Get the free Beneficiary Designation/change Form

Get, Create, Make and Sign beneficiary designationchange form

How to edit beneficiary designationchange form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designationchange form

How to fill out beneficiary designationchange form

Who needs beneficiary designationchange form?

Understanding the Beneficiary Designation Change Form

Understanding the beneficiary designation change form

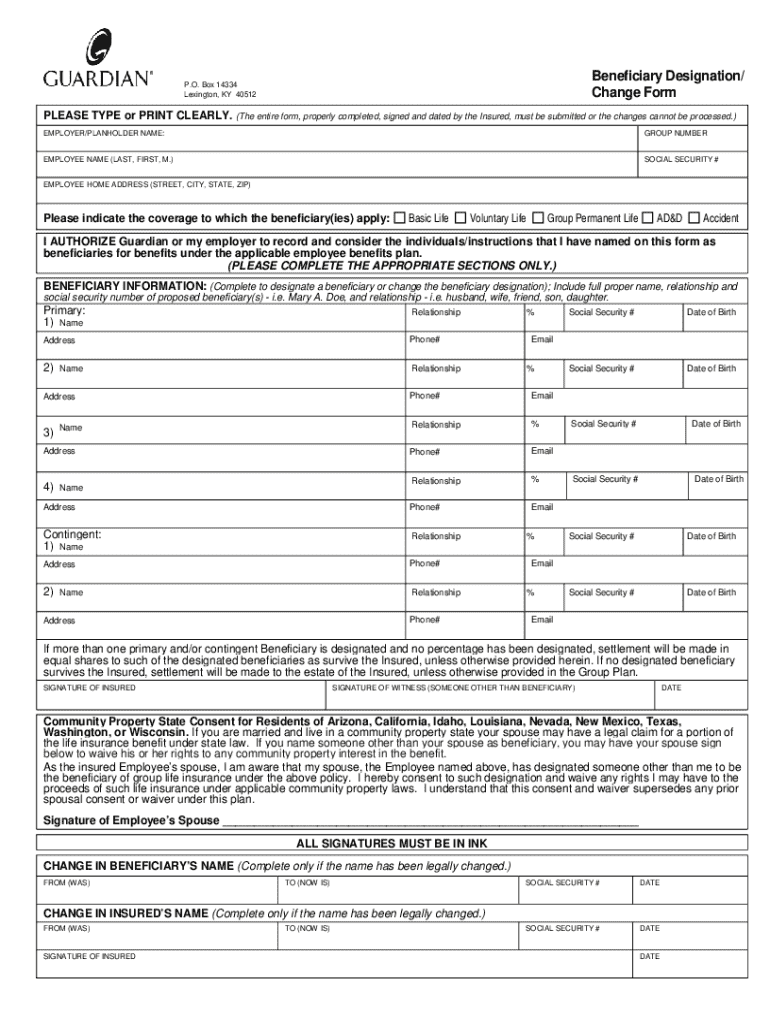

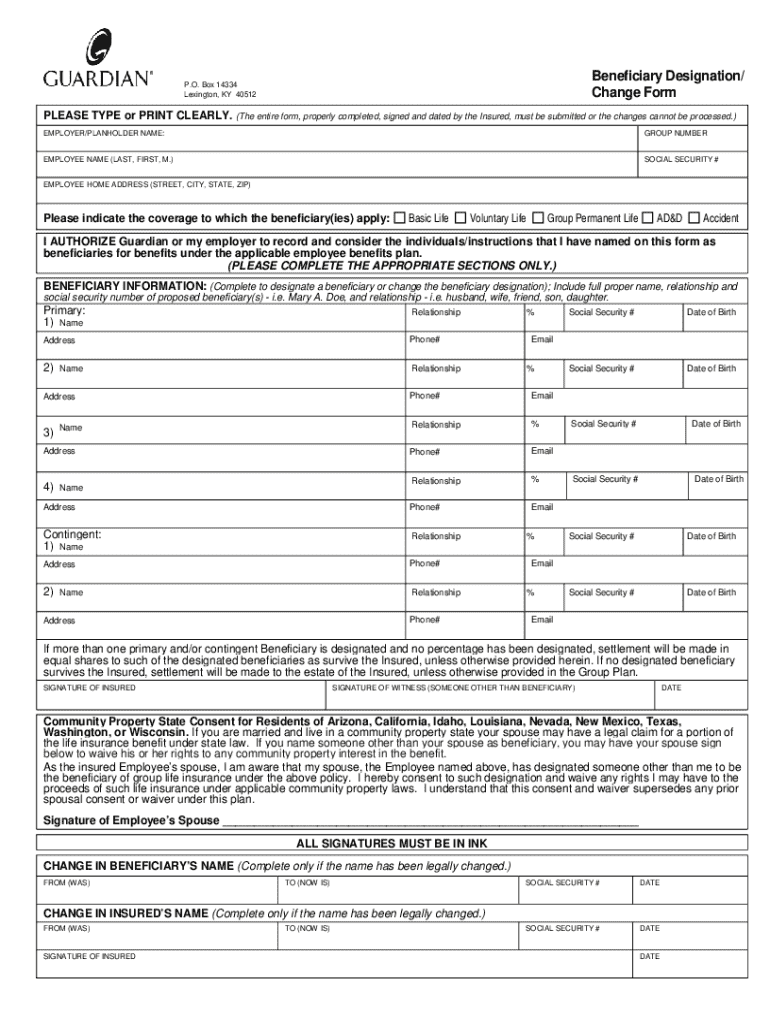

A Beneficiary Designation Change Form is a crucial document that allows policyholders to designate or update their beneficiaries for various financial instruments, including life insurance policies, retirement accounts, or trusts. This form serves as an official request to alter who will receive the benefits of these policies upon the policyholder's death, ensuring that their wishes are properly documented and legally recognized.

In estate planning, the importance of this form cannot be overstated. A correctly completed beneficiary designation change form guarantees that assets are distributed according to the policyholder's preferences, thereby avoiding probate delays and potential family disputes. Moreover, insurance companies and financial institutions require such forms to maintain up-to-date records and facilitate seamless transactions during beneficiaries' claims.

When should you use this form?

There are several pivotal life events that typically trigger the need to utilize a beneficiary designation change form. These include significant changes such as marriage, divorce, the birth of a child, or the death of a previously designated beneficiary. For instance, if you marry, you might want to update your life insurance policy to name your new spouse as the primary beneficiary. Likewise, in the event of a divorce, updating this form is essential to remove an ex-spouse from benefactor status.

Failing to update beneficiary information can carry serious implications. Without timely updates, individuals risk unintended beneficiaries receiving funds, leading to possible family conflicts or financial strains. If a policyholder has a will but neglects to update their beneficiary designations, the will might not control the distribution of assets as the deceased intended, underscoring the necessity of having both documents aligned.

Key components of the beneficiary designation change form

When completing a beneficiary designation change form, it's essential to provide specific information accurately. The form will typically require personal details of the policyholder, including their full name, date of birth, and contact information. Furthermore, details about current and new beneficiaries must be explicitly laid out, including the full names, addresses, and relationship to the policyholder.

Another critical aspect of the form is the designation of contingent beneficiaries. This refers to individuals who are set to receive benefits if the primary beneficiary is unable to do so. Having contingent beneficiaries ensures that the policyholder's wishes are fulfilled even in unforeseen circumstances. It's also vital to consider the types of beneficiaries you are naming, distinguishing between individual beneficiaries and entities, such as trusts or charities. Special considerations should also be taken for minors, as their inheritances may need to be managed by a legal guardian.

Step-by-step instructions for completing the form

To effectively complete the beneficiary designation change form, start by gathering the necessary documents. This might include a government-issued identification, existing policy documents, and any legal documents concerning past beneficiaries. Confirm that each beneficiary meets the eligibility requirements; for example, ensure that minors will be properly represented by a guardian until they reach adulthood.

When filling out the form, take a systematic approach — start from the top and work your way down. Ensure that you fill in all requested information in the appropriate sections without leaving any fields blank. Common pitfalls include misspelling names, failing to provide the correct Social Security numbers, or neglecting to sign and date the form. Collect all relevant information before submitting to ensure the form's accuracy and completeness. Double-check every detail before finalizing to avoid any potential delays.

Editing and making changes to your form

If you need to edit the beneficiary designation change form after initial completion, utilize pdfFiller’s editing tools for a seamless experience. Accessing pdfFiller's platform allows users to revise documents easily. You can upload your existing form, make changes, and keep track of versions with ease, ensuring that you have the most up-to-date documentation.

When managing your documents, adopt best practices such as saving multiple versions of your form and documenting changes accurately. This habit supports organization and provides a safety net in case of discrepancies. Security is paramount, especially given the sensitive nature of personal and financial information contained in these documents. Using a reliable platform like pdfFiller ensures that your data remains confidential and is protected against unauthorized access.

Signing and finalizing your beneficiary designation change form

After completing your beneficiary designation change form, the next step involves signing it properly. Depending on the platform you’re using, there are various signing methods available. Electronic signatures are legally accepted in most jurisdictions, making them a convenient option. They offer a quicker turnaround time compared to traditional signing methods which may require physical mail or in-person visits.

When collaborating with stakeholders, such as potential beneficiaries, pdfFiller offers features that facilitate sharing and feedback. You can send the draft to beneficiaries for input or concerns, thus ensuring transparency and minimizing the likelihood of disputes arising later. Engage all relevant parties in the process, as their collaboration can help ensure everyone understands the choices made in the beneficiary designations.

Submitting the completed form

Once your beneficiary designation change form is finalized and signed, it’s time to submit it. Submit your completed form through various methods: traditional mail, email, or fax. Each submission option has its pros and cons; for instance, email submissions generally provide quicker processing times, whereas mail is often seen as more formal.

After submission, remain attentive while awaiting confirmation of receipt. Depending on the institution, this may take a few days. It’s wise to inquire about the expected timeline for processing your changes and receiving notifications from the financial institution or insurance company.

Upon receipt of form: after-submission checklist

After submitting your beneficiary designation change form, it’s essential to verify that the changes have been made appropriately. Contact the issuer and request confirmation of the updates to your beneficiary designations. This action not only provides peace of mind but ensures that your intentions are reflected accurately in their records.

With this step completed, consider reviewing other related estate planning documents, such as wills and trusts. Regularly updating your beneficiary designations is a vital component of ongoing estate planning, and a periodic review can help ensure your designations are consistent with your current wishes and circumstances.

FAQs about beneficiary designation change forms

As with any important form, questions frequently arise regarding beneficiary designation changes. One of the common queries involves the ideal frequency for updating these designations. Experts recommend reviewing your beneficiaries at least once a year or after major life events, such as marriage or divorce.

Another common concern revolves around what happens when a beneficiary passes away before the policyholder. In such cases, it's advantageous to have a contingent beneficiary already designated or to complete a new form to avoid delays and complications. Lastly, many wonder if a beneficiary can refuse their designation. Generally, a beneficiary has the right to disclaim their inheritance, but state laws may apply, so consulting with a legal expert can clarify any specific implications.

Lastly, complex situations, such as disputes between beneficiaries, may arise. Establishing clear, legally executed documents that outline the policyholder's preferences can help minimize friction among surviving family members.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify beneficiary designationchange form without leaving Google Drive?

How can I send beneficiary designationchange form to be eSigned by others?

How do I fill out beneficiary designationchange form using my mobile device?

What is beneficiary designation change form?

Who is required to file beneficiary designation change form?

How to fill out beneficiary designation change form?

What is the purpose of beneficiary designation change form?

What information must be reported on beneficiary designation change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.