Get the free Budget and Low Income Information

Get, Create, Make and Sign budget and low income

How to edit budget and low income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out budget and low income

How to fill out budget and low income

Who needs budget and low income?

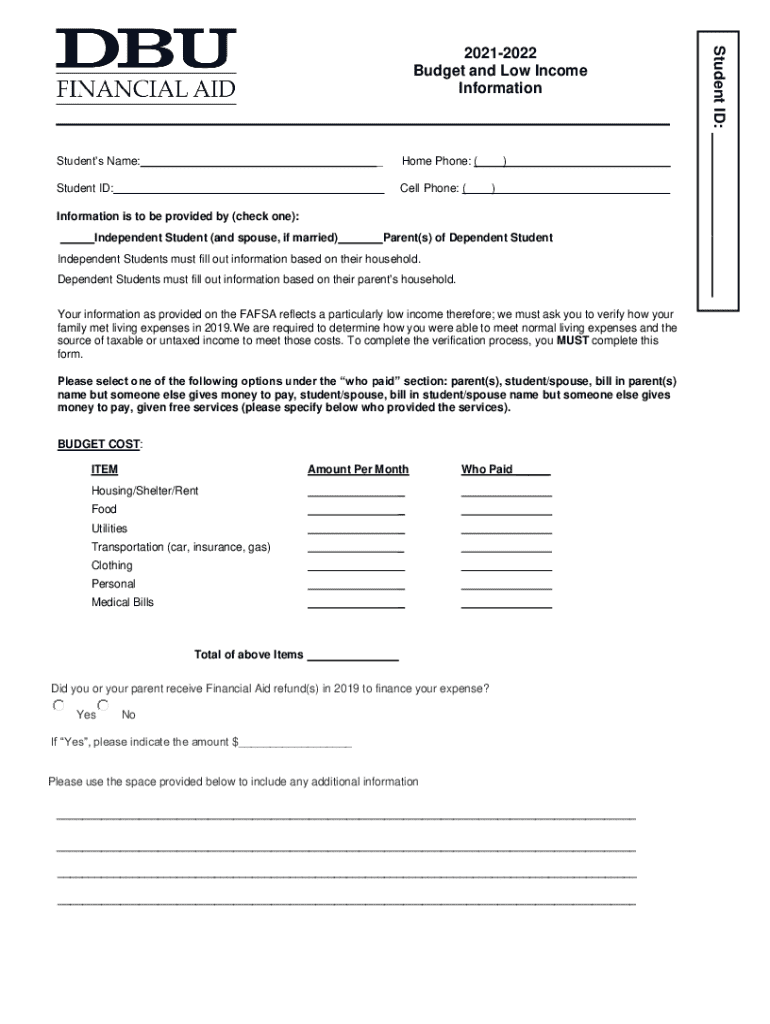

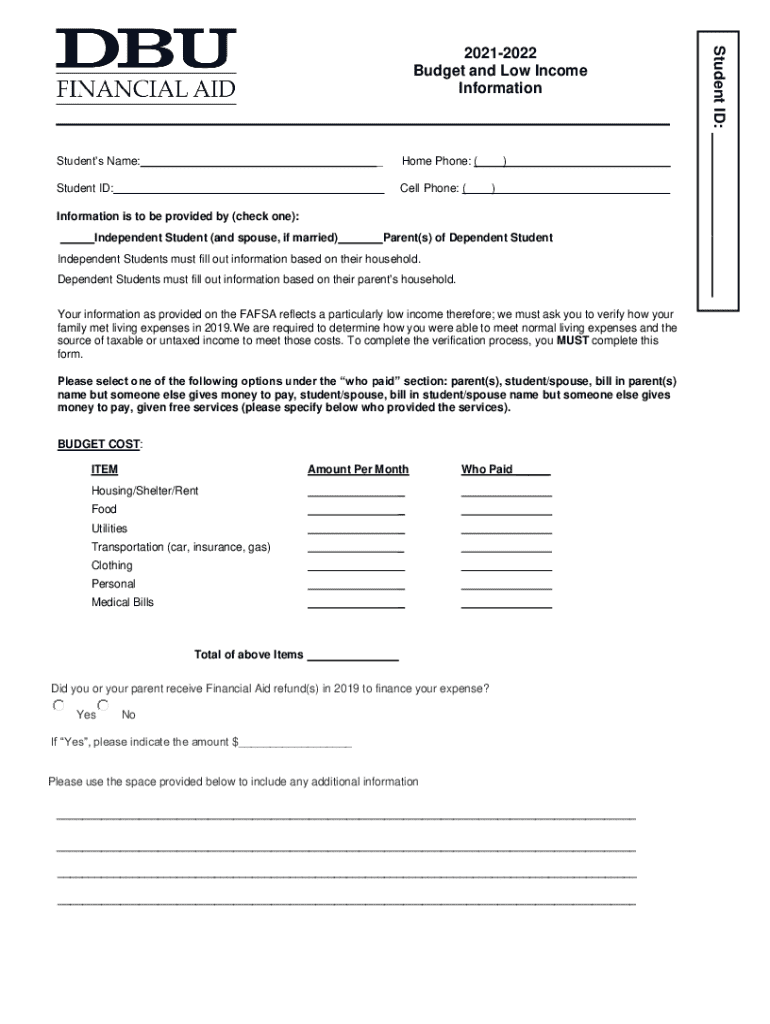

Comprehensive Guide to the Budget and Low Income Form

Understanding the budget and low income form

The budget and low income form serves as a crucial tool for individuals navigating limited financial resources. This document captures an individual’s income, expenses, and financial obligations, allowing users to achieve clarity on their financial standing. For many low-income individuals, budgeting is not merely about managing money; it represents a necessary step to ensure survival and planning for future stability.

Budgeting matters particularly for low-income individuals as it empowers them to track their spending, prioritize needs over wants, and save for unforeseen expenses. The benefits of using a budget and low income form include enhanced financial awareness, reduced stress surrounding money management, and the potential to make informed financial decisions that positively impact their lives.

Accessing the budget and low income form

To access the budget and low income form, you can easily navigate to pdfFiller's dedicated section for budget forms. This platform provides various formats, including PDF, DOCX, and more, catering to users' diverse needs. With pdfFiller's cloud-based solution, individuals have the flexibility to access their budget forms anytime and anywhere.

Here’s a step-by-step guide to accessing the form online:

How to effectively utilize the budget and low income form

To make the most of the budget and low income form, prepare thoroughly by gathering essential financial information. Begin by identifying your sources of income, which may include salaries, government assistance, or freelance work. Next, categorize your expenses into fixed and variable sections. Fixed expenses include rent, utilities, or car payments, while variable expenses encompass groceries, transportation, and leisure activities.

Once you have gathered all necessary information, start filling out the form. Enter your income accurately and categorize your expenses accordingly. Calculate the total income and compare it against your total expenses. This process will help highlight areas where you can potentially adjust spending or boost savings.

After completing your budget, saving and accessing it back is essential. You can either download a copy to your device or save it to a cloud storage option for easy retrieval. If your financial situation changes, you can easily edit the form within pdfFiller for real-time adjustments.

Tips for successful budgeting

To enhance your budgeting skills, consider setting practical and achievable financial goals. You may follow the 50/30/20 rule, which allocates 50% of income to needs, 30% to wants, and 20% to savings. For some individuals, zero-based budgeting may work better, which requires income to equal expenses. Consider incorporating the cash envelope system for effective expense management and implementing a 'pay-yourself-first' strategy that prioritizes savings before addressing all other expenses.

Additional tools and resources for budgeting

pdfFiller provides various interactive budgeting tools designed to assist users in understanding their finances better. Alternative budgeting apps, such as Mint or YNAB (You Need a Budget), offer unique features that complement using a budget and low income form. Additionally, participating in community support groups can foster shared tips and experiences that enhance your financial literacy.

To take full advantage of budgeting tools, familiarize yourself with frequently asked questions about budgeting which detail common challenges and solutions. Engaging with others who share similar financial situations can provide inspiration, motivation, and practical advice.

Common mistakes to avoid when using the budget form

Budgeting requires precision and awareness of all financial aspects. Common mistakes include underestimating expenses, which can lead to shocking outcomes at the end of the month. Ignoring irregular expenses, such as annual subscriptions or medical bills, can also cause budgeting failures. Additionally, failing to update the budget regularly, after each income change, or neglecting to account for financial emergencies may lead to serious financial distress.

Engaging with the pdfFiller community

Engagement is key to successful budgeting. Joining online forums can provide invaluable advice and support from fellow budgeters and financial advisors. Sharing experiences on social media creates a community that sustains motivation and accountability. Connecting with financial advisors is also an excellent way to gain personalized support tailored to your needs.

Conclusion with tools for ongoing financial management

Monitoring your budget over time is essential for financial health. As life changes occur, such as job loss or unexpected expenses, maintaining an accurate budget will help you adapt and respond effectively. Education in personal finance should be continuous; exploring resources, attending workshops, and engaging with experts can significantly enhance your financial acumen.

Contact information and support

For further assistance with the budget and low income form, reach out to pdfFiller's support team. Access additional budgeting guidance through their platform, which offers numerous resources, tutorials, and community workshops. Engaging in such resources not only enhances your budget management skills but also fosters a sense of community among users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my budget and low income directly from Gmail?

How do I edit budget and low income in Chrome?

Can I create an eSignature for the budget and low income in Gmail?

What is budget and low income?

Who is required to file budget and low income?

How to fill out budget and low income?

What is the purpose of budget and low income?

What information must be reported on budget and low income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.