Get the free Financial Analysis and Reporting - kahedu edu

Get, Create, Make and Sign financial analysis and reporting

How to edit financial analysis and reporting online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial analysis and reporting

How to fill out financial analysis and reporting

Who needs financial analysis and reporting?

Financial Analysis and Reporting Form - A How-to Guide

Understanding financial analysis and reporting

Financial analysis is the process of evaluating a business's financial performance and determining its viability, stability, and profitability. It involves reviewing financial statements and other reports to understand an organization's financial health and operational efficiency.

The objectives of financial reporting include providing relevant financial information that aids stakeholders in making well-informed decisions. Stakeholders often focus on metrics that highlight the business's strengths and weaknesses, fostering transparency and accountability.

The importance of financial analysis and reporting cannot be overstated, especially in today's complex business landscape. Organizations rely on these processes for strategic planning, budgeting, and performance evaluation, enabling them to stay competitive.

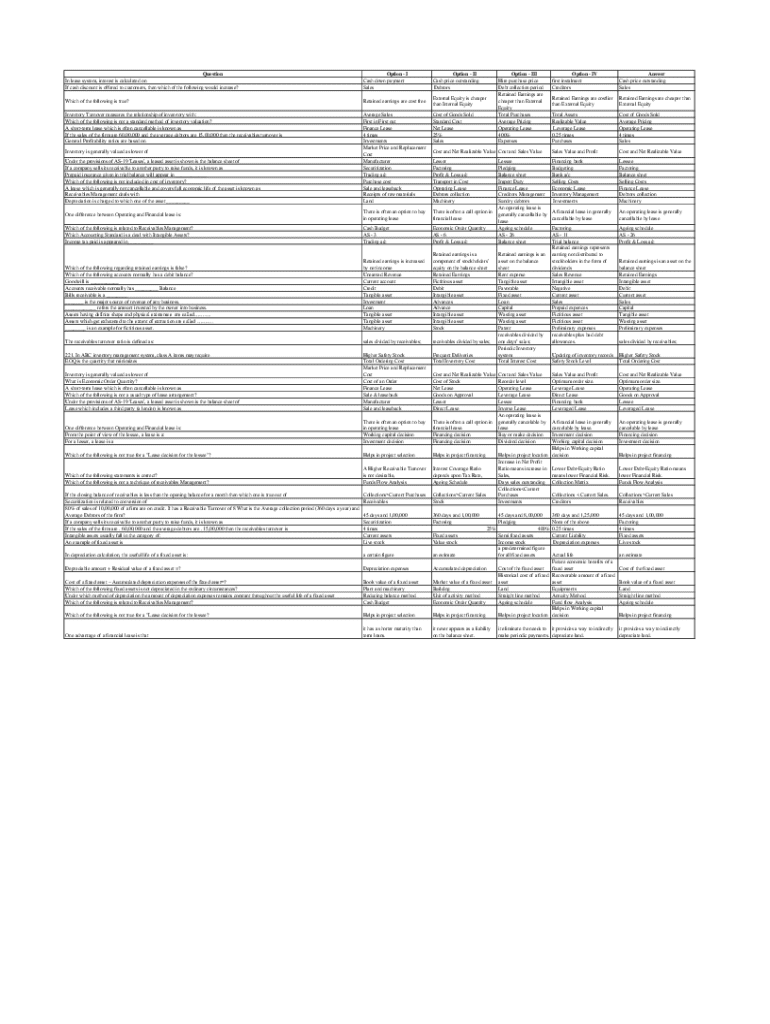

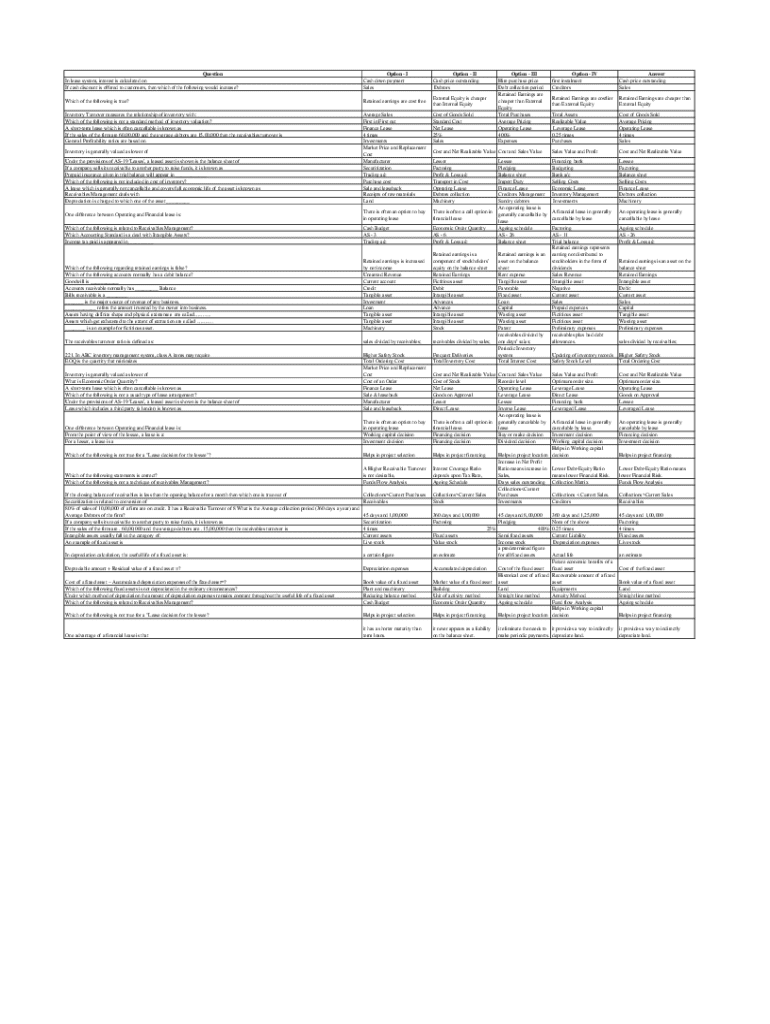

Overview of the financial analysis and reporting form

The financial analysis and reporting form serves as a structured template that consolidates financial data, making it easier to analyze and report on key metrics. By using this form, businesses can streamline their data collection and improve the accuracy of their financial assessments.

Different types of financial analysis forms serve various purposes, from assessing cash flow to evaluating profitability via income statements and balance sheets. Each type is crucial for understanding distinct aspects of a business's financial status.

Using a structured form simplifies the compilation of extensive financial data, facilitating better analysis and improving the clarity of reports. It enables consistent tracking and evaluation of financial performance, which is essential for strategic planning.

Step-by-step guide to accessing the financial analysis and reporting form

To start using the financial analysis and reporting form effectively, navigate to pdfFiller’s platform. This cloud-based platform provides seamless access and a user-friendly interface tailored for document creation and management.

Signing up or logging in is straightforward. New users can create an account in just a few minutes, while returning users can quickly access their documents and templates.

Once you're logged in, finding the right financial analysis and reporting form is made easy through the platform's search functionality and categories, allowing users to filter templates based on specific needs and objectives.

Completing the financial analysis and reporting form

Filling out the financial analysis and reporting form accurately is crucial for deriving meaningful insights. Begin with the header information, including relevant dates and titles, to offer a clear context to the data being presented.

Proceed to enter financial data into designated fields, ensuring that all necessary figures are included. After data entry, summarize your findings succinctly, highlighting key insights and patterns observed from the data.

Utilizing interactive tools available on pdfFiller enhances the analysis process. Calculation tools can automatically sum values while data visualization options transform numbers into graphs and charts, simplifying complex data for stakeholders.

Accuracy is key; therefore, verifying sources is essential to ensure data integrity while also avoiding common mistakes such as data misalignment or entry errors. Regular checks will maintain the reliability of your analysis and reporting.

Editing and customizing your financial analysis form

One of the significant advantages of pdfFiller is the ability to edit financial analysis and reporting forms easily. Whether you want to add notes, comments, or incorporate external data, the platform allows for straightforward customization.

Maintaining clarity within your document is vital, especially when sharing with external stakeholders. As you adapt the form to fit your audience's needs, consider using straightforward language and clear visuals to communicate effectively.

Following best practices during customization ensures that your report is not only functional but also engaging. Include visuals and structured layouts to present your findings clearly, enhancing the overall comprehension of the content.

eSigning and collaborating on the financial analysis and reporting form

With pdfFiller's eSigning capabilities, finalizing your financial analysis and reporting form is expedient. The platform guides you through the eSigning process, allowing you and your team to sign documents digitally without the hassle of printing and scanning.

Team collaboration is crucial for efficient workflow management, and pdfFiller facilitates this by allowing you to invite team members to collaborate on the form. Collaboration enables multiple users to provide input, making the analysis more comprehensive.

Tracking changes and managing version control is another significant feature, ensuring that all contributors can review changes and maintain the document's integrity over time. Keeping track of revisions minimizes the risk of errors or miscommunication.

Managing your financial analysis and reporting form

Once the financial analysis and reporting form is complete, effective management becomes essential. pdfFiller provides features for saving and storing documents securely in the cloud, allowing you to access your files from anywhere with internet connectivity.

Sharing options and permissions can be easily adjusted, granting specific access levels to team members or external stakeholders as necessary. This feature is particularly useful when certain sections of the report are sensitive or require confidentiality.

It's important to establish a routine for regular updates and maintenance of your analysis form. Consistently reviewing and revising your financial documents helps keep them relevant and aligned with the latest business activities or changes in market conditions.

Analyzing and interpreting your financial report

Analyzing the completed financial report requires understanding key metrics that profoundly impact business decisions. Profitability ratios, such as return on equity or net profit margin, provide insights into how effectively a company converts income into profits.

Liquidity ratios, such as the current ratio or quick ratio, assess the short-term financial health of the company. These metrics indicate whether the business can meet its immediate financial obligations, which is vital for maintaining operations.

Insights derived from these analyses can guide strategic planning and financial forecasting. Leveraging this data effectively can help businesses align their operations with future opportunities or challenges, ultimately leading to sustainable growth.

Common challenges and solutions in financial analysis and reporting

Financial analysis and reporting are often riddled with challenges, particularly concerning data accuracy. Ensuring that the information compiled is correct is crucial, as errors can lead to misguided decisions and financial missteps.

Overcoming complexity in financial reporting can also be significant, especially for those not deeply versed in finance. Simplifying the format and using clear language can help demystify data and enable better comprehension.

Continuous improvement is essential in financial analysis. Encourage feedback on reporting processes and seek out innovative tools and techniques that enhance accuracy and efficiency in financial management.

Conclusion and next steps

Effective financial analysis and reporting forms a foundation for informed decision-making and strategic management. Understanding how to utilize tools like the financial analysis and reporting form from pdfFiller equips teams with the insights needed to drive business success.

We encourage readers to explore pdfFiller’s resources for enhanced financial reporting solutions, utilizing their comprehensive features to streamline data management and collaboration for improved financial clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get financial analysis and reporting?

How can I edit financial analysis and reporting on a smartphone?

How do I fill out financial analysis and reporting using my mobile device?

What is financial analysis and reporting?

Who is required to file financial analysis and reporting?

How to fill out financial analysis and reporting?

What is the purpose of financial analysis and reporting?

What information must be reported on financial analysis and reporting?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.