Get the free Cf-1040

Get, Create, Make and Sign cf-1040

Editing cf-1040 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cf-1040

How to fill out cf-1040

Who needs cf-1040?

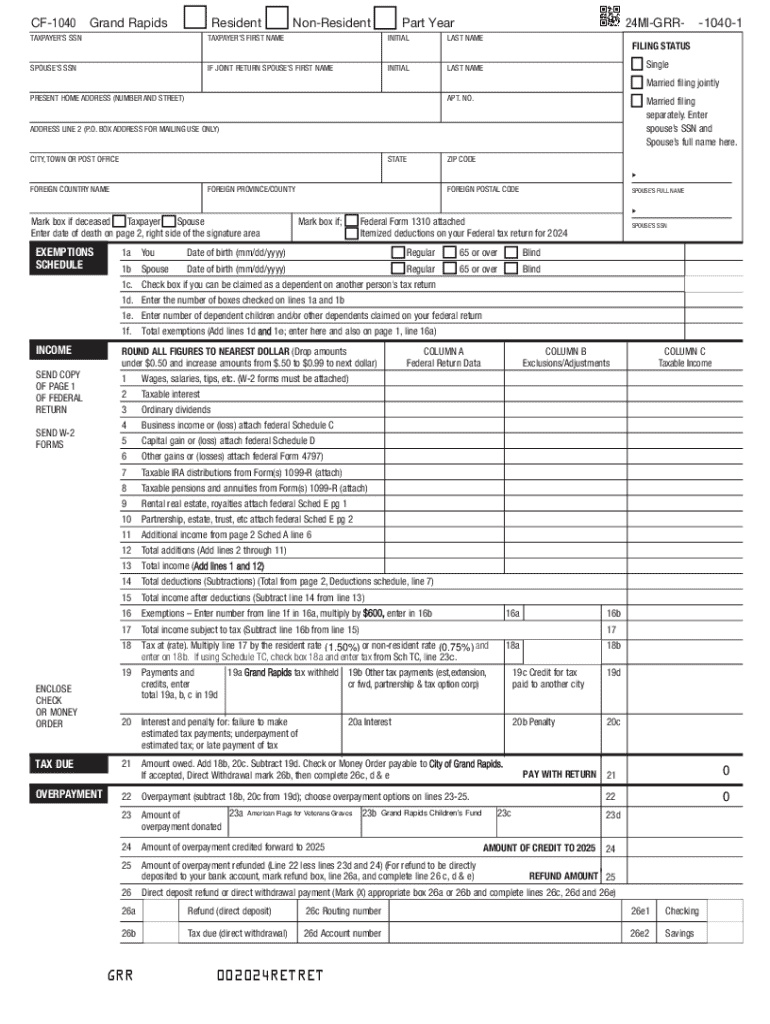

A Comprehensive Guide to the CF-1040 Form

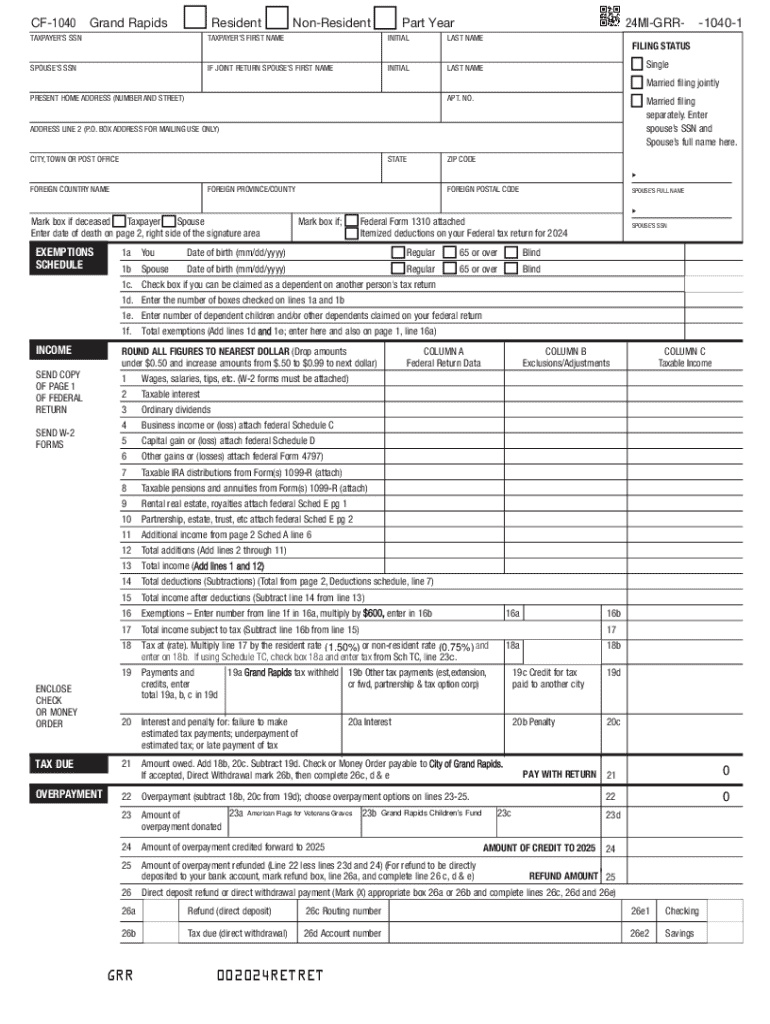

Understanding the CF-1040 Form

The CF-1040 form, often recognized as a vital tax document, is used by individuals and businesses to report income to the Internal Revenue Service (IRS). It essentially serves as a key tool in ensuring compliance with federal tax laws.

The importance of the CF-1040 form in tax filing cannot be overstated. It encompasses personal information, income earned, and various deductions and credits available to taxpayers, impacting the overall tax liability. The details captured in this form play a pivotal role in determining whether a taxpayer owes money, is eligible for a refund, or qualifies for additional benefits under tax regulations.

Key features of the CF-1040 form include sections for income reporting, deductions, and tax credits, as well as calculations of tax liability. Understanding these features will aid taxpayers in accurately filling out their forms and optimizing their tax filing process.

Preparing to fill out the CF-1040 form

Before filling out the CF-1040 form, it’s crucial to gather the necessary documentation. Required documents typically include W-2 forms from employers, 1099 forms for freelance or contract work, and any other documentation reflecting income, such as bank statements and investment income.

In addition to income statements, gather other key information including your Social Security Number (SSN), bank account details for potential direct deposit of refunds, and any prior tax returns, which can give insight into previous deductions used.

Organizing your financial information is equally essential. Start by compiling receipts, invoices, and statements, categorizing them by income and expenses to facilitate accurate reporting. Using spreadsheet tools or financial software can simplify tracking expenses and potential deductions, ensuring you do not overlook any tax-saving opportunities.

Step-by-step instructions for completing the CF-1040 form

Filling out the CF-1040 form is a systematic process that involves several sections. The first section requires personal information, where you’ll input your name, address, and the SSN. Ensure that your personal data matches the information on official identification documents, as discrepancies can delay processing.

Next comes income reporting in Section 2. Accurately report wages, salaries, and all sources of income, including tips and any additional income streams such as interest or dividends. The IRS uses this information to assess your overall earnings and apply the appropriate tax rate.

In Section 3, claiming deductions and credits can significantly affect your tax liability. It's essential to differentiate between standard deductions—set amounts depending on filing status—and itemized deductions, which might include mortgage interest, medical expenses, and certain educational expenses.

Section 4 covers calculating your tax liability, where understanding tax brackets is critical. The U.S. has progressive tax rates, meaning higher earnings are taxed at higher rates. Reviewing the tax tables can aid in determining the accurate amount owed or refunded.

Finally, section 5 involves finalizing your return. It’s crucial to double-check every entry for accuracy, as common mistakes include incorrect SSNs, math errors, and omitted income sources, which can lead to audits or penalties.

Editing and signing the CF-1040 form

After completing the CF-1040 form, consider using pdfFiller for efficient editing. The platform offers interactive tools that facilitate changes, including adding comments, notes, or corrections directly onto the PDF file. This feature is particularly beneficial for collaborative efforts, including review sessions with tax professionals.

When it comes to signing, pdfFiller supports secure electronic signatures, making the process convenient without the need for printing and scanning. ESignatures are generally recognized as legal and valid, as long as they adhere to the standards set by the IRS, ensuring your return is accepted without issue.

Submitting your CF-1040 form

Once the CF-1040 form is completed and signed, you’ll move on to submission. You have two main options: e-filing or paper filing. E-filing is generally faster and allows for direct deposit of refunds, while paper filing may require additional time for processing.

Choosing the right method for submission can also depend on personal preferences and available resources. Many taxpayers opt for e-filing due to its convenience and the ability to receive confirmation of acceptance almost instantly.

Tracking your submission is also essential. If you e-filed, you can easily check the status of your return online. If you chose to mail your return, follow up after a few weeks to confirm receipt; if you encounter any issues, be prepared to clarify any discrepancies with the IRS.

Managing your CF-1040 form after submission

After submitting your CF-1040 form, effective document management becomes crucial. Best practices dictate that you store copies of your tax forms, W-2s, and other supporting documentation in a secure and organized manner. Utilizing online document management systems can provide easy access and security, allowing you to retrieve documents as needed.

Looking ahead to future tax years, maintaining organized records can simplify the process significantly. Use cloud storage solutions to keep everything retrieving in one place, and regularly update your records in real time, which will prepare you well for next filing season while keeping abreast of any potential changes in tax laws or regulations.

FAQs about the CF-1040 form

When navigating the CF-1040 form, a plethora of questions may arise. One common concern is related to who is required to file. Generally, if your income exceeds a certain threshold set by the IRS, you are mandated to file. Specific situations like self-employment also necessitate filing, even if income is below those thresholds.

Another frequent question is about amendments—specifically, how to handle errors post-submission. The IRS allows filers to amend their returns through Form 1040-X, which can be filed electronically or on paper. This process ensures clarity and accuracy in your tax obligations.

Tax professionals can also provide insights into maximizing deductions and understanding specific situations affecting tax liabilities, which can be immensely valuable.

Support and additional tools

If you need assistance with the CF-1040 form, pdfFiller offers comprehensive customer support services. Their resources include FAQs, live chat options, and detailed user guides to navigate the complexities of tax documentation effortlessly.

Additionally, pdfFiller provides links to external tax resources, ensuring you have access to authoritative information about deductions, credits, and compliance with IRS regulations. Empowering users through education enhances user experience and fosters confident tax filing.

Community and collaboration

Engagement with other users can provide greater insights and shared experiences related to the CF-1040 form. Platforms such as forums or social media groups offer spaces where individuals can exchange tips, address concerns, and share advice on maximizing tax strategy.

Furthermore, utilizing the pdfFiller platform can help connect you with tax professionals for personalized consultations. This collaborative approach enhances your understanding of the CF-1040 form and tax strategies, promoting a well-informed filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the cf-1040 in Chrome?

How can I edit cf-1040 on a smartphone?

How do I complete cf-1040 on an Android device?

What is cf-1040?

Who is required to file cf-1040?

How to fill out cf-1040?

What is the purpose of cf-1040?

What information must be reported on cf-1040?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.