Get the free New Account Application

Get, Create, Make and Sign new account application

How to edit new account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account application

How to fill out new account application

Who needs new account application?

Navigating the New Account Application Form: A Comprehensive Guide

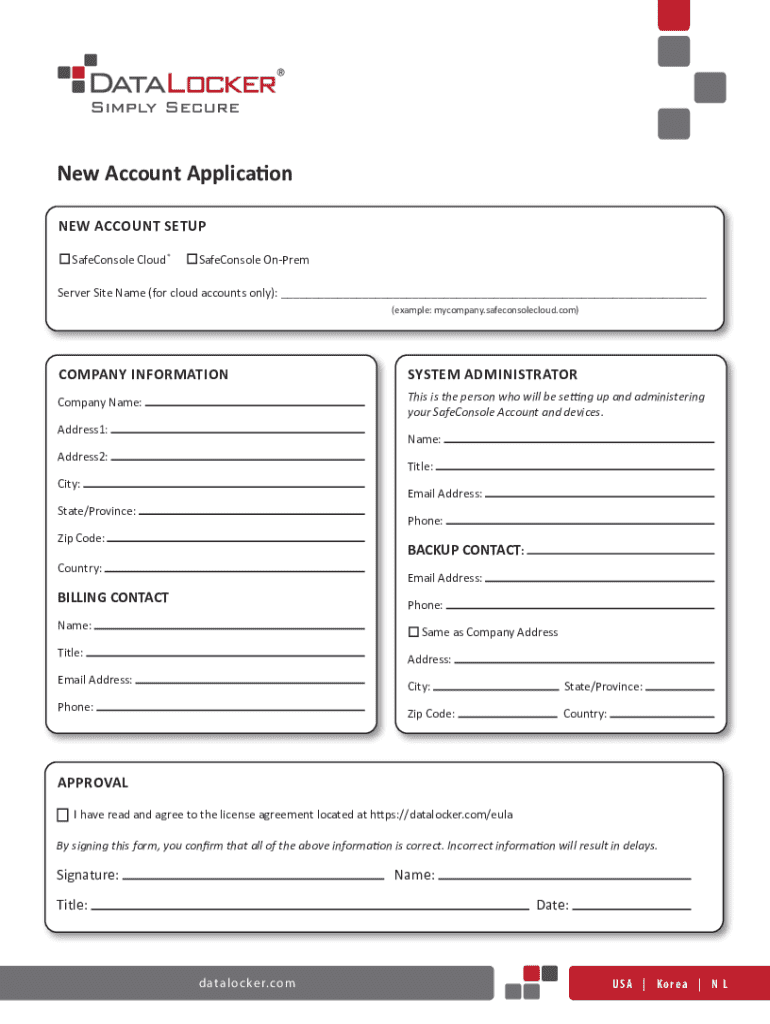

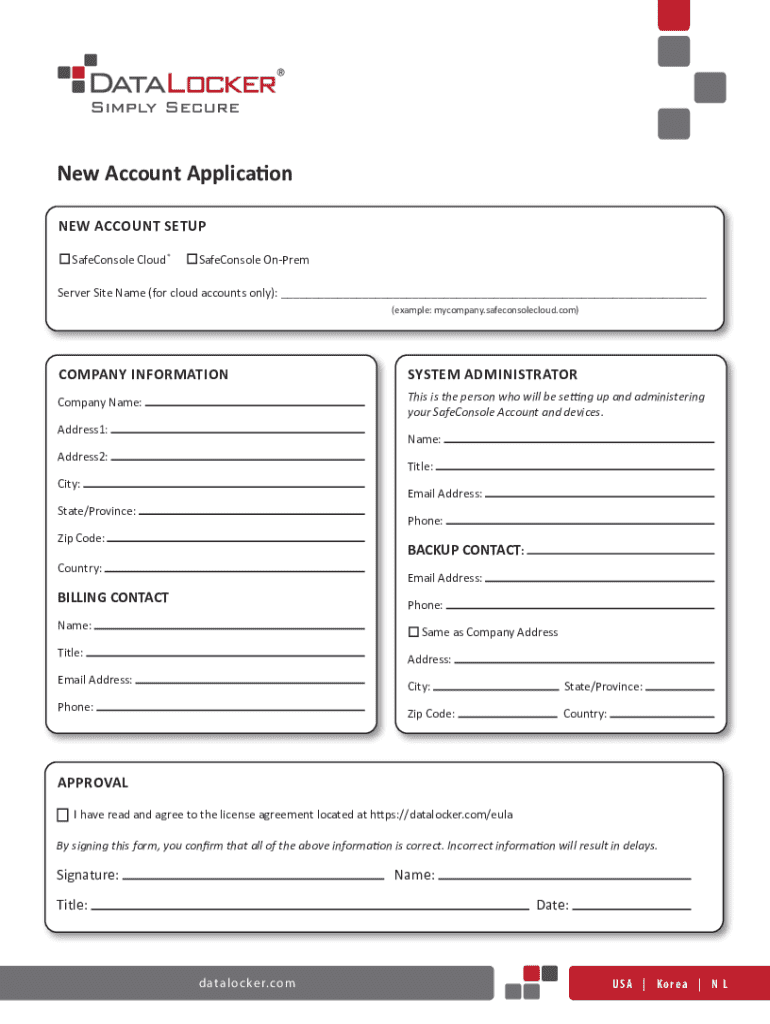

Understanding the new account application form

A new account application form is a crucial document, designed to initiate the process of opening a banking or financial account. By filling out this form, the individual or business provides the necessary information for the financial institution to assess eligibility and establish an account. The purpose of the form is not just administrative; it serves to validate the identity and financial background of the applicant, ensuring a secure and reliable banking experience.

Establishing a new account can hold significant importance in both personal and business contexts. For individuals, this could mean gaining access to essential financial services like savings or checking accounts necessary for everyday transactions. For businesses, opening new accounts can facilitate smoother operations, such as managing cash flow, accepting payments, or accessing credit lines essential for growth and stability.

Common scenarios necessitating the completion of a new account application include relocating to a new city and needing a local bank branch, starting a new business venture that requires a corporate checking account, or deciding to save for future goals and needing a dedicated savings account.

Types of new account applications

When considering a new account application form, it's crucial to recognize the various types available to meet your needs. Personal accounts are the most common, allowing individuals to manage their finances effectively. This might include checking accounts for daily transactions, savings accounts for storing funds with interest accumulation, and credit cards, which provide purchasing power along with the ability to build credit history.

For businesses, the requirements differ somewhat. Corporate checking accounts facilitate seamless management of business expenses, while business credit accounts assist in purchasing and credit management. Additionally, merchant accounts are essential for businesses aiming to accept card payments from customers, streamlining the sales process. Specialized accounts also play a role, including joint accounts for shared finances and trust accounts catering to specific financial interests of beneficiaries.

Essential information needed

Completing a new account application form requires specific information to ensure a smooth and efficient process. Personal information is foundational, including your full name, residential address, and Social Security Number (SSN) or taxpayer identification number. This information helps establish your identity and confirms your eligibility for the account.

Contact information is equally essential. This typically includes your phone number and email address, allowing the financial institution to reach you regarding your application. Additionally, banks often request financial information detailing your employment status, current income sources, and any other relevant financial details that support your application. This data aids in assessing your creditworthiness and ability to maintain the account.

Steps to fill out the new account application form

Preparing your information before completing the new account application form can significantly enhance the efficiency of the process. Start by collecting the necessary documentation. This may include proof of identity such as a government-issued ID, and verification of your address through utility bills or lease agreements. Furthermore, verify your eligibility based on the type of account you intend to open, as different accounts have varied requirements.

When you get to completing the form, follow a step-by-step approach. Begin with the Personal Information section, accurately entering your name and SSN. Next, navigate through the Contact and Financial Information sections, ensuring consistency with your documentation. Common pitfalls to avoid include incorrect social security numbers, mismatched addresses, or leaving fields blank, any of which can delay your application or even lead to rejection.

After thoroughly completing the form, consider the options available for submission. Many institutions now offer online submissions for convenience, while others may require in-person applications or mailing in the forms. Regardless of the method, be prepared for what comes next—this often involves a waiting period where the institution will process your application and verify provided information.

Editing and managing your application

Accuracy and completeness are paramount when handling your application. Before considering your application finalized, take time to review every detail. If edits are necessary, ensure that the process for reviewing and updating your information is straightforward, which is often facilitated by a user-friendly interface from banks or financial institutions.

Tracking the status of your application is critical as well. Most institutions provide online portals where applicants can log in and see the progress of their application. If you should encounter issues or experience a delay, reach out to customer support channels, which are often accommodating and can help clarify any hurdles you may face during the process.

Signing and finalizing your application

Understanding electronic signatures is essential in today's digital application environment. Electronic signatures hold the same legal validity as traditional signatures, thus providing a convenient option for completing your new account application form. Applications like pdfFiller streamline this process, allowing you to quickly and securely e-sign your documentation.

Once you submit your application, confirmation is the next critical step. Look out for confirmation emails that provide information about the successful submission of your application. These emails frequently include important details, such as the next steps or an estimated timeline for processing your application. To ensure that your application isn’t overlooked, consider setting reminders to follow up as needed.

FAQs about new account application forms

Navigating the new account application form can lead to questions. One common concern is what happens if you make a mistake on your application. Most institutions allow you to correct errors via an update process, or they may simply contact you for clarification. Processing times can vary, but typically you can expect feedback within a week, depending on the complexity of the application and the institution’s procedures.

Another frequently asked question is whether you can apply for multiple accounts simultaneously. Generally, this could be acceptable, but be sure to clarify each application’s requirements and ensure you are prepared to handle multiple verification processes. If help is needed, contact customer service, and take advantage of chat support options that many banks provide for quick resolutions.

Utilizing pdfFiller for your application needs

Using pdfFiller for new account applications offers several advantages. The platform’s seamless editing capabilities allow you to complete and modify PDFs effortlessly, addressing any changes you may need as you gather information for your application. The easy e-signing process further streamlines the submission of your account application, ensuring you don’t have delays due to signature requirements.

Beyond basic editing and signing, pdfFiller provides collaborative features beneficial for teams. If multiple people need to contribute information to an application, pdfFiller’s platform allows for straightforward collaboration, making it easy to manage inputs from different stakeholders.

Related documents and forms

When completing a new account application, there may be additional forms that one needs to consider. For instance, beneficiary designation forms may be required if opening a trust account or any account that involves future beneficiaries. Additionally, for certain accounts, a W-9 form may be necessary for tax purposes, ensuring compliance with IRS regulations.

Exploring pdfFiller can unveil further templates related to these and other financial forms, allowing users to streamline their paperwork with ease. Having access to a comprehensive template library can significantly enhance your financial documentation experience, making life easier as you navigate professional or personal financial landscapes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new account application for eSignature?

Can I edit new account application on an iOS device?

How can I fill out new account application on an iOS device?

What is new account application?

Who is required to file new account application?

How to fill out new account application?

What is the purpose of new account application?

What information must be reported on new account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.