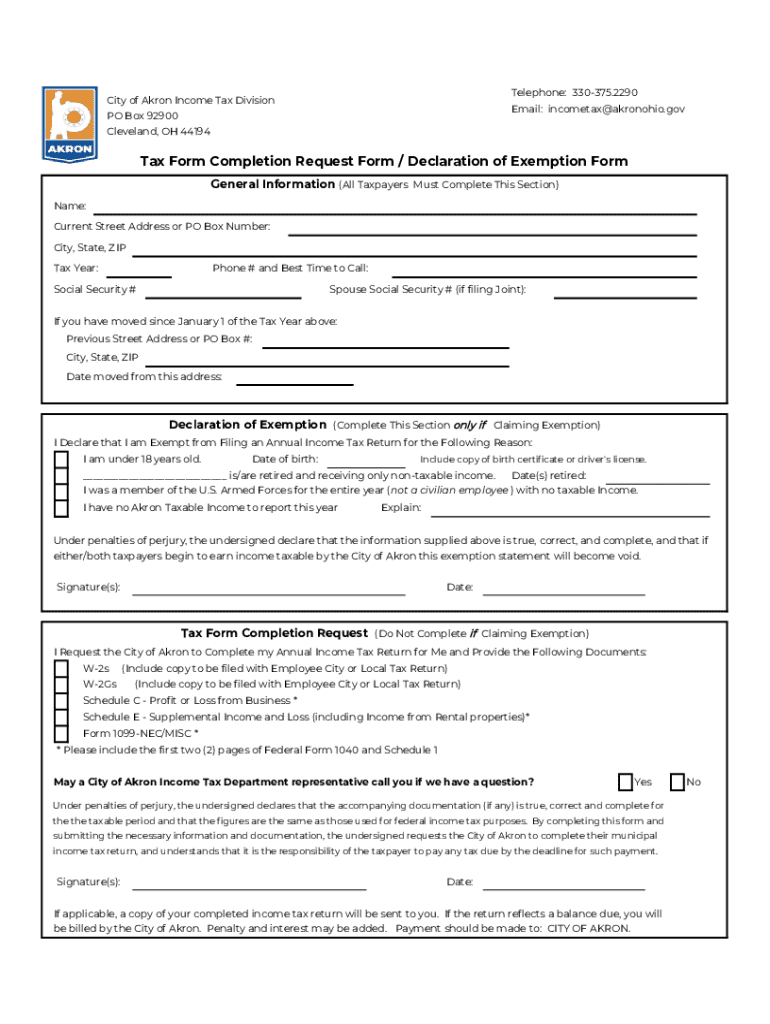

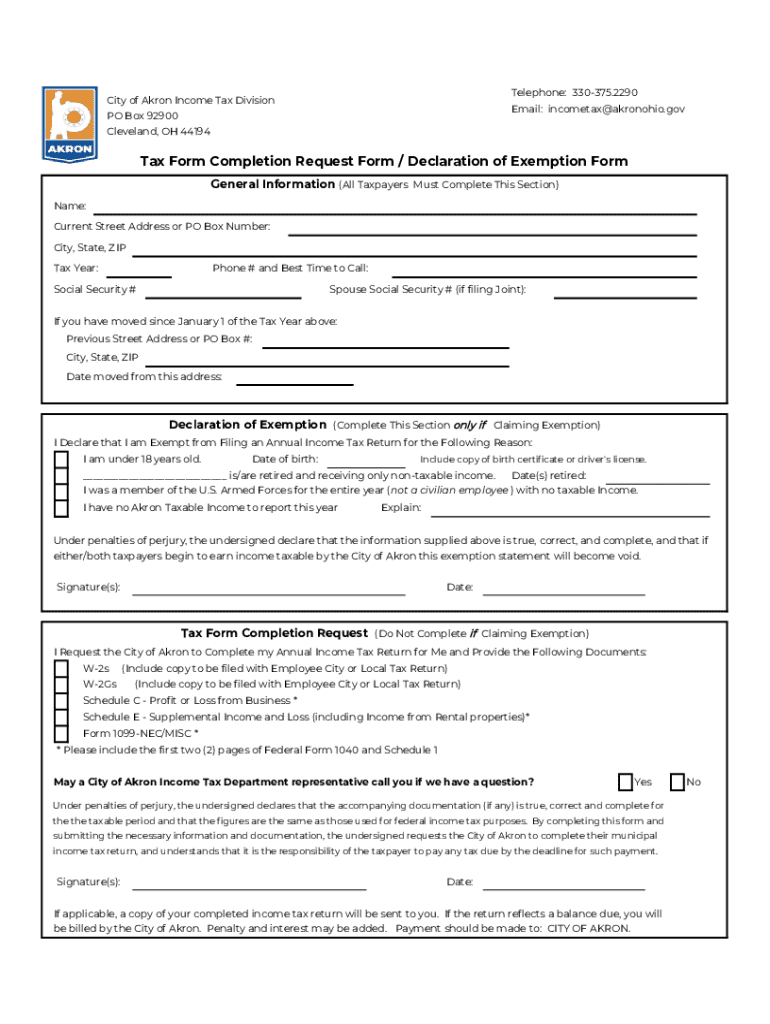

Get the free Tax Form Completion Request Form / Declaration of Exemption Form

Get, Create, Make and Sign tax form completion request

How to edit tax form completion request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax form completion request

How to fill out tax form completion request

Who needs tax form completion request?

Your Complete Guide to the Tax Form Completion Request Form

Understanding the tax form completion request form

The tax form completion request form is a crucial tool designed to assist individuals and businesses in accurately filling out their tax-related documentation. Its main purpose is to streamline the process by providing a structured method to request completion of various tax forms. It's vital to complete tax forms correctly, as inaccuracies can lead to penalties or delayed refunds, affecting your financial standing.

There are many scenarios in which one might need the tax form completion request form. For instance, if you are transitioning jobs, applying for loans, or encountering a complex tax situation, you may require specific forms such as the 1040, W-2, or 1099. Ensuring that these forms are completed correctly is paramount for compliance and maximizing tax benefits.

Types of tax forms covered

A range of tax forms falls under the scope of the tax form completion request form. Familiarity with different types of tax forms is essential for both individuals and businesses. The 1040 form, for instance, is the standard individual income tax return form used in the United States. The W-2 form reports an employee's annual wages and the taxes withheld from their paycheck, while the 1099 form is crucial for reporting income received that isn't from salary.

Each tax form has specific features and use cases. The 1040 incorporates different schedules for itemized deductions, allowing taxpayers to lower their taxable income significantly. Similarly, the W-2 is vital for employees to claim their tax credits effectively, while 1099s are used by independent contractors to report their earnings accurately. Being knowledgeable about these forms helps in making informed financial decisions.

Step-by-step guide to completing the tax form completion request form

Completing the tax form completion request form requires careful attention to detail. The first step is gathering all required information, which is divided into personal and financial categories. Personal information includes your name, Social Security Number (SSN), and address. Accurate financial information encompasses your income sources and potential deductions, which are crucial in determining your overall tax liability.

Once you have gathered the required information, the next step is filling out the form itself. Each section must be completed accurately, which includes providing all necessary details and confirming their correctness. Common mistakes to avoid include misplacing decimal points, omitting vital information, or misunderstanding the tax terminology used within the forms.

Interactive tools to aid in completion

pdfFiller offers a suite of interactive tools designed to facilitate the completion of tax forms. These tools enable users to edit PDFs easily, allowing you to make corrections or add information without needing to start from scratch. Notably, adding digital signatures ensures that all documents are signed securely, maintaining their legality.

The collaborative features available also enhance efficiency for team submissions. Users can share documents effortlessly, receiving feedback from colleagues or tax advisors in real-time. Whether you're working from home or in an office, pdfFiller’s platform ensures that everyone stays updated on the document's progress, minimizing errors and promoting clarity.

Submitting your completed tax form

After completing your tax form, the submission process comes next. You have multiple options for submission: filing electronically (e-filing) or mailing your forms to the appropriate tax office. Each method has its benefits; e-filing is typically faster and offers immediate confirmation of receipt, while mailing provides a physical record of your submission.

Be mindful of important deadlines. Each tax year has specific filing dates, which, if missed, can incur penalties. Tracking your submission status also plays a critical role; many states and the IRS provide online tools to check if they have received and processed your tax forms. This peace of mind can be crucial during the stressful tax season.

Additional services related to tax form completion

A variety of additional services can support users throughout the tax form completion process. For instance, templates specifically designed for various tax categories streamline the preparation process. Many people overlook potential tax deductions and credits, but resources are frequently available to help uncover these opportunities, saving money and enhancing financial health.

FAQs about tax form submission can clarify common uncertainties, while links to other useful forms—such as refund requests and amendments—simplify access to necessary documentation. By utilizing these resources, taxpayers can feel more confident in their ability to manage their tax responsibilities effectively.

Common issues and troubleshooting

While completing tax forms can be straightforward, issues may arise during the process. If you encounter problems, knowing how to resolve them is vital. First, review your form for errors, as even minor mistakes can cause delays. If issues persist, don’t hesitate to reach out to tax support services for help.

pdfFiller also offers support resources specifically for users navigating tax form challenges. Their help desk can guide users through common questions and problems, ensuring a smoother filing experience. Don't let confusion deter you from meeting your tax obligations.

Ensuring compliance and safety

Understanding tax laws and regulations is essential for compliance. Engaging in continued education on tax practices ensures that you remain aware of any changes that may affect your filing. Best practices for safeguarding your information include using secure platforms for document submission and being cautious with sensitive personal data.

pdfFiller protects your data through advanced security measures, ensuring your information remains private. By choosing a system that prioritizes security, users can manage their taxes without unnecessary worry about breaches or unauthorized access.

Success stories and testimonials

User experiences offer valuable insights into how the tax form completion request form can simplify tax processes. Real individuals have shared that pdfFiller not only saved them time but also alleviated the stress commonly associated with tax filing. These testimonials highlight successful outcomes, such as quicker refunds and fewer errors due to the efficiency of the tools provided.

Success stories focus on various users, from freelancers to small business owners, demonstrating the platform’s versatility. By employing pdfFiller, users can transform their tax preparation experience positively.

Stay updated with tax changes

Tax laws frequently change, which can affect your filing requirements and options. To stay informed, consider signing up for alerts on tax law changes through reliable sources. This proactive approach ensures you're always equipped with the latest information that could impact your tax situation.

Additionally, pdfFiller continues to enhance its offerings and features related to forms management. Keep an eye on upcoming features that may further ease the process of filling and submitting tax forms, as they are designed with users' needs in mind.

Frequently asked questions (FAQs)

Addressing common questions related to the tax form completion request process is critical for effective handling of tax forms. Many newcomers might seek clarification on the types of documents required or what to do in the case of an audit. This section aims to demystify any uncertainties to encourage individuals and teams to approach tax filing with confidence.

For new users of pdfFiller, the platform itself may present questions regarding how to effectively navigate its tools. Providing answers to such inquiries ensures that all users can take full advantage of the resources available to them.

Related pages

For those seeking further assistance with tax filing, related pages can bridge gaps in knowledge. Resources focusing on different tax filing scenarios can help taxpayers understand their unique requirements. Comprehensive guides on business tax forms and state-specific tax legislation can cater to diverse user needs, providing tailored support for effective tax management.

The integration of these resources ensures users can navigate the complexities of tax forms beyond the completion request form, empowering them to maximize their compliance while minimizing stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax form completion request in Chrome?

Can I create an eSignature for the tax form completion request in Gmail?

How do I complete tax form completion request on an Android device?

What is tax form completion request?

Who is required to file tax form completion request?

How to fill out tax form completion request?

What is the purpose of tax form completion request?

What information must be reported on tax form completion request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.