Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out 2025 property tax statement

Who needs 2025 property tax statement?

2025 Property Tax Statement Form: Comprehensive Guide

Understanding the 2025 Property Tax Statement

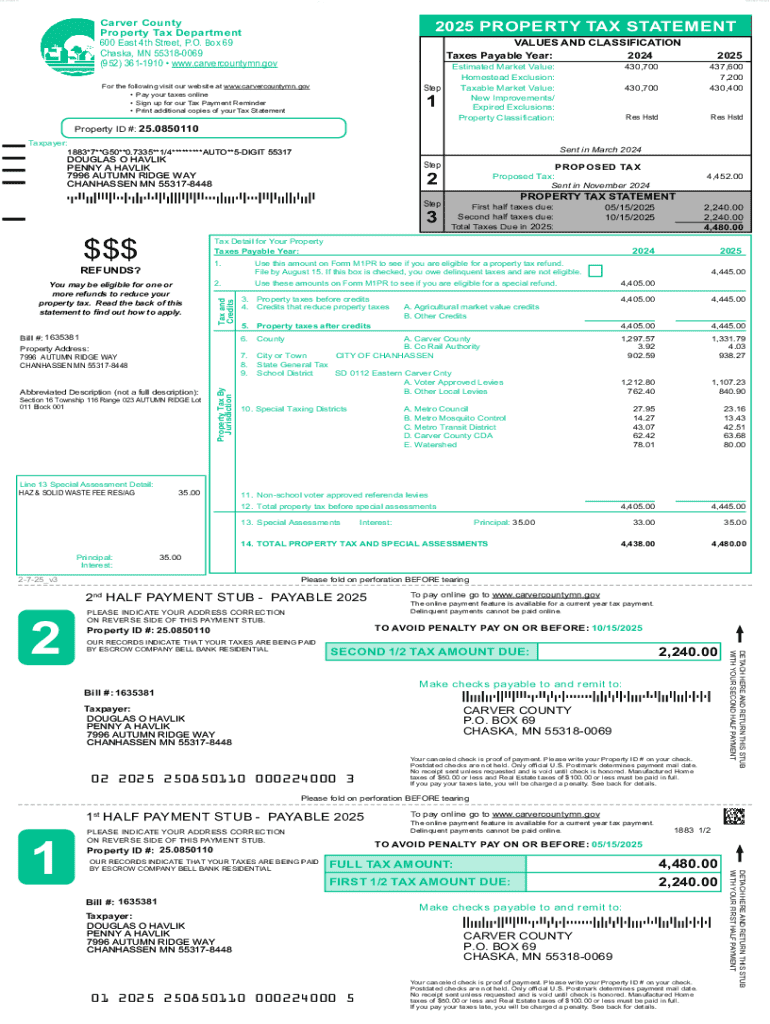

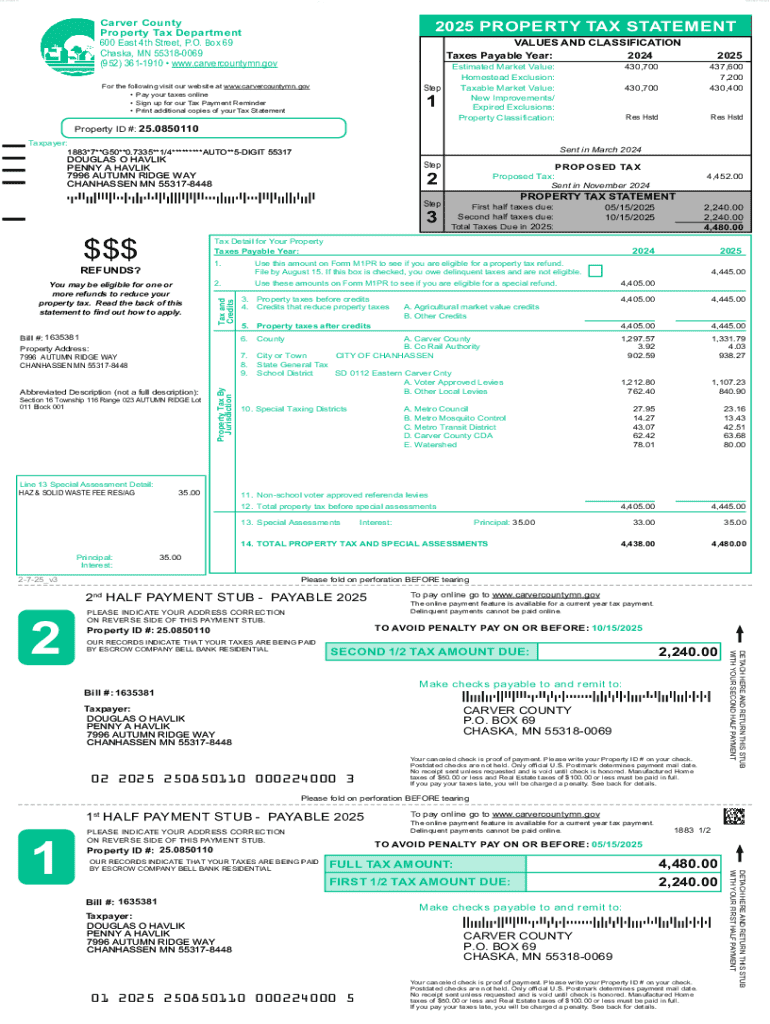

The 2025 property tax statement is a crucial document for homeowners, detailing the amount owed in property taxes for the year. This statement outlines not only the total tax liability but also breaks down how local tax rates and property assessments contribute to the amount due.

Homeowners should take this statement seriously as it affects both their financial planning and the value of their real estate. Accurate understanding of this form aids in budgeting for upcoming expenses and allows property owners to ensure they're not overpaying due to incorrect assessments.

Key dates to remember include the issuance of property tax statements, typically in the early part of 2025, as well as deadlines for payment before penalties accrue. Keeping track of these dates ensures that homeowners remain compliant with local regulations and avoid unnecessary fees.

How to access the 2025 property tax statement form

Accessing the 2025 property tax statement form can be done easily through various methods, enhancing convenience for homeowners. An advantageous method is online access via platforms such as pdfFiller, which allows users to obtain their forms rapidly.

For those who prefer traditional methods, the form can also be accessed via mail or by making an in-person request at local tax offices. This provides additional flexibility for individuals who may not be comfortable with digital platforms.

Filling out the 2025 property tax statement form

Completing the 2025 property tax statement form necessitates careful attention to detail. The form is divided into several sections, each requiring specific information to gauge your tax responsibility.

Common mistakes such as incorrectly recording property addresses or assessment numbers can lead to complications later on. Double-checking these sections before submission can save homeowners significant time and potential costs.

Editing the 2025 property tax statement form with pdfFiller

One of the standout features of pdfFiller is its robust editing capability, allowing users to make adjustments on the fly. Once you receive the 2025 property tax statement form, editing becomes straightforward with their tools.

Editing text fields is a breeze; simply click on the area you wish to change and input your new information. If errors need correcting, pdfFiller allows for seamless amendments without the hassle of reprinting entire documents.

Signing the 2025 property tax statement form

Signing your 2025 property tax statement is an essential step in the submission process. Electronic signatures gained substantial legal weight, which pdfFiller effectively leverages to streamline signing.

To eSign using pdfFiller, you must create and save your electronic signature, which can be used across various forms. This ensures that you meet all legal formalities without the need for printing.

Collaborating on your property tax statement

If you are working with a team, pdfFiller offers several collaborative features to enhance communication and ensure everyone is on the same page. This capability is crucial as property tax statements often require input from different stakeholders.

Team collaboration allows multiple users to review, edit, and comment on the document directly. This can significantly reduce the chances of errors and improve the overall accuracy of the final submission.

Managing your 2025 property tax statement

Once your 2025 property tax statement form is complete, effective management becomes essential. pdfFiller supports saving and storing documents in the cloud, ensuring that your forms are organized and accessible at any time.

Organizing tax documents properly can streamline future needs and audits. With pdfFiller, it's possible to create folders for different tax years, making it easier to track and retrieve required documents.

Understanding property tax regulations in 2025

As the 2025 tax year unfolds, several property tax regulations may change, impacting how property taxes are computed. Staying informed about current tax legislation and any local government policies is vital for homeowners.

Often, property tax laws will adapt to shifts in economic conditions or adjust to reflect a community's changing needs. Familiarizing oneself with FAQs about these potential changes can provide an additional edge in tax planning.

Using interactive tools and calculators

Interactive tools such as property tax calculators can aid homeowners in understanding their financial obligations better. These calculators provide invaluable insights into possible tax rebates and help estimate future property taxes based on current assessments.

Using such tools can empower homeowners to make informed decisions regarding property management and potential appeals of tax assessments.

Important links and resources

Utilizing valuable online resources can enhance your understanding of property tax obligations. Important links related to property tax assessments and local tax authorities provide essential info, helping to demystify the process.

Troubleshooting common issues with the 2025 property tax statement

Despite the digital conveniences, issues may arise when filling out or submitting your 2025 property tax statement. Common errors include incorrect information inputs or technical difficulties during the eSigning process.

In case of problems, reaching out to support teams or utilizing help sections on pdfFiller can provide immediate assistance. Knowing where to find solutions can mitigate frustrations and expedite your tax filing.

Tips for preparing for future property taxes

Preparing for future property taxes goes beyond just filling out forms. Keeping accurate records throughout the year aids in tax preparation and ensures that you can confidently file your taxes without fear of audit.

Understanding available tax deductions and relief programs can significantly impact your overall tax burden. Homeowners should stay informed about shifts in property value which may affect taxes in subsequent years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in pdffiller form without leaving Chrome?

Can I create an electronic signature for signing my pdffiller form in Gmail?

How do I complete pdffiller form on an Android device?

What is 2025 property tax statement?

Who is required to file 2025 property tax statement?

How to fill out 2025 property tax statement?

What is the purpose of 2025 property tax statement?

What information must be reported on 2025 property tax statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.