Get the free Beneficiary Designation

Get, Create, Make and Sign beneficiary designation

How to edit beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation

How to fill out beneficiary designation

Who needs beneficiary designation?

Understanding Beneficiary Designation Forms: A Comprehensive Guide

Understanding beneficiary designation

A beneficiary designation form is a critical document in estate planning that allows individuals to specify who will receive their assets upon their death. This form is commonly used for financial accounts, insurance policies, and retirement plans. By clearly stating the intended beneficiaries, individuals can avoid potential disputes and ensure their assets are distributed according to their wishes.

The importance of a beneficiary designation cannot be overstated. It serves not only as a tool for asset distribution but also as a means of providing peace of mind. When completed accurately, it helps bypass the often complex and time-consuming probate process, enabling beneficiaries to receive their inheritance promptly.

Many individuals misunderstand the purpose and implications of the beneficiary designation form. A common misconception is that naming a beneficiary in one document eliminates the need to address it in others. However, the designation needs to be consistent across various accounts and policies.

Types of beneficiary designation forms

There are several types of beneficiary designation forms, each serving specific financial instruments. Understanding which form to use is essential for effective estate planning.

Each type of beneficiary designation form affects your estate plan distinctively. For instance, naming a beneficiary on a retirement account may supersede instructions stated in a will, highlighting the need for consistent designations across all documents.

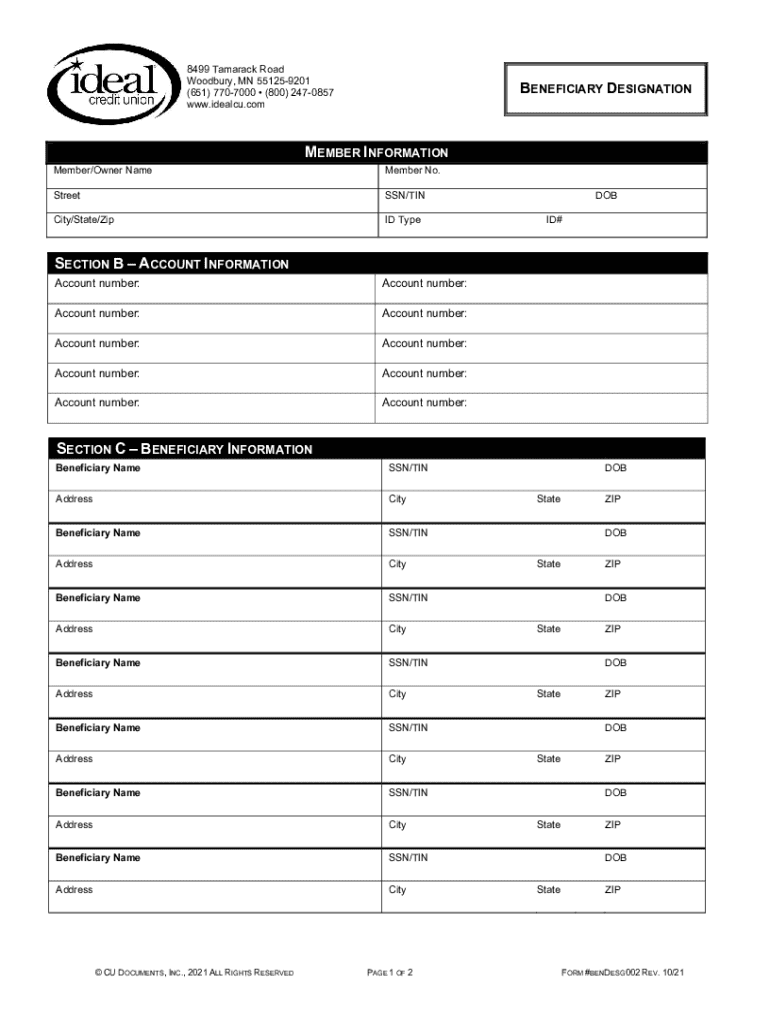

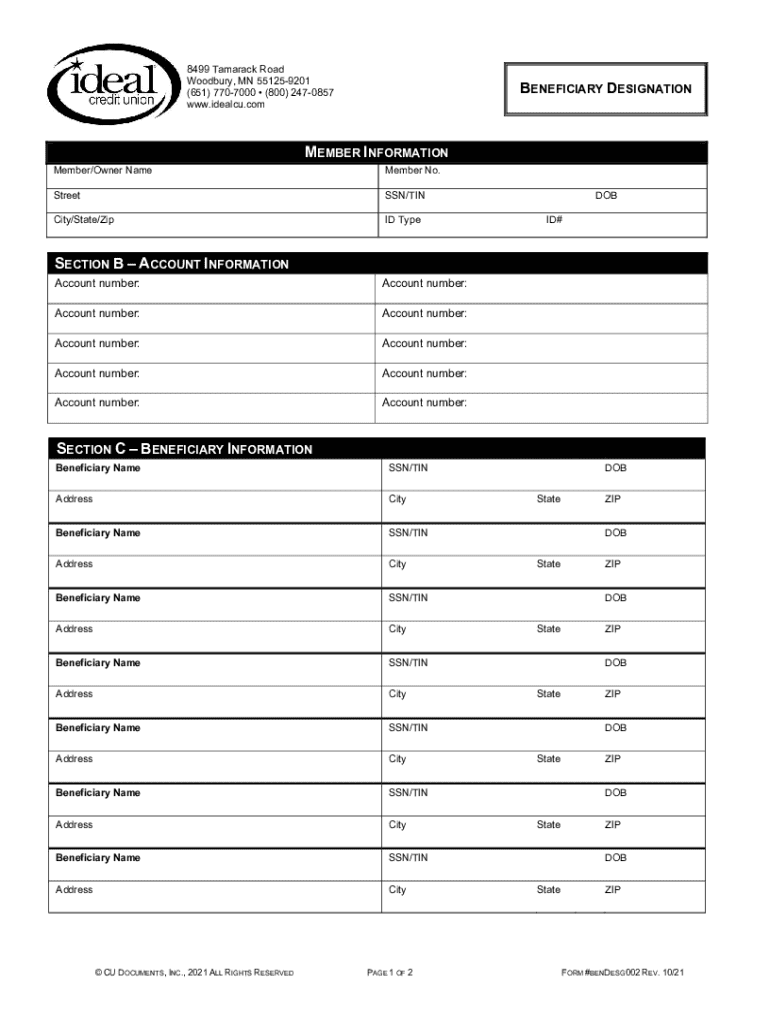

Key components of a beneficiary designation form

Filling out a beneficiary designation form correctly is crucial for ensuring that your assets are distributed according to your wishes. The form requires several key components:

Each component plays a vital role in ensuring the form is legally binding and confirms your intent effectively.

Step-by-step guide to filling out a beneficiary designation form

Filling out a beneficiary designation form can seem daunting, but following these steps can simplify the process.

Completing each step meticulously ensures that your beneficiary designation form is both accurate and effective in representing your asset distribution preferences.

Modifying your beneficiary designation

Life is full of changes, and sometimes you may need to update your beneficiary designation. Common life events such as marriage, divorce, and the birth of a child often prompt individuals to reconsider their designations.

To maintain an effective estate plan, regular reviews and updates of your beneficiary designations are essential.

Managing your beneficiary designation: best practices

Effectively managing your beneficiary designation involves regular review and clear communication.

Implementing these best practices can significantly streamline the management of your beneficiary designations.

Frequently asked questions about beneficiary designation forms

Understanding some common questions can help clarify the importance and process of beneficiary designation.

Being informed about these aspects can ease the complexities involved in beneficiary designation.

Leveraging pdfFiller for your beneficiary designation needs

pdfFiller provides an invaluable resource for individuals managing their beneficiary designation forms. The platform simplifies every aspect of document management.

Utilizing pdfFiller’s capabilities ensures you handle your beneficiary designation form efficiently, supporting your overall estate planning efforts.

Related resources and tools

To further enhance your understanding and process of beneficiary designation, consider exploring additional resources.

Utilizing these resources can round out your understanding and management of your beneficiary designations.

Testimonials: users share their experience with beneficiary designation forms

Many individuals have found success in managing their beneficiary designations. Testimonials often highlight the importance of having a clear designation.

These shared experiences underscore the necessity of a thoughtfully completed beneficiary designation form for effective estate planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my beneficiary designation in Gmail?

How do I edit beneficiary designation on an iOS device?

How do I complete beneficiary designation on an Android device?

What is beneficiary designation?

Who is required to file beneficiary designation?

How to fill out beneficiary designation?

What is the purpose of beneficiary designation?

What information must be reported on beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.