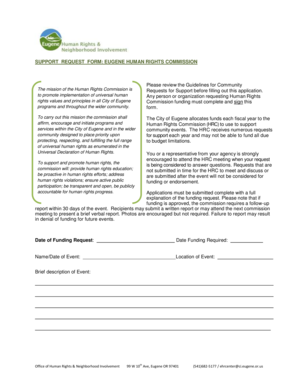

Get the free Guarantor's Form

Get, Create, Make and Sign guarantors form

How to edit guarantors form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out guarantors form

How to fill out guarantors form

Who needs guarantors form?

Understanding the Guarantors Form: A Comprehensive Guide

Understanding guarantors and their role

A guarantor is an individual or entity that agrees to be responsible for someone else's debt or obligation, commonly required in situations like rental agreements or loan applications. Guarantors are vital as they provide a safety net for landlords and lenders when the primary party lacks sufficient creditworthiness or income.

In the rental market, a guarantor assures landlords that the rent will be paid, especially when tenants have questionable financial histories. Similarly, in the realm of loans, a guarantor offers a lender confidence that the loan will be repaid, particularly if the borrower has limited credit history or lower income.

When to consider a guarantor

When renting a property, certain groups of tenants often find themselves in a position where a guarantor is necessary. This includes students living away from home for the first time or low-income renters struggling to demonstrate stable income or creditworthiness. Factors such as poor credit history, insufficient income, or a recent move can strongly influence the necessity for a guarantor.

In terms of loans, a guarantor may be required for personal loans, student loans, and mortgages. Here, having someone with a solid credit score and stable income can significantly increase the chance of obtaining approval for loans, often at better rates.

Additionally, signing service contracts can be made easier with a guarantor, adding reassurance to service providers, especially when establishing new client relationships.

Who can be a guarantor?

Choosing the right guarantor is critical to ensuring both parties can fulfill their obligations. A guarantor should ideally possess financial stability, which commonly translates to having a good credit history and a steady income. Moreover, there are age and residency requirements; for instance, many agreements require guarantors to be above 18 years and residing either in the same country or area as the tenant or borrower.

The relationship between the guarantor and the borrower or tenant can be another important factor. Commonly, family members, close friends, or even employers can serve as guarantors. However, it's crucial to choose someone who is not just financially secure but also someone whom the borrower or tenant can communicate with openly.

Responsibilities of a guarantor

Guarantors carry significant financial responsibilities; they are liable for ensuring that obligations such as rent payments or loan repayments are met in case the primary individual defaults. This liability can often last for the duration of the agreement, adding to the importance of understanding the commitment before entering.

Legal implications also accompany the role of a guarantor. It's essential to comprehend the terms laid out within the guarantor agreement. Failing to meet these obligations can lead to serious financial repercussions, including damage to the guarantor's credit score or even legal action from landlords or lenders.

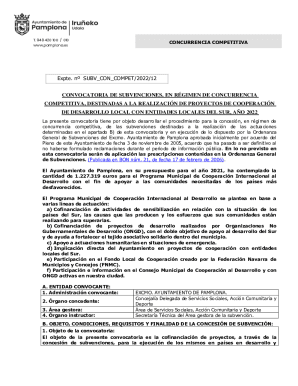

The guarantor agreement explained

A guarantor agreement is a critical document that outlines the responsibilities and rights of all parties involved. Typically, it includes details about the parties involved, the specific terms and conditions, as well as obligations such as payment amounts and due dates. Thoroughly reviewing the agreement is paramount, ensuring all parties understand the responsibilities they are assuming.

Key components often include the duration of the agreement, clauses about default, and the specific actions that can be taken if obligations are not met. Aligning expectations in this manner minimizes potential conflicts in the future.

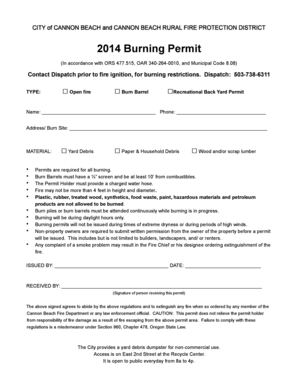

How to fill out a guarantors form

Filling out a guarantors form is typically a straightforward process but requires attention to detail. First, you'll need to include basic personal information such as your name, address, and contact information. This establishes a clear identity for the guarantor role.

Next, provide relevant financial information including income details, employment information, and any additional financial obligations. Also, include your relationship to the borrower or tenant, as this context can be critical for landlords or lenders.

To ensure the accuracy and completeness of the guarantors form, it is crucial to double-check all inputs and avoid common pitfalls such as not disclosing all financial obligations or misrepresenting the relationship.

Editing and customizing your guarantors form

pdfFiller provides an excellent platform for editing and customizing your guarantors form. Users can leverage its cloud-based editing features to make necessary adjustments, ensuring that all details are accurate and personalized.

With access to several templates, customizing your document has never been easier. Utilizing online tools for document management means fewer headaches and better organization, allowing for faster turnaround times and fewer errors.

Signing and managing your guarantors document

The use of eSignatures has revolutionized the way documents like a guarantors form are signed and managed. Electronic signatures are legally valid, providing a seamless way to finalize agreements. To sign your document online, simply follow the step-by-step process outlined in your pdfFiller account.

Additionally, pdfFiller's platform allows users to track and manage the status of documents efficiently, ensuring that all parties are informed throughout the signing process. This promotes transparency and helps mitigate any misunderstandings regarding who is responsible for what.

Common FAQs about guarantor forms

Understanding common queries related to guarantor forms can help streamline the process. One frequent question is, 'How long does it take to process a guarantor form?' Processing times can vary, but generally, expect confirmation within a few business days.

Another common query is, 'What happens if a guarantor defaults?' In such instances, the landlord or lender would typically pursue the borrower, and potential legal repercussions could be faced. Both parties should understand the consequences of failing to comply with the agreement.

Final tips for utilizing guarantors

Open communication with your guarantor is essential for maintaining a healthy relationship. Ensuring that they are fully informed about the obligations they are assuming can help clarify expectations and reduce anxiety. It can also be beneficial to prepare your guarantor for their potential responsibilities by discussing scenarios that may arise.

Finally, nurturing a good relationship with your guarantor can pay dividends in the long run. Regular check-ins and transparency about any changes in payment capabilities can foster trust and reduce misunderstandings.

Additional features and tools

pdfFiller also offers interactive tools and calculators that can help estimate financial obligations associated with being a guarantor. Whether you're looking to assess potential liabilities or evaluate the total obligations, these resources are invaluable.

For those wishing to learn more about the legal implications and preferences of being a guarantor, pdfFiller serves as a gateway to further learning and an empowering digital platform for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my guarantors form directly from Gmail?

How do I edit guarantors form straight from my smartphone?

Can I edit guarantors form on an Android device?

What is guarantors form?

Who is required to file guarantors form?

How to fill out guarantors form?

What is the purpose of guarantors form?

What information must be reported on guarantors form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.