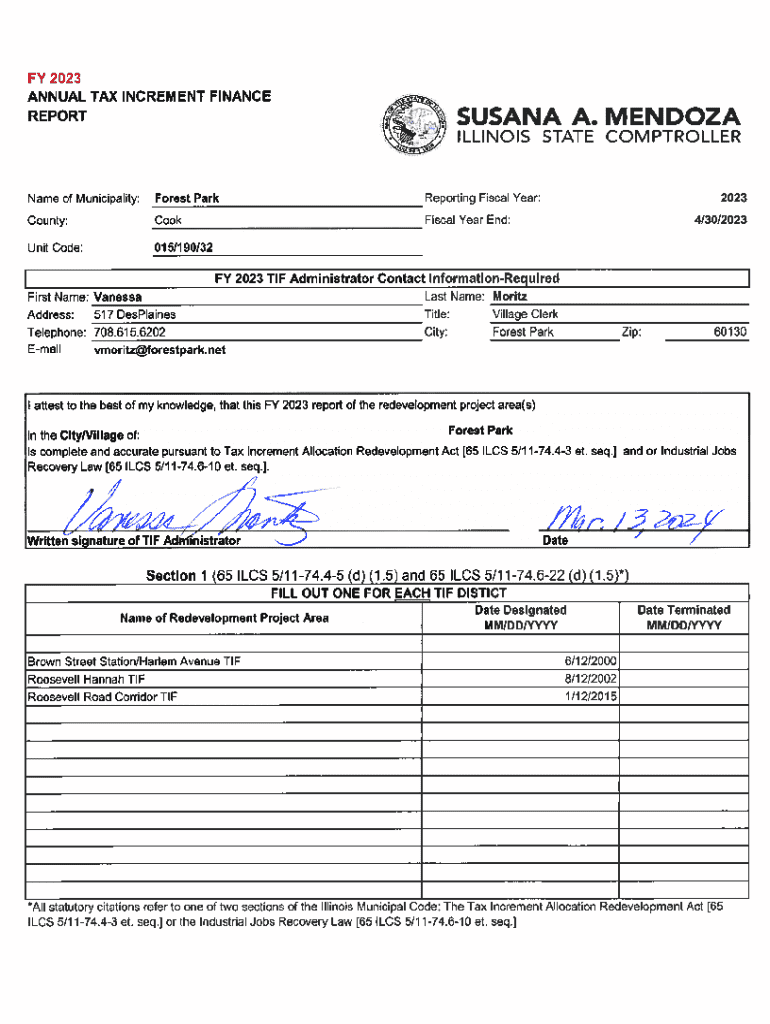

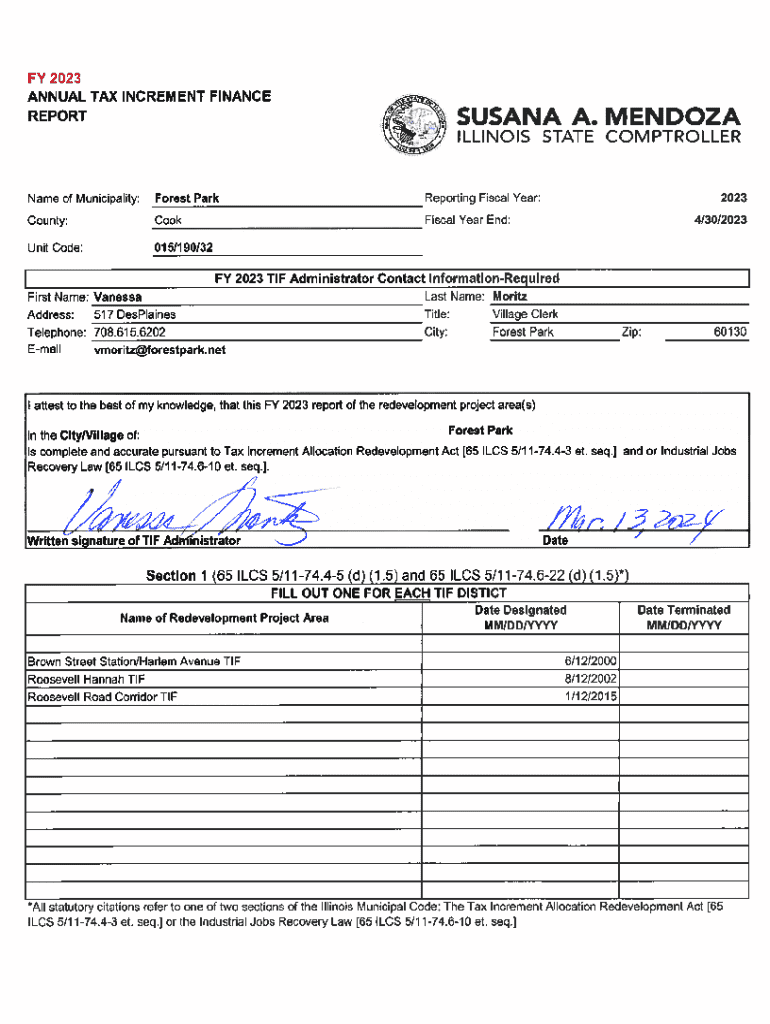

Get the free Tax Increment Financing (TIF) Annual Report - XML File

Get, Create, Make and Sign tax increment financing tif

Editing tax increment financing tif online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax increment financing tif

How to fill out tax increment financing tif

Who needs tax increment financing tif?

Tax Increment Financing (TIF) Form - How-to Guide

Understanding tax increment financing (TIF)

Tax Increment Financing (TIF) is a financing method that municipalities use to promote economic development within specific areas. The concept revolves around capturing the future tax benefits generated by increased property values in a designated TIF district, thereby allowing for reinvestment in that area without imposing a tax burden on residents.

Historically, TIF emerged in the United States in the mid-20th century as a response to declining urban areas, enabling local governments to stimulate growth without upfront taxpayer funds. Regions once neglected can emerge revitalized through the strategic application of TIF, offering new amenities, jobs, and an improved quality of life.

The TIF process relies on a robust legal framework shaped by state and local laws, defining which districts can be designated for TIF and the eligibility criteria that developers or property owners must meet.

Components of a TIF form

The TIF Form is structured to capture essential details needed for application and approval. Understanding its components can significantly streamline the application process, ensuring that all necessary information is accurately communicated.

Typically, a TIF Form includes the following key sections, each designed to gather precise information about the property and the proposed project.

Completing these sections comprehensively will lay the groundwork for a successful TIF application.

How to complete the TIF form

Completing the TIF Form accurately is vital for approval. Here’s a systematic approach to ensure your form is filled out correctly.

A disciplined approach in these steps can decrease the likelihood of errors and improve the chances of a successful TIF application.

Tools for editing and signing the TIF form

After completing the TIF Form, ensuring its accuracy and professionalism is paramount. pdfFiller offers an array of tools for document editing and signing, facilitating a smooth process.

To utilize pdfFiller for managing your TIF Form, follow these steps:

Moreover, the eSigning capabilities of pdfFiller empower users to gather electronic signatures easily. Follow simple steps to send the form for signature, ensuring legal validity during the TIF application process.

Submitting the TIF form

Submitting the completed TIF Form requires adherence to specific guidelines to ensure acceptance and timely processing. Understanding these requirements is crucial for a successful submission.

Moreover, awareness of submission deadlines is vital. Missing deadlines can lead to delays or even rejection of the TIF application. It is recommended to maintain a timeline of submission milestones to avoid predicaments.

Common challenges and troubleshooting

While filling out and submitting the TIF Form, individuals and teams can face common challenges that may impede the application process.

To mitigate these challenges, establish clear communication with local TIF administrators. Additionally, consider joining online forums dedicated to TIF discussions, which can be invaluable for finding resources and support.

Case studies: Successful TIF projects

Examining successful TIF projects provides insights into effective strategies and common practices in implementation. Numerous localities have utilized TIF to spur development and revitalization.

In both cases, lessons learned emphasized the importance of community involvement and long-term planning to ensure sustainability and positive local economic impacts.

Staying updated: TIF news and resources

Staying informed about current developments regarding TIF is pertinent for stakeholders. Various resources and platforms regularly provide news updates, legislative changes, and best practices.

Engaging with these resources can help stakeholders remain connected to the ongoing trends within TIF financing.

Additional considerations

When evaluating TIF financing, it’s essential to consider its long-term impacts on local economies and communities. TIFs, when applied correctly, can enhance property values, stimulate job creation, and improve public infrastructure which benefits the overall community.

Looking into the future, trends in TIF usage are evolving with the increasing focus on sustainable development and technology-driven solutions. The integration of data analytics in TIF applications is becoming more prevalent, providing developers with greater insights into market conditions and feasibility assessments.

Interactive features on pdfFiller

pdfFiller not only serves as a document management platform but also empowers users to share their experiences and learn from one another. Through testimonials and user stories, prospective TIF applicants can see the real-world impact of utilizing pdfFiller for their document needs.

Engagement from the community enhances the resource’s value, offering an extensive knowledge base for newcomers and seasoned professionals alike.

Connecting with our community

For individuals and teams involved in TIF processes, engaging with a wider community can be profitable. Social media platforms serve as a medium for discussing challenges and solutions related to TIF financing.

By connecting with others in the field, stakeholders can gain insights and foster collaborations that may enhance their TIF-related endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax increment financing tif?

Can I create an eSignature for the tax increment financing tif in Gmail?

How do I edit tax increment financing tif on an iOS device?

What is tax increment financing tif?

Who is required to file tax increment financing tif?

How to fill out tax increment financing tif?

What is the purpose of tax increment financing tif?

What information must be reported on tax increment financing tif?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.