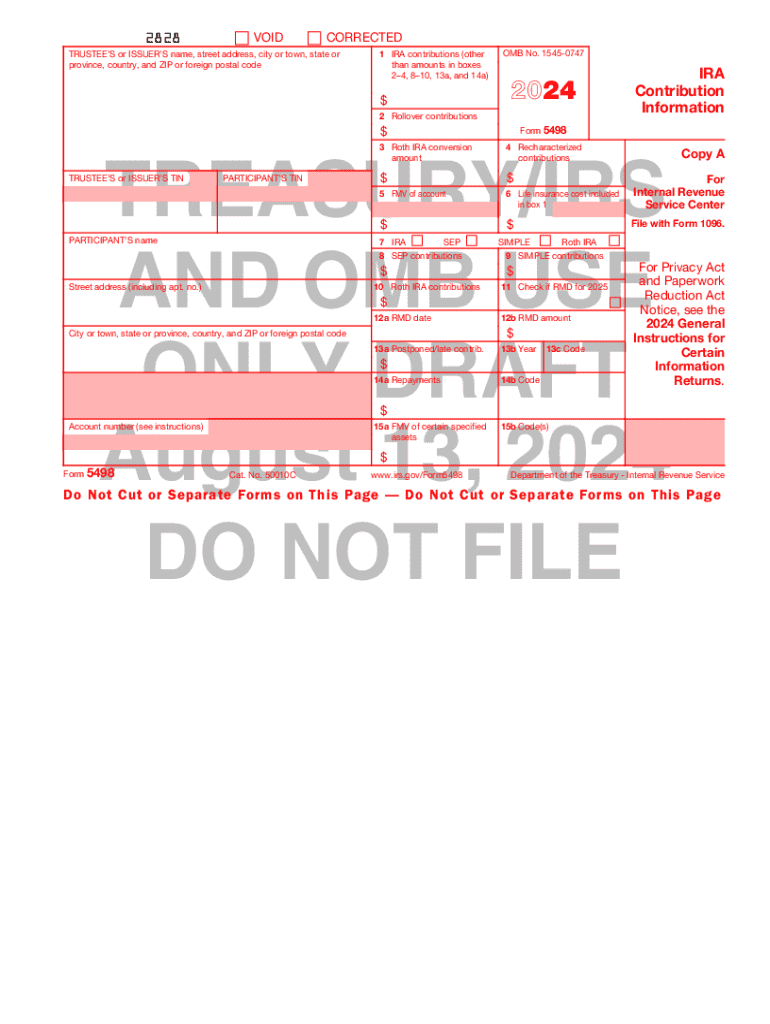

Form 5498: IRA Contribution Information

Understanding Form 5498

Form 5498 is an IRS document used by financial institutions to report contributions made to individual retirement accounts (IRAs). Its primary purpose is to inform both the account holder and the IRS about the contributions that have been made during the calendar year, ensuring accurate tax reporting. This form plays a crucial role in helping taxpayers understand their retirement savings and assists the IRS in tracking the contributions for compliance with contribution limits.

Understanding Form 5498 is essential for effective tax management. By recognizing the types of contributions reported, taxpayers can make informed decisions regarding future contributions, rollovers, and conversions. Additionally, this form is vital in confirming that contributors are within the permissible limits set by the IRS.

Key information contained in Form 5498

Form 5498 contains several key details critical for taxpayers, including the type of IRA account, the amounts contributed for the year, and any rollovers or conversions completed. Key terms include:

Who receives Form 5498?

Individuals who have contributed to an IRA will receive Form 5498 from their financial institution. This includes those enrolled in traditional, Roth, SEP, or SIMPLE IRAs. Financial institutions, such as banks or brokerage firms, are responsible for ensuring that Form 5498 is accurately filled out and sent to both the IRS and the account holder by the required deadline.

As a recipient, it’s important to recognize your role. Form 5498 contains essential data for filing your tax returns correctly. If any discrepancies arise between your records and the information reported on Form 5498, it can lead to complications with the IRS and potential penalties.

Timing and issuance of Form 5498

Form 5498 is typically issued annually by May 31 for contributions made in the previous tax year. It's essential for taxpayers to understand that while the deadline for contributions to IRAs can extend to April 15 (or the tax filing deadline), Form 5498 will reflect all contributions made during the year up until that deadline. Expect to receive this form by mail or electronically, depending on your institution’s practices.

If you have not received Form 5498 by early June, it's advisable to follow up with your financial institution. Verify that your contributions were processed, and inquire about the form's status to avoid any issues when filing taxes.

Completing Form 5498

Filling out Form 5498 requires attention to detail. Here’s a step-by-step guide for accurately completing the form:

Common mistakes to avoid include inputting incorrect Social Security numbers, failing to report all contributions, and overlooking rollover or conversion entries. Ensuring the accuracy of Form 5498 helps in maintaining compliance with tax laws.

Handling Form 5498 for tax purposes

When preparing your tax return, Form 5498 acts as a reference point for reporting contributions accurately. This document does not need to be submitted with your tax return; however, it serves to verify your contributions and ensure you are within the contribution limits. If you are contributing to multiple accounts, keep in mind the combined limits for different types of IRAs and the deductions you can claim.

It's crucial to understand the tax implications of your contributions. For example, contributions to Roth IRAs may be made after-tax, whereas contributions to traditional IRAs may be tax-deductible, affecting your taxable income for the year.

FAQs about tax implications of Form 5498

Common questions include:

Editing and managing your Form 5498 online

Utilizing cloud-based solutions like pdfFiller streamlines the process of filling out and managing Form 5498. This platform allows you to edit and fill out your form conveniently from anywhere, eliminating the need for tedious paperwork and manual entries.

With pdfFiller, you can easily navigate the interface to input your information directly into a digital version of Form 5498. The benefits include collaborating with tax preparers in real-time, securely managing your documents, and accessing your completed forms anytime, ensuring you have everything you need at your fingertips.

eSigning and sharing your completed form

Once your Form 5498 is completed, eSigning it through pdfFiller is simple. Just follow these steps:

This method enhances security and ensures that your sensitive data remains protected, all while making the process significantly more efficient.

Common issues and solutions related to Form 5498

As with any financial document, errors on Form 5498 can arise. Common issues include discrepancies in reported contribution amounts, incorrect account types, or inaccuracies in personal information. Addressing these problems promptly is crucial for maintaining proper tax records.

The first step in rectifying errors is to contact your financial institution to discuss the discrepancies. They can provide guidance on correcting the form if it has already been submitted or issued. If amendments are necessary, follow these steps:

Form 5498 in special circumstances

Certain situations may complicate the handling of Form 5498, particularly when dealing with contributions that go beyond standard guidelines. For example, rollovers from employer retirement plans or conversions from traditional IRAs to Roth IRAs are significant financial moves that carry their own reporting requirements.

If you have multiple IRAs, reporting contributions accurately to Form 5498 can become more complex. It’s crucial to maintain meticulous records of contributions across all accounts to ensure compliance and appropriate tax reporting. Consider these scenarios:

Leveraging powerful tools for document management

The features of pdfFiller are ideal for individuals and teams looking to enhance their document management process. With premium tools for collaboration, you can easily coordinate with multiple stakeholders on your Form 5498.

Secure storage options allow you to keep your sensitive documents, like Form 5498, protected while maintaining easy access from any device. This flexibility can significantly improve productivity, especially for those managing multiple forms or working in teams.

Enhancing your document workflow

Optimizing your workflow with pdfFiller means streamlining the processes of creation, management, and storage of critical documents. Features that transform your experience include automatic reminders for filling out forms, easy tracking of document history, and straightforward sharing options. By utilizing these tools, you can focus more on your retirement planning without worrying about paperwork.

Additional support and resources

For those seeking personalized help regarding Form 5498, professional consultation can be invaluable. Financial advisors or tax professionals can provide tailored advice, ensuring that your contributions align with your financial goals.

Additionally, accessing community resources can enhance your understanding. Online forums, workshops, and support articles related to IRA contributions and Form 5498 are excellent ways to stay informed and educated about retirement planning and manipulation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ira contribution form to be eSigned by others?

Can I create an electronic signature for the ira contribution form in Chrome?

How do I fill out ira contribution form on an Android device?

What is form 5498?

Who is required to file form 5498?

How to fill out form 5498?

What is the purpose of form 5498?

What information must be reported on form 5498?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.