Get the free Microbusiness Loan Program Request for Grant Applications (rfga) Round Iv

Get, Create, Make and Sign microbusiness loan program request

Editing microbusiness loan program request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out microbusiness loan program request

How to fill out microbusiness loan program request

Who needs microbusiness loan program request?

Microbusiness Loan Program Request Form: A Comprehensive Guide

Understanding microbusiness loan programs

Microbusiness loans are financial products specifically designed for small businesses typically defined as having fewer than 10 employees and generating limited annual revenue. These loans cater to entrepreneurs seeking to finance operations, expand their businesses, or cover unexpected expenses. For many aspiring business owners, microbusiness loans represent a crucial stepping stone to nurture their ideas into successful ventures. The importance of these loans cannot be overstated; they enable entrepreneurs to invest in essential tools, inventory, marketing, and workforce, which are vital for growth.

Common uses for microbusiness loans include purchasing equipment, maintaining cash flow, hiring staff, and funding marketing campaigns. However, the key benefit lies in the accessibility of these loans, which often come with lower interest rates and flexible terms compared to traditional bank loans.

Eligibility criteria for microbusiness loans

To qualify for a microbusiness loan, certain eligibility criteria must be met. Typically, microbusinesses must demonstrate a strong operational history, even if it's brief. Qualifying attributes include a clear business plan, proof of operational viability, and an established customer base. While each lender may have specific requirements, most will look for evidence of consistent revenue generation and the potential for growth.

Creditworthiness plays a significant role in obtaining a microbusiness loan. Lenders assess the business owner's personal credit score and may also evaluate the business's financial history. Additionally, applicants are expected to provide comprehensive documentation, such as financial statements, tax returns, and proof of ownership. Geographical restrictions may apply depending on the lender, as some programs are tailored to support local entrepreneurs and stimulate regional economic development.

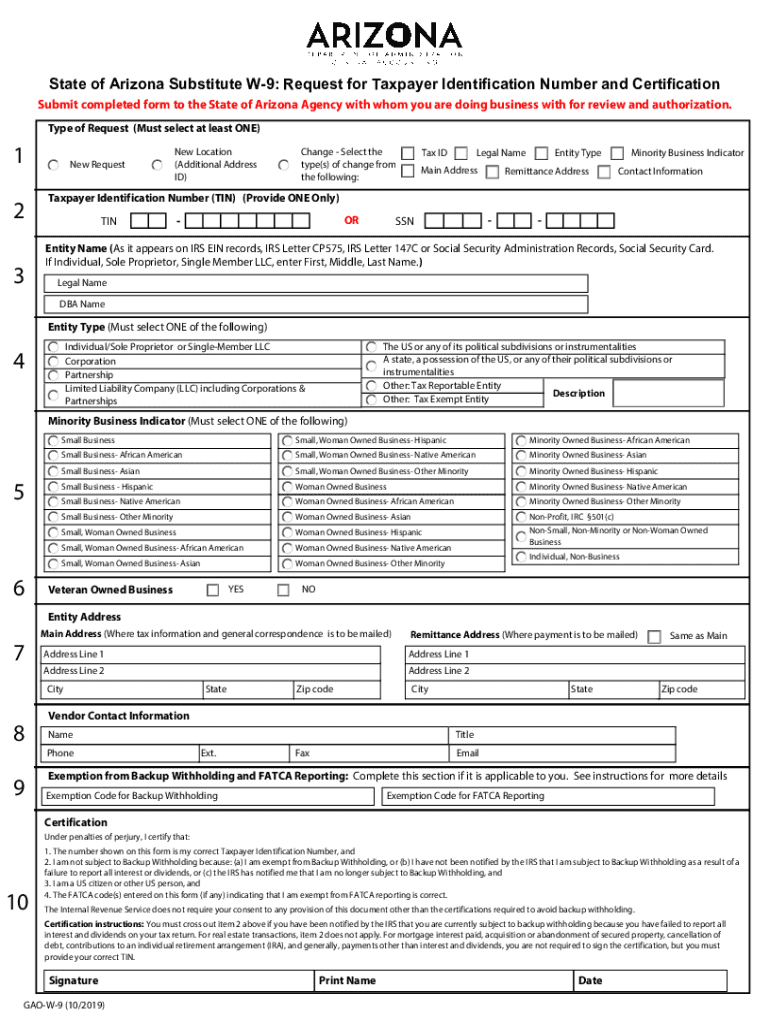

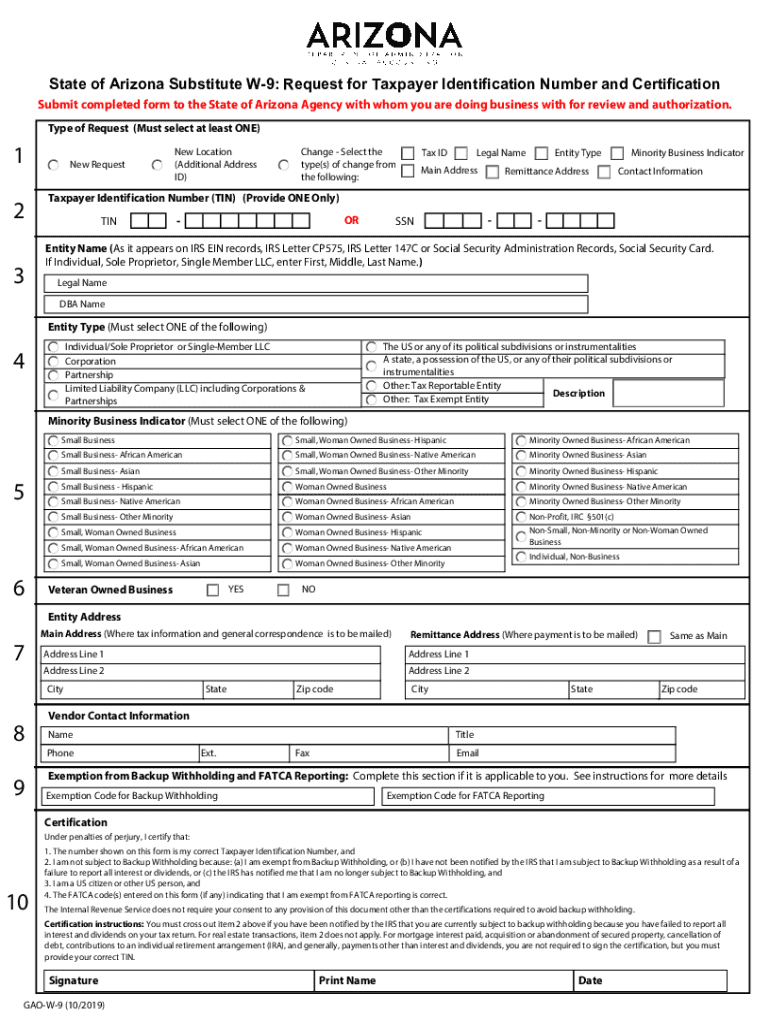

Introduction to the microbusiness loan program request form

The microbusiness loan program request form serves as the primary tool for entrepreneurs to apply for financial assistance. This form not only gathers essential information about the applicant and their business but also facilitates the loan evaluation process, ensuring that all necessary details are captured for review. Key components of the form include sections for business information, loan request specifics, and personal and business financial data.

By streamlining the application process, the form helps lenders assess the risk and suitability of granting funds to prospective borrowers, thus fostering an efficient funding cycle.

Step-by-step instructions to fill out the microbusiness loan program request form

Filling out the microbusiness loan program request form requires careful attention to detail to ensure accuracy and completeness. Here's a breakdown of the process:

Section 1: Business information

Start by providing your business name, address, and contact details. Clearly state the ownership structure, for example, sole proprietorship, partnership, or corporation. Clarity in this initial section helps establish credibility.

Section 2: Loan request details

In this section, specify the amount of funding you're requesting. Be specific about the loan's purpose—whether for equipment, operational costs, or marketing efforts. Clearly describing your funding needs improves the chances of approval.

Section 3: Personal financial information

Include your personal background information along with a breakdown of your income and expenses. Lenders need to understand the personal financial health and how it correlates with your ability to repay the loan.

Section 4: Business financial information

Submit current financial statements, including balance sheets and income statements. Additionally, provide a projected revenue and expenses document, which shows your business's anticipated financial trajectory.

Interactive tools to assist with your application

Several online tools can assist you in completing the microbusiness loan program request form effectively. For instance, online calculation tools can help you determine the optimal loan amount to request based on your business needs. Budget planning templates facilitate better financial organization and help articulate funding requirements clearly.

Moreover, document upload features allow you to seamlessly attach supporting documents such as financial statements directly to your application form, enhancing the likelihood of a thorough review.

Common mistakes to avoid when filling out the form

When completing the microbusiness loan program request form, applicants often make common mistakes that affect their chances of approval. One prevalent error is submitting incomplete information. Ensure that every section of the form is filled out completely to avoid delays.

Another common mistake is failing to provide required documentation. Always verify that you have included all necessary paperwork before submitting your request. It's also critical to accurately represent your financial data; misrepresentations can lead to denial and impact future lending opportunities.

Post-submission process

After submitting your microbusiness loan program request form, it's important to know what to expect. Typically, the review process takes anywhere from a few days to several weeks, depending on the lender's backlog and the complexity of your application.

You can check your application status by contacting the lender directly or using an online tracking system if provided. Keeping open lines of communication with the lender is advantageous as it showcases your eagerness and preparedness to act on feedback.

Frequently asked questions about microbusiness loan requests

Potential applicants often have several questions surrounding microbusiness loan requests. A common query is regarding qualification: How do I know if my business qualifies? Eligibility largely depends on meeting specific criteria set by the lender, typically revolving around business size, revenue, and creditworthiness.

Another question pertains to improving approval chances: Maintaining accurate financial records and clearly articulating your business plan can significantly enhance your position. Repayment terms can vary across lenders, so it's essential to ask about them upfront. If you have further inquiries during the application process, reaching out to the lender’s representative is advisable.

Best practices for managing your microbusiness loan

Once you obtain your microbusiness loan, having a solid management plan is vital for success. Implement effective repayment strategies, ensuring that you budget monthly payments without straining your overall finances. Engaging financial professionals for assistance can help align your budget with business goals.

Leveraging funds wisely is also crucial; invest in areas that promise the best return, whether by upgrading technology, enhancing marketing strategies, or hiring skilled personnel. Finally, always track your business’s financial performance post-funding to assess the impact of the loan on your growth trajectory.

Case studies and success stories

Real-life examples of microbusinesses thriving through loans provide inspiration and valuable lessons. Many small, family-run businesses have successfully utilized microbusiness loans to restructure operations, expand product lines, or increase marketing outreach. For instance, a local bakery that faced rising ingredient costs successfully applied for a microbusiness loan to streamline operations, purchase bulk ingredients, and rebrand, resulting in a significant increase in sales.

These case studies not only showcase the transformative potential of microbusiness loans but also illustrate the need for strategic planning and effective financial management that reinforces the importance of forming an actionable business plan.

Additional support and resources

Accessing additional support and resources can significantly impact the success of your microbusiness loan application. Local business counseling services often provide expert guidance in creating a robust business plan and preparing financial documents. Engaging in networking opportunities with other microbusiness owners can also lead to collaborations and shared learning experiences that enhance your business acumen.

Utilizing regional resources such as small business development centers can provide crucial support in navigating the loan process and connecting with funding opportunities tailored specifically for your locale.

Conclusion: The impact of microbusiness loan programs on local economies

Microbusiness loan programs play a fundamental role in bolstering local economies by empowering entrepreneurs to create jobs, foster innovation, and improve community engagement. By providing necessary funding, these programs not only enhance individual businesses but also contribute to broader economic vitality.

Supporting diverse business ecosystems encourages employment opportunities and enhances the overall quality of life within communities, highlighting the intrinsic value of microbusiness initiatives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send microbusiness loan program request for eSignature?

How can I edit microbusiness loan program request on a smartphone?

How do I complete microbusiness loan program request on an iOS device?

What is microbusiness loan program request?

Who is required to file microbusiness loan program request?

How to fill out microbusiness loan program request?

What is the purpose of microbusiness loan program request?

What information must be reported on microbusiness loan program request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.