Get the free Financial Assistance Property Closeout Certification

Get, Create, Make and Sign financial assistance property closeout

How to edit financial assistance property closeout online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial assistance property closeout

How to fill out financial assistance property closeout

Who needs financial assistance property closeout?

Understanding the Financial Assistance Property Closeout Form: A Comprehensive Guide

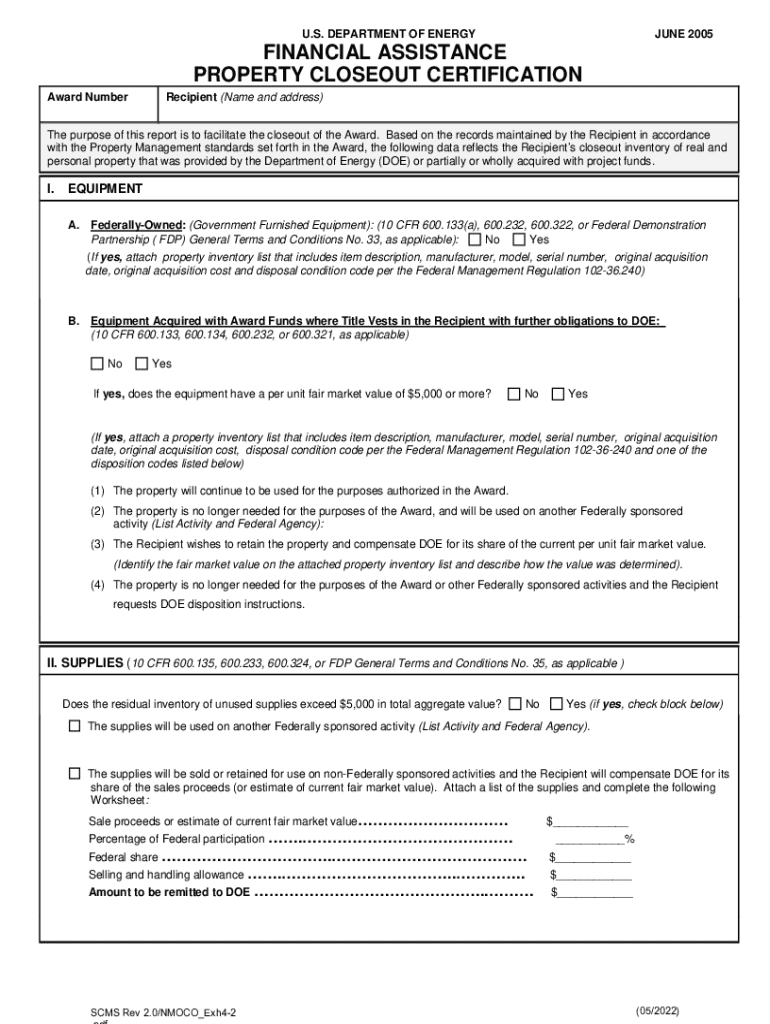

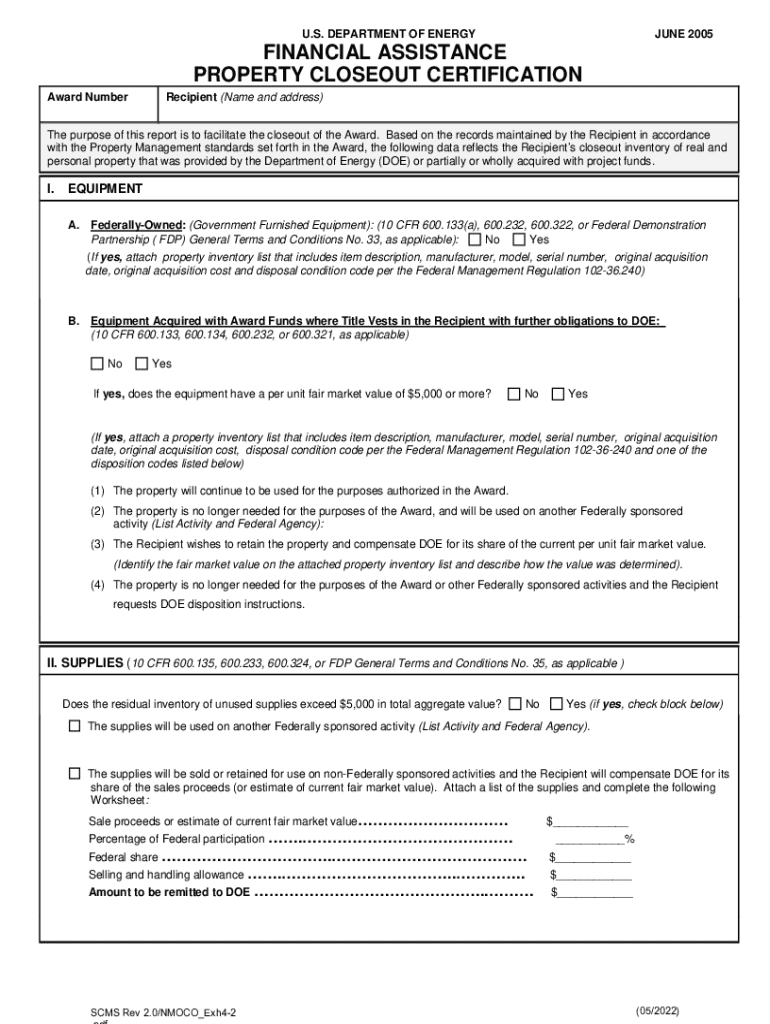

Overview of financial assistance property closeout

Financial assistance property closeout refers to the formal process through which organizations report the conclusion of their use of funds and associated assets obtained through financial grants or aid. This is an essential step that ensures transparency and accountability, safeguarding the interests of both the funders and the recipients.

Proper closeout processes are crucial as they help mitigate risks associated with improper reporting or asset mismanagement. When the closeout is handled correctly, it fosters trust between grantors and recipients, ensuring future funding opportunities and compliance with financial regulations.

Understanding the financial assistance property closeout form

The financial assistance property closeout form is a document that provides necessary and detailed information regarding the financial aid received and the assets acquired from it. Completing this form is mandatory for organizations that have received financial assistance in the form of grants, loans, or other financial sources.

Individuals or organizations that have received financial assistance must complete this form to ensure proper management and reporting of the awarded resources. This encompasses nonprofit organizations, educational institutions, and any business entity benefitting from governmental or private funding.

Essential components of the closeout form

The financial assistance property closeout form includes several key components that must be accurately filled out to ensure compliance and avoid complications. Understanding these components is essential for a smooth submission process.

Step-by-step guide: completing the closeout form

Completing the financial assistance property closeout form can seem daunting, but breaking it down into steps makes the process more manageable. Here’s a simple guide.

Editing and managing the closeout form

Once you have begun the process of filling out your financial assistance property closeout form, managing and editing your document efficiently is crucial. Tools like pdfFiller offer seamless editing capabilities, ensuring you can make changes quickly and accurately.

With pdfFiller, you can save and retrieve your document at any time. This is especially important when collaborating with team members who may need to review or contribute to the documentation. The platform also provides features that allow for real-time collaboration without the hassle of back-and-forth emails.

Signing and submitting the closeout form

After completing the form, the next step is to sign and submit it appropriately. pdfFiller offers various options for eSigning, making this process straightforward and compliant with regulations.

When submitting the closeout form, adhere to the submission guidelines provided by your funding organization. This includes timelines and specific formats required. Being aware of the deadlines is essential, as late submissions can have repercussions on future funding eligibility.

Post-submission: what to expect

After submitting your financial assistance property closeout form, you may enter a phase of dialogue with grant administrators. This step is crucial as administrators will often seek to clarify details or ask for additional information.

It's vital to track the status of your closeout form proactively. If corrections are required, respond promptly to minimize delays. Understanding that the closeout process may involve some back and forth allows for better management of expectations.

Common issues and solutions

As with any process, several common issues may arise when completing the financial assistance property closeout form. Challenges may include incorrect data entries or missing documentation, both of which can lead to delays or complications.

Understanding compliance and record keeping

Compliance regulations play a pivotal role when submitting financial assistance property closeout forms. Being familiar with these regulations helps mitigate the risk of penalties and ensures proper adherence to all requirements.

Guidelines for retaining records and documentation post-closeout are equally critical. Organizations should keep copies of the submitted closeout form and any supplemental documents for future reference, as they may be required during audits or for future funding applications.

Integrating pdfFiller for enhanced document management

Utilizing pdfFiller for managing the financial assistance property closeout form enhances efficiency considerably. The platform streamlines the entire process, from editing to collaboration and submission, making it a preferred choice for many organizations.

Moreover, pdfFiller supports compliance and efficiency by ensuring that all documents are stored securely and managed effectively. The additional tools available on pdfFiller further facilitate the management of financial documentation, allowing users to focus on their core responsibilities without getting bogged down by paperwork.

Appendices (optional sections)

Gaining a thorough understanding of the financial assistance property closeout form goes beyond just completing it. Including various supplementary sections, such as a glossary of key terms related to this form, helpful resources, and contact information for further assistance, can prove invaluable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the financial assistance property closeout in Chrome?

How can I fill out financial assistance property closeout on an iOS device?

How do I edit financial assistance property closeout on an Android device?

What is financial assistance property closeout?

Who is required to file financial assistance property closeout?

How to fill out financial assistance property closeout?

What is the purpose of financial assistance property closeout?

What information must be reported on financial assistance property closeout?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.