Get the free Tax Form a

Get, Create, Make and Sign tax form a

Editing tax form a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax form a

How to fill out tax form a

Who needs tax form a?

A comprehensive guide to tax form A: Everything you need to know

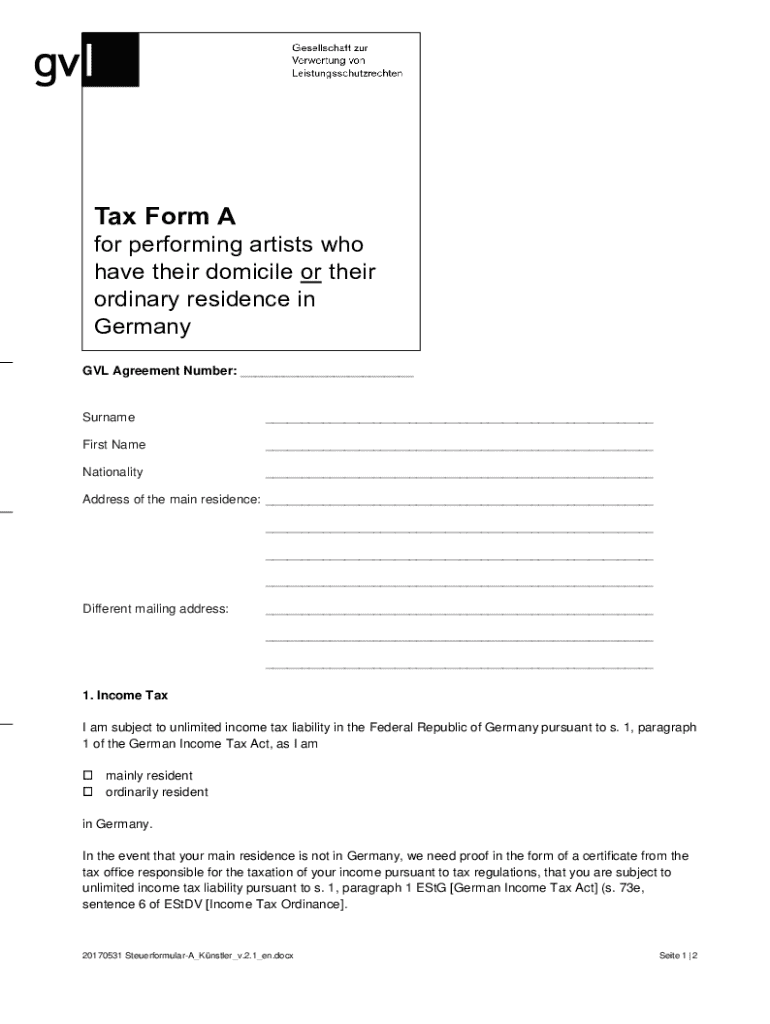

Understanding tax form A

Tax Form A is a critical document in the realm of personal income taxation, designed for individuals who need to report their financial activities for the year. Its primary purpose is to collate personal and financial information, aiding tax authorities in calculating the tax liability of the filer. This form serves as a foundational element in tax compliance, ensuring individuals meet their legal responsibilities. Accurate completion is essential for avoiding penalties and ensuring potential refunds are processed promptly.

Who needs to file Tax Form A? Generally, anyone earning income, be it from employment, self-employment, or investments, is required to file this form. If your income exceeds the threshold set by the IRS for your filing status, you are mandated to submit Tax Form A. Additionally, various credits and deductions available through this form can significantly impact your overall tax burden.

Key features of tax form A

Tax Form A requires specific information crucial for accurate tax reporting. Understanding what details need to be included can simplify the filing process. The form is structured to capture essential personal and financial details, all in a systematic manner.

Subsections within the form collect various types of information, including personal identification details, income sources, and possible deductions or tax credits. Each component plays a role in determining tax obligations, and understanding each section makes the filing process more manageable.

Step-by-step instructions for completing tax form A

Completing Tax Form A may seem daunting, but a systematic approach can simplify the experience. Start by gathering all necessary documentation to ensure accurate data entry. Having everything you need at hand will streamline the process significantly.

Identification documents such as a driver's license and Social Security information are essential. Additionally, income statements like W-2s and 1099s will be vital in reporting your earnings. Don't forget to compile records of any deductions, such as mortgage interest, medical expenses, or charitable contributions.

Completing the form

Begin filling out the form with your personal details, including full name, address, and Social Security number. Next, move to the income section. Report all sources of income accurately. This includes wages, interest, dividends, and any self-employed earnings. Clearly document deductions and credits in the respective sections to optimize your tax outcome.

Common pitfalls to avoid include overlooking income sources or miscalculating deductions, which could lead to delays or audits. Always double-check your figures and ensure all required fields are completed.

Editing and signing tax form A

Once you've completed your draft of Tax Form A, the next step involves editing and signing the document. pdfFiller provides an effective platform for users looking to edit PDFs quickly and efficiently.

To start editing, upload your completed Tax Form A to pdfFiller. Utilize the editing tools available for making changes, from correcting errors to adding missing information. The interface is user-friendly, allowing for a smooth editing experience.

eSigning tax form A

Once your form is finalized, the next step is to sign. Using pdfFiller's eSignature feature, you can electronically sign Tax Form A in just a few clicks. This process eliminates the need to print, sign, and scan documents, making it faster and more efficient.

Managing your tax form A

After filing your Tax Form A, effective management of the document is essential. Save and store your completed form securely using pdfFiller's cloud storage system. This feature ensures easy access anytime, anywhere, and offers the peace of mind that your documents are safeguarded.

Collaborating with others is also straightforward. pdfFiller allows you to share your form with team members or tax professionals for feedback or review, facilitating teamwork.

Tax form A filing options

When it comes to filing Tax Form A, you have two primary options: paper filing and electronic filing. Both methods have their pros and cons, but electronic filing is increasingly favored for its convenience and speed.

Filing your tax return electronically minimizes errors and expedites processing times, resulting in quicker refunds. Moreover, e-filing can help ensure that you meet state-specific requirements, which may vary based on your location.

Frequently asked questions (faqs) about tax form A

Individuals often have questions surrounding the requirements and eligibility for Tax Form A. Frequently, filers seek answers about who should file, what documents are necessary, and how to correct mistakes in submitted forms. Addressing these inquiries upfront can alleviate confusion and support tax compliance.

Moreover, troubleshooting common issues, such as missing documentation or filing errors, is crucial. Knowing where to find guidance can make the process much smoother.

Tax resources and additional support

Having the right resources can empower you to navigate the complexities of tax forms successfully. Find essential links to related tax forms, publications, and state-specific information, all of which can provide clarity. Furthermore, having access to contact information for support assistance can help you promptly resolve any issues as they arise.

Utilizing these resources, you can enhance your understanding of Tax Form A and improve your overall tax filing experience.

Why choose pdfFiller for your tax form A needs

pdfFiller stands out as an invaluable tool for anyone navigating the tax filing process, particularly with Tax Form A. As a cloud-based document management system, it empowers users to edit PDFs easily, collaborate with team members, eSign documents, and manage files all from a centralized platform.

The collaboration features available mean that individuals and teams can streamline their workflow, increasing efficiency and accuracy when working on tax documents. Compliance and security are at the forefront of pdfFiller, ensuring that your sensitive financial information remains protected.

Related content

Exploring other important tax forms can enhance your overall understanding of personal taxes. Each form has its specific use, and being well-versed in various forms can optimize your tax strategy. Additionally, seasonal tax tips and updates are invaluable for keeping abreast of changing tax laws or regulations.

User testimonials and success stories can inspire confidence in your ability to navigate the tax filing process efficiently with pdfFiller’s assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tax form a?

How do I edit tax form a on an Android device?

How do I complete tax form a on an Android device?

What is tax form a?

Who is required to file tax form a?

How to fill out tax form a?

What is the purpose of tax form a?

What information must be reported on tax form a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.