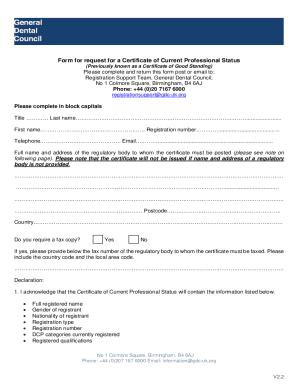

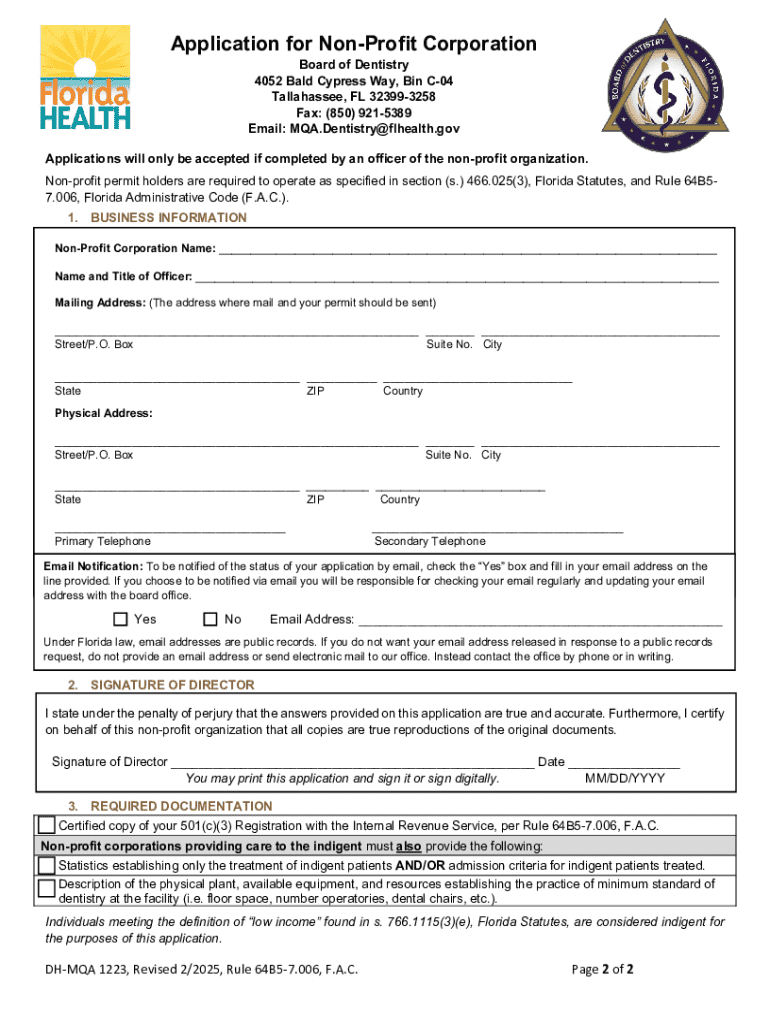

Get the free Application for Non-profit Corporation

Get, Create, Make and Sign application for non-profit corporation

How to edit application for non-profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for non-profit corporation

How to fill out application for non-profit corporation

Who needs application for non-profit corporation?

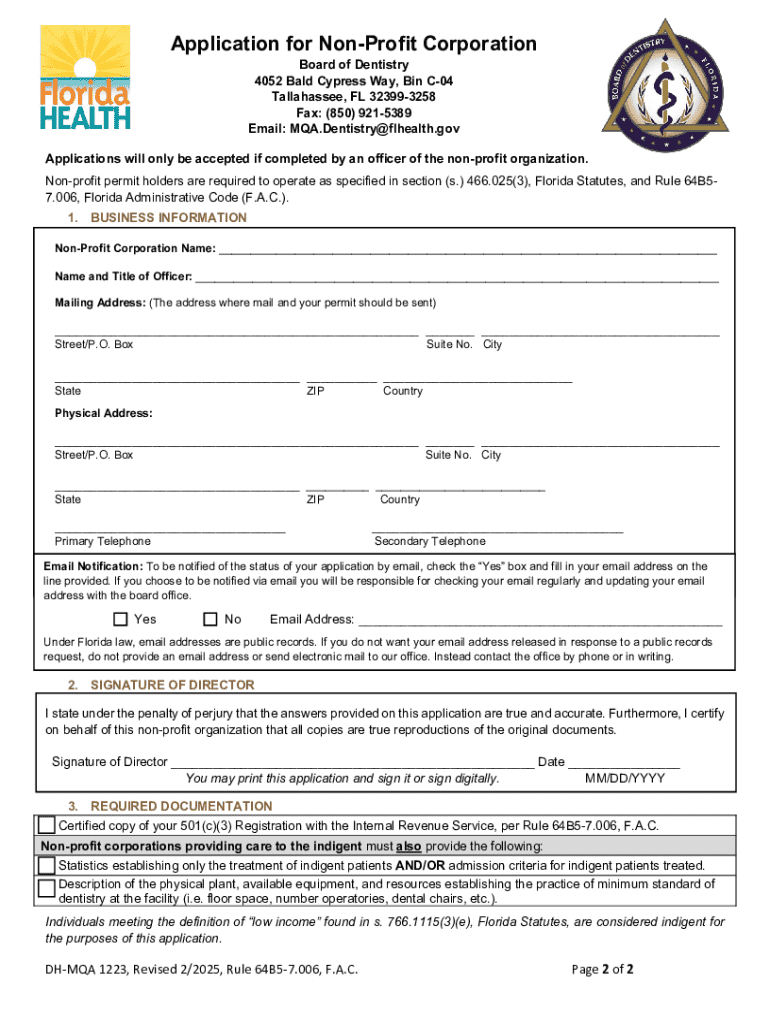

Navigating the Application for Non-Profit Corporation Form

Understanding non-profit corporations

A non-profit corporation is an organization established for purposes other than generating profit for its owners or shareholders. Non-profit corporations are dedicated to social causes, educational pursuits, religious missions, and other charitable endeavors. The primary aim is to benefit the public or a specific community without the expectation of profit for stakeholders.

The essence of non-profit corporations lies in their altruistic mission. While they can generate income, any surplus revenue is reinvested to further advance their mission rather than distributed as profits. This gives non-profit corporations the ability to tackle pressing community issues and advocate for social change, providing invaluable services where they are needed most.

Is a non-profit corporation right for you?

Determining if a non-profit corporation aligns with your vision requires reflection on your mission and goals. Consider whether your objectives are focused on addressing social issues, providing community services, or supporting educational initiatives. A clear understanding of your mission will guide your decision and inform your strategy as you move forward.

Identifying community needs is pivotal. Conducting research to unpack the specific gaps in your community can help articulate your non-profit's purpose. Who are you aiming to help, and how will your organization fill any existing voids? Engaging with local residents and stakeholders can reflect genuine issues that need addressing.

Lastly, evaluate the commitment required to launch and manage a non-profit corporation. Establishing a non-profit involves time, effort, and resources. Are you ready to handle the complex responsibilities of running a non-profit organization, including compliance, fundraising, and community engagement?

Advantages of forming a non-profit corporation

Forming a non-profit corporation offers legal protection for founders and board members. By incorporating, individuals are generally shielded from personal liability related to the organization's debts and obligations. This sense of security encourages passionate individuals to take action without the fear of financial repercussions.

Additionally, establishing a non-profit corporation can help secure tax-exempt status under IRS guidelines. This tax exemption benefits not only the organization but also potential donors, who can make tax-deductible contributions. Enhanced credibility and trust are other significant advantages, making it easier to establish partnerships and seek funding.

Essential considerations before filing

Before diving into the application for non-profit corporation form, consider the state-specific requirements unique to each jurisdiction. Various states have distinct rules and regulations governing non-profit formations, including application fees, paperwork requirements, and corporate structures. Familiarize yourself with these regulations to avoid complications.

Choosing a name for your non-profit is another vital step. The name must reflect your mission while being distinct from existing organizations. Conducting a name search can ensure that your selected name is not already in use. Moreover, defining your non-profit's purpose and activities in clear, concise language will streamline the application process.

Steps to complete the application for non-profit corporation form

Step 1: Preparing your articles of incorporation

The articles of incorporation are foundational documents for a non-profit corporation. They should include essential information such as the corporation's name, purpose, and the address of its registered office. Also, mention the initial board of directors and how the dissolution of the organization would be handled. Missteps can lead to delays or denials in your application.

Step 2: Establishing your bylaws

Bylaws serve as the internal governance framework of your organization. They outline the responsibilities of directors, the procedures for board meetings, and membership criteria. Include details regarding conflict-of-interest policies and voting rights. Strong bylaws are crucial for operational stability and legal compliance.

Step 3: Selecting your board of directors

Choosing the right board of directors is vital for the success of your non-profit. Board members should possess diverse skills, experiences, and a commitment to your mission. Each state mandates specific minimum requirements for board composition, which might include a minimum number of members or residency requirements. Promoting diversity and representation can enhance your organization's effectiveness.

Filing for tax-exempt status

Once you successfully file your application for non-profit corporation form, securing tax-exempt status from the IRS is the next crucial step. For most organizations, IRS Form 1023 is required, which necessitates detailed information elaborating on your program activities and financial projections. However, smaller non-profits may qualify to use the more streamlined IRS Form 1023-EZ.

Navigating the tax-exempt application process can be daunting. Questions about the difference between Form 1023 and Form 1023-EZ often arise. The full Form 1023 allows for more extensive detail, but the EZ form simplifies the paperwork for eligible applicants. Candidates must still carefully consider their organization's suitability and readiness.

Tools to help you with document creation

pdfFiller is a powerful tool for compiling documentation necessary in the non-profit formation process. Utilizing their cloud-based document editor allows you to access, fill out, and manage the application for non-profit corporation form seamlessly. Collaborating with team members can be facilitated through shared document features, ensuring all input is collected throughout the drafting process.

Moreover, pdfFiller offers eSignature solutions, enabling you to secure essential signatures without needing to print or scan. This not only makes the submission process easier but also saves time and paper, aligning with sustainable practices.

Getting an employer identification number (EIN)

Acquiring an Employer Identification Number (EIN) is a crucial step for your non-profit organization. An EIN is required to open a bank account, apply for grants, and file your taxes. Fortunately, applying for an EIN is straightforward and can be done online through the IRS website. The application requires basic information about your organization, including its legal structure and location.

Having an EIN not only helps in identifying your organization for tax purposes, but it also enhances credibility when approaching potential donors and grant-making entities. Ensure you have the necessary details at hand when applying to make the process smooth.

Compliance services: staying aligned with regulations

Once your non-profit is operational, maintaining compliance with state and federal regulations is essential. This typically involves annual filings, such as Form 990, which provides the IRS with an overview of your organization’s financials and activities. It's crucial to stay informed about state-specific compliance requirements post-filing, as failing to do so could jeopardize your non-profit status.

Developing a compliance calendar that outlines your reporting obligations can greatly assist in staying on track with requirements. Regular reviews and audits can also help ensure your organization remains in good standing, allowing you to focus on fulfilling your mission.

Who we serve: target audience insight

The process of applying for non-profit corporation status targets a diverse audience. Individuals exploring non-profit options often come with a strong desire to impact their communities positively. Whether driven by a personal story, a professional background in social work, or a passion for environmental advocacy, these individuals are looking for guidance.

Small teams preparing to launch community initiatives represent another segment eager to navigate the requirements effectively. They seek clarity on forming a robust structure that will enable their mission. Additionally, organizations looking to transition to non-profit status require comprehensive resources that address their specific needs during this significant shift.

Expert insights and resources

Engaging with experts in the field can provide invaluable guidance on the intricacies of starting a non-profit. Interviews with non-profit founders can reveal their experiences, challenges encountered, and the strategies they adopted to succeed. Learning from case studies of successful non-profit launches can also serve as a roadmap for aspiring founders.

Frequently asked questions about non-profit formation often shed light on common misconceptions and hurdles. Addressing these queries equips emerging organizations with information vital for smooth operations and adherence to requirements.

Solutions for ongoing management of your non-profit

Establishing your non-profit is just the beginning. Effective record-keeping is critical for financial transparency and compliance. Utilize digital tools to streamline your documentation processes, from fundraising tracking to meeting minutes. Solutions for financial management should also integrate aspects of budgeting and reporting.

Community engagement and growth strategies are essential for sustainability. Consider implementing outreach programs that actively involve your target demographic in decision-making. Building relationships with community members fosters trust and ensures that your organization stays aligned with the needs it aims to fulfill.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my application for non-profit corporation in Gmail?

Where do I find application for non-profit corporation?

How do I edit application for non-profit corporation on an Android device?

What is application for non-profit corporation?

Who is required to file application for non-profit corporation?

How to fill out application for non-profit corporation?

What is the purpose of application for non-profit corporation?

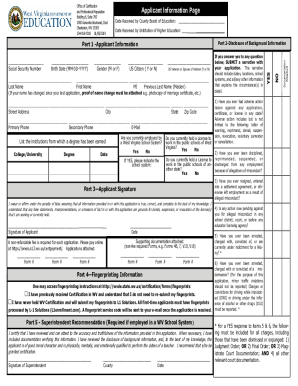

What information must be reported on application for non-profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.