Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form How-to Guide

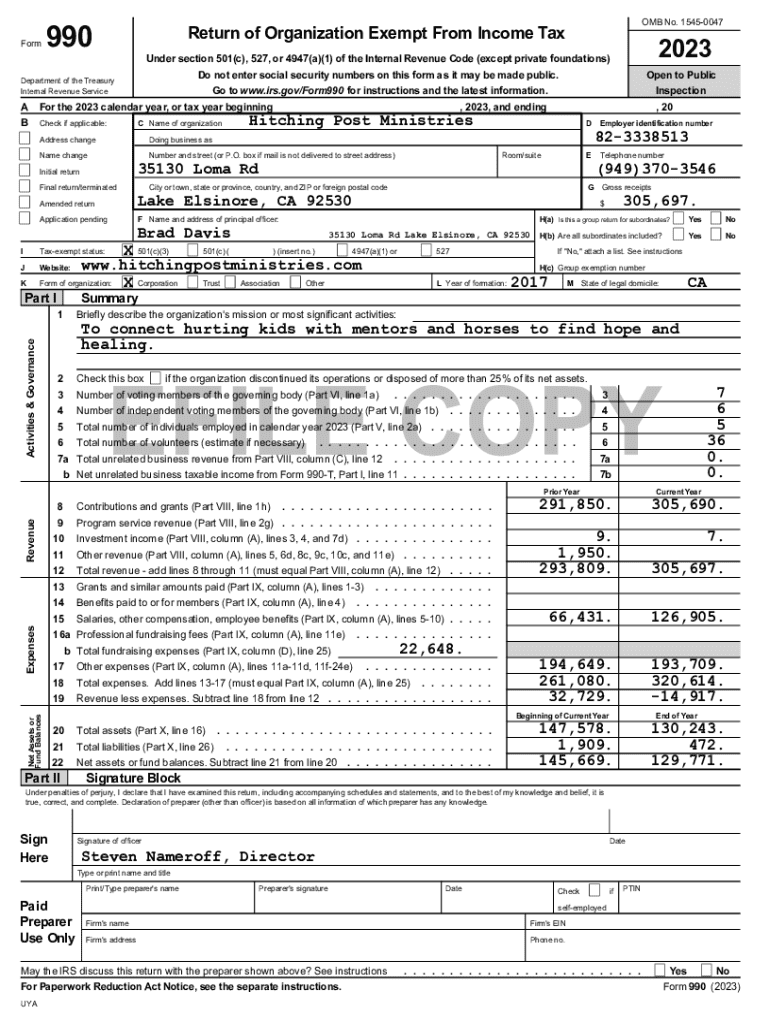

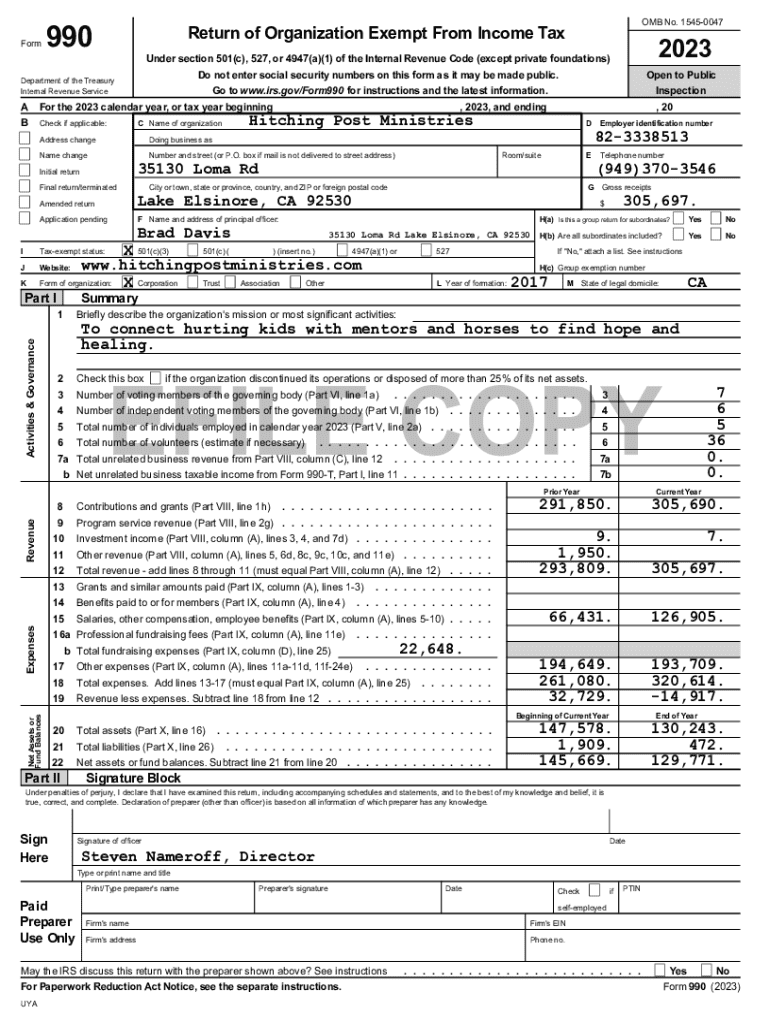

Overview of Form 990

Form 990 is a crucial document that non-profit organizations in the United States must file annually with the Internal Revenue Service (IRS). This form allows the IRS to evaluate an organization's financial status and its compliance with tax regulations. It serves as a transparent record that discloses how each dollar is spent, why, and the impact on its mission.

The importance of Form 990 for non-profits cannot be overstated, as it provides essential information to the public, donors, and stakeholders about an organization's financial health. There are several variations of Form 990, including Form 990, Form 990-EZ, and Form 990-N (e-Postcard), each catering to different types and sizes of organizations based on their financial thresholds.

Who must file Form 990?

Understanding who is required to file Form 990 is essential for compliance and avoiding penalties. Generally, tax-exempt organizations with gross receipts of over $200,000 or total assets exceeding $500,000 must file the long Form 990. Smaller organizations, those with gross receipts below $200,000, and total assets under $500,000, may file Form 990-EZ, while those with receipts under $50,000 can opt for the simplified Form 990-N.

Additionally, certain organizations may be exempt from filing requirements. These exemptions include religious organizations, certain government entities, and organizations that meet specific financial thresholds. It is crucial for organizations to assess their revenue and assets to determine their filing requirement accurately.

Filing requirements for Form 990

Filing Form 990 requires adherence to specific deadlines and guidelines. Typically, non-profit organizations must file their Form 990 by the 15th day of the 5th month after the end of their financial year. For most organizations operating on a fiscal calendar year ending December 31, this means the deadline is May 15. Filing requirements differ based on the chosen form variant, so organizations must ensure they understand which form applies to their situation.

When preparing to file, it's imperative to gather all necessary documentation, including financial statements, records of revenue and expenses, and any supplementary information required by the IRS. Choosing the correct form variant is crucial, as filing the wrong form can lead to complications and potential penalties. The IRS provides guidelines on determining the appropriate form based on organization size and revenue.

Penalties for non-compliance

Non-compliance with Form 990 filing requirements can lead to severe consequences, including financial penalties. Common reasons for late or incomplete filings include inadequate record-keeping, lack of awareness of deadlines, or misunderstanding of the form's complexity. The penalties can range from $20 per day for late filings, up to a maximum of $10,000 or 5% of the organization's gross receipts, whichever is less.

Beyond financial ramifications, not filing Form 990 can result in more serious legal implications, risking an organization's tax-exempt status. thus, it is crucial for organizations to prioritize adherence to IRS guidelines and ensure thorough preparation in advance of filing deadlines.

Understanding public inspection regulations

Form 990 is not only vital for compliance; it also serves as a tool for transparency in the non-profit sector. The IRS requires that Form 990 filings be made available for public inspection. This means that donors, stakeholders, and the public can easily access important information concerning an organization’s financial practices and governance.

The key information available to the public includes organizational details, revenue sources, expenditures, and details regarding board member compensation. Organizations are encouraged to embrace transparency, which can build trust and credibility with donors. Individuals wishing to request a copy of Form 990 can do so through the IRS or by directly contacting the organization.

Detailed instructions on filling out Form 990

Filling out Form 990 can appear daunting, but breaking it down into sections makes it manageable. The form encompasses several key parts, each requiring careful attention and accuracy:

Common mistakes when completing the form include misreporting financial figures, failing to report all required activities, or not properly completing required schedules. To avoid these pitfalls, organizations should leverage checklists and templates, while also conducting multiple reviews of the completed form before submission.

Using Form 990 for charity evaluation research

Form 990 should not only be viewed through the lens of compliance—it is also a valuable tool for research and evaluation. Donors and researchers leverage this form to assess the financial health and operational transparency of non-profit organizations. Key metrics to focus on include total revenue, program service expenses, and the percentage of funds spent directly on programs versus administrative costs.

Analyzing these indicators can provide deep insights into an organization’s efficiency and effectiveness. By interpreting the financial data contained in Form 990, potential donors can make informed decisions regarding their contributions, choosing to support organizations that best align with their charitable objectives.

Practical tools for filling and managing Form 990

Utilizing tools to streamline the process of filling out and managing Form 990 is a smart move for any organization. Platforms like pdfFiller offer interactive tools and templates designed to simplify each step of the form completion process. These tools make it easy to edit PDFs, e-sign documents, and collaborate with team members, ensuring accuracy and efficiency.

A cloud-based document solution like pdfFiller empowers users to access their forms from anywhere, making it easier to manage filings even when team members are remote. Additionally, collaboration features allow organizations to work together seamlessly in preparing Form 990, enhancing both efficiency and accuracy.

Sample IRS Form 990 and its annotations

For hands-on understanding, reviewing a sample IRS Form 990 can be incredibly beneficial. Downloading a sample version complete with annotations can provide clarity on what each section entails and the type of information required. This resource can help organizations visualize their own information and how best to structure their reporting.

Key things to note when reviewing a sample form include the formatting, the language used in various sections, and specific documentation required for attachments. Understanding these nuances allows organizations to prepare and present their information correctly, ultimately avoiding any compliance issues.

FAQs about Form 990

Addressing frequently asked questions surrounding Form 990 can demystify the filing process and provide clarity to organizations. Some common questions include: how do I know which form to file? What if my organization has no revenue this year? What happens if I miss the filing deadline?

The board’s role in Form 990 filing – a checklist

The board of directors plays a pivotal role in the Form 990 filing process. Board members are responsible for providing oversight and ensuring that the necessary reviews are conducted prior to submission. Subsequently, they help create a culture of accountability and transparency within the organization.

These best practices ensure that the organization remains compliant while fostering a responsible governance structure that can enhance donor trust.

Third-party resources for Form 990 assistance

Navigating the complexities of Form 990 can be overwhelming, but several third-party resources are available to provide assistance. Support organizations and consultants specializing in non-profit compliance can offer insights and guidance. Additionally, there are various online platforms dedicated to helping non-profits with their filing processes.

Historical context of Form 990

Form 990 has a storied history, evolving alongside the needs for transparency in the non-profit sector. Originally introduced in the 1940s, this form has undergone numerous amendments and adaptations to enhance financial accountability and ensure that non-profits comply with federal standards. The significance of Form 990 in promoting transparency and accountability cannot be overstated, as it helps mitigate fraud and abuse in the charitable sector.

In recent years, legislative changes have impacted filing requirements, with increased scrutiny placed on financial reporting and governance practices. Understanding this historical context is essential for organizations trying to navigate modern compliance challenges.

Conclusion: The significance of accurate Form 990 completion

Accurate completion of Form 990 is of paramount importance for non-profit organizations. Through diligent document management and careful preparation, organizations not only avoid penalties but also enhance their credibility and trust with stakeholders. Embracing a proactive approach to compliance as well as utilizing resources available through platforms like pdfFiller can make a significant difference in the efficiency of the filing process.

In summary, understanding the intricacies of Form 990 can empower non-profits to fulfill their mission effectively while maintaining compliance and fostering a culture of transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 990 in Chrome?

Can I create an electronic signature for signing my form 990 in Gmail?

How do I complete form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.