Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out evidence of insurability form

Who needs evidence of insurability form?

Understanding the Evidence of Insurability Form: Your Comprehensive Guide

Understanding Evidence of Insurability (EOI)

Evidence of Insurability (EOI) is a crucial document in the insurance application process, primarily used by insurers to assess the risk associated with a potential policyholder. By requiring an EOI, insurers can make informed decisions when it comes to underwriting, determining premiums, and evaluating the overall insurability of an applicant.

The importance of an EOI form cannot be overstated. It serves not only as a tool for risk assessment but also as a protective measure for the insurance company, ensuring that they have a complete picture of the applicant's health and lifestyle before issuing coverage.

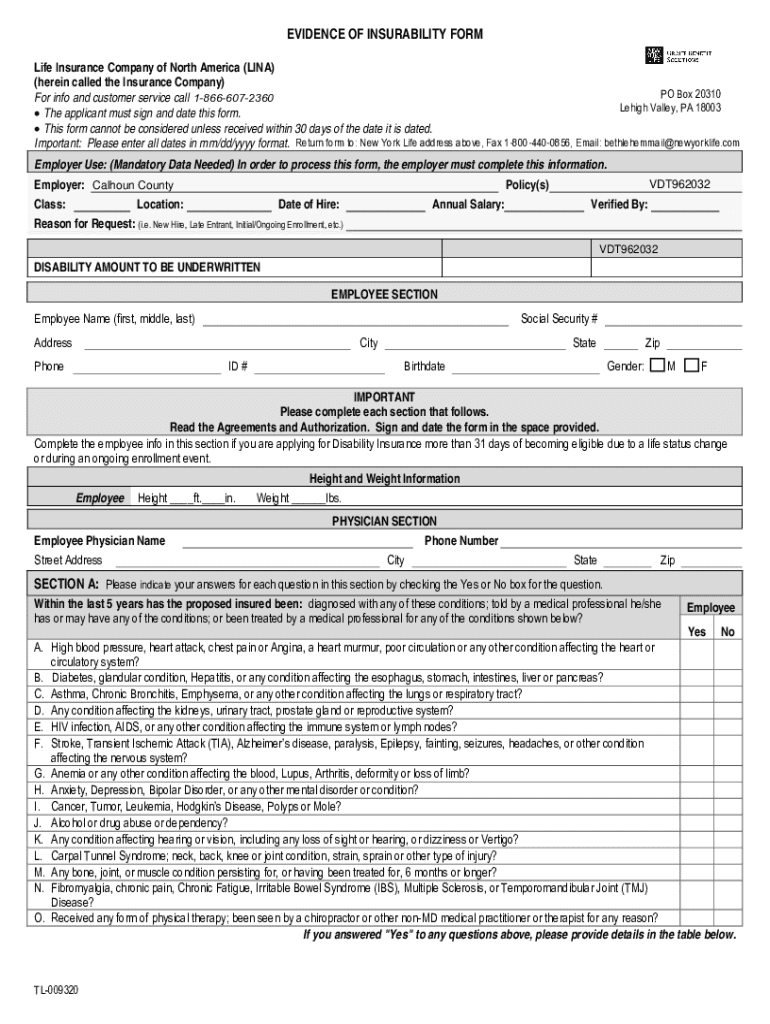

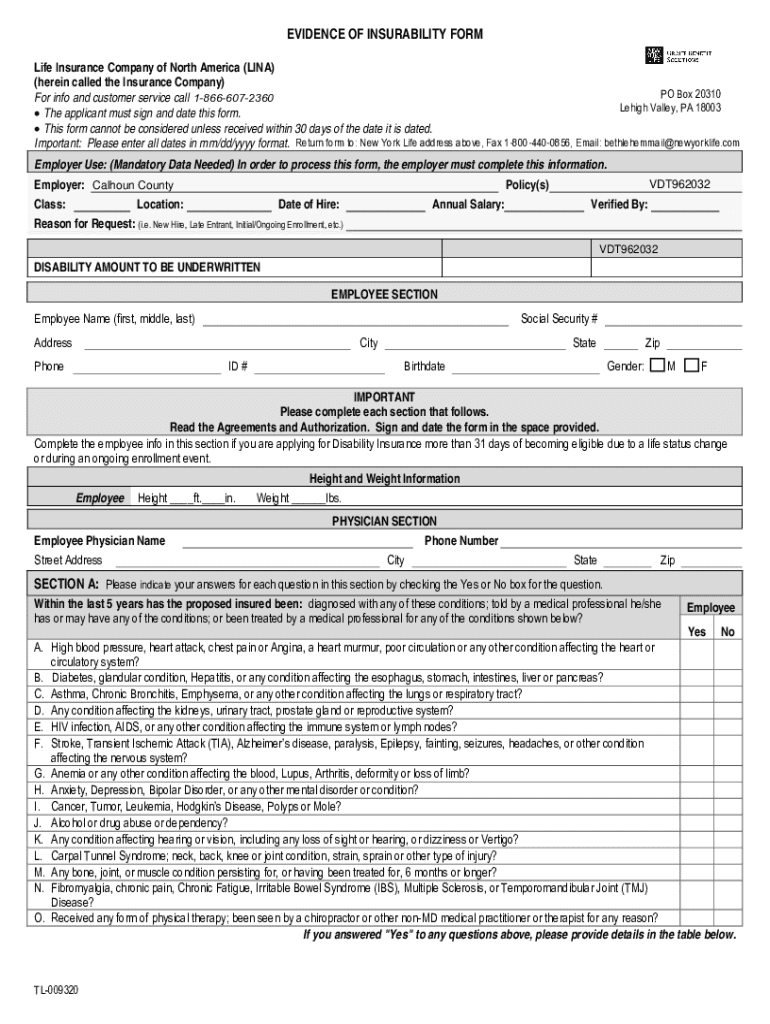

The purpose of the Evidence of Insurability form

The Evidence of Insurability form is where applicants provide necessary personal and health information that insurers require to evaluate their risk. Typically, the form asks for details like medical history, current medications, and any existing health conditions.

Completing and submitting the EOI form promptly can significantly enhance the chances of your application being processed without delays. Timeliness can lead to smoother transitions when enrolling in insurance or requesting additional coverage.

When to complete an Evidence of Insurability form

There are specific circumstances under which completing an Evidence of Insurability form is required. This often includes enrolling in a new insurance plan, experiencing significant changes in health status, or requesting additional coverage under an existing plan.

Insurers usually have standard timelines for when EOI submissions must be made, often dictated by triggering events such as open enrollment periods or changes due to life events, like marriage or the birth of a child.

Types of insurance that require Evidence of Insurability

Various types of insurance require the completion of an Evidence of Insurability form. Life insurance, for instance, assesses risk based on an applicant's health and lifestyle factors. Disability insurance also uses EOI to ensure that individuals are eligible for benefits.

In the case of critical illness insurance, the EOI process is important for evaluating the likelihood of future claims based on pre-existing conditions. Furthermore, group health insurance policies may necessitate EOI when new participants are added or if current members decide to increase their coverage.

How the Evidence of Insurability process works

Completing an Evidence of Insurability form involves a few essential steps. First, gather all necessary personal and health information to prepare for filling out the form accurately.

Next, carefully fill out the EOI form, ensuring that all information is correct and comprehensive. After completing the form, submit it to the insurance provider. The insurer will review your submission to make an underwriting decision, which typically takes anywhere from a few days to several weeks depending on the complexity of your case.

Documentation required for EOI approval

When submitting an EOI, certain documentation may be required to support your claims. Common documents include your medical history or completed health questionnaires, as well as supporting documents from your healthcare providers.

It's vital to compile these documents effectively to ensure a smooth approval process. Keeping organized records and ensuring that all relevant information is provided can streamline your EOI submission.

Frequently asked questions about Evidence of Insurability

As you navigate the Evidence of Insurability process, you may have common questions. Typical EOI forms include questions regarding your medical history, lifestyle habits, and the state of your current health. Understanding the terminology associated with EOI assessments can also be pivotal for clarity.

If there are discrepancies in the health information provided, it’s important to address these concerns directly to prevent issues later in the application process. Regular communication with your insurer can facilitate a smoother transition.

Dealing with late submissions for Evidence of Insurability

Submitting your EOI late can have significant implications, including potential coverage gaps or denial of your application. It's essential to understand the deadlines associated with your policy to avoid these issues.

If you've submitted an EOI late, don't lose hope. Depending on your insurance provider, you may have options available to rectify the situation. Additionally, if your EOI submission is denied, there are often appeal processes in place for reconsideration.

Navigating non-evidence maximum (NEM) scenarios

The concept of Non-Evidence Maximum (NEM) is pivotal for applicants who are considering increasing their coverage limits without providing EOI. NEM scenarios allow for some coverage increases under predefined conditions without the necessity of a complete health evaluation.

Understanding where NEM applies can significantly affect how policyholders manage their insurance needs. It’s vital to know the implications of exceeding the NEM limits, which could prompt a requirement for an EOI to ensure new coverage limits are substantiated.

Optional coverage and the need for EOI

Opting for additional coverage often requires an EOI, with policies differing on what constitutes optional coverage. Situations triggering EOI requirements could include increasing coverage limits or adding riders for critical illness.

Understanding the implications of these additional coverages is essential. This awareness can aid policyholders in avoiding future health-related surprises that could affect premiums or continued eligibility.

Tips for successfully completing the Evidence of Insurability form

Filling out the Evidence of Insurability form accurately is vital for a successful submission. Best practices include reading all instructions thoroughly before starting and ensuring all requested information is complete and accurate.

Common mistakes to avoid include leaving questions blank or providing incomplete medical histories. Utilizing tools like pdfFiller can enhance efficiency by allowing users to edit PDF forms seamlessly, ensuring that all information is correct before submission.

Interactive tools and resources for EOI management

pdfFiller provides a suite of features designed to simplify the EOI process. From editing and signing documents to collaborating on submissions, the platform enhances the efficiency of managing your EOI documents.

Utilizing collaborative tools for teams managing multiple EOI submissions can streamline workflows. Additionally, pdfFiller offers user-friendly assistance and support, ensuring any queries or challenges encountered while completing forms are promptly addressed.

Related articles and further reading

To further your understanding of insurance documentation, exploring related articles can be invaluable. Topics such as the importance of comprehensive medical histories, the impact of lifestyle choices on insurance rates, and other relevant guides can provide deeper insights.

Additionally, familiarizing yourself with common insurance terms and the regulatory landscape can enhance your ability to navigate insurance documentation confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pdffiller form without leaving Google Drive?

How do I make changes in pdffiller form?

How do I complete pdffiller form on an Android device?

What is evidence of insurability form?

Who is required to file evidence of insurability form?

How to fill out evidence of insurability form?

What is the purpose of evidence of insurability form?

What information must be reported on evidence of insurability form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.