Get the free Dr 1485

Get, Create, Make and Sign dr 1485

Editing dr 1485 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dr 1485

How to fill out dr 1485

Who needs dr 1485?

Everything You Need to Know About the DR 1485 Form

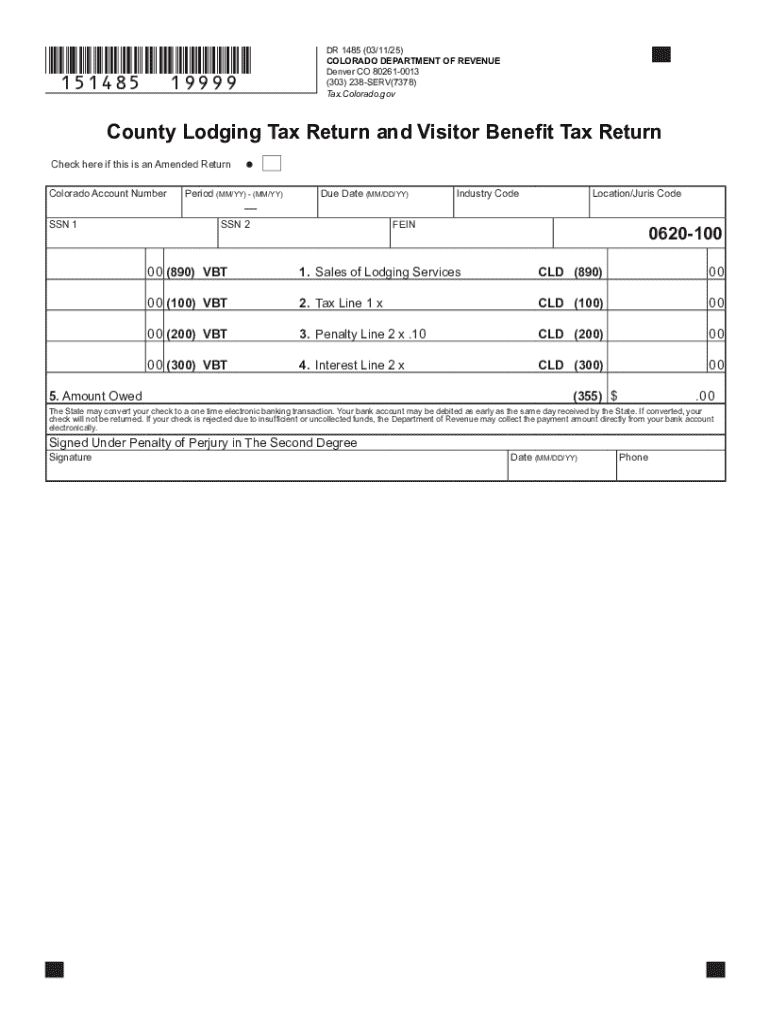

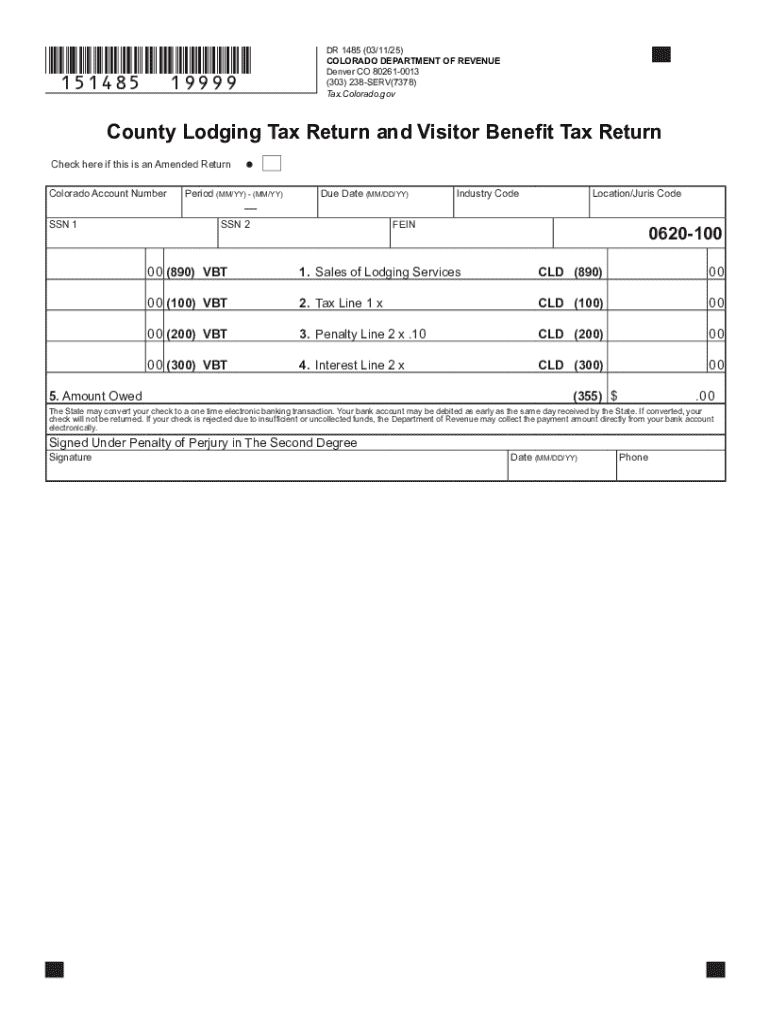

Overview of DR 1485 Form

The DR 1485 Form is a crucial document required for compliance with county lodging tax regulations. Its primary purpose is to report the gross rental income received from lodging operations, along with the applicable taxes owed to the county. This form plays a significant role in ensuring that lodging providers contribute their fair share of taxes to support local services and infrastructure.

Filling out the DR 1485 Form accurately helps avoid legal issues and ensures that lodging businesses remain in good standing within their communities. Key information required on the form includes the business name and address, property owner details, gross rental income, and calculations of tax owed.

Understanding the context of DR 1485

County lodging taxes are fees imposed on short-term rentals, such as hotels, motels, and vacation rentals. These taxes are essential for funding local government operations, tourism marketing, and infrastructure improvements. Generally calculated as a percentage of gross rental receipts, lodging taxes vary by location and are applied to nightly rates charged to guests.

Properly completing the DR 1485 Form is vital for lodging providers. This not only ensures legal compliance but also helps businesses avoid unnecessary penalties and fines. By correctly reporting income and taxes, property owners can maintain a transparent relationship with tax authorities and foster trust within their community.

Step-by-step guide on filling out the DR 1485 Form

Before diving into filling out the DR 1485 Form, preparation is key. Collect necessary documentation, such as rental agreements, previous tax returns, and records of rental income. Additionally, make sure to review the current applicable tax rates to understand how they apply to your business.

The DR 1485 Form consists of several sections that require careful attention. Here’s a breakdown of what you'll need to complete:

Editing and customizing the DR 1485 Form

pdfFiller offers excellent tools for editing the DR 1485 Form. Its interactive features make completing the form easy and efficient. Users can add text, check boxes, and comments directly onto the form, ensuring their entries are clear and accurate.

Additionally, pdfFiller enhances accessibility through its collaboration tools. Team members can share the form easily, allowing for real-time updates and feedback. This collaborative approach ensures everyone involved is on the same page, ultimately leading to more accurate submissions.

Submitting the DR 1485 Form

Once the DR 1485 Form is complete, it’s time to submit it. There are several methods to submit the form, including mailing it directly to the tax office or utilizing online submission options when available. Ensure you follow the guidelines for each submission method to avoid unnecessary delays.

Bear in mind that each submission method has its own deadlines. Keeping track of these deadlines is crucial to avoid incurring late fees. After submission, you may need to follow up if there are any issues or inquiries from the tax authority regarding your form completion.

Common mistakes to avoid

Filling out the DR 1485 Form can seem straightforward, but there are common pitfalls that many people encounter. For example, errors in numerical entries, omitting necessary signatures, or providing incorrect identifying information can all lead to complications and delays.

To minimize mistakes, consider the following tips:

Resources for further assistance

If you find yourself needing more help with the DR 1485 Form, local tax authorities are invaluable resources. For example, the La Plata County Tax Office can provide direct assistance and clarification on lodging taxes and the completion of relevant forms.

Moreover, there are various learning materials available online, including templates and FAQs. These resources can help address common concerns and streamline your understanding of lodging tax obligations.

Benefits of using pdfFiller for the DR 1485 Form

Using pdfFiller for your DR 1485 Form simplifies the entire process, making it more efficient. The platform’s cloud-based advantages mean you can access your forms from anywhere, anytime. This flexibility is ideal for business owners managing multiple properties.

Security measures are also paramount, as pdfFiller offers robust protections to ensure your sensitive data remains confidential. User testimonials highlight how pdfFiller has played a pivotal role in streamlining document management and improving overall productivity.

Interactive tools available on pdfFiller

pdfFiller provides several interactive tools to enhance the user experience. For instance, features such as form tracking allow you to monitor the status of your submissions effortlessly. Additionally, interactive tutorials are available for first-time users, ensuring a smooth onboarding experience.

To maximize the benefits of pdfFiller, utilize tips and tricks available on their platform for effective document management. Learning how to navigate and use all the features will ultimately save time and reduce frustration during the form-filling process.

Final thoughts on the DR 1485 and document management

Efficient document management plays a crucial role in ensuring compliance with tax regulations, including the DR 1485 Form. Staying proactive about managing your documents will not only streamline your operations but also keep you well-informed about changes in tax regulations.

Engaging with the pdfFiller community can provide ongoing support and resources, enabling users to leverage shared experiences and knowledge about the DR 1485 and other important forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my dr 1485 directly from Gmail?

How can I get dr 1485?

How do I fill out dr 1485 on an Android device?

What is dr 1485?

Who is required to file dr 1485?

How to fill out dr 1485?

What is the purpose of dr 1485?

What information must be reported on dr 1485?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.