Get the free Personal Loan Application Form

Get, Create, Make and Sign personal loan application form

How to edit personal loan application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal loan application form

How to fill out personal loan application form

Who needs personal loan application form?

Personal Loan Application Form - A Comprehensive Guide

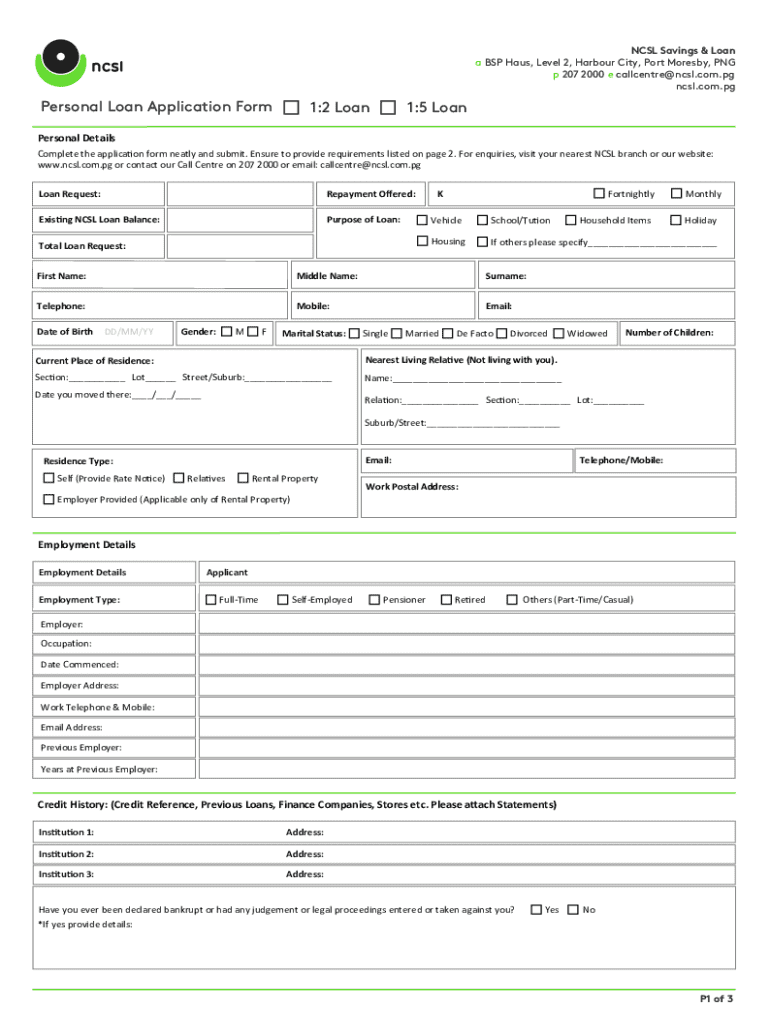

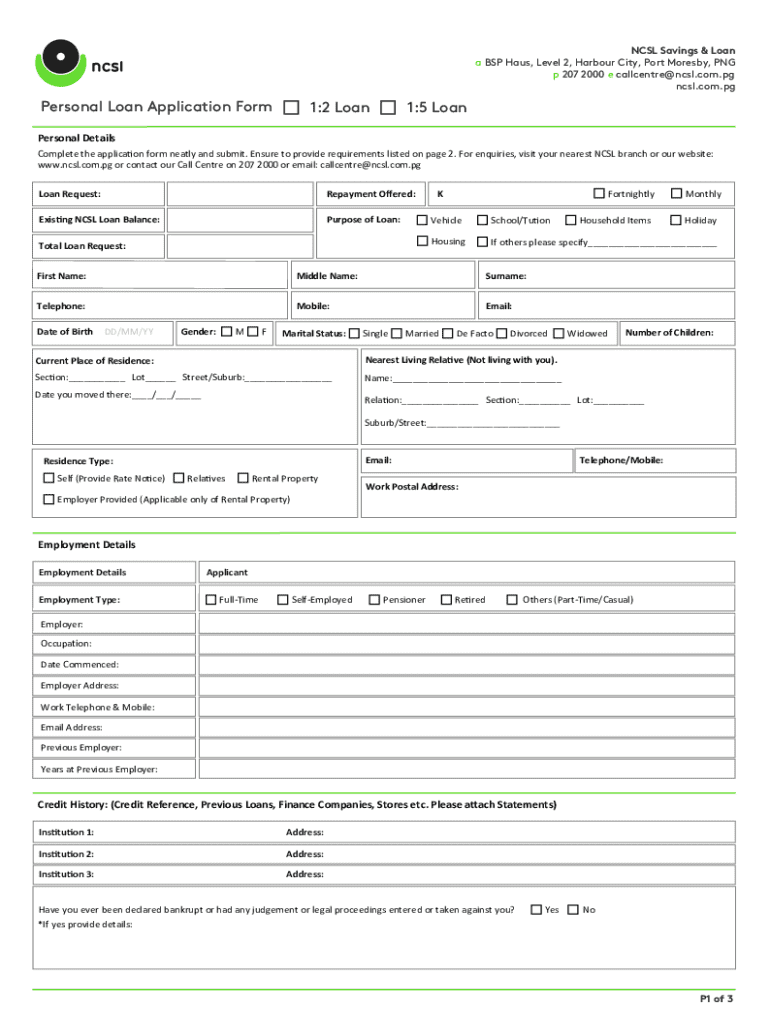

Understanding the personal loan application form

A personal loan is a type of unsecured loan that individuals can borrow to fulfill various financial needs, ranging from debt consolidation to funding major purchases. When you apply for a personal loan, the application form plays a crucial role in the lender's decision-making process, serving as the primary document that outlines your financial scenario and borrowing requirements.

The importance of a well-filled personal loan application form cannot be overstated. It provides lenders with the necessary information they require to assess your creditworthiness and financial stability. Common uses for personal loans include medical expenses, home improvements, wedding costs, or consolidating higher-interest debts, making them versatile financial tools.

Key components of the personal loan application form

Understanding the essential components of the personal loan application form is vital for accurate completion. The application typically comprises sections that require basic personal information, employment and income details, financial obligations, and specifics about the loan being requested.

Steps to fill out the personal loan application form

Filling out the personal loan application form requires careful preparation and attention to detail. The process begins with gathering the necessary documents to support your application and ensure completeness.

Tools for editing and managing the application form

With the advent of digital solutions, managing your personal loan application form has never been easier. Utilizing platforms like pdfFiller can streamline your application process.

Submitting your personal loan application

Once you have filled out your personal loan application form, the next step is submission. Understanding the various methods available for submitting your application can save you time.

After application submission

Following your submission, effective communication with lenders plays a crucial role in the application process. Knowing how to manage these interactions will enhance your experience and potentially expedite approvals.

Frequently asked questions about personal loan applications

Navigating the personal loan application process can be daunting, which often leads to common queries among applicants. Addressing these frequently asked questions can provide clarity and guidance for potential borrowers.

Final tips for a successful application experience

Maximizing your chances for a successful personal loan application encompasses several strategies, from the timing of your application to maintaining good credit health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my personal loan application form directly from Gmail?

How can I modify personal loan application form without leaving Google Drive?

How do I fill out personal loan application form on an Android device?

What is personal loan application form?

Who is required to file personal loan application form?

How to fill out personal loan application form?

What is the purpose of personal loan application form?

What information must be reported on personal loan application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.