Get the free Business Loan Application

Get, Create, Make and Sign business loan application

How to edit business loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business loan application

How to fill out business loan application

Who needs business loan application?

Business Loan Application Form: A How-to Guide Long-Read

Understanding the business loan application process

A business loan application form is not just a piece of paper; it's a gateway to financial growth. Business loans are vital for many companies, allowing them to bolster their operations, expand their market reach, or adapt to competitive pressures. The significance of these loans cannot be overstated—success often hinges on the ability to access timely funds.

There are several key reasons why a business might pursue a loan. One common purpose is securing startup funding, which is essential for new enterprises looking to establish their presence in the market. Additionally, existing businesses often seek loans to support expansion efforts, such as opening new locations or scaling operations. Lastly, targeted investments, such as purchasing equipment, play a crucial role in enhancing service delivery and improving efficiency.

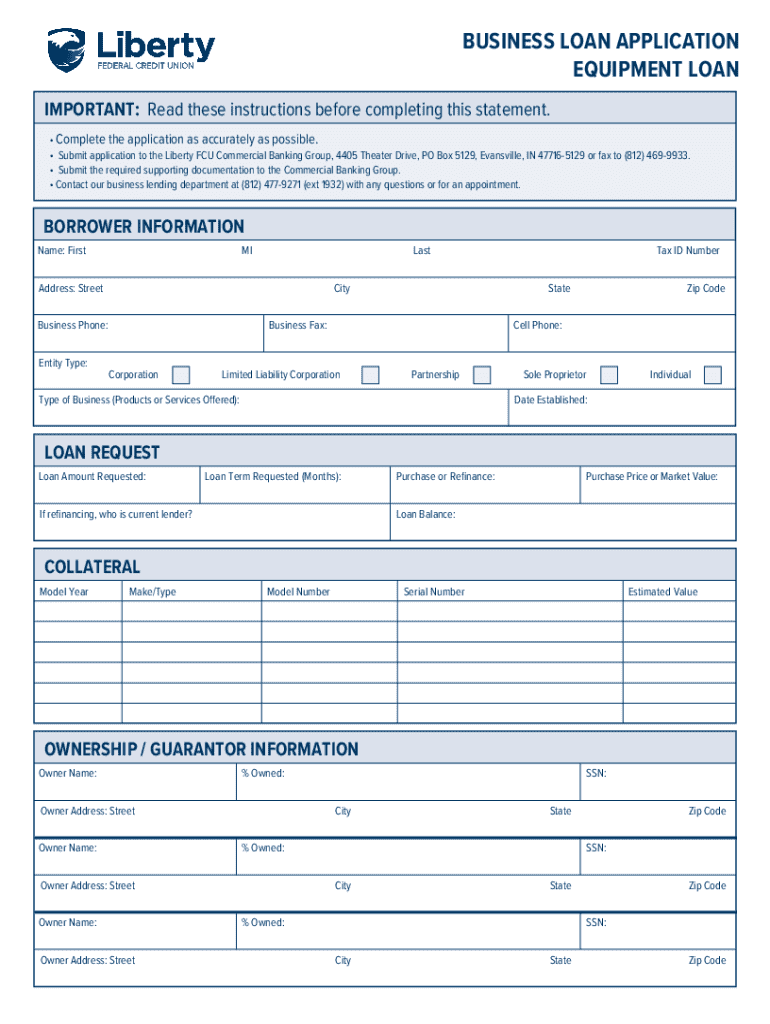

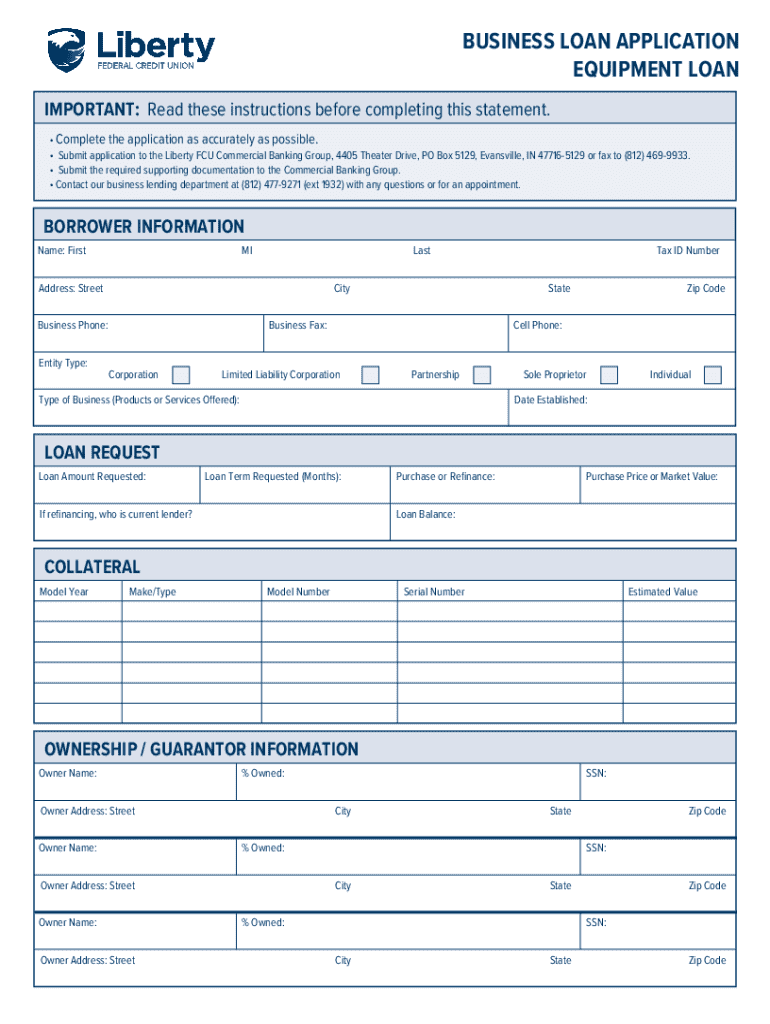

Essential information required for a business loan application form

Completing a business loan application requires careful attention to detail. Lenders need a comprehensive understanding of you and your business. Initially, personal identification details are paramount. This includes basic information like your name and address, along with your Social Security Number, which verifies your identity for the lender.

The next section involves business information, which encompasses your business name, its structure (e.g., LLC, corporation), and a tax identification number. A summary of your business plan gives lenders insight into your strategy, goals, and how you intend to use the funds. Financial information is another critical area. Be prepared to provide revenue statements, profit and loss statements, and details regarding your business credit score, which all significantly influence the lender's decision.

Lastly, lenders usually require information about collateral and assets. This section may include types of collateral you can offer, such as real estate or equipment, and an evaluation of these assets’ worth.

Step-by-step guide to completing the business loan application form

The application process can feel overwhelming, but following a structured approach makes it manageable. Start with pre-filling preparation. Gather all necessary documents to streamline your application—this typically includes business licenses, tax returns, and financial statements. Reviewing the specific loan requirements of your chosen lender will also help ensure you provide adequate information.

When it comes time to fill out the application form, take it section by section. Start with personal information; accuracy is key here. Move on to business details and then address financial disclosures, making sure that every figure aligns with your financial documents. For maximum impact, check for completeness; missing information or inaccuracies can lead to delays or rejections.

Common pitfalls include leaving sections incomplete, misreporting financial information, or failing to include necessary documentation. Each of these issues can slow down the approval process or result in denial.

Editing and finalizing the business loan application form

Once you've filled out the application form, editing and finalizing it is crucial. Utilize pdfFiller's editing tools to make any necessary changes. You can alter text, add or remove sections, and use templates to enhance clarity and professionalism.

Before submission, confirm that your application is ready. Double-check all entries for accuracy and handle any calculations to ensure they match your financial statements. This careful review can prevent future headaches.

eSigning your business loan application

In an increasingly digital world, eSigning has emerged as a vital step in the business loan application process. An electronic signature validates your commitment to the application and expedites the process, making it more efficient.

Using pdfFiller for eSigning is straightforward. You can follow a step-by-step process to apply your signature digitally. Ensuring the legal validity of your eSignature is essential, so be certain that it complies with state and federal laws, adding an extra layer of legitimacy to your application.

Submitting your business loan application

Once your application is in top shape, it's time for submission. You have multiple methods to do this. Online submission is typically the fastest route; follow the lender's specific guidelines for electronic submissions. Alternatively, traditional mail instructions should be followed if you're opting for a paper submission.

After submission, tracking your application status is crucial for maintaining a clear idea of where you stand. Following up with lenders can provide insight into the approval timeline, allowing you to plan accordingly.

Managing your business loan post-application

After submitting your application, proper management of records and documentation becomes vital. Keeping digital copies organized via pdfFiller can streamline this process, making it easier to find essential documents whenever needed.

Additionally, preparing for potential loan interviews is an important step. Lenders often invite applicants for discussions. Anticipating questions they may ask and emphasizing key points about your business can significantly enhance your chances of approval.

Conclusion on the importance of a well-prepared loan application

A well-prepared application can be the difference between securing a loan and missing out on vital funding. Leveraging tools like pdfFiller not only simplifies the creation of your business loan application form but also provides continuous accessibility to your documents. This becomes invaluable as your business evolves.

Managing documents collaboratively is effortless with pdfFiller, as teams can work together within a single cloud-based platform, ensuring everyone is on the same page as funding opportunities arise.

Additional tips for future loan applications

As you prepare for future loan applications, consider building stronger business credit. This approach can enhance your attractiveness to lenders. Keeping organized financial records is another best practice that streamlines future processes, minimizing potential issues when applying for additional funding.

Lastly, exploring multiple lenders and loan options is essential for making the most informed decision possible. Each lender may have different terms and interest rates, so always perform thorough research to find the best fit for your business needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business loan application in Gmail?

Can I edit business loan application on an Android device?

How do I fill out business loan application on an Android device?

What is business loan application?

Who is required to file business loan application?

How to fill out business loan application?

What is the purpose of business loan application?

What information must be reported on business loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.