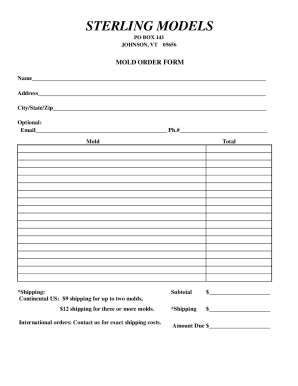

Get the free Loan Application / Information Sheet

Get, Create, Make and Sign loan application information sheet

How to edit loan application information sheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out loan application information sheet

How to fill out loan application information sheet

Who needs loan application information sheet?

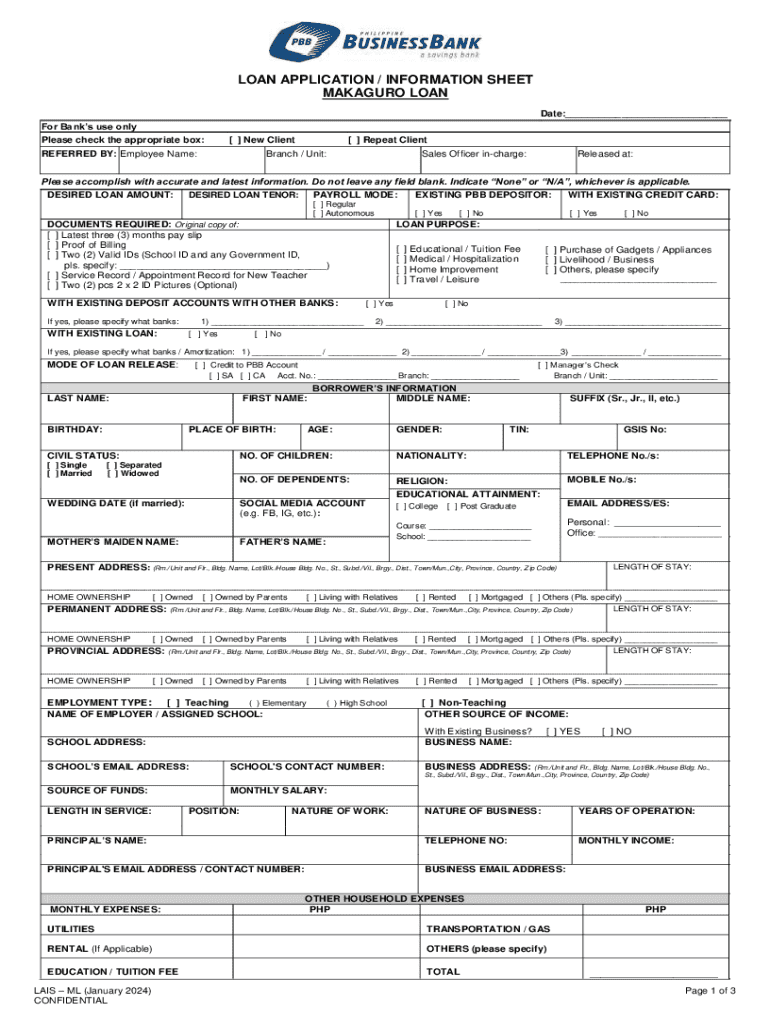

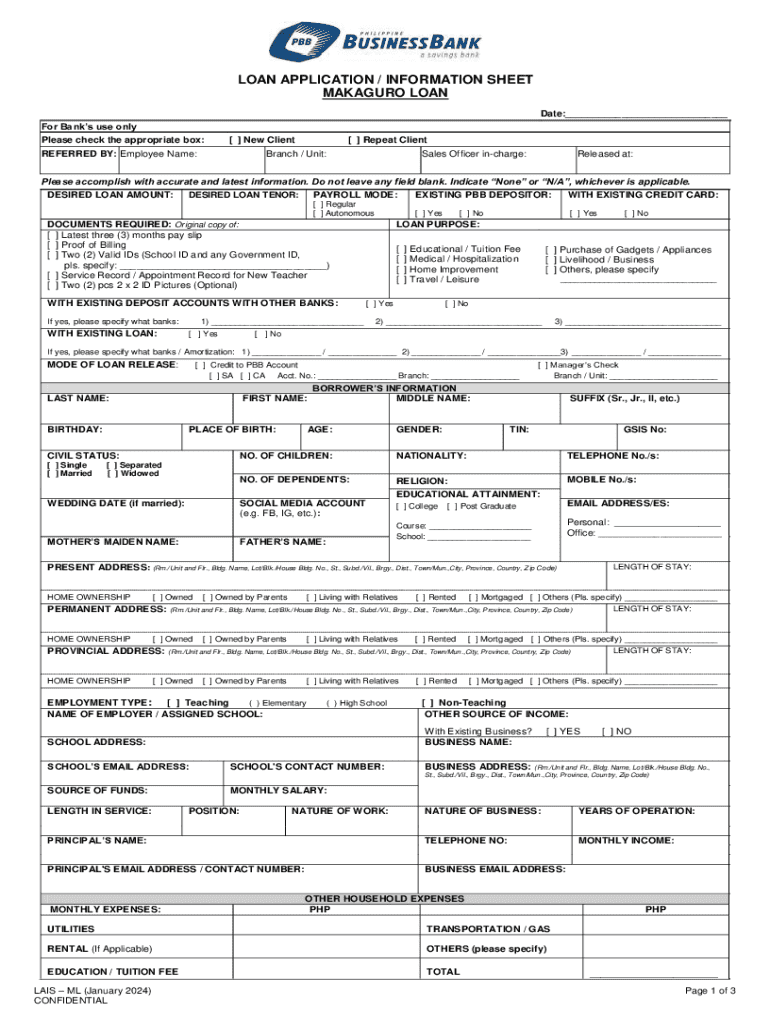

Comprehensive Guide to the Loan Application Information Sheet Form

Understanding the loan application process

A loan application information sheet serves a crucial function in the lending process. This document details the financial status and personal data of borrowers seeking loans, playing a pivotal role in determining approval or denial of the application. Banks, credit unions, and online lenders typically require this sheet when applying for personal loans, mortgages, business loans, and auto loans.

Accuracy in this application is not just a best practice; it significantly impacts approval times and the terms of the loan. Incomplete or inaccurate information can lead to delays or unfavorable terms, such as higher interest rates. Many applicants overlook trivial details, like typos in personal information or miscalculations in income, which can derail the entire process.

Components of a loan application information sheet

The loan application information sheet consists of vital sections that require careful attention. Each component enhances the lender's ability to evaluate the applicant's financial situation and risk profile effectively.

Comprehensively compiling this information helps lenders quickly assess an applicant’s eligibility and lends itself to a more efficient process overall.

Step-by-step guide to completing the loan application information sheet

Before filling out the loan application information sheet, preliminary preparation is essential. Gather necessary documents like income statements, tax returns, and a list of current debts. Creating a checklist will streamline the process and ensure no crucial information is overlooked.

As you fill out the form, pay attention to detail. Each section requires clear and precise information—for example, use full names as they appear in official documents, and ensure financial figures are correct. Here are some tips to consider:

Beware of common mistakes, like leaving sections incomplete or not providing supportive documentation.

Submitting the loan application information sheet

Once the form is complete, it's time to submit it. Different submission methods include traditional printed forms or online applications. Utilizing pdfFiller’s digital tools allows for a seamless online submission experience, providing ease of access from anywhere.

You should also follow up on your application. Keep track of the lender's timeline for approval, which varies widely based on the financial institution and loan type. Most approvals can take anywhere from a few hours to several business days.

Managing and editing your loan application information sheet

Utilizing pdfFiller can greatly enhance your document management experience. Editing your loan application form becomes effortless with this platform, allowing you to modify details before submission easily. You can also collaborate with financial advisors or partners in real-time, ensuring everyone is on the same page.

Moreover, saving templates for future applications can help expedite the process down the line. Being able to manage versions and updates helps keep your documents organized and accurate.

eSigning your loan application information sheet

The eSignature process is increasingly becoming a standard in loan applications. An eSignature not only simplifies the signing process but also bears legal validity, making it as secure as traditional signatures.

Using pdfFiller, you can easily add an eSignature to your loan application information sheet. The process involves selecting the signature field within the document and following simple prompts to add your electronic signature, all while ensuring security and compliance throughout.

Post-application steps and considerations

After submission, applicants can expect varying responses from lenders. If approved, you'll typically receive details regarding the loan terms, including interest rates and repayment schedules. In the event of a denial, it’s essential to understand the reasons provided, which can help in future applications.

Getting prepared for the loan closing is another critical step. Gather documents like proof of insurance, identification, and pay stubs, as these will be necessary to finalize the process. It's also wise to understand the closing costs involved, as well as the loan terms before signing.

Support and assistance options

If you encounter challenges while completing the loan application information sheet, customer support is readily available through many financial institutions and service providers like pdfFiller. Support can guide you through filling out the form correctly and answering any questions you may have.

Additionally, there are ample resources to help improve your credit score prior to applying for loans. Financial counseling services through local banks and credit unions can provide tailored advice to enhance your chances of approval.

FAQs about loan application information sheet forms

Many first-time applicants may have questions about the loan application information sheet that can help clarify common confusions. Addressing these commonly asked questions is essential for easing anxieties and making the process smoother.

Using interactive tools and resources on pdfFiller

pdfFiller offers a range of interactive features that can aid in completing your loan application information sheet efficiently. Automating form filling and utilizing tools for calculating loan repayment can save considerable time and reduce errors.

Maximizing these resources will not only enhance your experience but also improve the chances of submitting a polished, well-prepared application that meets lender's expectations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the loan application information sheet in Chrome?

How do I edit loan application information sheet straight from my smartphone?

How do I fill out loan application information sheet using my mobile device?

What is loan application information sheet?

Who is required to file loan application information sheet?

How to fill out loan application information sheet?

What is the purpose of loan application information sheet?

What information must be reported on loan application information sheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.