Get the free Monthly Return of Equity Issuer on Movements in Securities

Get, Create, Make and Sign monthly return of equity

How to edit monthly return of equity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly return of equity

How to fill out monthly return of equity

Who needs monthly return of equity?

Monthly return of equity form: A comprehensive guide

Understanding monthly return of equity

The monthly return of equity (ROE) is a key financial metric used to evaluate the performance of a company’s equity over a short period. Defined as the net income generated by shareholders' equity, it provides insights into how effectively a company is using its equity base to generate profits. Unlike annual ROE, which offers a broader perspective over a year, monthly ROE provides a snapshot of business performance and can signal trends that require immediate attention.

The significance of monthly ROE cannot be overstated. It enables businesses to monitor their performance more closely and make informed decisions based on short-term trends. This nimbleness can be vital in a fast-paced economic environment where timely adjustments can tilt the balance towards success or failure.

Preparing to use the monthly ROE form

To effectively complete the monthly return of equity form, certain prerequisites need to be met. First and foremost, you should have access to accurate and up-to-date financial data, including net income and total equity figures. Familiarity with key terms like net income (the profit left after all expenses have been deducted) and equity (the difference between assets and liabilities) is essential for efficiently filling out the form.

The monthly ROE form is particularly beneficial for various professionals, including financial analysts aiming to conduct comprehensive evaluations, business owners seeking to track performance, and investors interested in understanding the company’s profitability relative to equity.

Step-by-step guide to completing the monthly ROE form

Completing the monthly return of equity form can be made easy with a structured approach. Here’s a step-by-step guide:

Utilizing the monthly ROE data

Once you have completed the monthly return of equity form and derived your ROE, it’s time to analyze the results. Understanding what these numbers signify about your business is essential for making informed decisions. For example, a consistent upward trend in ROE may indicate effective management and healthy profit margins, whereas a downward trend could signal potential challenges or inefficiencies.

Benchmarking against industry averages can also provide a clear context for your ROE. Research to find relevant benchmarks and use them to evaluate where your business stands within your industry. This can help guide future strategies and adjustments that align with achieving better financial health.

Enhancing your experience with pdfFiller

Using pdfFiller to work on your monthly return of equity form can significantly enhance your experience. The platform offers seamless editing of PDF forms, allowing users to make necessary changes instantly. Features like real-time collaboration enable teams to work together efficiently, improving accuracy and reducing the time spent on form completion.

Additionally, pdfFiller's eSigning and document management capabilities simplify the processes of signing and securing your documents. Upon completing the monthly ROE form, you can easily sign it electronically, which is not only faster but also adds a layer of convenience and security.

Common mistakes to avoid

Calculating your monthly return of equity can be straightforward, but several common mistakes can lead to inaccuracies. Misreporting figures, overlooking important financial entries, or miscalculating net income or equity can skew your final ROE. It's crucial to take the time to ensure that all financial data is accurate and complete before submission.

Furthermore, ensuring compliance with financial standards is imperative. Familiarize yourself with relevant regulations and maintaining accuracy in your financial reporting not only protects your business but also promotes credibility among stakeholders.

Additional tools and resources

To enhance your financial analysis, various interactive tools are available on pdfFiller for users. These resources can aid in comprehensive reporting and analysis, ensuring that you’re equipped with the tools necessary for informed decision-making.

Additionally, understanding financial reporting guidelines, such as generally accepted accounting principles (GAAP) and international financial reporting standards (IFRS), is crucial. These guidelines affect how your ROE is calculated and reported, making it essential to stay informed in order to maintain compliance.

Frequently asked questions (FAQs)

As you navigate the completion and application of the monthly return of equity form, you may encounter questions. For instance, what should you do if you get stuck while filling it out? Or how often you should submit the monthly ROE? Typically, businesses should assess their ROE monthly, allowing for timely evaluations and adjustments based on the data.

Financial experts recommend maintaining accurate records and tracking your ROE strictly as best practices. This consistency will afford you greater visibility into your company's financial performance, supporting better decision-making.

User testimonials and case studies

Users of pdfFiller have reported significant improvements in their financial tracking processes thanks to the monthly return of equity form. For instance, a small business owner shared how utilizing the form allowed them to identify cash flow issues early on, leading to timely interventions and corrective actions that ultimately saved their business from facing larger financial pitfalls.

Another successful case involved a financial analyst who implemented real-time tracking of ROE across multiple clients. The analyst mentioned that using the monthly ROE form available via pdfFiller enhanced their ability to make data-driven recommendations, ultimately fostering stronger relationships with clients by enabling them to achieve better financial outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my monthly return of equity directly from Gmail?

How can I edit monthly return of equity on a smartphone?

How do I edit monthly return of equity on an Android device?

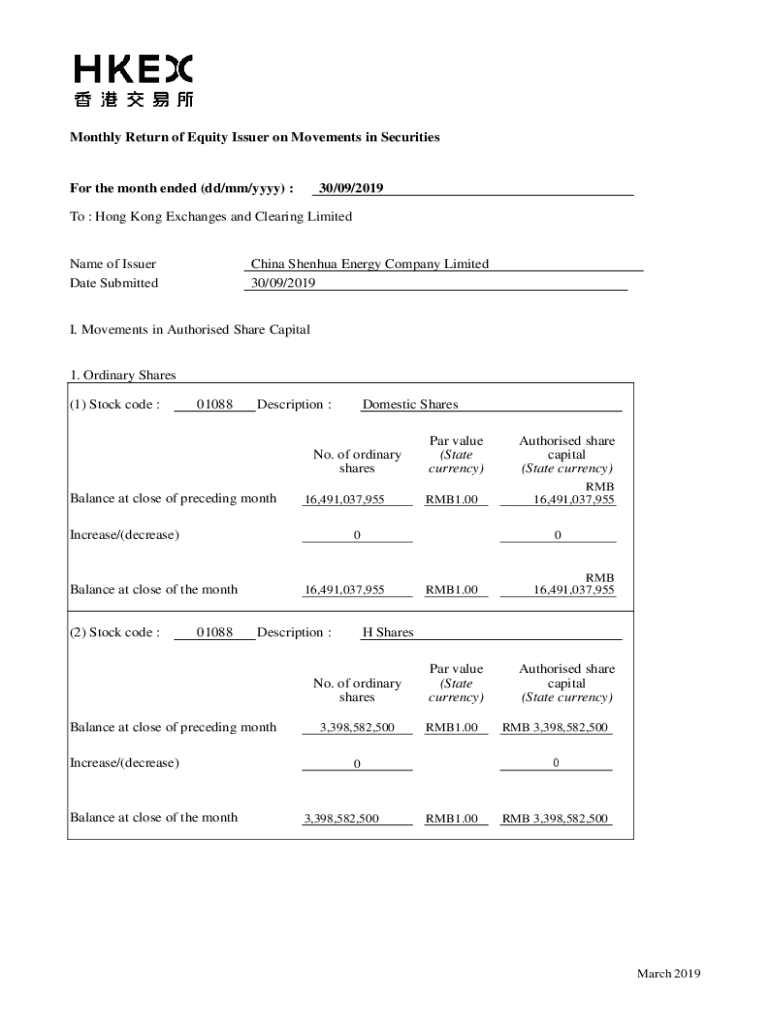

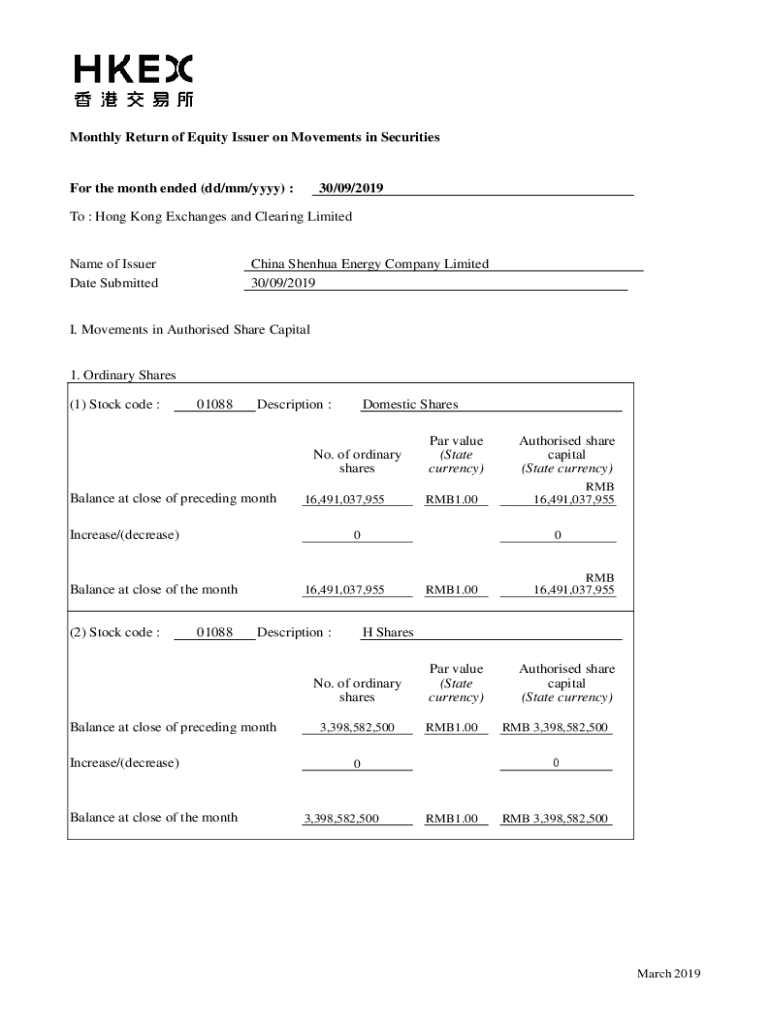

What is monthly return of equity?

Who is required to file monthly return of equity?

How to fill out monthly return of equity?

What is the purpose of monthly return of equity?

What information must be reported on monthly return of equity?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.