Get the free Credit Application – Commercial/business

Get, Create, Make and Sign credit application commercialbusiness

Editing credit application commercialbusiness online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application commercialbusiness

How to fill out credit application commercialbusiness

Who needs credit application commercialbusiness?

Understanding the Credit Application Commercial Business Form

Understanding the credit application commercial business form

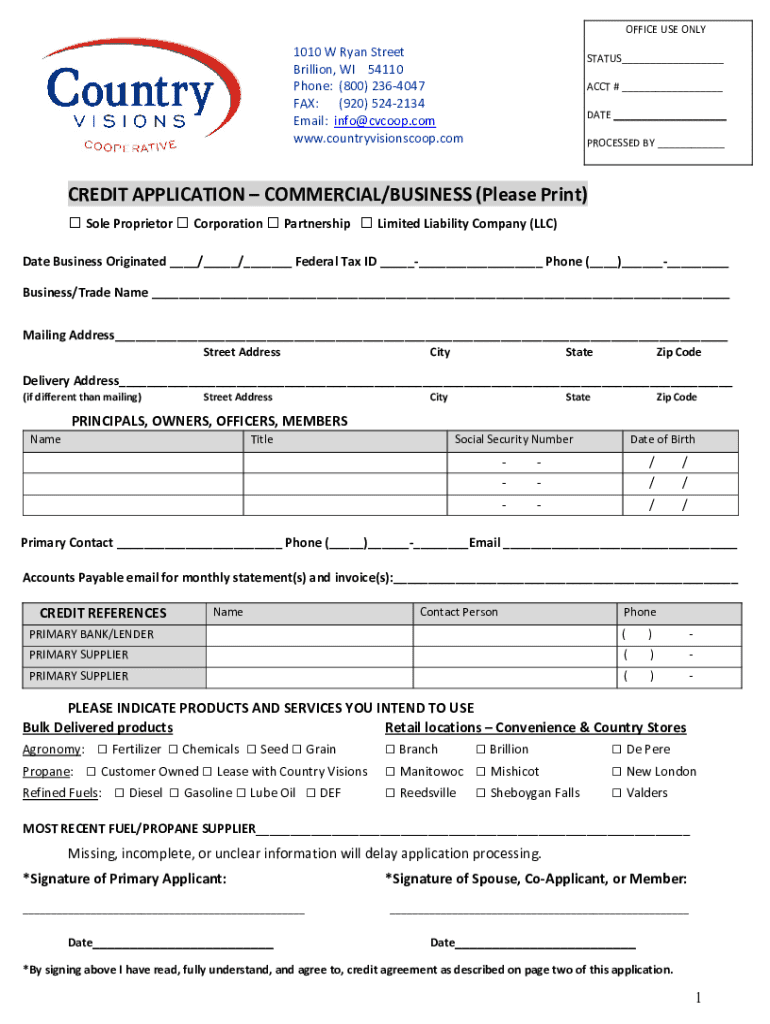

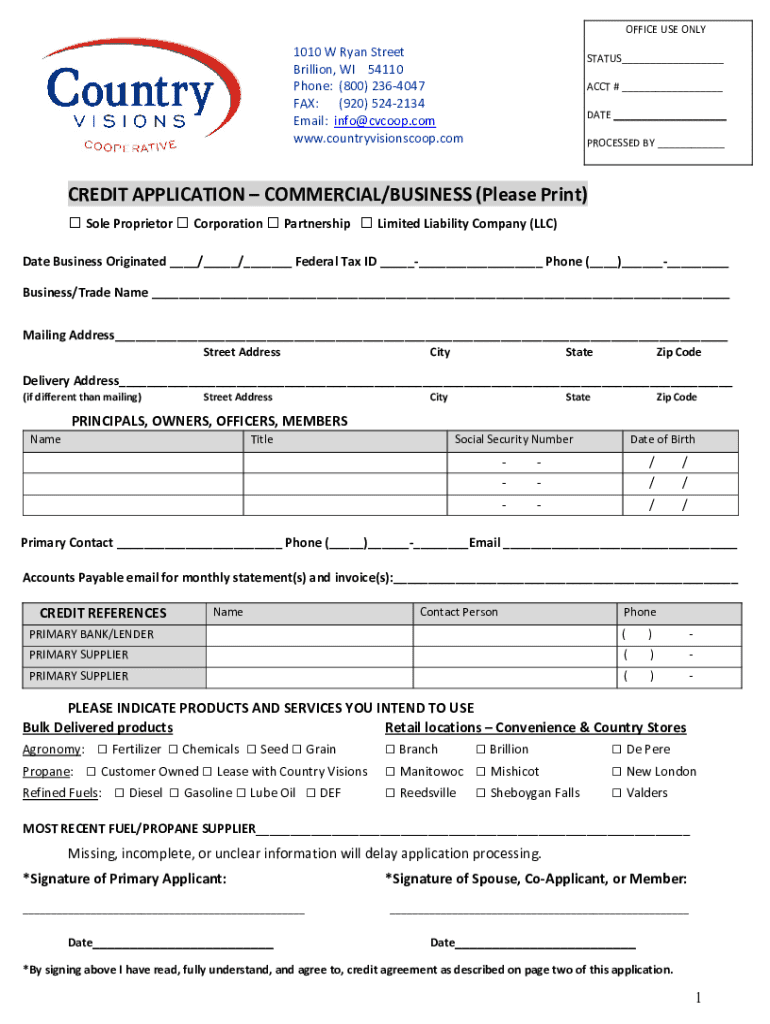

The credit application commercial business form serves as a key document in the realm of commercial finance. It is a formal request that businesses submit to creditors or financial institutions to seek credit approval. This form is critical because it assesses the creditworthiness of a business, helping lenders make informed decisions on whether to extend credit and under what terms.

Moreover, this form has widespread applications within various commercial settings, such as securing loans, lines of credit, leases, or other financial agreements. It doesn't just list financial data; it reveals a business's operational credibility, making it a vital tool for operational growth and strategy.

Legally, a credit application commercial business form can have implications on both parties involved. For the applicant, submitting inaccurate or misleading information may lead to denials or even legal consequences. Conversely, the creditor must comply with regulations, such as the Fair Credit Reporting Act, ensuring they handle the applicant's data appropriately.

Who needs a credit application commercial business form?

The credit application commercial business form is essential for various stakeholders in the business ecosystem. Primarily, business owners and entrepreneurs utilize this form when seeking financing options for their operations or expansions. For them, a successful application can secure the funds required for growth initiatives, helping them fulfill their business strategies.

Creditors and financial institutions also rely on this form as part of their underwriting process. By assessing these applications, they can evaluate risks and determine credit limits, interest rates, or other terms. Additionally, vendors and service providers may use this form to establish credit terms with business clients, protecting their cash flow and ensuring timely payments.

Key components of a credit application commercial business form

Understanding the key components of a credit application commercial business form is crucial for successful completion. This ensures that all necessary information is accurately captured, fostering credibility and reliability.

Step-by-step guide to filling out the credit application commercial business form

Successfully completing a credit application commercial business form involves careful preparation and attention to detail. Begin by gathering all necessary information, including your business's financial data and ownership structure. This preparation allows you to fill out the form quickly and accurately.

Next, proceed to fill out the form section by section. Pay close attention to instructions provided, making sure not to skip over required fields. Common mistakes include leaving sections blank or providing incomplete information, which can lead to delays or denials in processing.

Before submission, conduct a thorough review of the entire application. Consider using a checklist to confirm that you have included all requested details, thus ensuring completeness and accuracy. Double-check figures and spelling to avoid misunderstandings or processing issues.

Editing and managing your credit application

Once you have completed the credit application commercial business form, managing and editing it can be made easier with tools like pdfFiller. This platform provides powerful editing capabilities that allow you to make adjustments quickly and efficiently, ensuring your document reflects the most current and accurate information.

Additionally, eSigning the form is a breeze with pdfFiller. Electronic signatures are not only legally binding but also expedite the submission process. Collaborating with team members while filling out the form becomes simpler by using the platform’s sharing options, which allow multiple people to access the document, make changes, and track revisions seamlessly.

Submitting your credit application commercial business form

Submitting your completed application is the next critical step. There are two primary methods for submission: online and offline. Online submission is often quicker, allowing for immediate processing, while offline methods such as printing and mailing may take longer but can be suitable for certain situations.

Regardless of the method chosen, secure submission practices must be adhered to. Ensure that personal and financial information is transmitted safely and only through secured channels. After submission, it’s beneficial to establish follow-up procedures to track the status of your application. Knowing what to expect, including timelines for approval or potential requests for additional information, can make the process less stressful.

Common questions about credit application commercial business forms

Navigating the credit application commercial business form process often raises questions. Understanding these FAQs can clarify many uncertainties. For instance, applicants may wonder, 'What happens if my application is denied?' Understanding factors like credit scores or financial instability can help prepare businesses for potential outcomes.

Many applicants also seek answers regarding the approval timeline, which can vary based on lender response time or the complexity of the application. Lastly, being aware of information that may be requested post-submission, such as further documentation or clarification on financial claims, prepares businesses for whatever may come.

Best practices for ensuring successful credit applications

To optimize the chances of a successful credit application commercial business form submission, certain best practices should be considered. First and foremost, building a strong business profile is essential. Demonstrating a solid operational history, reliable revenue streams, and a clear business plan can enhance credibility.

Maintaining good credit history by managing debts responsibly, paying bills on time, and reducing credit utilization will also reflect positively on applications. Furthermore, keeping financial records organized allows for quick and accurate responses to lenders, ensuring they have all needed documentation readily available.

Leveraging pdfFiller for your credit application needs

pdfFiller is particularly advantageous in creating, managing, and submitting credit application commercial business forms, as it simplifies document management tasks. With its cloud-based platform, users can access their documents from anywhere, facilitating remote collaboration and timely submissions.

The platform also offers excellent customer support and resources, ensuring users can receive assistance with any difficulties they encounter. The combination of editing tools and eSigning capabilities makes pdfFiller an invaluable resource for businesses navigating their credit application processes. Thesefunctions define efficient document handling in today's fast-paced business environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the credit application commercialbusiness electronically in Chrome?

How do I edit credit application commercialbusiness straight from my smartphone?

Can I edit credit application commercialbusiness on an Android device?

What is credit application commercialbusiness?

Who is required to file credit application commercialbusiness?

How to fill out credit application commercialbusiness?

What is the purpose of credit application commercialbusiness?

What information must be reported on credit application commercialbusiness?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.