Get the free Cr-a

Get, Create, Make and Sign cr-a

Editing cr-a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cr-a

How to fill out cr-a

Who needs cr-a?

CR-A Form: A Comprehensive How-to Guide

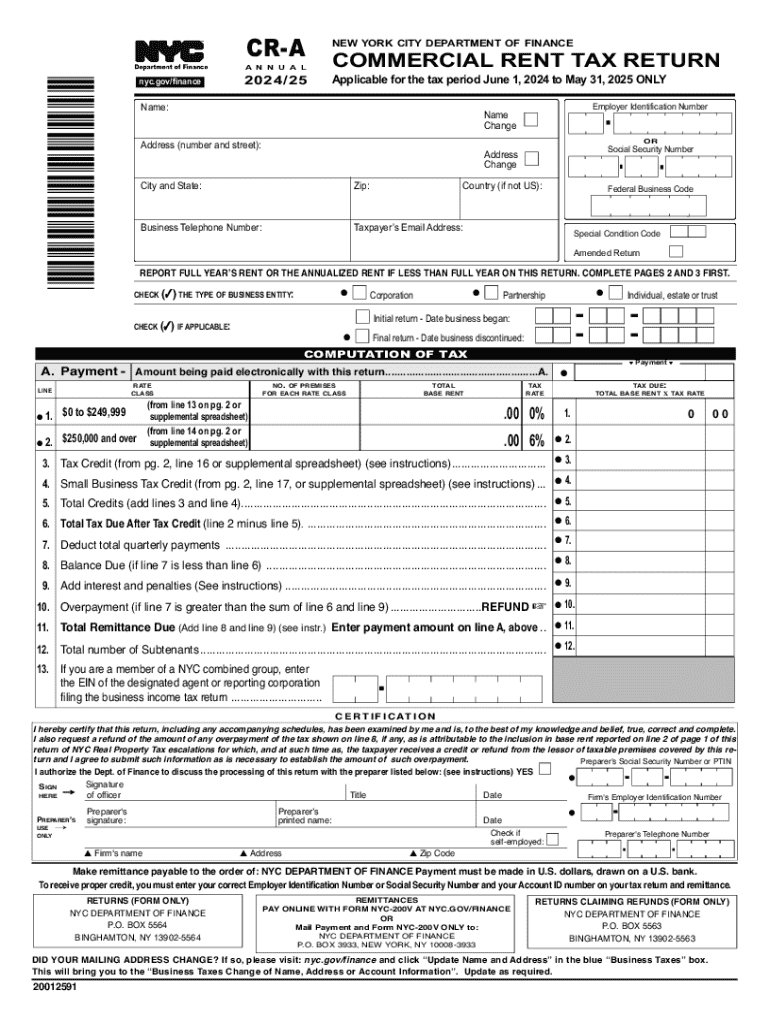

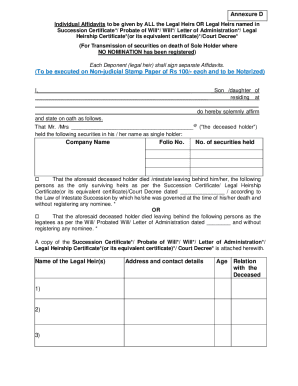

Overview of the CR-A Form

The CR-A Form is a crucial document used within various administrative and legal contexts to capture essential personal and submission-related information. Its primary purpose revolves around standardizing data collection processes for organizations and individuals alike. By adopting such forms, entities can streamline their operations, ensuring that no vital information is overlooked in critical processes.

The significance of the CR-A Form in document management cannot be overstated. It acts as a foundation for tracking submissions, maintaining records, and fulfilling regulatory requirements. In a world where documentation plays an integral role in communication and operations, the CR-A Form stands out as a tool that enhances accountability and organization.

Understanding the structure of the CR-A Form

To navigate the CR-A Form effectively, one must grasp its structure. The form is typically segmented into distinct sections, each targeting specific data collection needs. The first section focuses on personal information, ensuring that the collector understands who is submitting the form. This information often includes the full name, date of birth, and relevant identification numbers.

The second section delves into contact details, crucial for follow-ups and verification processes. Here, individuals must provide their address, email, and phone number. Lastly, the submission details section specifies what the form pertains to and any associated deadlines or requirements. Understanding the difference between required and optional fields is vital, as overlooking required fields can lead to submission issues.

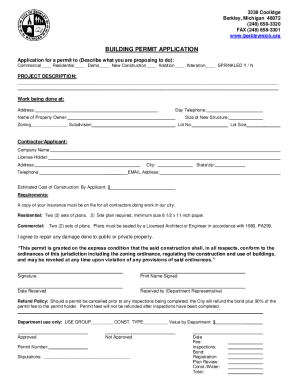

Step-by-step instructions for completing the CR-A Form

Completing the CR-A Form can be simplified by following a structured approach. Start with gathering the necessary information, which includes personal identification documents, address verification, and any previous correspondence related to the submission. Ensuring that your documentation is prepared ahead of time will facilitate a smoother process.

Next, begin filling out the personal information section. Accuracy is paramount here, as any mistakes can lead to delays in processing. For instance, if your name has a specific spelling, ensure it matches your identification documents. Once you have completed the personal information, proceed to detail your contact information. It’s essential not only to provide correct details but also to double-check for typographical mistakes that could hinder communication.

Finally, finalize the submission details by clearly stating the purpose of the CR-A Form and any relevant deadlines. This section requires careful attention to ensure that you meet all expectations set forth by the receiving authority.

Tips for editing and signing the CR-A Form

Once you've completed the CR-A Form, utilizing pdfFiller’s editing tools will be essential for ensuring everything is precise. Start by reviewing all the filled sections; pdfFiller allows you to click on any text or field to make immediate changes. This functionality can help you correct any small errors that might have occurred during the initial input. Additionally, adding comments or annotations can provide extra context or clarification for any sections where further explanation might be beneficial.

When it comes to signing the CR-A Form, digital signatures offer many advantages. They allow you to sign and submit documents quickly and securely. Moreover, electronic signatures are legally recognized and can streamline workflows significantly. To ensure legality and compliance, make sure your digital signature meets the requirements set by your jurisdiction, which pdfFiller helps facilitate by guiding users throughout the signing process.

Collaboration and sharing options for the CR-A Form

Collaborating with team members on the CR-A Form is made easy with pdfFiller. This platform empowers users to share forms seamlessly, enabling real-time collaboration. You can invite colleagues to edit or review the document, which fosters team engagement and reduces the likelihood of errors.

Managing feedback is crucial; therefore, adopting best practices for collaboration is advised. Establish clear guidelines about who will make final edits to avoid conflicting changes and ensure that all voices are heard. Utilizing the comment features also allows team members to add their input without altering the original content.

Managing the CR-A Form after submission

After submitting the CR-A Form, effective management of the document becomes critical. Using pdfFiller simplifies storage and archiving by offering cloud-based solutions that are accessible from anywhere. This accessibility means you can always reference past submissions for future needs or compliance checks, ensuring that all documentation remains organized.

Tracking the status of your submission is also essential. pdfFiller provides tools and features that allow users to monitor the progress of their documents, alerting them to any action required or feedback provided by the review authority. Being proactive can save time and help ensure that any required follow-up actions or additional documentation are submitted promptly.

Handling common issues with the CR-A Form

Encountering issues with the CR-A Form is not unusual, but troubleshooting these common errors can often be handled easily. For example, submission rejections frequently stem from incomplete information or matching discrepancies between submitted data and official records. Developing an understanding of the most common errors can help users avoid them altogether.

For those facing persistent problems, it’s advisable to reach out for assistance. pdfFiller provides customer support channels that can guide you through resolving any challenges you face, helping you get back on track swiftly. Utilizing these resources ensures that you do not remain stuck and can move forward with your documentation needs efficiently.

Keeping your CR-A Form up to date

Maintaining an updated CR-A Form is vital for several reasons, including ensuring that all your information is current for any institutional requirements. Outdated forms can lead to unnecessary complications, misunderstandings, or even delays in processing submissions. Regular updates can help prevent these issues.

Revising the CR-A Form can be made seamless with pdfFiller. The platform allows users to create new versions of forms without the need for starting from scratch, vastly simplifying the revision procedure. Users can track changes made over time, ensuring that all necessary adjustments are documented efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cr-a for eSignature?

Can I sign the cr-a electronically in Chrome?

How do I complete cr-a on an Android device?

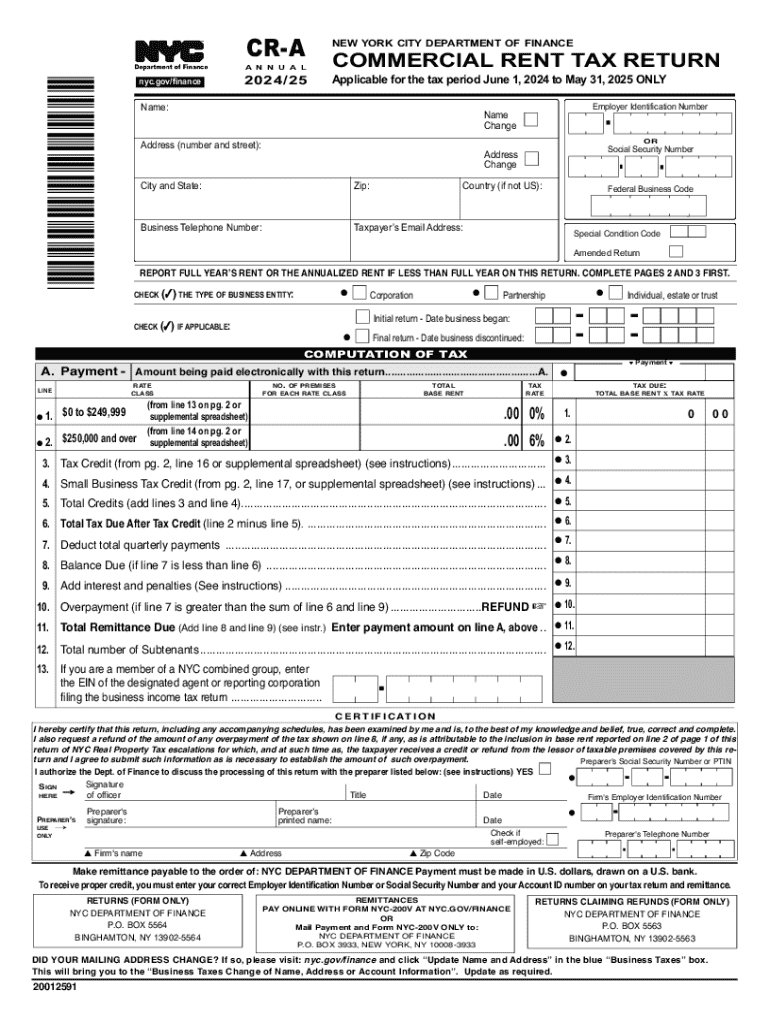

What is cr-a?

Who is required to file cr-a?

How to fill out cr-a?

What is the purpose of cr-a?

What information must be reported on cr-a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.