Get the free Retiree Life Insurance Enrollment Form

Get, Create, Make and Sign retiree life insurance enrollment

Editing retiree life insurance enrollment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out retiree life insurance enrollment

How to fill out retiree life insurance enrollment

Who needs retiree life insurance enrollment?

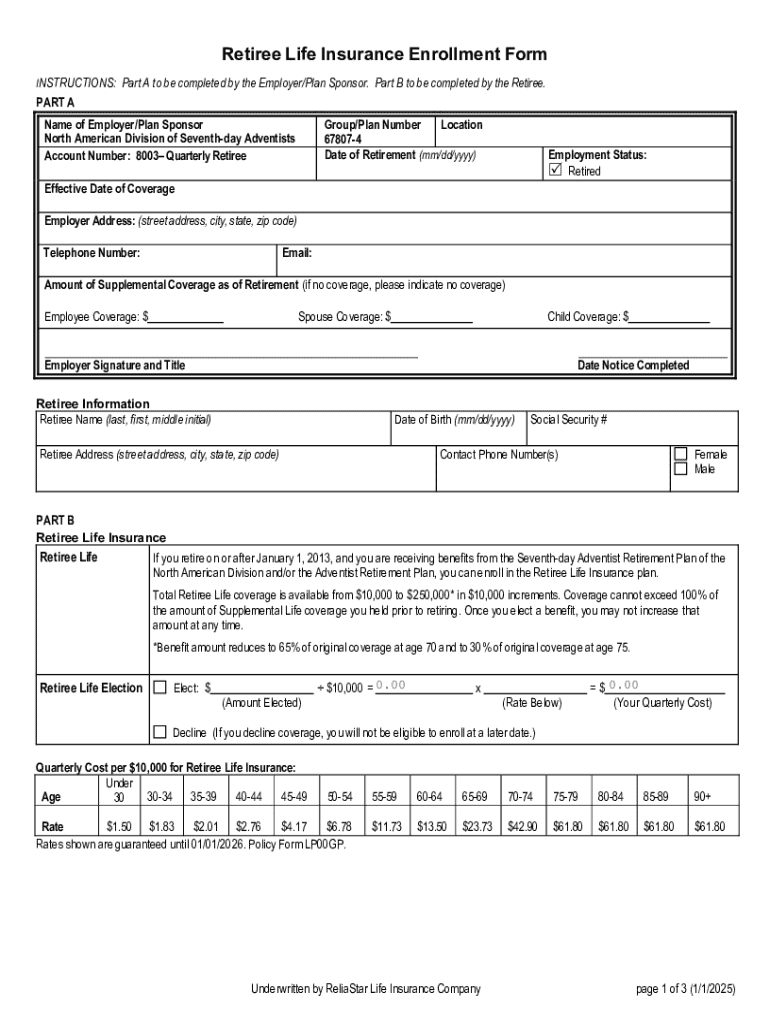

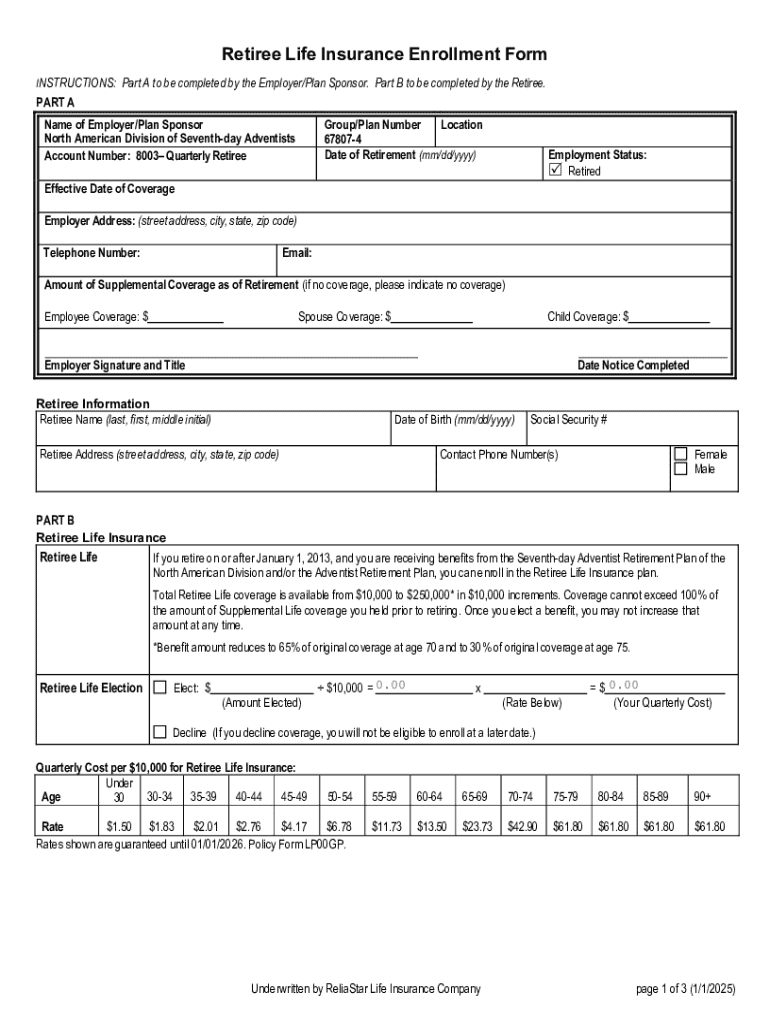

Comprehensive Guide to Retiree Life Insurance Enrollment Form

Understanding retiree life insurance

Retiree life insurance is a specialized type of life insurance designed to provide financial protection for beneficiaries after a retiree passes away. This coverage is crucial as it helps dependents manage living expenses, debts, and other financial obligations that may arise, ensuring that loved ones are shielded from financial strain during a difficult time.

The importance of having retiree life insurance cannot be understated. It allows retirees to leave a legacy, ensuring their loved ones are taken care of. Additionally, this type of insurance can cover funeral costs and any outstanding debts, providing peace of mind that comes from knowing families will not be burdened with unexpected financial responsibilities.

Eligibility criteria for enrollment

To enroll in a retiree life insurance policy, applicants typically must meet certain eligibility criteria. Generally, these criteria include age requirements, where most companies set a minimum age often around 55 or 60 years, reflecting the demographic of retirees. Additionally, healthcare and lifestyle considerations play a pivotal role in eligibility, as insurers may review an applicant’s health history or current health status.

When considering enrollment, it’s essential to understand the differences between group and individual policies. Group policies are often offered by employers or associations and may present more advantageous rates; however, coverage might be limited. On the other hand, individual policies usually provide tailored coverage options, securing lifelong insurance regardless of job status.

Preparing for enrollment

Before enrolling in a retiree life insurance policy, it's important to gather necessary documentation. Essential identification includes a driver’s license or passport, Social Security number, and possibly proof of residency. Additionally, previous insurance records may assist in determining appropriate coverage. Having all documents ready will streamline the application process.

Selecting the right coverage is critical. Factors such as lifestyle, health status, and the number of dependents can heavily influence the type of policy that will best serve your needs. For example, a retiree with a spouse and children may need a more robust policy compared to a single retiree. Evaluating various scenarios can vastly aid in making an informed decision.

Step-by-step guide to completing the enrollment form

To access the retiree life insurance enrollment form, users can easily find it on pdfFiller. The platform provides an intuitive interface to download the form or even access interactive tools ensuring ease of use. Whether preparing in advance or filling it out in real-time, having user-friendly options is essential.

Filling out the enrollment form involves several sections that need careful attention. Each plays a crucial role in the overall process. Here’s a breakdown of these sections:

Common mistakes to avoid include leaving fields incomplete or incorrectly filling in beneficiary information, as these errors can lead to complications during claims. Double-checking and reviewing the information provided is an essential step in the application process.

Editing and managing your enrollment form

Once you’ve completed the enrollment form, pdfFiller offers excellent editing tools that allow you to make any necessary changes seamlessly online. You can modify text, add or delete sections, or even collaborate with others by sharing the document for review. This feature is especially useful for families discussing options together.

Saving and sharing your form is also simple. After final edits, there are multiple options available for downloading the completed document or sending it directly via email. This versatility ensures that you can have copies saved securely for your records or shared with insurance providers.

After enrollment: what to expect

After submitting the retiree life insurance enrollment form, it's crucial to understand your policy terms. Key terms such as premium—what you will pay for your coverage—and coverage limits—maximum payouts under your policy—are essential for budget management and benefits understanding.

Following the approval of your application, you can expect a confirmation of enrollment. Depending on the insurer, the timeline for receiving your policy document may vary from a few days to several weeks. It is important to keep track of this document as it outlines the specific coverage details and terms.

Optional enhancements for your coverage

Beyond standard retiree life insurance, consider exploring additional coverage options that can bolster financial security. For instance, dependent life insurance ensures that additional family members are protected under your policy, expanding your coverage beyond just yourself.

Another valuable option is accidental death and dismemberment insurance, which offers additional payouts in the event of unexpected accidents, enhancing your overall benefit. Understanding how to convert existing term policies to whole-life policies can also be beneficial for those seeking lifelong coverage as their needs change over time.

Managing changes and updates

Maintaining accurate and current information in your retiree life insurance policy is critical. Procedures for updating your policy information typically involve notifying your insurance provider of any changes in personal circumstances, such as changes in marital status, the birth of children, or other significant life events. Each of these factors can influence your insurance coverage needs.

Knowing when to update your policy is essential. Key life events that necessitate revisions include marriage, divorce, the birth or adoption of children, or the passing of a beneficiary. Keeping these details current ensures that the coverage reflects your life situation.

Tools and support from pdfFiller

pdfFiller is committed to supporting users in their document management journey, offering live support for any questions during the enrollment process. Users can easily access customer support representatives who are knowledgeable and equipped to assist with any concerns regarding the retiree life insurance enrollment form.

Additionally, pdfFiller provides interactive tools for ongoing policy management, allowing users to efficiently manage, edit, or update their insurance documents from any location. This level of support empowers users to take control of their insurance needs seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit retiree life insurance enrollment in Chrome?

Can I sign the retiree life insurance enrollment electronically in Chrome?

Can I create an eSignature for the retiree life insurance enrollment in Gmail?

What is retiree life insurance enrollment?

Who is required to file retiree life insurance enrollment?

How to fill out retiree life insurance enrollment?

What is the purpose of retiree life insurance enrollment?

What information must be reported on retiree life insurance enrollment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.