Get the free Tax Exemption / Quarterly tax The Motor Vehicle Agency ...

Get, Create, Make and Sign tax exemption quarterly tax

Editing tax exemption quarterly tax online

Uncompromising security for your PDF editing and eSignature needs

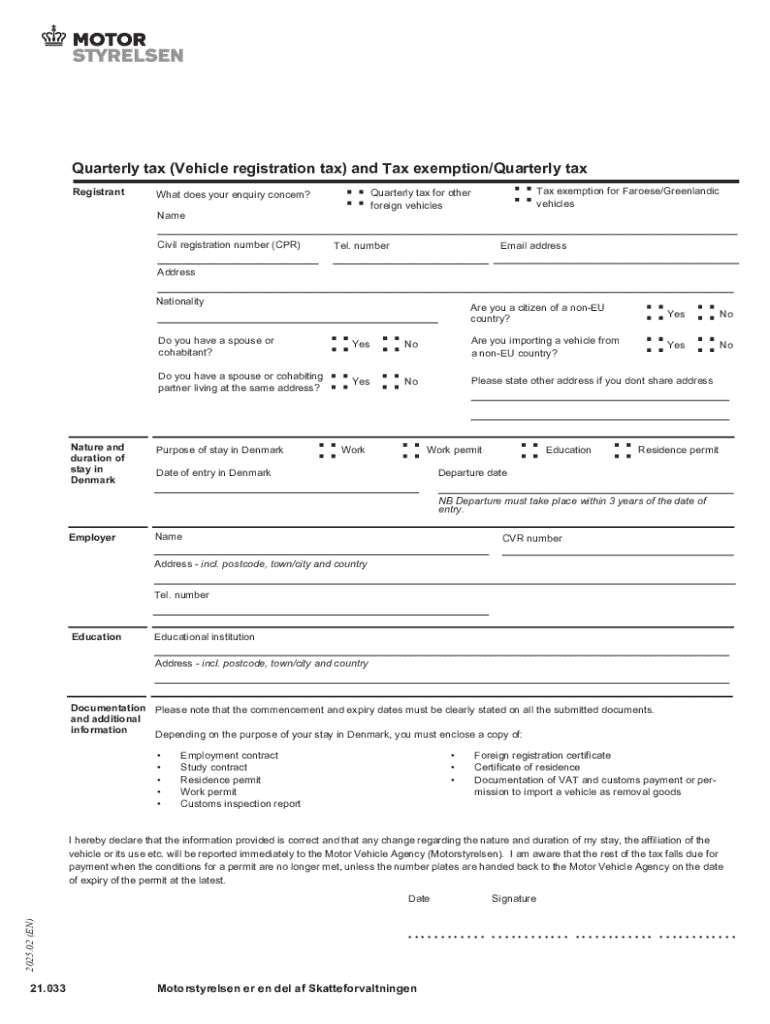

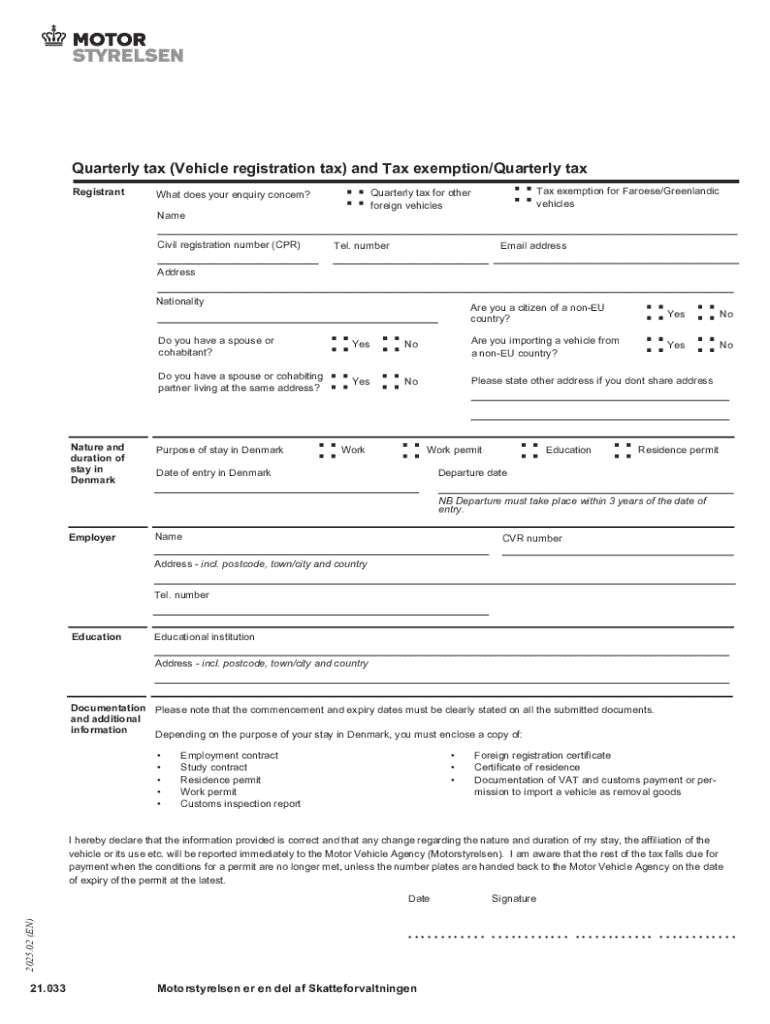

How to fill out tax exemption quarterly tax

How to fill out tax exemption quarterly tax

Who needs tax exemption quarterly tax?

Tax exemption quarterly tax form: A comprehensive guide

Understanding tax exemptions

Tax exemptions are provisions in the tax code that allow taxpayers to reduce their taxable income. They are crucial for both individuals and businesses, offering substantial savings and reducing the overall tax burden. Understanding the varieties of tax exemptions available is essential for effective financial planning.

Overview of quarterly tax forms

Quarterly tax filing is essential for those who expect to owe tax at year-end. Certain taxpayers, including self-employed individuals and business owners, must make estimated tax payments every quarter. This ensures that they stay compliant with tax obligations and avoid penalties for underpayment.

Tax exemption quarterly tax forms

When it comes to tax exemption quarterly filings, specific forms must be used, such as the IRS Form 1040-ES for individuals and various state-specific forms for local obligations. Understanding which forms apply to you is critical to ensure proper compliance.

To qualify for tax exemptions on these forms, you must meet specific eligibility criteria, such as income thresholds and filing status. It’s essential to gather the necessary information and documentation before you begin to fill out these forms.

Step-by-step guide to filling out the tax exemption quarterly tax form

Before you start filling out the tax exemption quarterly tax form, proper preparation is critical. Gather essential documents, including income statements, previous tax returns, and other financial records that will aid in accurately completing the form.

1. Personal Information

Fill in your name, address, and tax identification number carefully. Ensure all information is correct to avoid issues with submissions.

2. Income Reporting

Report your various income sources. Self-employment income, interest income, and dividends all need to be accurately reported to calculate your estimated taxes.

3. Claiming exemptions

Clearly indicate any tax exemptions. This will usually involve specific lines where these deductions can be claimed.

4. Calculating quarterly estimates

Estimate your quarterly taxes using several methods, such as previous year's tax liabilities or projected income. Be meticulous to ensure accurate calculations.

Avoid common pitfalls like misunderstanding exemptions or missing deadlines by organizing your materials and creating a timeline.

Editing and managing your tax form

After filling out your tax exemption quarterly tax form, ensuring that it’s properly edited is vital. Tools such as pdfFiller allow you to make changes easily to your forms. Utilize their editing features to correct any errors or update information without hassle.

Additionally, pdfFiller provides secure eSigning and sharing options, which can be invaluable when handling sensitive tax documents. It facilitates collaborative reviews and approvals among team members.

FAQs about tax exemption quarterly tax form

As you navigate the complexities of tax exemption applications, numerous questions may arise. Common inquiries include details about filing requirements and deadlines. For instance, understanding the circumstances that necessitate quarterly filing can save you time and avoid costly mistakes.

In addition, troubleshooting form submissions and approvals can be daunting. Familiarize yourself with the most frequent issues and their solutions to ease the filing process.

Interactive tools to assist with tax exemption filing

pdfFiller offers a suite of interactive tools that can streamline the entire filing process. Innovative calculators can help you estimate taxes due based on your inputs and previously filed returns.

The real-time collaboration features allow teams to work on tax documents simultaneously, improving workflow efficiency and minimizing errors. Using these tools aids in maintaining accuracy and compliance.

Staying compliant and updated

Keeping abreast of changes in tax laws is crucial for individuals and businesses alike. Regular updates will allow you to understand how modifications might affect your tax exemptions and filing requirements.

Explore resources that provide ongoing education on tax matters. Consulting with tax professionals for complex exemption queries can also ensure you're making informed decisions.

Connect with pdfFiller community

Engage with others who are navigating document management and tax filing processes by connecting with the pdfFiller community. Users frequently share their stories and best practices for managing tax documents efficiently.

Participate in discussions on social media and forums related to tax filing. These interactions can provide valuable insights, tips, and support from like-minded individuals.

Coverage of related tax forms and extensions

Besides the tax exemption quarterly tax form, there are various other tax forms you might encounter. It's important to be aware of related tax exemptions and deductions specific to your situation to maximize your savings.

For individuals or businesses needing additional time to file, understanding how to seek extensions on quarterly tax filings is vital. Misunderstanding these regulations can lead to unnecessary penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax exemption quarterly tax to be eSigned by others?

How can I get tax exemption quarterly tax?

Can I edit tax exemption quarterly tax on an iOS device?

What is tax exemption quarterly tax?

Who is required to file tax exemption quarterly tax?

How to fill out tax exemption quarterly tax?

What is the purpose of tax exemption quarterly tax?

What information must be reported on tax exemption quarterly tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.