Get the free W-8ben-e

Get, Create, Make and Sign w-8ben-e

How to edit w-8ben-e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-8ben-e

How to fill out w-8ben-e

Who needs w-8ben-e?

W-8BEN-E Form - Comprehensive How-to Guide

Understanding the W-8BEN-E Form

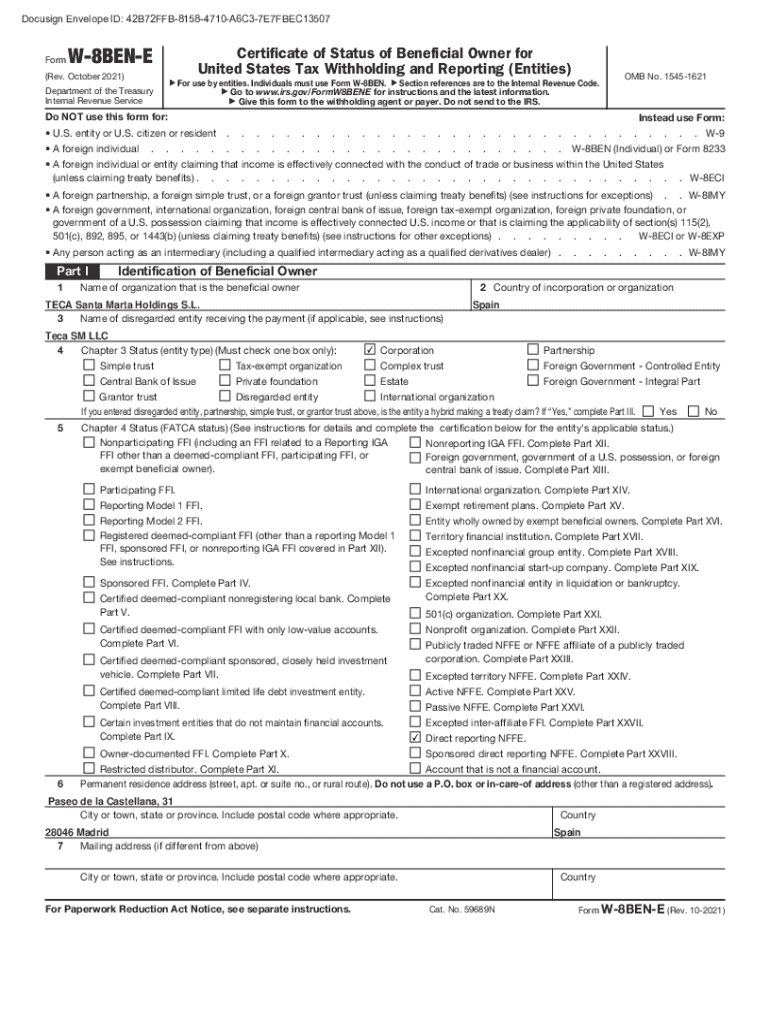

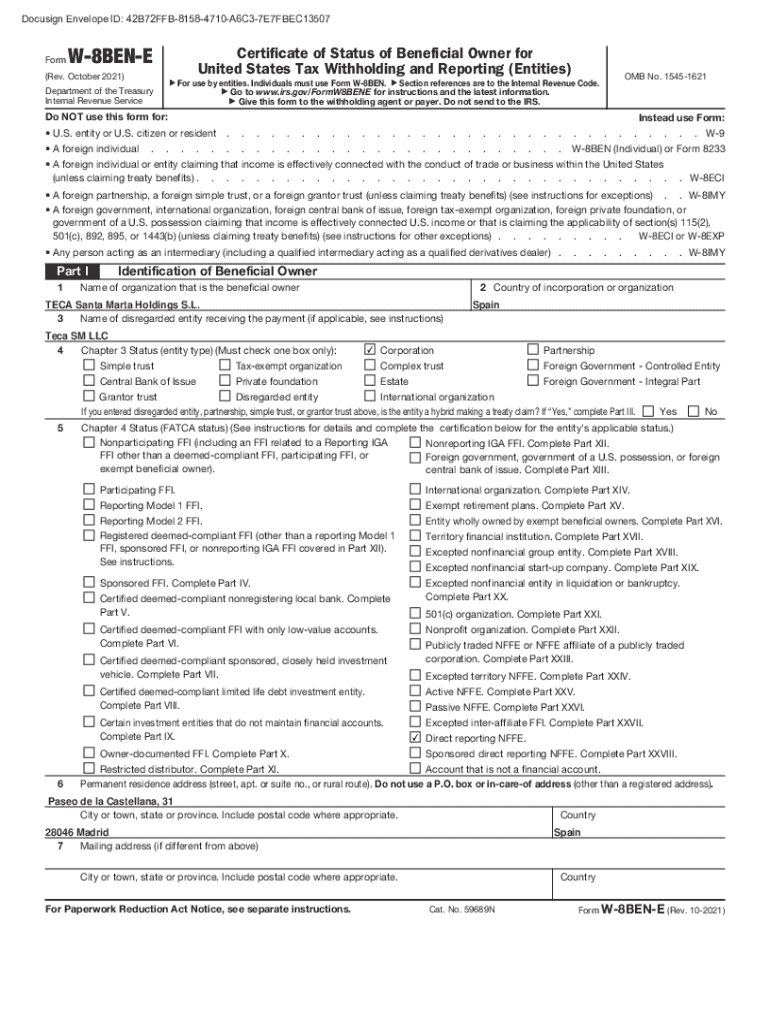

The W-8BEN-E form, officially known as the 'Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)', is a vital document for foreign entities doing business in or with the United States. This form certifies the entity’s status as a non-U.S. entity, allowing it to establish eligibility for preferential tax treatment under IRS regulations.

The importance of filling out the W-8BEN-E form cannot be overstated. It ensures compliance with U.S. tax laws and prevents unnecessary withholding taxes on payments received from U.S. sources. In essence, it acts as proof of foreign status, asserting that the entity is not subject to certain U.S. tax obligations.

Common misconceptions about the W-8BEN-E include the belief that all foreign entities require this form. In reality, only those receiving specific types of income from U.S. sources need to submit it. Furthermore, many believe that filling out the W-8BEN-E guarantees tax exemption, which is incorrect – it merely claims benefits available under specific tax treaties.

Who needs to complete the W-8BEN-E form?

Entities required to submit the W-8BEN-E generally include foreign corporations, partnerships, and other types of organizations that receive U.S. source income. These entities must complete the form to claim benefits like reduced withholding rates under applicable tax treaties with the U.S.

The primary benefits for foreign beneficial owners include reduced tax liabilities and compliance with withholding tax regulations. By properly filing the W-8BEN-E, entities can significantly reduce the withholding tax rates applied to their income, which can improve overall profitability.

Detailed breakdown of the W-8BEN-E sections

The W-8BEN-E form is structured into several parts, each requiring specific information. Understanding these sections is critical for accurate completion and compliance with IRS rules.

Part : Identification of beneficial owner

This section requires basic identification information about the beneficial owner, including the legal name, country of incorporation, and address. It’s crucial to ensure this information matches with official documents to avoid processing delays or rejections.

Part : Claim of tax treaty benefits

In this section, the entity must claim any applicable tax treaty benefits. This involves providing details about the specific treaty under which benefits are claimed, and for what type of income. It's essential to consult the IRS tax treaties page or a tax professional to determine eligibility.

Part : Certification

The final section requires the signature of a person authorized to certify the information on the form. Correctly authenticating this certification with the date and title of the signatory is critical, as it serves to verify the truth of the claims made on the form.

Filling out the W-8BEN-E form

Filling out the W-8BEN-E form can seem daunting, but when approached with a step-by-step method, it becomes manageable. Start by gathering necessary documents like the entity’s registration details, tax identification number (if applicable), and details required to claim any treaty benefits.

Common pitfalls often arise from misentering contact details or inaccurate claims regarding tax treaty benefits. Ensure that all information entered is accurate and complete before submitting the form. Double-check for errors, as the IRS may reject incorrectly filled forms.

Visual examples of properly filled forms can often be found within IRS publications or legal resources, which are excellent for reference. Using these examples can provide clarity on how to appropriately complete each section of the form.

Frequency of W-8BEN-E submission

Entities are required to provide a W-8BEN-E when they have become a new beneficial owner or when there have been significant changes in circumstances that affect the information previously provided. U.S. withholding agents generally ensure they retain the most current form to comply with tax rules.

Best practices indicate that entities should review their submitted forms at least annually or whenever there are changes in ownership or business structure. Eliminating expired forms and ensuring fresh documentation maintains compliance and ensures uninterrupted income streams from U.S. sources.

Digital and electronic signatures on W-8BEN-E

Digital signatures are becoming more accepted within document processing, including the W-8BEN-E form. However, ensuring these signatures comply with IRS regulations is critical. Entities must confirm that their digital signing method is secure and verifiable.

To properly execute digital signatures, it’s advisable to use reputable e-signature platforms that provide encrypted and legally recognized signatures. This not only aids in compliance but also expedites the submission process, particularly for international transactions.

Best practices for collecting W-8BEN-E forms

Ensuring compliance when collecting W-8BEN-E forms is critical, especially for businesses with multiple international partners. Establishing a clear process for collecting, reviewing, and storing completed forms is essential to minimize errors and avoid penalties.

Educating international partners on the importance and requirements of the W-8BEN-E form can lead to smoother transactions. Providing them with comprehensive guides or access to helpful resources will encourage timely and accurate responses.

Automating the W-8BEN-E process

Leveraging technology to automate the W-8BEN-E form process can significantly reduce burdens associated with manual data entry and tracking. Automation tools can streamline the collection, verification, and storage processes, ensuring all W-8BEN-E forms are up-to-date and compliant.

Benefits of automated systems include faster processing times, reduced errors, and improved compliance tracking. Solutions like pdfFiller offer cloud-based services that allow seamless document management for international business dealings.

Implications of not filling out the W-8BEN-E

Failing to fill out the W-8BEN-E form can result in severe consequences for foreign entities. Without this documentation, U.S. withholding agents may apply the maximum withholding tax rates, greatly impacting profitability.

In addition to potential financial losses due to excessive withholding, entities may face legal ramifications if they fail to comply with IRS regulations. As tax laws become more strictly enforced, ensuring that all required forms are submitted becomes essential for maintaining good standing.

W-8BEN vs. W-8BEN-E: key differences explained

While both the W-8BEN and W-8BEN-E forms serve similar purposes, they cater to different audiences. The W-8BEN form is designed for individuals, whereas the W-8BEN-E is intended for entities, such as corporations or partnerships.

This distinction emphasizes the type of information required and the specific claims for tax treaty benefits. Understanding when to use each form is critical for compliance and ensuring that the correct documentation is submitted to the IRS.

Resources and tools for W-8BEN-E management

Managing W-8BEN-E forms effectively requires access to the right tools and resources. Interactive online tools can assist in the completion process while IRS guidance materials clarify expectations for both foreign entities and U.S. businesses.

Consider leveraging document management solutions, such as pdfFiller, which streamline the process of filling out, signing, and storing W-8BEN-E forms in a secure, cloud-based environment.

Optimize your international transactions with W-8BEN-E compliance

Filling out and submitting the W-8BEN-E form accurately can facilitate smoother payment processes, enhancing business relationships between U.S. firms and foreign entities. Correct compliance not only streamlines transactions but also assures financial security amid complex international banking regulations.

Proper W-8BEN-E compliance can significantly impact financial management by reducing withholding taxes and improving the overall profitability of foreign partners. Leveraging tools available through platforms like pdfFiller ensures that entities remain compliant while focusing on their core business activities.

Real-life applications of the W-8BEN-E form

Real-world applications of the W-8BEN-E form highlight its importance in various industries, especially within global supply chains. For example, a foreign corporation receiving royalties from a U.S. entity must submit this form to claim tax benefits outlined in the relevant tax treaty.

Successful compliance stories from corporations illustrate how competent management of W-8BEN-E forms can create financial advantages and foster positive relationships between international business partners. Testimonials from businesses utilizing document management solutions like pdfFiller further emphasize the ease and efficiency the right tools can bring.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send w-8ben-e for eSignature?

How can I get w-8ben-e?

How do I fill out the w-8ben-e form on my smartphone?

What is w-8ben-e?

Who is required to file w-8ben-e?

How to fill out w-8ben-e?

What is the purpose of w-8ben-e?

What information must be reported on w-8ben-e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.