Get the free New Account Information / Credit Application

Get, Create, Make and Sign new account information credit

Editing new account information credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account information credit

How to fill out new account information credit

Who needs new account information credit?

New Account Information Credit Form: How to Guide

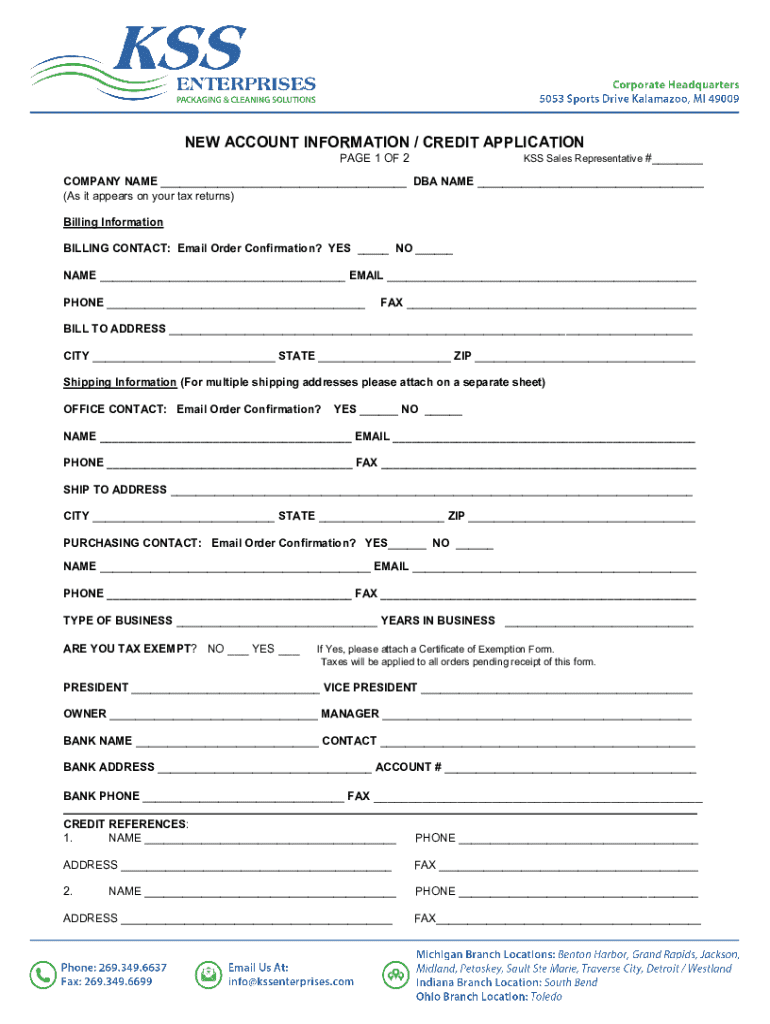

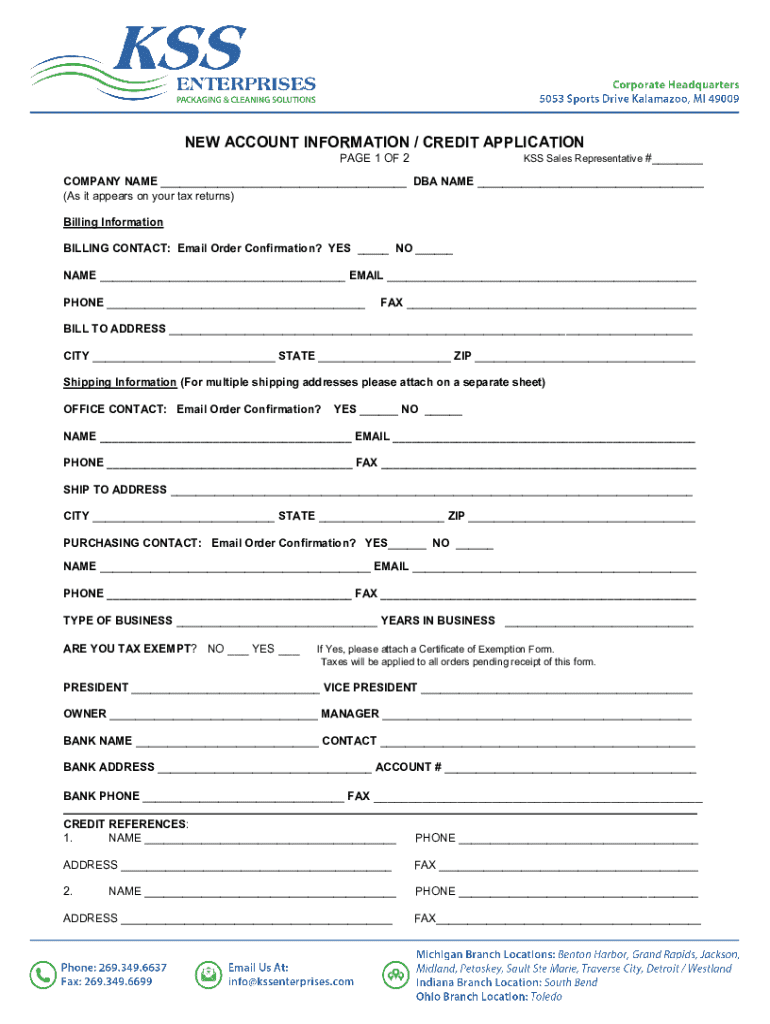

Understanding the new account information credit form

A new account information credit form is a crucial document designed to gather detailed information concerning a user or organization's financial history and identity verification. It typically encompasses various personal and financial details necessary for initiating a new account, whether it’s for banking, credit facilities, or other financial services. The form is essential in protecting both the institution and the user by ensuring identity verification and financial accountability.

The primary purpose of the new account information credit form is to streamline the onboarding process for new users, assuring institutions can verify the identity of applicants while facilitating accelerated access to services. Accurate information in these forms is vital; inaccuracies can lead to delays in processing applications, potential account rejections, or even legal complications. Ensuring each piece of information is precise eliminates variables that could hamper the establishment of a new account.

Who needs to fill out this form?

Filling out the new account information credit form is necessary for a range of individuals and organizations. Individuals applying for personal accounts benefit from this form as it helps them set up bank accounts, credit cards, loans, and other financial products. Common scenarios necessitating the form include applying for a mortgage, opening a checking account, or engaging in any transactions requiring credit checks.

For businesses, the new account information credit form serves an essential role in simplifying new employee onboarding and managing team accounts. When new employees are hired, filling out this form allows the business to set up payroll details, benefits, and access to corporate credit options. This ensures that employees can quickly integrate into the company’s financial systems without delays.

Preparing to fill out the new account information credit form

Before diving into the new account information credit form, it's essential to gather all the required information and documents. Common forms of personal identification include a government-issued ID, social security number (SSN), or taxpayer identification number (TIN). Financial information such as your income details, employment history, and existing liabilities may also be required, depending on the account type you are applying for.

Utilizing document management tools can greatly enhance the preparation process. For instance, accessing the form via pdfFiller not only provides a user-friendly interface but also ensures you can save your progress and access it from anywhere. Keeping a digital folder organized with all relevant documents makes it easier to fill out the form without unnecessary delays.

Step-by-step instruction for completing the form

Getting started with the new account information credit form requires setting up a pdfFiller account. Once your account is created, navigate the pdfFiller dashboard to locate the new account information credit form. The process is straightforward, with a variety of tools available at your disposal to assist with edits and updates.

When filling out the form, break it down section by section. Start with personal information, where you will enter your name, address, and contact details. The financial history section requests details about your income, accounts, loans, and liabilities, making it vital to have that information handy. Lastly, the account preferences section allows you to specify the type of services or plans you are interested in. Employ best practices for input by double-checking your entries and avoiding common mistakes such as typos or missing fields.

Signing and submitting the form

E-signing the new account information credit form has revolutionized how submissions are handled. Using pdfFiller’s eSigning features, completing the process becomes more efficient by eliminating the need for physical paperwork. E-signatures are legally binding in various jurisdictions, meaning you can be confident that your signed document is valid.

To eSign your form, simply follow the prompts provided within the pdfFiller portal. After completing your signature, you have various submission options. Besides submitting directly online through pdfFiller, downloadable options are available if you prefer mailing your form. Ensure that whichever submission method you select aligns with the institution’s policies.

What to expect after submission

After submitting your new account information credit form, you will typically receive a confirmation of submission via email. This confirmation is crucial as it serves as proof that your application is in process. Expect a timeline for processing, which can substantially vary based on the institution's protocols. It’s prudent to follow up if you haven’t heard back within the expected timeframe to clear up any potential issues hindering your application.

Be prepared to handle any requested follow-ups or corrections, as processing errors can occur. Keep an open line of communication with the institution to ensure that any outstanding information is resolved quickly and adequately.

Tips for managing your account information

Managing your account information doesn't end after submitting the new account information credit form. Utilizing pdfFiller can streamline your document organization, allowing you to keep track of all submissions and documents in one place. Regularly updating your information ensures that any changes in your financial situation or personal details do not disrupt your account's functionality.

It’s crucial to prioritize data security and privacy, especially when handling sensitive financial information. Ensure that your pdfFiller account is safeguarded with strong passwords and that you regularly review the privacy settings available within the platform.

FAQs about new account information credit forms

Addressing common concerns around the new account information credit form can simplify the process for many users. A frequent question is, 'What if I made a mistake after submitting the form?' In most cases, you can contact the institution to rectify issues before final processing. Tracking the status of your submitted form can often be done via online portals or through customer service representatives.

Moreover, you can save your form and return to it later, allowing you to gather all necessary information without feeling rushed. Lastly, be aware of any fees associated with submitting the form; while standard account applications may be free, specific credit applications can incur charges.

Leveraging pdfFiller for all your document needs

The utility of pdfFiller extends far beyond the new account information credit form. From editing PDFs to managing various types of documents, pdfFiller provides a comprehensive platform tailored for individuals and teams seeking accessible solutions for document creation and management. Its features not only streamline processes but also enhance collaboration among team members.

Leveraging additional features such as customizable templates, robust editing tools, and secure sharing options can significantly simplify document management tasks. By utilizing pdfFiller effectively, users can save time and reduce frustration, ensuring that all documents are handled with professionalism and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get new account information credit?

How do I edit new account information credit in Chrome?

Can I edit new account information credit on an Android device?

What is new account information credit?

Who is required to file new account information credit?

How to fill out new account information credit?

What is the purpose of new account information credit?

What information must be reported on new account information credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.