Get the free Ms Debt Management Services Act - dbcf ms

Get, Create, Make and Sign ms debt management services

How to edit ms debt management services online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ms debt management services

How to fill out ms debt management services

Who needs ms debt management services?

Comprehensive Guide to the MS Debt Management Services Form

Understanding debt management services in Mississippi

Debt management services provide structured support designed to help individuals in Mississippi effectively manage their debt. These services involve tailored financial education, negotiation strategies with creditors, and sustainable repayment plans. Individuals facing debt challenges often find that professional guidance can lead to better outcomes, allowing them to regain control over their finances.

The importance of debt management cannot be understated, particularly for those who may be struggling with overwhelming financial obligations. Effective debt management helps reduce stress, improve credit scores, and enables individuals to make informed decisions regarding their financial futures.

Common services offered include debt counseling—a personalized evaluation of your financial situation, budget planning for managing income and expenses, and debt negotiation to potentially lower the total amount owed. These services serve as a valuable resource for individuals seeking to pave a path toward financial freedom.

Types of debt management services forms

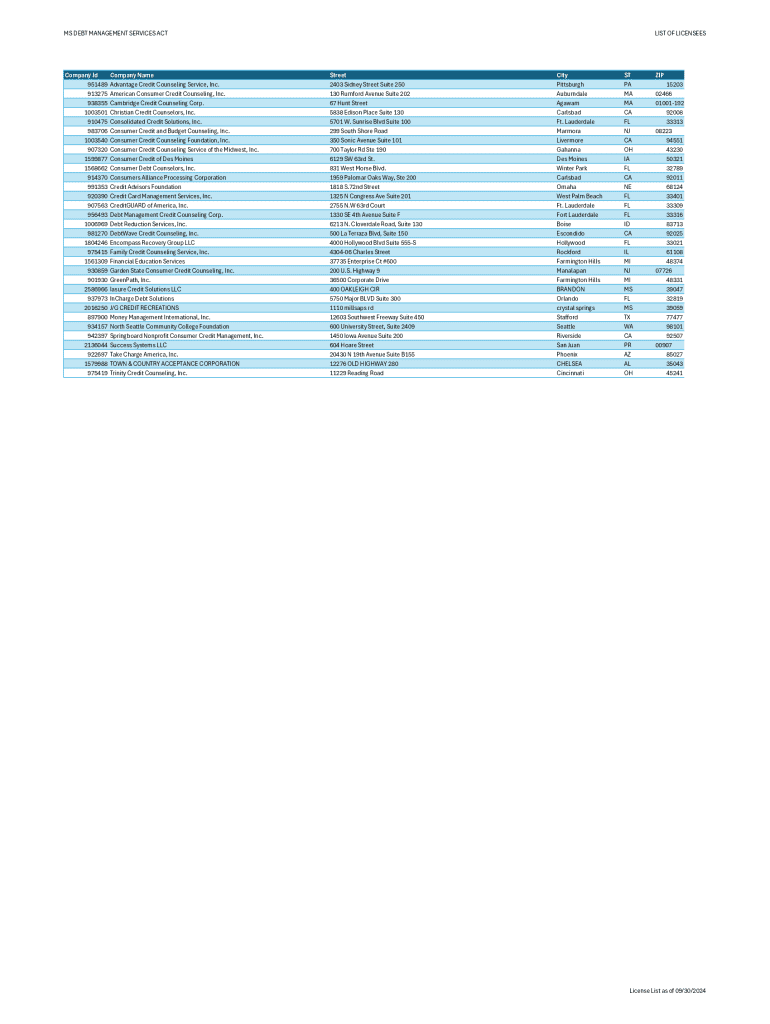

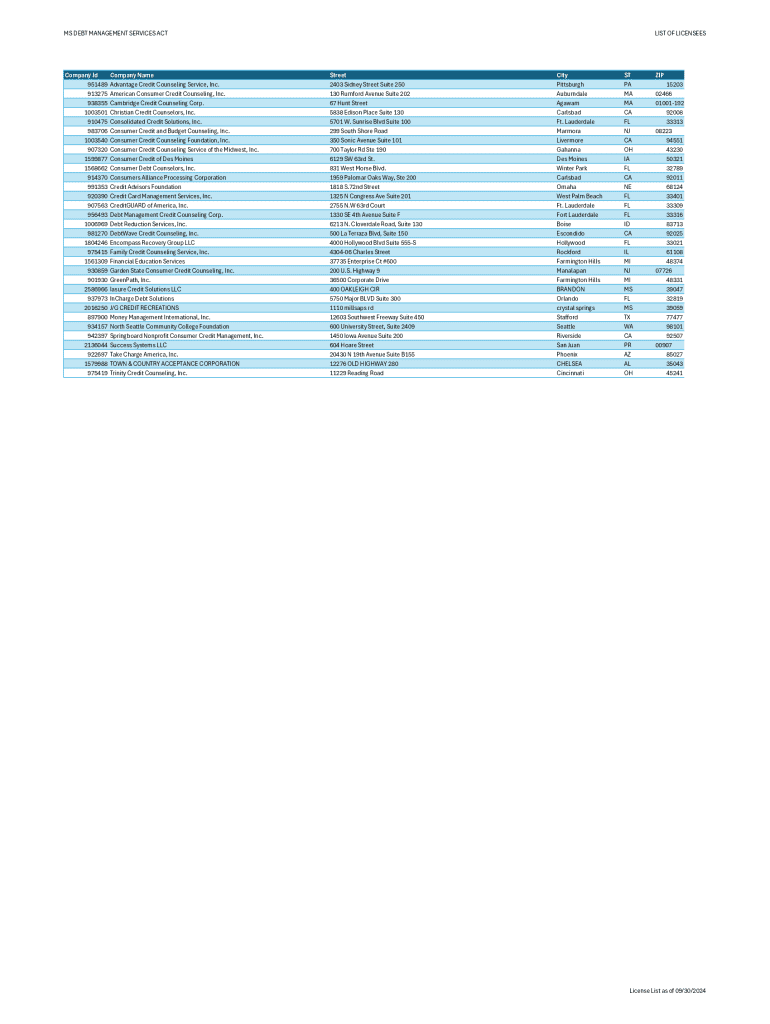

Navigating the debt management process involves filling out specific forms that are crucial for establishing a comprehensive plan. In Mississippi, three primary forms are commonly utilized: the Consumer Debt Management Service Form, the Financial Disclosure Form, and the Client Agreement Form. Each plays a distinct role in supporting the efficiency and success of debt management services.

Completing each of these forms accurately ensures that clients receive tailored support and increases the likelihood of achieving a successful resolution to their debt issues.

Step-by-step instructions for completing the MS debt management services form

The process of completing the MS Debt Management Services Form can be straightforward if you follow a series of organized steps. Here’s how to ensure you’re well-prepared to fill out your form accurately.

Taking the time to follow these steps not only saves you hassle but also facilitates a smoother interaction with your selected debt management service.

Editing and managing your MS debt management services form

Once your MS Debt Management Services Form has been filled out, you may find it essential to edit and manage the document to retain its accuracy. Tools such as pdfFiller’s online document editing capabilities allow users to revise their forms effortlessly.

After submission, circumstances may change, requiring updates to your form. It’s crucial to know how to modify your submitted document efficiently. Best practices include saving all versions of your documents and keeping track of any changes made.

Signing the MS debt management services form

Signing your MS Debt Management Services Form is a pivotal step that formalizes your intent and agreement with your chosen provider. Electronic signatures are now widely accepted, significantly streamlining the process.

Utilizing pdfFiller for eSigning your documents provides a fast and secure method to finalize your agreement. Ensure that your consent aligns with state regulations to avoid any legal complications.

Submitting your completed MS debt management services form

After completing the necessary forms, understanding the submission process is vital. In Mississippi, you have various submission methods available.

After submission, you can expect processing confirmations and potential follow-up steps based on the service provider's requirements. Timely communication is key to assuring all aspects are handled efficiently.

Frequently asked questions (FAQs)

Many clients have queries about the debt management process in Mississippi, making it essential to address common concerns.

Tools and resources for effective debt management

To assist in navigating your financial situation, tools and resources are invaluable. pdfFiller offers interactive tools designed to enhance financial planning.

For additional support, local agencies can provide tailored financial counseling, offering further insights into debt management.

Troubleshooting common issues

Encountering issues while completing your MS Debt Management Services Form can be daunting, but understanding common pitfalls and knowing how to handle issues can simplify the process. If you notice form errors, identifying the section, correcting it, and resubmitting as necessary will help streamline your efforts.

In cases where you’re unsure about certain steps, contacting support from your debt management service provider is crucial. They are equipped to offer guidance tailored to your situation.

If things go wrong and you find yourself struggling with the debt management process or experiencing unexpected complications, assess your options patiently. Knowledge of available alternatives can empower you to make informed decisions.

About pdfFiller and its document management solutions

pdfFiller stands out in document management by providing users with intuitive tools that enable seamless editing, signing, and collaboration—all within a secure, cloud-based platform. Users benefit from an accessible and efficient way to manage essential documents like the MS Debt Management Services Form.

Testimonials highlight the positive impact of pdfFiller on debt management, showcasing experiences of users who successfully got their debt under control by using the platform. To get started with pdfFiller today, sign up, and explore the many tools that can simplify your debt management journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ms debt management services?

Can I create an eSignature for the ms debt management services in Gmail?

How do I complete ms debt management services on an iOS device?

What is ms debt management services?

Who is required to file ms debt management services?

How to fill out ms debt management services?

What is the purpose of ms debt management services?

What information must be reported on ms debt management services?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.