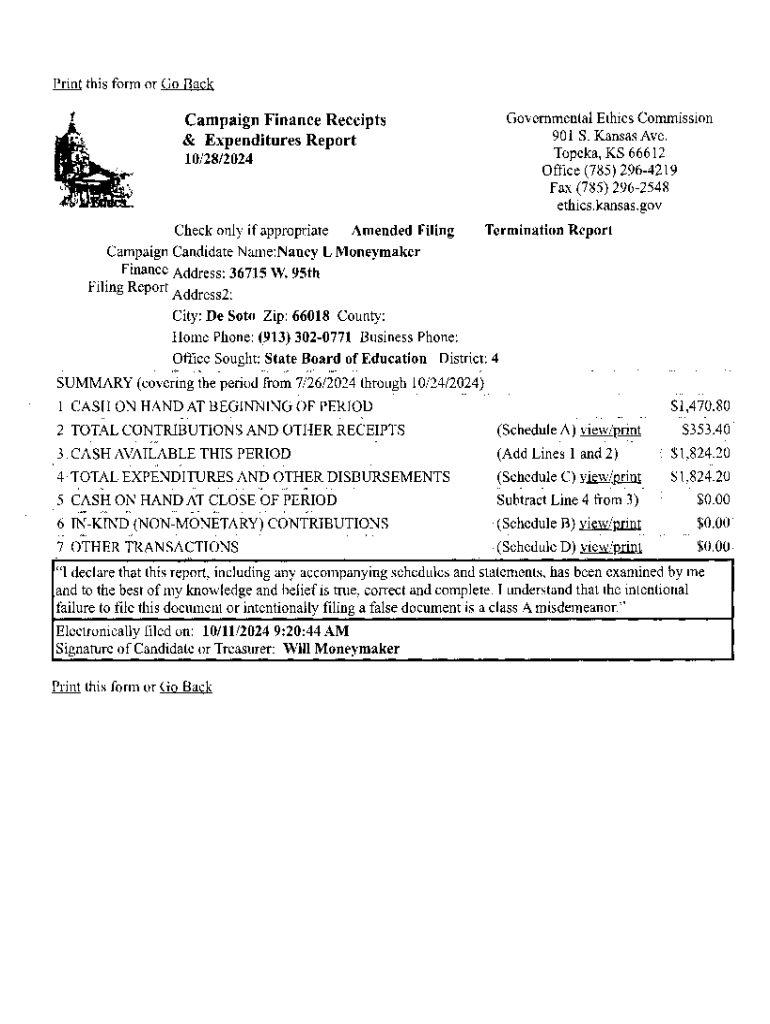

Get the free Campaign Finance Receipts & Expenditures Report - ethics ks

Get, Create, Make and Sign campaign finance receipts expenditures

Editing campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Understanding the Campaign Finance Receipts and Expenditures Form

Understanding campaign finance forms

Campaign finance forms are essential documents that track the financial activities of political campaigns. They serve the purpose of detailing the sources of campaign funding, known as receipts, and the expenditures made during the campaign. These forms are pivotal as they not only ensure transparency but also uphold integrity in election processes, allowing voters to have insights into who finances political candidates.

Transparency in political funding builds trust within the electorate. By requiring campaigns to submit detailed financial reports, it becomes easier to identify potential conflicts of interest or undue influence from donors. Thus, the importance of campaign finance forms extends beyond mere compliance; they are a cornerstone of democratic accountability.

Overview of receipts and expenditures

In the context of campaign finance, receipts refer to any funds received by a political campaign. This includes contributions from individuals, organizations, and other entities. Understanding the various types of receipts is vital for campaigns to accurately report financial activities. Receipts typically enhance a campaign's viability, contributing to its operational budget and outreach efforts.

On the other hand, expenditures encompass the money spent by a campaign. These can include costs for advertising, operational expenses, and compensations for staff. Reporting expenditures is crucial as it provides insight into how campaign funds are allocated, ensuring that financial resources are used effectively and for legitimate purposes.

Key components of receipts and expenditures forms

Both the receipts and expenditures forms contain several key sections that candidates must fill out. Each section underscores different aspects of funding and spending, which are necessary for complete transparency.

Sections of the campaign finance receipts form

The campaign finance receipts form typically includes sections such as the details of the contributor, contribution amounts, dates of receipt, and the categories that the funds fall within. Common sources of campaign contributions generally include:

Sections of the campaign finance expenditures form

The expenditures form outlines how campaign funds are spent, requiring campaigns to categorize their expenses accurately. Typical categories within this form include:

Step-by-step guide to filling out the campaign finance receipts form

Filling out the campaign finance receipts form requires careful attention to detail. The process begins with gathering necessary information, which includes personal details such as the campaign name, the candidate's name, and contact information. Additionally, each contributor's details must be meticulously recorded.

Necessary information required

The information required on the receipts form typically includes:

Detailed instructions for each section

For each section, ensure the information is accurate and double-check the spelling to avoid any discrepancies. Use clear and concise language in the description fields. A line-by-line approach helps streamline the process.

Common mistakes to avoid

Frequent errors include omitting required information, inaccuracies in amounts, and failing to report small contributions. To avoid these, maintain organized records throughout the campaign and periodically review your entries for accuracy.

Step-by-step guide to filling out the campaign finance expenditures form

Completing the campaign finance expenditures form follows a similar structure to the receipts form. It begins with providing essential details such as the campaign name and the dates of the expenditures. Tracking all expenses in a clear manner is vital for compliance and transparency.

Essential information required

Key details necessary for the expenditures form include:

Detailed instructions for each section

As with the receipts form, input all information accurately. For expending data, categorize expenses to aid clarity. For example, separate advertising, operational, and salary expenses into distinct sections for a comprehensive overview of expenditures.

Tips for accurate reporting

Carefully log each expenditure as they occur to avoid last-minute rush and inaccuracies. Use a consistent method for documentation—whether it’s digital or paper—to enhance tracking and auditing capabilities.

Legal considerations and compliance

Compliance with campaign finance laws is pivotal for any political campaign. These laws, which can vary at the federal, state, and local levels, dictate the limits on contributions, required disclosures, and the penalties for non-compliance. Understanding these regulations is vital to avoid legal repercussions.

Understanding campaign finance laws

At the federal level, the Federal Election Commission (FEC) oversees campaign finance regulations, setting forth guidelines on how much money candidates can receive and from whom. States may have additional requirements that are even more stringent, so it is imperative to be well-informed about local laws.

Consequences of non-compliance

Failing to comply with campaign finance laws can lead to severe penalties, including fines, investigations, and damage to the campaign’s reputation. Campaigns found in violation may face civil penalties, and in extreme cases, candidates may be barred from running in future elections.

Filing and submission guidelines

Once the campaign finance receipts and expenditures forms are completed, the next step is filing them with the appropriate authorities. This ensures compliance with local laws and regulations.

Where and how to submit forms

Forms can be submitted in various ways, including electronically through state or federal election websites, or via traditional mail. Double-check the accepted filing methods in your jurisdiction to avoid complications.

Important deadlines to remember

Be aware of key deadlines for submission, including those for pre-election and post-election reports. Missing a deadline could result in penalties, so organizing filing schedules in advance is crucial.

Utilizing tools for campaign finance management

Managing campaign finance documents can become overwhelming, particularly as the election date approaches. Utilizing tools like pdfFiller helps streamline the process, allowing users to create, edit, eSign, and manage campaign finance forms seamlessly.

pdfFiller as a solution

pdfFiller is an exceptional document management solution designed to facilitate ease of use. With its features, users can ensure thorough preparation for filing.

FAQs about campaign finance receipts and expenditures

Navigating the world of campaign finance forms can raise numerous questions, especially for first-time candidates. Addressing common concerns can help streamline the process and alleviate confusion.

Addressing common concerns

A few frequently asked questions include how to report small contributions, what constitutes a legal expenditure, and how to handle erroneous submissions. It's essential to consult your local election office if uncertainties arise, as they can provide tailored assistance.

Practical tips for first-time filers

First-time filers should keep detailed and organized records throughout their campaign, engage in regular check-ins on their financial reporting, and set reminders for deadlines to ensure compliance without stress. Starting early and keeping track of all transactions as they happen significantly aids in the filing process.

Case studies of successful campaigns

Analyzing successful campaigns offers valuable insights into best practices for managing campaign finances. Campaigns that report their receipts and expenditures accurately tend to maintain better reputations and avoid legal entanglements.

Analysis of campaigns with strong compliance

For instance, a well-known local city council campaign demonstrated exemplary financial reporting by ensuring all contributions were disclosed during each reporting period. Their comprehensive approach allowed constituents to engage more with the election process and helped build trust in their candidacy.

Lessons learned from missteps

Conversely, campaigns that face compliance issues often encounter substantial setbacks, including reputational damage and monetary fines. A notable case where a campaign delayed reporting led to significant penalties, emphasizing the need for timely and accurate submissions.

Next steps post-submission

Once the campaign finance receipts and expenditures forms have been submitted, the work is not yet done. Keeping meticulous records of all receipts and expenditures is essential for ensuring accountability.

What to do after filing

Maintain backups of all submitted information and track any changes or supplements that need to be provided. Regular audits of your financial records will aid in preparing for future reports.

Preparing for future reports

Implementing a sustainable process for ongoing compliance means setting up financial tracking systems that are adaptable for future campaigns. Using tools like pdfFiller facilitates smooth reporting and continuity, making future filings easier.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify campaign finance receipts expenditures without leaving Google Drive?

How can I send campaign finance receipts expenditures for eSignature?

How do I edit campaign finance receipts expenditures in Chrome?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.