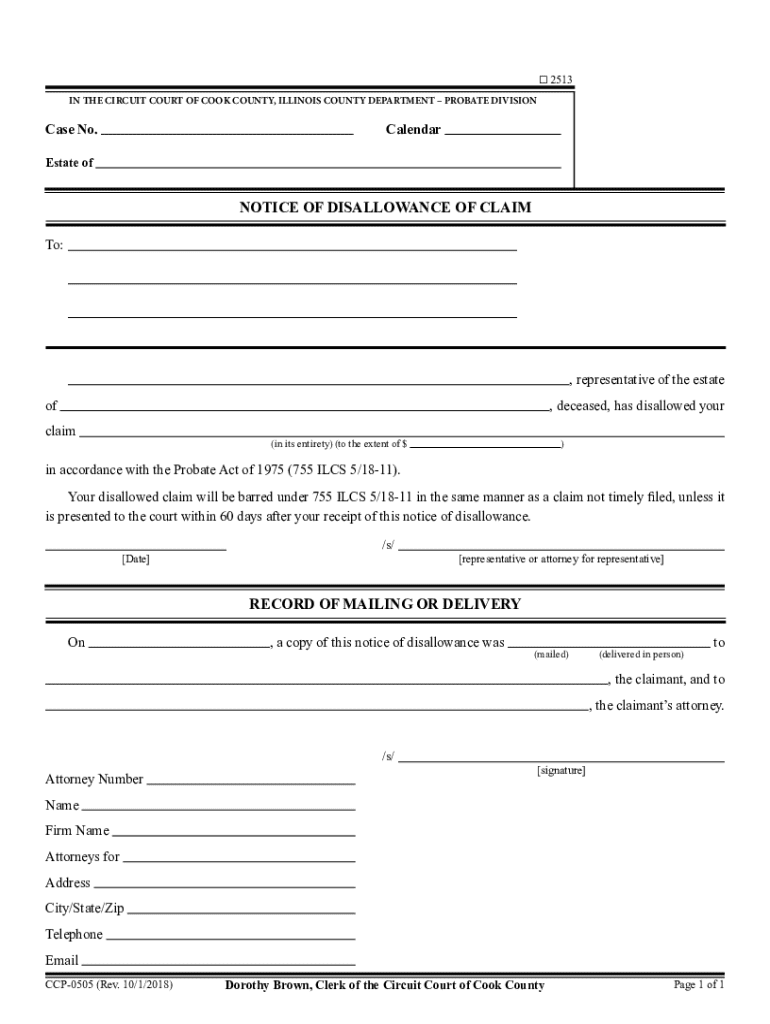

Get the free Notice of Disallowance of Claim

Get, Create, Make and Sign notice of disallowance of

How to edit notice of disallowance of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of disallowance of

How to fill out notice of disallowance of

Who needs notice of disallowance of?

Understanding the Notice of Disallowance of Form: A Comprehensive Guide

Understanding the notice of disallowance of form

A Notice of Disallowance is a formal communication typically issued by tax authorities, such as the IRS, indicating that a submitted claim, usually for tax deductions or credits, has been rejected. This notice plays a critical role in the document processing landscape by informing taxpayers about the status of their claims and providing a pathway for appeal or correction. Understanding this notice is essential, as it not only impacts your financial situation but also your obligations as a taxpayer.

The primary purpose of a Notice of Disallowance is to clarify the reason behind the rejection, ensuring that the taxpayer is fully aware of why their claim did not meet the stipulated requirements. Common scenarios leading to the issuance of this notice include incomplete form submissions, discrepancies in reported income, or failure to provide necessary supporting documentation.

Key components of a notice of disallowance

A typical Notice of Disallowance contains several essential components that provide clarity and direction for the taxpayer. Firstly, each notice includes a claim reference number, which is crucial for tracking and referencing your specific situation. This number helps both the taxpayer and the tax authority to identify the claim quickly in their systems.

Another critical element in the notice is the stated reason for disallowance. This section clearly outlines why the claim was rejected, whether due to inaccuracies, omitted information, or non-compliance with regulations. Additionally, the notice provides instructions for appealing or responding to the decision, which typically includes information about deadlines and how to submit any required documentation.

What you should do upon receiving a notice of disallowance

Upon receipt of a Notice of Disallowance, the immediate steps you should take are critical for the potential resolution of your claim. Firstly, thoroughly review the disallowance details outlined in the notice. Understanding the specifics will help you pinpoint exactly what was lacking or incorrect in your original submission.

Next, gather all required documentation that supports your original claim. This may include past tax returns, receipts, or any forms that corroborate your figures. Preparing for possible follow-up actions, such as drafting a response or an appeal, is also key. Be mindful of any timelines mentioned in the notice, as responding promptly can significantly impact the outcome of your case.

Resources for understanding your rights

Taxpayer rights are paramount during the disallowance process. It's essential to familiarize yourself with these rights to effectively navigate any challenges that arise. The Taxpayer Bill of Rights outlines different aspects of your rights, including the right to be informed, the right to privacy, and the right to challenge the IRS’s position and be heard.

Access to these resources can significantly assist you in addressing issues related to a disallowance notice. For instance, if you feel that your claim was unjustly disallowed, knowing your rights empowers you to take appropriate actions, such as filing an appeal or requesting additional clarification from the IRS.

Responding to a notice of disallowance

Responding to a Notice of Disallowance requires careful attention to detail. Start by drafting a response letter that follows a clear and structured format. Begin with your personal information and the claim reference number, followed by a polite opening that states the purpose of your letter.

In the body of your letter, clearly address the reasons stated in the disallowance notice, providing accurate and concise explanations or additional documents that support your claim. Remember to include any necessary documentation that you didn’t submit initially. The importance of sending your response correctly cannot be overstated; ensure that you address it to the correct department and keep records of your correspondence to establish a paper trail.

How to avoid future disallowances

Preventing future Notices of Disallowance hinges on understanding common pitfalls that often lead to such outcomes. Submitting incomplete or incorrect forms is a primary reason for disallowances. It is crucial to ensure that every piece of required information is accurately provided and supports your claim comprehensively.

Misunderstanding requirements is another frequent contributor. To mitigate these issues, consider implementing document review strategies before submitting any forms. Utilizing the pdfFiller platform can enhance your preparation. Its features enable you to edit PDFs seamlessly, verify compliance with requirements, and assure that all necessary details are included.

Frequently asked questions about notices of disallowance

Many people face confusion regarding the specifics of a Notice of Disallowance as they navigate this complex process. One common question is the difference between a disallowance and a denial. While both terms indicate a rejection, a denial typically means your claim was not accepted from the outset, whereas a disallowance implies that your claim was initially recognized but later rejected due to some issues that arose.

Tracking the status of your response is also a frequent inquiry. The best approach is to contact the customer service department of the tax authority, providing them with your claim reference number for a more efficient process. If your appeal is unsuccessful, you should be informed of your options for further recourse, including potentially seeking a hearing.

Case studies of successful responses

Analyzing successful responses to Notices of Disallowance can provide valuable insights for taxpayers. For example, consider the case of an individual taxpayer who received a notice due to a missing W-2 form. Upon responding with the required document, the taxpayer successfully reversed the disallowance. This underscores the importance of timely and appropriate documentation.

In another scenario, a small business faced disallowance due to perceived discrepancies in reported revenue. After conducting a thorough review and providing additional proof of income, they successfully appealed the decision. Key takeaways from these experiences include the necessity of being proactive, ensuring your documentation is complete, and understanding the nuances involved in responding effectively.

Interactive tools available on pdfFiller

Taking advantage of the interactive tools available on the pdfFiller platform can significantly simplify the process of responding to a Notice of Disallowance. The platform offers features for creating and editing responses, allowing users to customize their documents seamlessly. Additionally, the eSigning capability facilitates faster turnaround times for document submissions.

Collaboration features are another standout aspect of pdfFiller, enabling team responses to notices, which can be particularly beneficial in professional environments. By working together, team members can ensure a more thorough response, decreasing the likelihood of future disallowances and improving overall accuracy in submissions.

Updates and news related to notices of disallowance

Keeping abreast of recent changes in tax forms and disallowance processes is crucial for taxpayers. The IRS frequently updates its guidance and forms, which can directly impact how notices of disallowance are issued and processed. For instance, changes to certain tax deduction qualifications may create new scenarios where disallowances become more prevalent.

Stay informed by subscribing to updates from the IRS and utilizing resources available on the official website. Awareness of such changes can significantly enhance your capacity to manage potential disallowances effectively, conditioning you to react promptly and appropriately to notices as they arise.

Closing thoughts on managing the disallowance process

Navigating the disallowance process can be daunting, but maintaining transparency and effective communication is key. The integration of resources like pdfFiller facilitates streamlined document management and reduces the stress associated with handling Notices of Disallowance. By leveraging the tools and insights provided, you can empower yourself to respond effectively and safeguard your financial interests.

Remember, proactive measures, meticulous adherence to submission guidelines, and thorough knowledge of your rights will serve you well in managing the complexities of tax-related communications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit notice of disallowance of from Google Drive?

Can I create an electronic signature for signing my notice of disallowance of in Gmail?

How do I edit notice of disallowance of on an Android device?

What is notice of disallowance of?

Who is required to file notice of disallowance of?

How to fill out notice of disallowance of?

What is the purpose of notice of disallowance of?

What information must be reported on notice of disallowance of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.