Get the free Business Loan Application

Get, Create, Make and Sign business loan application

How to edit business loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business loan application

How to fill out business loan application

Who needs business loan application?

Your Comprehensive Guide to Business Loan Application Forms

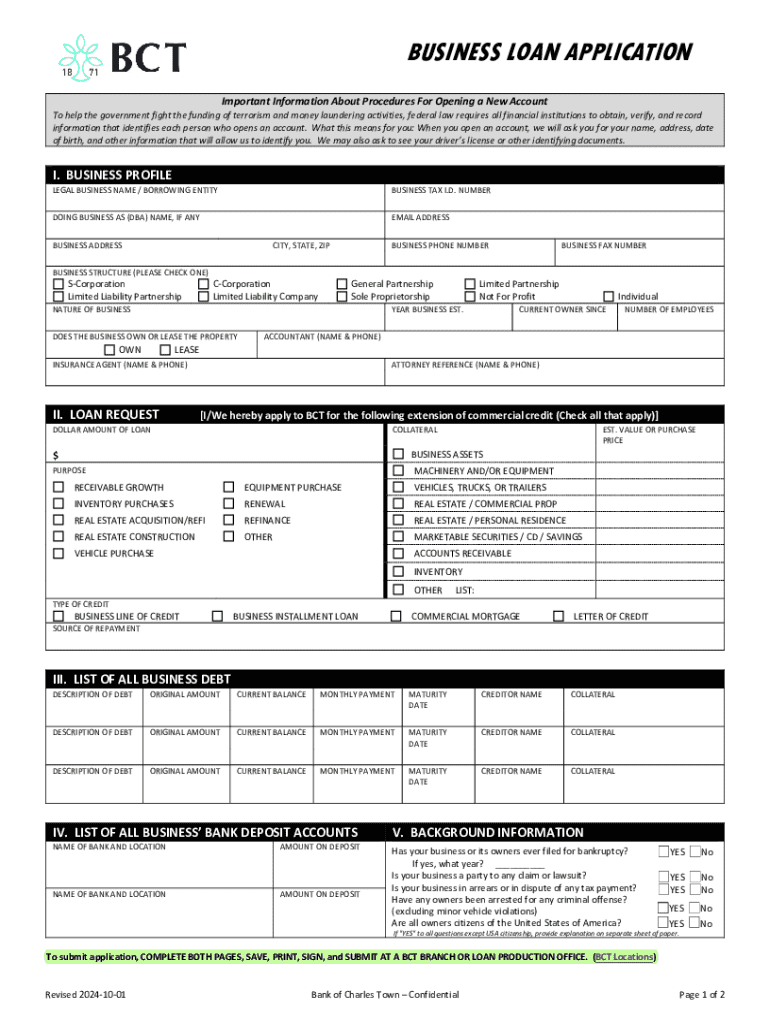

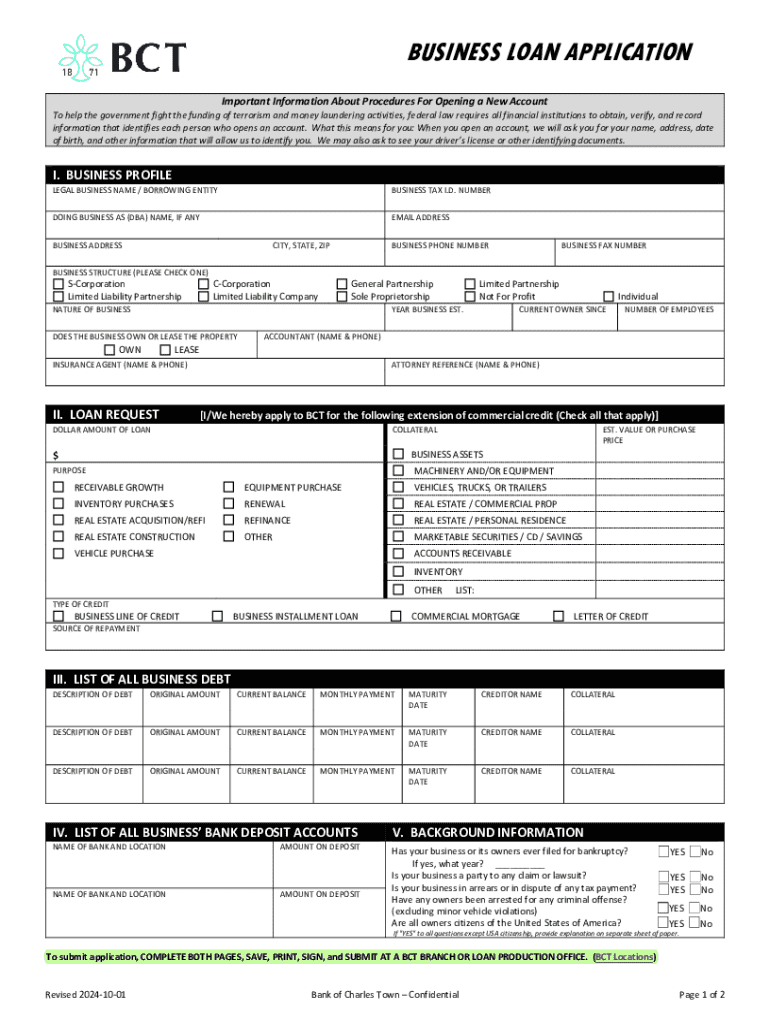

Understanding the business loan application form

A business loan application form is a critical document that potential borrowers must complete when seeking financing from lenders. The primary purpose of this form is to provide lenders with the necessary information to assess the borrower's creditworthiness and overall financial stability. This documentation plays a vital role in the approval process, helping lenders make informed decisions regarding loan disbursement.

Business loans can vary significantly in terms of their purpose and structure, and an application form may be required for each type. Traditional bank loans, microloans, equipment financing, and lines of credit all necessitate a business loan application form. Understanding the nuances of these loans can set your application apart from others, making it easier for you to navigate the process and secure funding.

The key players in the loan application process are the lenders and borrowers. Lenders can range from traditional banks and credit unions to alternative financing sources like peer-to-peer lending platforms and fintech companies. As a borrower, it's crucial to understand what lenders are looking for to align your application accordingly.

Essential elements of a business loan application form

Filling out a business loan application form requires several key pieces of information to present a complete picture of your business. First and foremost, your personal information is crucial. This should include your full name, contact details, and a brief overview of your business structure - whether you are a sole proprietor, partnership, LLC, or corporation.

Next, the business information section, which includes the business name, address, and industry classification, provides context for your application. This helps lenders understand your market positioning and the industry dynamics at play.

Equally important, the financial information presented in the form illustrates your business's current revenue and profit margins. Here, you should also include projected financials like income statements and cash flow forecasts, as they indicate your capability to repay the loan. Accurate details in these areas can significantly impact your application's success.

Step-by-step guide to filling out the application form

Completing a business loan application form can appear overwhelming, but breaking it down into manageable steps makes the process easier. Step one is to gather all necessary documentation. This includes financial statements from previous years, personal and business tax returns, and a comprehensive business plan outlining your goals and strategies.

Moving to step two, actually completing the application form, it's vital to accurately fill in both personal and business information. Many applicants make the mistake of rushing this part. For instance, misspelling names or incorrectly entering financial data can be pitfalls affecting credibility. Always double-check the accuracy of the information you provide.

Step three involves compiling financial projections and additional documentation. Providing a solid financial picture is crucial, so consider including charts or graphs to visually represent your data. Transparency is key; lenders appreciate when you present your financials realistically rather than inflating numbers to appear more favorable.

Editing and customizing your application form with PDFfiller

Utilizing PDFfiller’s interactive tools can streamline the editing of your business loan application form. With intuitive functionalities, you can customize fields specifically tailored to your lending requirements. This user-friendly platform allows you to add your business logo, ensuring a professional look for your document with minimal effort.

To customize your application, simply access PDFfiller and upload your document. From there, you can edit text fields, add checkboxes, or even include dropdown menus for various options. Once you’ve tailored the application to your needs, saving and securely exporting your form is straightforward, allowing for easy sharing and submission.

Signatures and submission processes

The inclusion of an eSignature in the business loan application process lends credibility and expedites the submission. Electronic signatures are legally valid, akin to traditional handwritten signatures, making them a convenient option for busy applicants. Always ensure that the eSignature process complies with your local regulations.

When it comes to submitting your application, best practices involve understanding the most suitable methods—be it via email, in person, or through specialized lending portals. Always follow up after submission to track your application's status. This proactive approach not only reflects well on your professionalism but may also accelerate the lender's response time.

Tips for a successful business loan application

Navigating through the business loan application can be a daunting task, but avoiding common mistakes can significantly improve your chances of success. Omitting key information or presenting inaccurate financial data are frequent pitfalls. Prospective borrowers should ensure that all requested details are included and accurately reflected throughout the application.

Leveraging professional help can be beneficial, particularly if you're unsure about any aspect of your application. When in doubt, consulting financial advisors or accountants can clarify nuances and enhance the quality of your submission. Moreover, preparing for possible lender questions through diligent research can position you advantageously in discussions with potential lenders.

Managing the loan post-application

Understanding the approval process is crucial, as different loan types have varying timelines. While some may offer quick approvals, others, especially those involving larger sums, might take weeks. Staying informed about your application's progress is important; consider following up with your lender regularly to ensure you remain on their radar.

If your application is denied, don’t lose heart. Instead, clarify the reasons for rejection and refine your application for future efforts. Utilizing PDFfiller can also assist you in keeping track of all your documents and correspondence associated with the loan. Efficiently organizing your loan-related documentation makes it easier to retrieve information as needed.

FAQs about business loan application forms

Many applicants wonder what happens if their application is denied. Understanding your lender’s decision can pinpoint areas needing improvement. Additionally, applicants often seek to improve their chances of approval by ensuring their credit score is in good shape and they meet all required criteria.

Alternatives to traditional loan applications exist, such as crowdfunding or grants, which might be better suited for certain businesses. Exploring these options enables applicants to pursue the best financial paths for their specific needs.

Conclusion: Streamlining your loan application process with PDFfiller

PDFfiller plays an integral role in simplifying the business loan application process. With its comprehensive features, users can efficiently draft, edit, and manage their application documents through a single, cloud-based platform. By leveraging the resources available with PDFfiller, borrowers can focus on creating a compelling application rather than being overwhelmed by administrative logistics.

Embrace the convenience that PDFfiller brings to document management, ensuring your essential business paperwork is always accessible from anywhere at any time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business loan application from Google Drive?

How do I make edits in business loan application without leaving Chrome?

Can I create an electronic signature for the business loan application in Chrome?

What is business loan application?

Who is required to file business loan application?

How to fill out business loan application?

What is the purpose of business loan application?

What information must be reported on business loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.