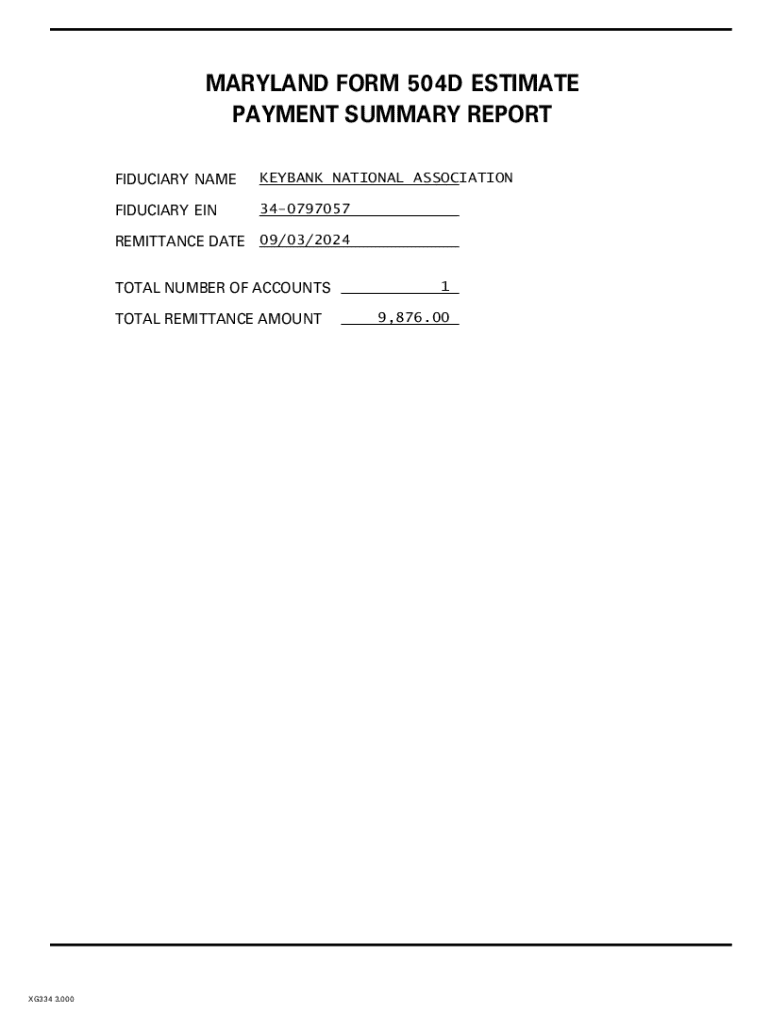

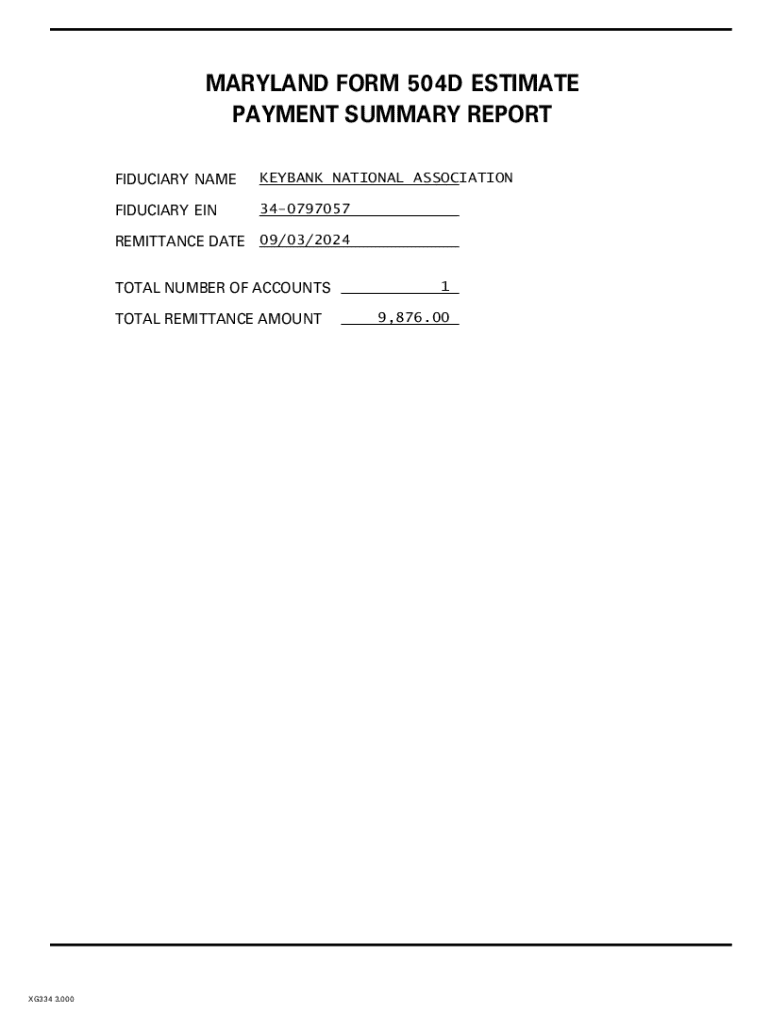

Get the free Maryland Form 504d Estimate Payment Summary Report

Get, Create, Make and Sign maryland form 504d estimate

Editing maryland form 504d estimate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland form 504d estimate

How to fill out maryland form 504d estimate

Who needs maryland form 504d estimate?

Understanding the Maryland Form 504D Estimate Form: A Comprehensive Guide

Overview of Maryland Form 504D

Maryland Form 504D is an essential tax form utilized for estimating income tax payments by individuals and certain businesses within the state. Its primary purpose is to allow taxpayers to report and pay estimated tax liabilities for the upcoming tax year. For Maryland residents, this form plays a crucial role in the state tax system, enabling them to stay compliant while planning for their fiscal responsibilities. The timely submission of Form 504D helps avoid penalties that can arise from underpayment of taxes.

The significance of Maryland Form 504D extends beyond filing; it aids taxpayers in budgeting their finances throughout the year. Key deadlines are crucial for the submission of this form, including the due dates for quarterly payments, which typically fall in April, June, September, and January of the following year. Ensuring timely submission is vital for avoiding potential interest or penalties related to tax liability.

Eligibility and requirements

Understanding who needs to fill out Form 504D is fundamental. Generally, any Maryland resident who expects to owe $500 or more in state tax for the upcoming year must submit Form 504D. This requirement often includes individuals with self-employment income, dividends, interest income, and any variation of earned income that does not have withholding tax applied.

To qualify for estimated tax payments, taxpayers must meet specific criteria. If you anticipate that your withholding taxes and refundable credits will not cover your tax liabilities, then you fit the criteria for filing. Special attention should also be given by teams or individuals who have variable income streams, like freelancers or small business owners, as they may experience fluctuations that affect their estimated tax payments.

Filling out the Maryland Form 504D

Filling out the Maryland Form 504D can be straightforward if you follow the proper steps. Here's a step-by-step guide on completing each section effectively:

When calculating your estimated taxes, ensure to double-check your numbers and avoid common pitfalls such as underestimating your income or missing allowable deductions. Accurate calculations help prevent issues down the line.

Electronic submission of Maryland Form 504D

Submitting Maryland Form 504D electronically has become a popular choice due to its convenience. Using tools such as pdfFiller, taxpayers can efficiently submit their forms online with just a few clicks. Mobile accessibility ensures that you can manage your submissions from anywhere, enhancing the overall experience.

The benefits of electronic submission are manifold, including faster processing times, reduced paperwork, and the ability to receive immediate confirmation upon submission. Plus, modern platforms prioritize security, meaning your sensitive information is safe during the transmission process.

Editing and signing your form using pdfFiller

With pdfFiller, editing PDF forms is seamless and user-friendly. Users can select from a range of tools that allow for precise edits, whether it’s updating personal information or adjusting income estimates. Adding electronic signatures requires just a few clicks, allowing you to secure your document easily.

Furthermore, pdfFiller enhances collaboration features, enabling team members to work together efficiently on Form 504D. With multiple contributors able to access and edit the form, teamwork becomes simpler, ensuring that every detail is checked and confirmed for accuracy.

After submission: What happens next?

Once you submit your Maryland Form 504D, the next steps involve awaiting confirmation of receipt from the Maryland Comptroller’s office. This acknowledgment may arrive via email or through your chosen submission platform. It’s important to keep a record of this confirmation for your records.

To track the status of your submission, regularly check your email or access your pdfFiller account for updates. In case of discrepancies or issues arising from your submission, contacting the Maryland Comptroller’s office directly is advisable to resolve any uncertainties.

Frequently asked questions about Maryland Form 504D

The Maryland Form 504D often leads to many questions among taxpayers. A common inquiry is the difference between Form 504D and similar forms like 504UP or 504NR. While Form 504D is for individual taxpayers, the other forms cater to specific needs such as non-resident issues or special considerations.

Another frequent question pertains to penalties for late submissions. Failing to file Form 504D or submitting it after the deadline can result in additional interest and penalties. It’s crucial to stay aware of deadlines to avoid these repercussions. If errors occur post-submission, promptly contacting the appropriate department for amendments is recommended to rectify the situation.

Related forms and resources

There are other Maryland 504 forms that could be useful, including Form 504UP and Form 504NR. Each serves specific purposes aligned with taxpayer needs based on their residency status or tax situation. Links to templates for these forms are often available through the Maryland Comptroller’s website, providing a convenient resource for taxpayers looking for additional guidance.

For comprehensive tax resources, the Maryland State Comptroller’s website is invaluable, offering insights on tax rates, filing requirements, and specific guidelines for various forms. Users can access these resources to stay informed and compliant with state tax laws.

Common mistakes to avoid

When completing the Maryland Form 504D, several common mistakes can lead to complications. One of the most prevalent errors is underestimating tax liability, especially for those with fluctuating incomes or who are new to self-employment. This can lead to substantial penalties if tax payments are underpaid.

Another frequent error is incorrect personal information, such as misspelled names or wrong Social Security Numbers. These discrepancies can delay processing or create issues down the line. Best practices for ensuring compliance include double-checking all entries, using tax estimation calculators, and maintaining organized documentation throughout the year.

Tools & features of pdfFiller for Form 504D

pdfFiller offers powerful interactive tools designed to streamline document management for Form 504D users. From editable templates to auto-fill features, these tools simplify the tax preparation process and enhance user experience. Tax professionals, in particular, find substantial value in these capabilities, allowing them to manage multiple clients' forms effectively.

User testimonials often highlight the ease and efficiency of submitting tax documents through pdfFiller. Many customers have shared success stories about how employing this platform helped to organize their tax documentation and ensured timely submissions, emphasizing the system’s reliability and user-friendly design.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find maryland form 504d estimate?

How do I edit maryland form 504d estimate straight from my smartphone?

Can I edit maryland form 504d estimate on an iOS device?

What is maryland form 504d estimate?

Who is required to file maryland form 504d estimate?

How to fill out maryland form 504d estimate?

What is the purpose of maryland form 504d estimate?

What information must be reported on maryland form 504d estimate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.