Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

Editing campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Understanding the Campaign Finance Receipts Expenditures Form

Understanding campaign finance forms

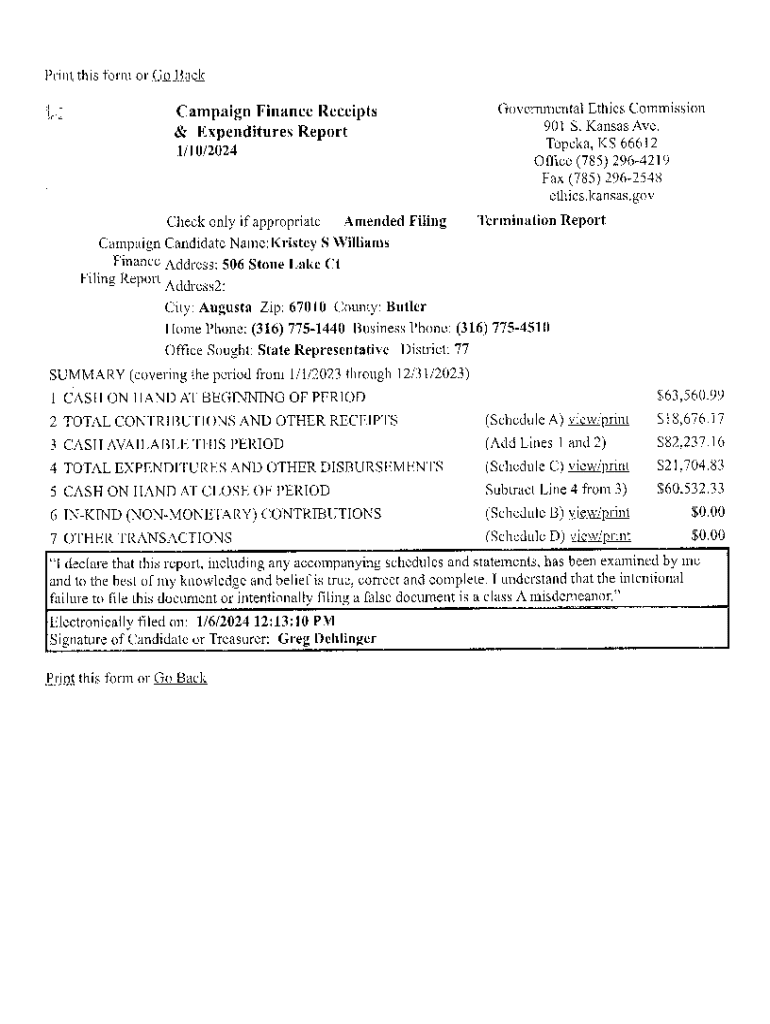

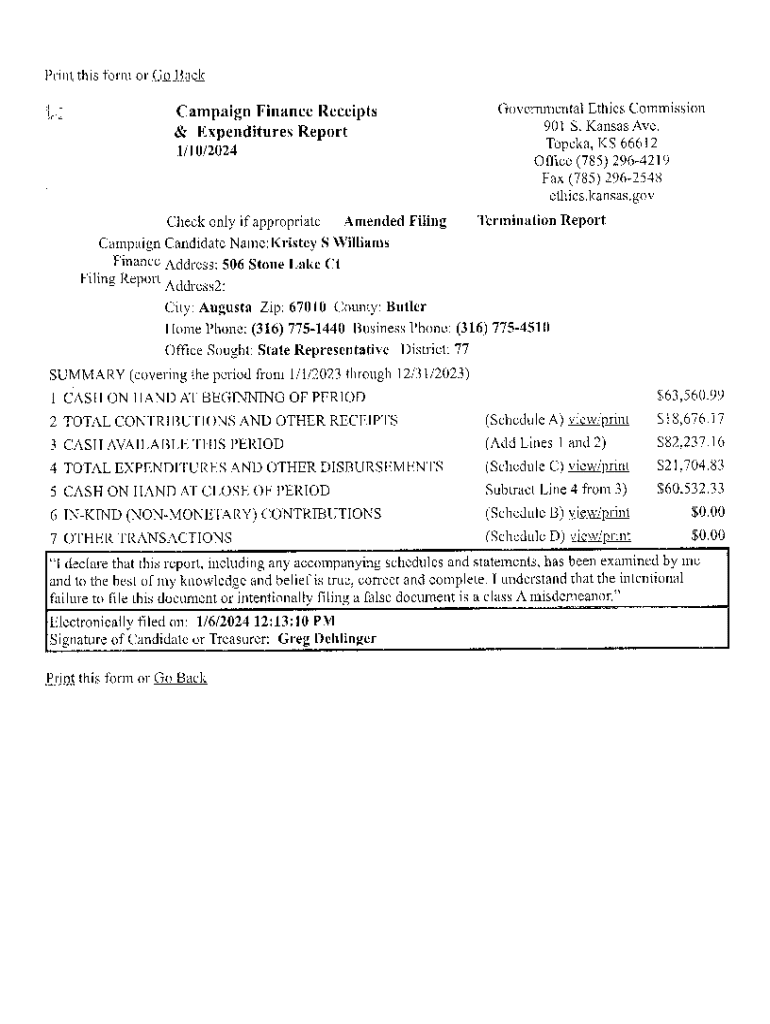

Campaign finance receipts and expenditures forms are essential documents required for campaign transparency and accountability. These forms record all financial transactions associated with a political campaign, encompassing contributions received and expenses incurred. The accurate filing of these forms not only reflects a candidate's financial integrity but also complies with regulatory requirements set forth by federal and state authorities.

Maintaining precise financial records ensures that campaigns can avoid legal pitfalls and allows voters to make informed decisions based on a candidate's financial backing. These forms are critical in promoting transparency in the political process, providing insight into a campaign's funding sources and its spending patterns.

Types of campaign finance forms

Campaign finance encompasses various forms that serve distinct purposes. The two primary categories are receipts forms, which track incoming funds, and expenditures forms, which detail outgoing funds. Receipts forms include contributions from individuals, political action committees, and other groups, while expenditures forms cover all campaign-related expenses, such as advertising, personnel, and event costs.

Understanding the differences between these forms is crucial for compliance. Receipts provide a comprehensive overview of how much money a campaign has raised, while expenditures outline how that money is spent.

Eligibility and requirements

Not everyone is required to file a Campaign Finance Receipts and Expenditures Form. Generally, candidates running for federal office, as well as those in many state and local elections, must file these forms. Specific thresholds often determine this requirement, such as the total amount of money raised or spent during the campaign. Understanding your local election authority's rules is crucial, as these can vary significantly.

When preparing to file, ensure you have all necessary information at hand, including campaign details, the names and addresses of contributors, and a comprehensive list of expenditures. Documentation such as bank statements and receipts will support your declarations and help maintain accuracy.

Step-by-step guide to completing the form

Gathering required information

The initial step in filling out the campaign finance receipts expenditures form involves gathering necessary information. This includes personal and campaign details, such as the candidate's name, address, and the campaign's name. Financial sources will be categorized into contributions, loans, and refunds, while expenditures will be classified into direct costs and indirect costs.

Filling out the campaign finance receipts section

Accurately reporting income sources is crucial. Contributions should specify the individual or entity giving, the amount, and the date received. Loans need to include the lender’s information, repayment terms, and any associated interest rates. Refunds must be documented clearly to demonstrate returning funds to contributors.

Completing the expenditures section

When detailing expenses, categorize them into direct and indirect costs. Direct costs include services specifically related to the campaign, such as advertising or campaign staff salaries, while indirect costs might cover operational expenses. Be diligent in reporting in-kind contributions—goods or services donated to the campaign—as well as other expenditures.

Review and double check

Before submission, it's vital to review your entries carefully. Common mistakes to avoid include mathematical errors, omission of required information, and reporting inaccuracies. A thorough review will not only enhance accuracy but also ensure compliance, preventing potential legal challenges.

Tools for managing campaign finance forms

Using online platforms like pdfFiller can significantly ease the burden of completing and managing campaign finance receipts and expenditures forms. These platforms offer various features that assist users in the process.

By leveraging these tools, campaign teams can ensure that financial reports are not only accurate but also easier to manage throughout the election cycle.

Filing and submitting your form

Once the Campaign Finance Receipts and Expenditures Form is completed, the next step is submission. Different jurisdictions have varying submission protocols, which may include electronic submissions or physical filing. It's essential to know where and how to submit to be in compliance with deadlines set by the election authority.

To avoid penalties, make sure that you submit the form on time. Setting reminders can help ensure a timely submission, helping to avoid last-minute issues that could lead to fines or complications.

Tracking and managing campaign finances

Ongoing financial management during a campaign is just as important as initial filings. Best practices include regularly updating financial records, utilizing digital tools for tracking receipts and expenditures, and conducting periodic financial reviews to ensure compliance. Many candidates find that using interactive tools designed for financial tracking streamlines this process.

Additionally, keeping an eye on reporting requirements and updating the forms as necessary is crucial to avoid inconsistencies in campaign finance statements. Having a proactive approach can help safeguard your campaign against potential scrutiny.

Troubleshooting common issues

Campaign finance reporting can sometimes present challenges, whether due to misreporting or technical issues with the submission process. If you encounter any difficulties with the Campaign Finance Receipts and Expenditures Form, it’s essential to know where to seek help.

Being proactive about troubleshooting can save time and ensure compliance with campaign finance laws.

Staying compliant with campaign finance laws

Compliance with federal and state campaign finance laws is essential for any candidate. Understanding these regulations ensures that campaigns operate transparently and ethically. Failing to comply with these laws can not only lead to penalties but also damage a candidate's public reputation.

Candidates must familiarize themselves with specific regulations governing donations and expenditures in their locality. Staying informed about changes in these laws is a continuous process as regulations can evolve, impacting how campaigns must operate.

Utilizing pdfFiller for your campaign finance needs

pdfFiller empowers users to streamline the campaign finance process by providing a user-friendly platform for filling out and managing the Campaign Finance Receipts Expenditures Form. Being cloud-based means that candidates and campaign teams can access their documents from anywhere, making collaborations and edits straightforward.

The platform also enhances productivity through collaborative features, allowing multiple team members to contribute to the document seamlessly. With easy access to eSignature options and PDF editing tools, pdfFiller proves to be an invaluable resource for candidates aiming to ensure their financial documentation is both accurate and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the campaign finance receipts expenditures in Gmail?

How do I fill out the campaign finance receipts expenditures form on my smartphone?

How do I fill out campaign finance receipts expenditures on an Android device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.