Get the free form abs 15g

Get, Create, Make and Sign form abs 15g

Editing form abs 15g online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form abs 15g

How to fill out form abs-15g

Who needs form abs-15g?

How to Fill Out and Manage the ABS-15G Form

Understanding the ABS-15G form

The ABS-15G form is crucial for individuals looking to claim tax exemption on income accruing through various financial channels. It serves as a declaration form to be addressed to the Income Tax Department, preventing the deduction of tax at source (TDS) on sums that are not applicable to a particular financial year.

Accurate completion of the ABS-15G form is essential as it commits you to the financial information you provide — the tax department relies on these details for assessment. It's predominantly used by taxpayers, particularly senior citizens or anyone with a taxable income below the exemption limit, to ensure they aren't unjustly taxed on certain earnings.

Key elements of the ABS-15G form

The ABS-15G form consists of several sections that need to be filled out meticulously to ensure compliance and achieve the intended tax relief. The structure of the form is straightforward, allowing applicants to articulate their details clearly. Each section targets specific data points, with particular emphasis on ensuring only required information is provided.

The primary sections include personal identification, income details, and certification of the submitted information. While most of this information is mandatory, applicants should be cautious about which parts of the form can be optional, ensuring that unnecessary blanks do not jeopardize their submissions.

Step-by-step guide to completing the ABS-15G form

Completing the ABS-15G form requires a systematic approach to ensure all requisite details are accurately reported. Here’s how to execute this task efficiently.

Step 1: Gather necessary documentation

Before even beginning the form, gather necessary documents such as your PAN card, bank statements showing earnings, and any previous tax documents. These will provide the necessary information to complete the form accurately.

Step 2: Filling out section 1 - General information

This section requires your basic information, such as your name and contact details. It's critical to ensure that names match exactly as they appear on official documents, like your PAN.

Step 3: Filling out section 2 - Financial information

Here, you’ll report all income sources applicable for exemption. Include specific figures from your earnings, ensuring accuracy to avoid future complications. Detail every item because discrepancies can lead to your form being rejected.

Step 4: Filling out section 3 - Certification and signatures

In this final section, certify that the details provided are accurate to the best of your knowledge and sign the form. This signature holds legal importance. Make sure your signature matches your official documents to avoid discrepancies.

Step 5: Double-check your entries

Before you submit, reviewing your form for spelling errors, mathematical inaccuracies, and incomplete sections is essential. A checklist can help streamline this process. Engaging a peer to review your work can reveal any missed mistakes.

Editing and modifying the ABS-15G form

One of the significant challenges faced by users is the editing of the ABS-15G form after initial completion. Utilizing tools like pdfFiller can simplify the process by offering interactive features that facilitate quick changes with minimal stress.

pdfFiller not only enables direct edits but also provides cloud storage options, ensuring that your forms are saved securely and are easily retrievable. Users can use tools like electronic sticky notes and text boxes to annotate as necessary.

eSigning the ABS-15G form

The importance of electronic signatures in today's digital administrative processes cannot be understated. With pdfFiller’s eSigning capabilities, you can quickly add your signature securely without the hassle of printing and scanning documents.

Following the step-by-step process to include an eSignature ensures that your submission is not only legally recognized but also expedites the review process considerably. Always verify that your eSignature aligns with the legal standards expected by regulatory authorities.

Managing your completed ABS-15G form

Post-submission, the organization remains key to ensuring that all your documents, including the ABS-15G form, are easily accessible. Utilize a systematic approach to file and categorize completed forms in a manner that promotes easy retrieval.

Implementing a tracking system for submissions can further assist in managing timelines for follow-ups or necessary actions, such as acknowledging requests from the tax authorities. Being punctual can help reduce potential compliance issues.

Troubleshooting common issues

Filling out the ABS-15G form can occasionally lead to complications, primarily due to incorrect entries or misinterpretation of requirements. Understanding common pitfalls can enhance your likelihood of successful submission.

If your form is rejected, thoroughly reviewing the tax authority’s feedback will provide insights into required corrections. Engaging with our customer support through pdfFiller can also assist in solving complex issues that may arise during this process.

Insights into regulatory changes impacting ABS-15G form

Keeping abreast of recent regulatory changes is essential for individuals completing the ABS-15G form. Changes can affect the income thresholds for exemptions or introduce new mandatory reporting conditions that could impact how taxpayers approach the form.

Users should actively seek updates from credible financial advisories or the official Income Tax Department notifications to ensure compliance with the most current requirements.

User experiences and case studies

Real-world testimonials from past users of the ABS-15G form provide valuable insights into best practices and common challenges they faced. For instance, a senior citizen shared how having access to an interactive platform like pdfFiller simplified the process by allowing direct edits and secure eSigning.

Another individual noted that breaking down the form into its respective sections made completion less daunting and easier to manage. Their experience underlines the importance of leveraging document management tools for effective filing.

Tools and resources for enhanced form management

The pdfFiller platform provides a suite of features tailored for users of the ABS-15G form, which includes not just editing tools, but collaboration features that allow multiple stakeholders to review and contribute seamlessly to the document.

Moreover, additional resources, such as downloadable templates for the ABS-15G form and links to the Income Tax Department’s guidelines, enhance the understanding and usability of the form. Taking advantage of these resources can drastically improve the form completion experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form abs 15g for eSignature?

How do I make edits in form abs 15g without leaving Chrome?

Can I edit form abs 15g on an iOS device?

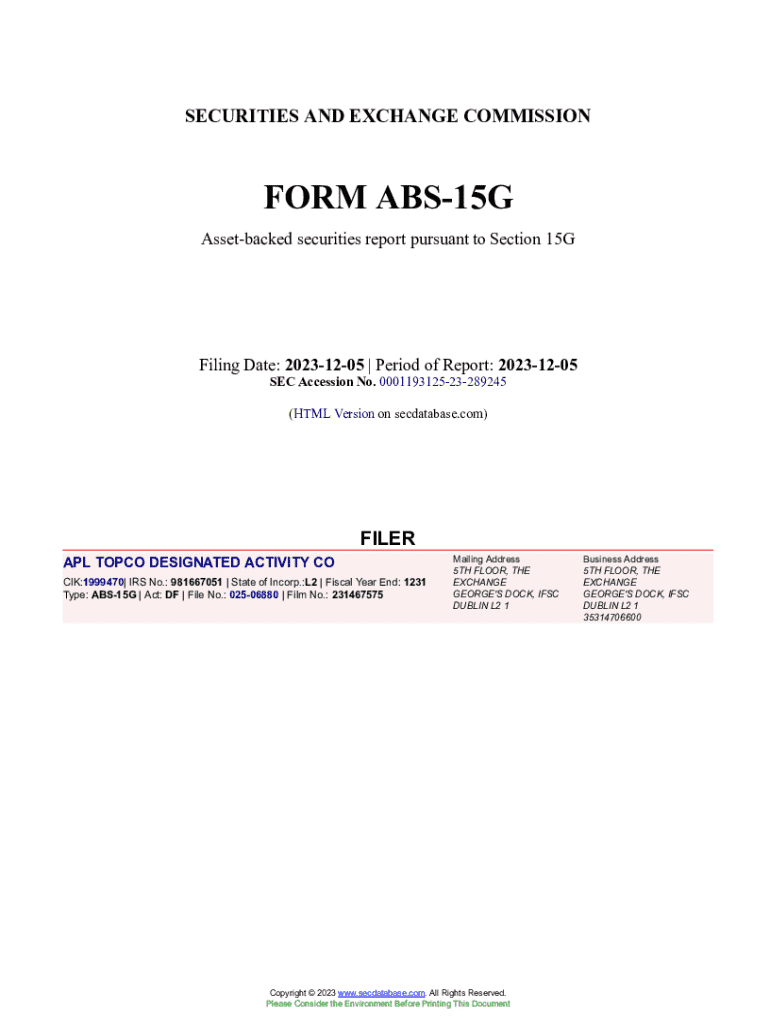

What is form abs-15g?

Who is required to file form abs-15g?

How to fill out form abs-15g?

What is the purpose of form abs-15g?

What information must be reported on form abs-15g?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.